Ryland Zweifel

Investment Thesis

Innovative Industrial Properties, Inc. (NYSE:IIPR) is the largest cannabis real estate investment trust (“REIT”) in the United States. Due to its pioneer status and relatively large size, the company can conclude lease contracts with the best operators and the largest farms, which provides it with a solid competitive moat. The default of one of the key tenants scared investors, and the risk of mass bankruptcy is more than reflected in the price. However, we do not expect bankruptcies to become systemic.

Cannabis is a young and promising market that can grow at least due to the emerging trend toward legalization. Innovative Industrial has a high growth rate, stable marginality, and a strong balance sheet. Over the past five years, the company has increased its dividends 15 times: from $0.15 to $0.80. In our opinion, Innovative Industrial is trading at a discount to fair value. We rate IIPR as a Buy.

Company Profile

Innovative Industrial Properties specializes in the purchase, management, and leasing of industrial real estate to enterprises that are engaged in the production of cannabis and have a state license. The company’s business is built on buying real estate from cannabis farmers and leasing it back to them for a long-term period. The weighted average lease term is 16.6 years, the fee is charged on a triple-net lease basis.

The company’s real estate portfolio includes 111 properties with a total area of more than 8.6 million square feet. The five largest tenants account for 47% of revenue, the top 5 states account for 66.2%.

Industry Opportunity

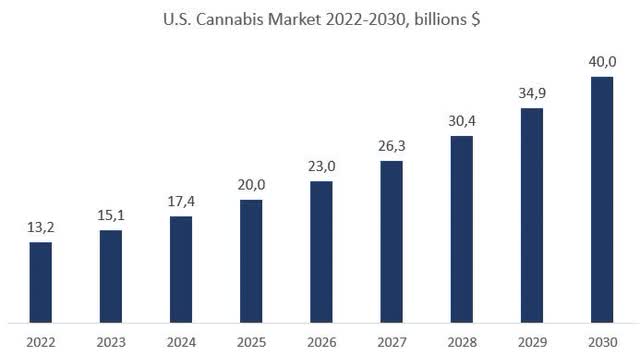

U.S. legal cannabis is a relatively young and actively developing market. Every year, marijuana is recognized as legal for medical purposes against a variety of diseases or recreational purposes in individual states. According to research, the U.S. cannabis market estimated at $13.2 billion will grow with a CAGR of 14.9%. Thus, the market should reach $40 billion by 2030.

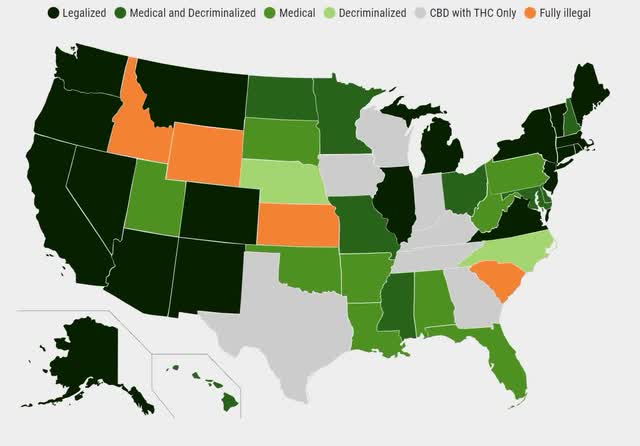

By the end of 2022, marijuana can be legalized for personal consumption in Arkansas, North Dakota, Maryland, and Missouri. Over the past two years, 11 states have legalized weed for personal consumption, and if you look at the full timeline of cannabis laws, you can see how the adoption of marijuana in the United States has accelerated in recent years. At the moment, cannabis is completely banned in 6 states and fully legalized in 18 states.

Considering the number of laws and amendments adopted regarding the marijuana market, for example, the SAFE banking act, which allows legitimate companies to receive bank financing. Or the Marijuana Opportunity Reinvestment and Expungement Act (MORE), which excludes marijuana from controlled substances and abolishes criminal liability for its sale, storage, and production. Both of these laws have already been passed by the House of Representatives and are being discussed in the Senate. If approved by the Senate – and the chances of this outcome are quite high – this will open up capital for the cannabis market, which will lead to increased funding, the opening of new companies, and active M&A transactions.

Size Matters

As mentioned, Innovative Industrial Properties is the largest cannabis REIT and a pioneer in its industry. Direct public competitors are AFC Gamma, Power REIT, and NewLake Capital Partners.

Innovative Industrial is much larger than its competitors: the company’s quarterly revenue exceeds the total revenue of its competitors by more than two times. The status of a pioneer in the industry and the largest company forms the image of a reliable partner in the eyes of cannabis operators. Due to its large financial capabilities, Industrial Properties is a preferable counterparty to its competitors. It is likely that as cannabis is legalized and new markets emerge, IIPR will be able to succeed significantly. The company will be able to find large and promising real estate objects and conclude lease agreements with the best representatives of the market.

Kings Garden Default

Operators are what Innovative Industrial Properties’ business is built on. Most recently, Kings Garden, one of the largest tenants, defaulted. The shares of IIPR collapsed that day by more than 20% and thus showed the great fears of investors about cannabis REITs. Nevertheless, if we study the situation in more detail, it seems more like an isolated case than the beginning of a chain of cannabis companies’ bankruptcies.

