jittawit.21

Investment Thesis

Innovative Industrial Properties (NYSE:IIPR) share price had declined from its Nov 2021 peak of USD 284 per share to USD 96 per share currently (29 Jul 2022). But this is not a buying opportunity.

While the company has grown significantly since its 2016 IPO, this was driven by its financing strategy rather than operating or marketing strategies. This depended on high market price for its shares together with growth in its AFFO per share.

Given the high interest rate, decline in IIPR share price and the potential recession, this model is no longer tenable. IIPR would find it challenging to grow its lettable areas as well as grow its AFFO per share.

Looking at IIPR through a no-growth lens, there is no margin of safety at the current market price.

Rationale

IIPR is a specialized industrial REIT. It owns properties that are leased to state-licensed operators for their regulated medical-use cannabis facilities.

There are several articles in Seeking Alpha that have provided the background and profile of IIPR. Refer to them if you are not familiar with the company.

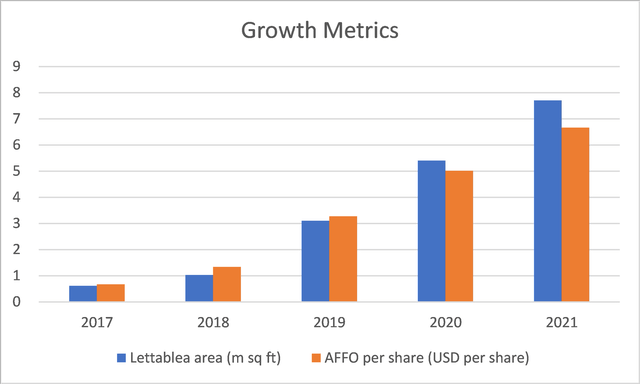

The company IPO in 2016 with just one property of 127,000 sq ft. of lettable area. As of the end of 2021, it had grown to 103 properties with 7.7 million sq ft. of lettable area. The growth was phenomenal as can be seen from Chart 1. At the same time, there is also more a than 6-fold increase in the AFFO per share.

Chart 1: Key Growth Metrics (Author)

As such, IIPR has been considered by many as a growth stock. But the growth is not sustainable as IIPR would have problems growing the lettable areas as well as the AFFO per share in future.

- The growth in the lettable area was funded mainly from growth in equity. This in turn came from issuing new shares at increasing prices. The increasing share issuance prices was supported by increasing market price of the shares. With the decline in the share price and the current market sentiments, further growth via such a funding source would be a problem.

- The growth in AFFO per share came from having rent growing at a faster rate than the growth in the number of shares. The growth in the rental yield is also slowing down. At the same time with lower market prices for its shares, more shares have to be issued to raise the same amount of funds. Both of these will affect the growth in the AFFO per share.

Details to support the above contention are presented in the following sections.

Growth in lettable areas

The company described itself as being “…focused on the acquisition, ownership and management of specialized industrial properties…”

But looking at the operations and business model, I would describe its focus as acquiring and owning the properties only.

IIPR does not manage its properties in the sense that it does not have a property management team. Rather it relies on the tenants to do so. This is aptly described in its Form 10k as:

“…lease our properties on a triple-net lease basis, where the tenant is responsible for all aspects of and costs related to the property and its operation during the lease term, including structural repairs, maintenance, real estate taxes and insurance.”

This is supported by the fact that it had only 18 employees as of the end of Dec 2021.

Unlike retail or office REITs, there is no opportunity for yield improvement from higher utilization of the floor space. Growth will have to come from increasing the properties under management.

Drivers of growth

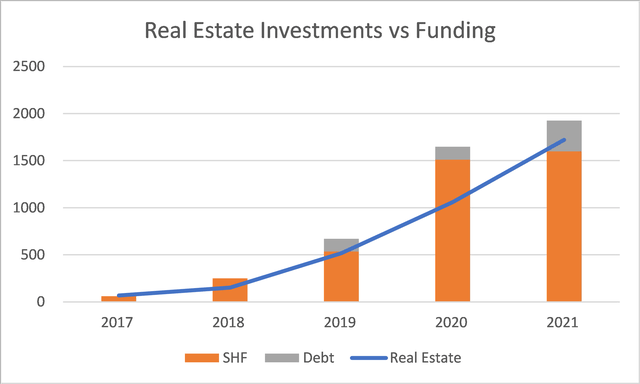

IIPR growth in the lettable area has been funded mainly by new issuance of shares as illustrated in Chart 2.

