BlackJack3D

Innospec (NASDAQ:IOSP) is a leading international specialty chemical company divided into three business units: Fuel Specialties, Performance Chemicals, and Oilfield Services. There is a positive correlation between the crude oil futures price and the revenue generated by two of the three business segments at Innospec (Fuel Specialties and Oilfield Services). However, the rise in price for crude oil futures throughout the first half of 2022 has not necessarily been considered by market analysts when formulating their EPS estimates.

Not only am I expecting earnings to beat analysts’ estimates, but I’m also anticipating the share price to rise in the run-up to the earnings call. I rate IOSP a buy, with a near-term price target of $102.00 (5.5%), climbing to $107.50 by mid-November (11%).

Analysis

Revenue for Fuel Specialties and Oilfield Services has historically been strongly correlated to the price of crude oil futures. In fact, with specific reference to the Oilfield Services business unit, Innospec stated the following in their 10-K:

Trends in oil and gas prices affect the level of exploration, development and production activity of our customers, and the demand for our services and products.

And in their Q4 2021 earnings press release, Innospec highlighted a delay in demand recovery for jet fuel – which is primarily derived from crude oil – as the main cause for gross margins in the Fuel Specialties business running below their target levels.

Therefore, by using linear regression to model the relationship between revenue earned and historical crude oil futures prices, we can forecast revenue for the next two quarters.

Revenue Estimates

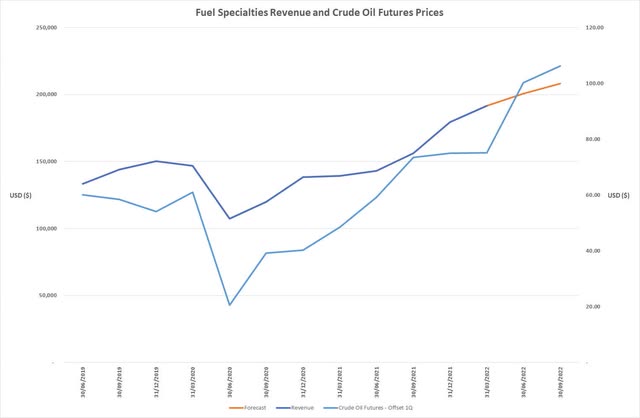

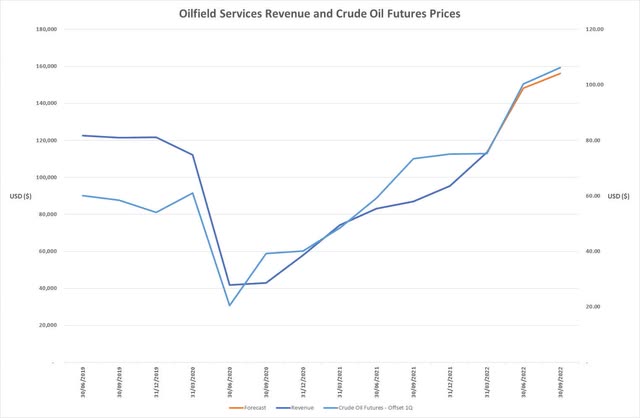

The analysis below considers the revenue earned by the two business units for the past 12 quarters, and the historical crude oil futures price for the final day of the prior quarter. For the purposes of the analysis, a one quarter lag to the crude oil futures price has been applied, allowing for any customer decisions based on the Futures price to materialize as revenue for Innospec. That is, the crude oil futures price at the close on March 31, 2019, is being compared against the Q2 2019 revenue.

Fuel Specialties:

Relationship between Crude Oil Futures prices and Fuel Specialties revenue (Image created by author using data from Investing.com and Innospec’s SEC filings)

Oilfield Services:

Relationship between Crude Oil Futures prices and Oilfield Services revenue (Image created by author using data from Investing.com and Innospec’s SEC filings)

As can be seen in the graphs above, the revenue earned in both business units follows the crude oil futures price trend.