For example, PharmaCann, the largest tenant, whose revenue accounts for about 13% of all IIPR rental income, sees great potential in New York. Thanks to the legalization of marijuana for recreational purposes in this state, Pharma will be able to increase its revenue by up to 50% in 2023. Another tenant, Trulieve, which brings 8% of revenue to IIPR, is now actively supporting and funding an initiative to adopt cannabis for recreational purposes in Florida in 2024. Previously, a similar petition was rejected in 2022, but now, according to experts, the Supreme Court will not be able to reject the current initiative so easily.

Thus, two key tenants are actively developing and fighting for the largest markets, which would hardly be possible for companies in a pre-default state.

Financial Performance

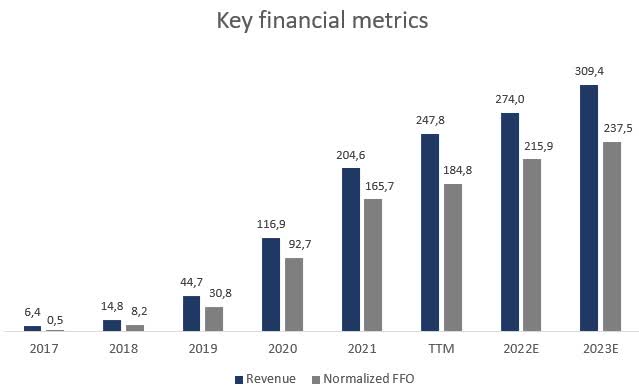

The growth of key indicators such as revenue and normalized funds from operations is slowing down, and this is quite expected. Every year there are fewer and fewer states where cannabis is not legalized, and the company is gradually moving from extensive to intensive growth.

Created by the author

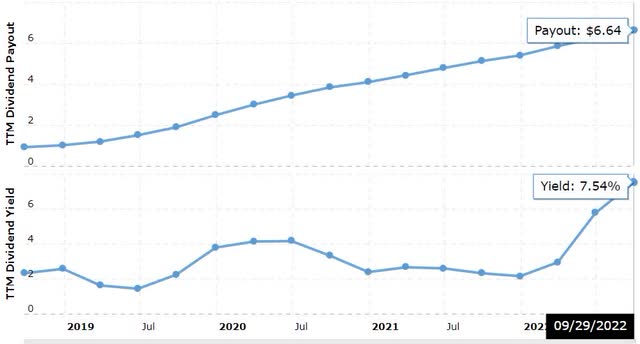

Despite the default of Kings Garden, according to the results of the last reporting period, IIPR increased dividend payments to $1.8 and annual to $6.8. The current dividend yield (TTM) is 7.54%, which is almost 3 percentage points higher than the median value for the sector (4.87%). The Dividend Payout Ratio is 88.56%.

The company has a strong balance sheet. The financial leverage is 1.29x, which is below the industry average. The current Net Debt/FFO ratio is 1.37x, which indicates a moderate debt burden.

IIPR Stock Valuation

At the moment, IIPR is trading at a premium to peers. In our opinion, the award seems reasonable. Unlike competitors, Innovative Industrial Properties has a competitive moat, through which it will be able to choose the best operators of the cannabis market and buy their land. The company has been operating in this market longer than its competitors and has a long history of dividend payments.

| IIPR | AFCG | PW | NLCP | |

| Market Cap | $2.63B | $306.80M | $35.63M | $304.82M |

| P/FFO (TTM) | 16.24x | 7.31x | 5.22x | 8.95x |

| Dividend yield | 7.54% | 13.92% | – | 9.86% |

| Payout ratio | 88.56% | 83.45% | – | 95.61% |

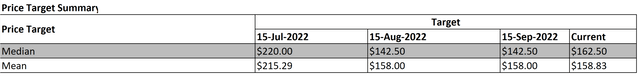

The minimum price target from investment banks set by Craig-Hallum is $125 per share (38.8% upside potential). In turn, BTIG estimates IIPR at $196 (117.7% upside potential). According to the Wall Street consensus, the company’s fair market value is $158.0, which implies 81.1% upside potential.

Key Risk

The current macroeconomic situation has a negative impact on cannabis producers. At the moment, the industry is experiencing a drop in product prices, as well as some mature firms are facing overproduction. Thus, the income of tenants and the IIPR itself may suffer significantly. Although we do not expect that tenant defaults will become systemic, this risk will continue to have a discounting effect on the value of the company’s shares.

Conclusion

Innovative Industrial Properties is a good opportunity to invest in the growing cannabis market. In the next few years, cannabis may be fully legalized in the United States as a recreational product. IIPR is likely to become the absolute beneficiary of legalization due to the competitive moat caused by the large size of the company and the status of a pioneer. The recent default of Kings Garden scared investors, and now the risk of systemic bankruptcy of tenants is largely embedded in IIPR shares.

In our opinion, Mr. Market overestimates the risk and underestimates the prospects. Innovative Industrial is distinguished by high financial indicators and a solid dividend yield. In addition, the company trades at a discount to fair market value. We are bullish on IIPR.

Be the first to comment