Chart 2: Funding the Real Estate Investments (Author)

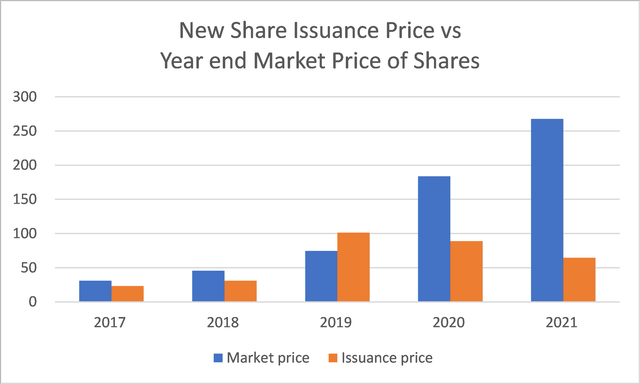

At the same time, the equity funding came from increasing share issuance price. From an IPO price of USD 20 per share, the average share subscription price in Q1 2022 was USD 93 per share. This increase in subscription prices was helped by the uptrend in the market price of the shares. Chart 3 shows the trends in the market price and the average new share issuance price.

Chart 3: New Issuance Share Price vs Market Price of Shares (Author)

Note to Chart 3: The new issuance share price for each year is based on the funds raised divided by the number of shares issued. It represents the average price from additional new shares, conversion of loans and other options.

It may be more challenging to fund property acquisitions for the next few years from this source. Investors would not be willing to subscribe to new shares unless they are offered at discount to the market price. The lower share price makes this more challenging.

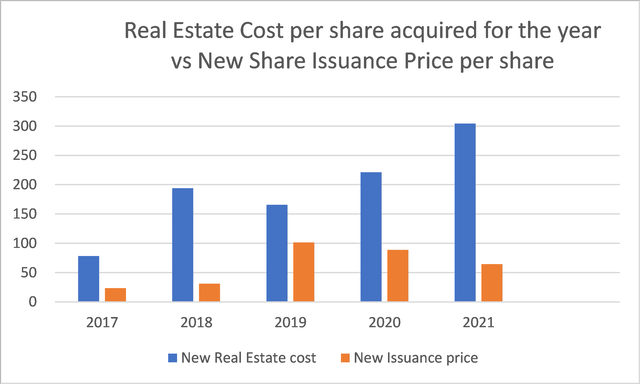

The higher share issuance price has also enabled the company to acquire properties at higher prices. Refer to Chart 4. Higher property prices led to higher rents.

Chart 4: Per Share Comparison – Real Estate Cost vs New Share Issuance (Author)

Note to Chart 4: The real estate cost is for the properties acquired for the year divided by the total number of shares outstanding.

Growth in AFFO per share

The AFFO per share is a function of both rental and the number of shares outstanding. The growth in the AFFO per share is because rental grew at a faster rate than the number of shares as shown in Chart 5.

Chart 5: Annual Rent vs Number of Shares (Author)

Note to Chart 5: The indices were derived by dividing the rent and number of shares for each year by the respective values in 2017.

Such a situation arose because the additional properties acquired each year was funded mainly by new equity. Refer to Chart 2.

- But the properties were acquired at increasing cost per sq ft. which in turn leads to increasing rent per sq ft. Refer to Chart 6. So, the AFFO went up.

- On the other hand, the additional shares were issued at higher prices. Refer to Chart 3. This meant a smaller number of new shares issued in each year as compared to if the shares were issued based on the 2017 prices.

- The increasing rents with lower rate of increase in the number of shares led to growth in the AFFO per share.

But this growth in the AFFO per share hid a problem. The rental yield for the new properties were decreasing. Refer to Chart 6.

My contention is that the growth in the AFFO per share was due to its financing strategy. Kudos to management for taking advantage of the situation to quickly grow the company. But growth in AFFO per share in the future will be difficult without the higher rents at lower number of shares.

Chart 6: Additional Real Estate Metrics (Author)

Notes to Chart 6:

1) The additional real estate refers to properties acquired during the respective years.

2) The rental yield = additional rental / additional real estate investments

3) Addition = current year value minus last year value

No growth scenario

The stock market has turned bearish. You can attribute this to the high inflation and the possible recession.