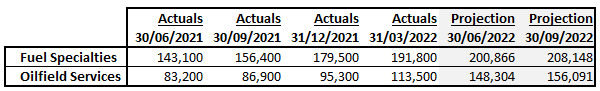

The analysis suggests increased revenue in Q2 and Q3 for both Fuel Specialties and Oilfield Services versus Q1 2022 and the equivalent quarter in 2021:

Revenue for Fuel Specialties and Oilfield Services business units (Image created by author using data from Innospec’s SEC filings and author’s calculations)

Implications on Earnings

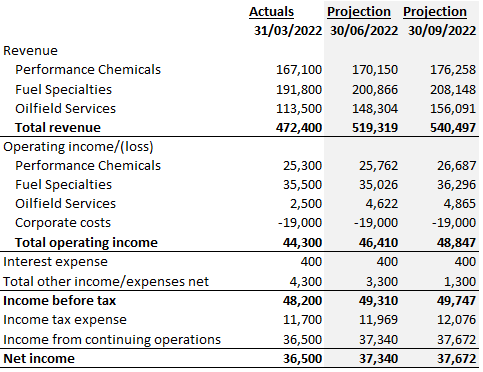

By using the revenue estimates calculated from the regression analysis for Fuel Specialties and Oilfield Services and by applying the assumptions outlined in the bullet points below, I have forecast net income for Q2 and Q3 2022.

- Revenue estimates for the Performance Chemicals business unit have been calculated using the same YoY revenue growth rate as Q1 2022 (32.7%).

- Operating income has been calculated by multiplying the Q1 2022 operating margins for each business unit with the revenue estimates.

- Corporate costs and interest expenses have been run rated from Q1 2022.

- A prudent assumption on Other Income has been applied and a 24.3% effective tax rate (the Q1 2022 rate) has been used to calculate income tax.

Forecast of Innospec’s Earnings (Image created by author using data from Innospec’s SEC filings and author’s calculations)

Opportunity

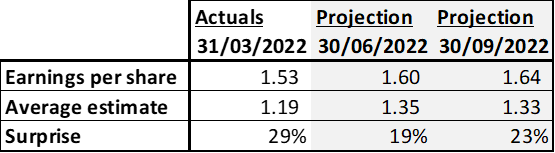

When adjusting the net income for non-GAAP amounts and assuming the diluted average shares are reduced by 30k per quarter from the Q1 2022 average (on Feb. 15, 2022, the company announced a repurchase plan for up to $50m of common stock over a three-year period; March 2022 saw 10k shares repurchased), the EPS is:

Anticipated Earnings per Share (Image created by author using data from Innospec’s Yahoo Finance and author’s calculations)

Per the table, both Q2 2022 and Q3 2022 earnings will beat analysts’ estimates.

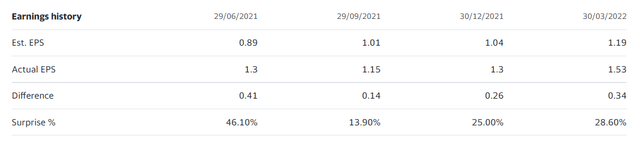

Innospec has a track record of beating analysts’ estimates, as you can see from the table below:

Earnings History (Yahoo Finance)

In fact, such is the track record of Innospec to outperform estimates, the market will typically buy the stock in the run-up to the earnings call with little movement to the price in the days that follow.

Below, I have included charts showing the share price movement in the five days before and after the earnings release for each of the last four quarters.

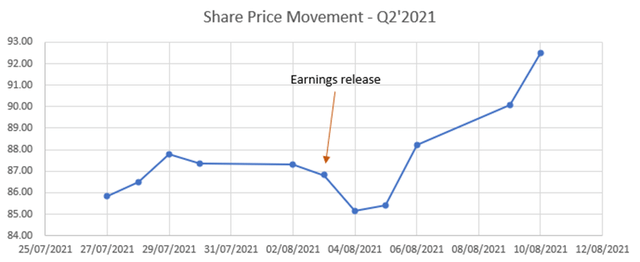

Q2 2021:

Share price movement in the days around the Q2’21 earnings release (Image created by author using data from Yahoo Finance)

- Gains from July 27, 2021, to Aug. 3, 2021 (earnings release) = 1.2%

- Gains from July 27, 2021, to Aug. 10, 2021 = 7.8%

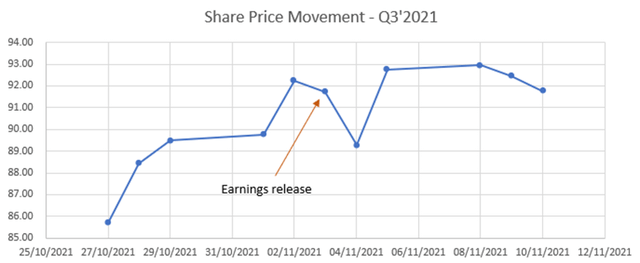

Q3 2021:

Share price movement in the days around the Q3’21 earnings release (Image created by author using data from Yahoo Finance)

- Gains from Oct. 27, 2021, to Nov. 3, 2021 (earnings release) = 7.0%

- Gains from Oct. 27, 2021, to Nov. 10, 2021 = 7.1%

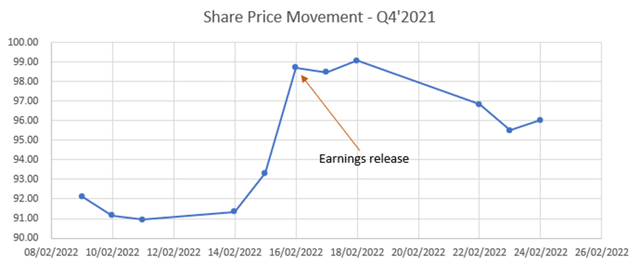

Q4 2021:

Share price movement in the days around the Q4’21 earnings release (Image created by author using data from Yahoo Finance)

- Gains from Feb. 9, 2022, to Feb. 16, 2022 (earnings release) = 7.2%

- Gains from Feb. 9, 2022, to Feb. 24, 2022 = 4.3%

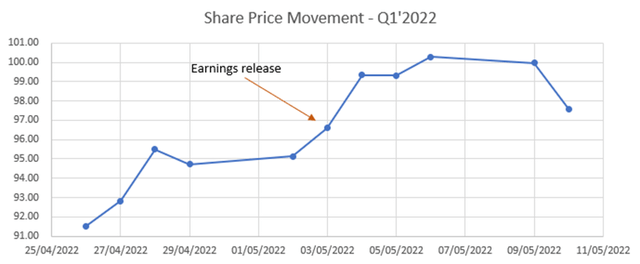

Q1 2022:

Share price movement in the days around the Q1’22 earnings release (Image created by author using data from Yahoo Finance)

- Gains from April 26, 2022, to May 3, 2022 (earnings release) = 5.5%

- Gains from April 26, 2022, to May 10, 2022 = 6.6%

Given that the above analysis suggests Innospec will once again beat analysts’ estimates, I expect to see Innospec’s share price climb in the run-up to its next earnings release on Aug. 3, 2022.

Valuation

At the time of writing, Innospec’s current share price is $96.69. If the EPS estimates outlined in this article materialize, then, based on the average increase over the past four quarters when earnings have outperformed estimates, the share price should rise by 5%-5.5% by Aug. 11, 2022 (five days after the upcoming earnings release). This provides a near-term price target of $102.

Applying the same rationale to five days after the Q3 2022 announcement and assuming $102 is achieved in August, my price target is $107.50 in November.

Risks

Negative risks

The crux of this investment thesis centers around the relationship between crude oil futures and the revenue generated by the Fuel Specialties and Oilfield Services business units. If the trend witnessed over the past 12 quarters fails to continue, then the revenue, earnings, and EPS beats calculated in this article will be incorrect.

Moreover, the article analyses the markets response to the stock in the days preceding the earnings release and the days that follow. Even if the EPS analysis holds, the market response witnessed over the past four quarters may not be replicated.

Although beyond the time frame of this piece of research, the crude oil futures contracts have fallen below $100 again. Applying the same analysis as before would indicate that the revenue growth projected for Q2 and Q3 2022 will not be sustained going into Q4 2022.

Positive risks

For the purposes of this article, the revenue and operating income of the Performance Chemicals business unit has been calculated by multiplying the revenue growth from Q1 2021 to Q1 2022, with the revenue earned in Q2 and Q3 2021, respectively. However, Innospec have stated in their corporate presentation that they expect high single-digit organic volume growth and expanding margins for this business unit. An operating margin of 15.1% has been used in this analysis.

Optically, Innospec now report on Performance Chemicals before Fuel Specialties (which was previously referenced first) and Oilfield Services in all published materials. Although this point might seem arbitrary, it suggests to me that the senior management team at Innospec are optimistic about the prospects of this business unit and see it as a driving force for future growth for the company.

The corporate presentation goes on to identify significant potential for margin expansion for the Oilfield Services business unit, which, given that this article has assumed a 3.1% operating margin for Q2 and Q3 2022 and the average operating margin in 2019 was 8.3%, bodes well for the company’s future earnings.

Conclusion

There is a positive correlation between the historical crude oil futures price and the revenue earned in the subsequent quarter by the Fuel Specialties and Oilfield Services business units. Off the back of that relationship, the analysis indicates that Q2 2022 and Q3 2022 earnings will beat analysts’ estimates – and that’s before any management anticipated margin expansion materializes. I expect the share price to increase prior to the upcoming earnings release, culminating in a 5.5% rise in price by mid-August and total upside of 11% by mid-November. I would therefore rate IOSP as a buy.

Be the first to comment