The first impact is the decline in the share price of IIPR. It would be more challenging to fund the acquisitions with new equity. Given the high interest rate environment, debt would also be challenging. Without the funding, acquiring new properties would be difficult. In other words, it would be challenging for IIPR to continue its pace of growth of lettable areas.

Secondly, at a lower share price, it would be difficult to issue new shares at the historical high prices. Any equity funding with relatively lower share issuance price would mean issuance of more shares. Even if there is no change to the absolute AFFO, the AFFO per share would decline.

As such if you were considering investing in IIPR at this stage, you should consider investing based on a no-growth scenario. In other words, buy IIPR based on its current “earnings power value” basis.

Other metrics to support this no growth scenario are:

- Decreasing trends in the rental yield.

- The potential for more failures in the cannabis sector given the higher interest rates, inflation and the recession.

Margins of safety

I estimated the no-growth AFFO per share at USD 7 per diluted share based on the average 2021 values and the projected 2022 values.

2021 AFFO per diluted share = USD 6.66

2022 AFFO per diluted share = USD 7.48 (annualized)

Average AFFO per diluted share = USD 7.07

At the current market price of USD 96 per share, this is equal to a AFFO to price yield of 7.3%. One way to gauge whether this is good is to compare it with the market cap rate.

The difficulty here is that there are no currently updated cap rates. These would have taken into account the current interest rate regime and the potential recession. However, we can have a feel of this from the following 2021 cap rates:

- “…average…cap rates have held stable for the last three quarters at 5.8% for industrial facilities…” Q2 2021 Industrial Market Outlook, Colliers

- “Single-tenant industrial cap rates…end the year at an average of 5.6 percent.” 2021 Net Lease Industrial Sales and Cap Rates, Commercialresearch.com

I would expect the cap rate to be higher in 2022 given the current interest rate situation. So far the Fed four hikes in 2022 have increased rates by 2.25 %. I would be surprised if the 2022 cap rates do not rise by a similar quantum. If so, we are looking at more than 7% cap rates. At this cap rates, there is hardly any margin of safety.

Note that I have used IIPR own AFFO computation in my analysis. I suspect that IIPR would have taken an optimistic approach when computing this metric.

Risks

In my valuation, I have assumed that the current rental and hence AFFO can be maintained. The main problem here is that IIPR tenants are start-ups.

While there may be growth opportunities in the medical cannabis sector, it is difficult to identify the eventual winners. Looking at IIPR current earnings without factoring in some losses due to “weeding” (no pun intended) in the sector is not realistic.

Start-ups are prone to failure and the cannabis sector is no different.

- “Cannabis start-up failure rate to exceed 97% according to this Accelerator CEO” New Cannabis Venture

- “…investing in a new company is risky business. With a very high failure rate for cannabis start-ups (at 97% as compared to 75% for other industries)…” 3cannabis.com

IIPR experienced the Kings Garden problem. It would be foolish not to factor in others.

As such the 7.3% AFFO yield of IIPR that assumes no start-up failure is a very optimistic view.

Furthermore, in the property sector it is very common for impairment of assets if it remains vacant for some time. While IIPR have not had this experience, this is another potential risk if there are more start-up failures. That is why having a margin of safety is important.

Conclusion

IIPR growth over the past few years was due to its financing strategy rather than some operating or marketing strategy. This led to growths in the lettable area as well as AFFO per share.

It had grown the assets under management by mainly issuing new equity. This was carried out with increasing issuance share prices. At the same time, rental income had grown at a faster rate than the growth in the number of shares leading to growth in AFFO per share.

The current economic scenario has changed the financing landscape. The lower price of IIPR shares will mean that it may be more difficult to raise funds via equity. The implication is that it will be more difficult to grow its lettable areas. Even if this can be achieved, it will involve more shares than previously. This will impact the growth of its AFFO per share.

From a conservative investing perspective, I would look at the no-growth scenario when valuing IIPR. On such a basis, there is no margin of safety at the current price taking into account the potential 2022 cap rates of about 7%.

The analysis assumes that the current rental income can be sustained. The risk is that IIPR customers are start-ups. There are bound to be failures and if these involve IIPR’s tenants, the rental income will be affected. That is why I believe that with the 7.3 % AFFO yield, there is no margin of safety. You should wait for the AFFO yield to go above 9%.

I am not suggesting that there will not be future growth. Certainly there will be growth due to rental revisions. But I expect these to be at the long term USD GDP growth rate of about 4%. The advise is that given the current scenario, do not invest in IIPR as if it was still a growth stock.

Be the first to comment