jetcityimage

Indian IT services large caps have seen their margins disappoint so far, and Infosys (NYSE:INFY), the second-largest Indian IT services company, was no different. Coupled with the uncertain macro backdrop ahead, medium-term revenue visibility is also a challenge. Nonetheless, the company is executing well despite the headwinds, as reflected in its industry-leading growth (revenue growth guidance was revised upwards at 14-16%) and margin trajectory, and therefore, my positive view of INFY shares remains.

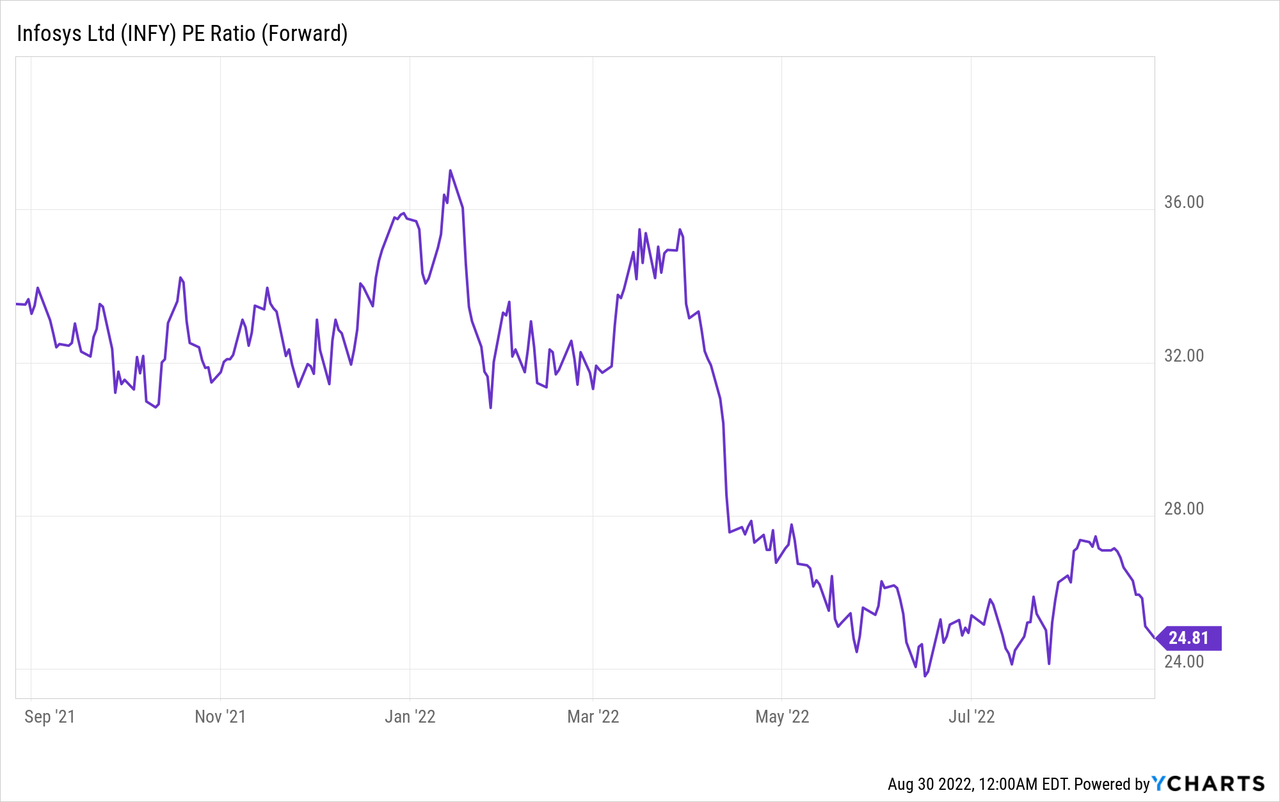

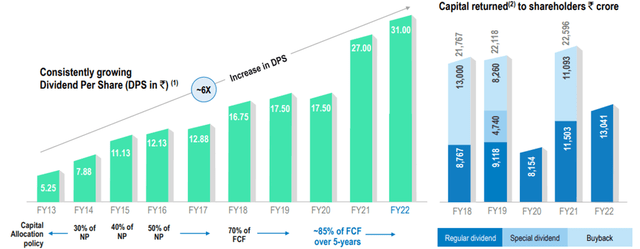

While I am cautious about the Indian IT services sector following the lower margin results throughout the first quarter of fiscal 2023, the YTD valuation reset appears to have priced in much of the downside. On a relative basis, INFY trades at a premium, which I view as deserved not only on account of its industry-leading financials but also its ability to weather the cycles and perhaps even gain market share through the upcoming downturn. Coupled with the significantly increased dividend (c. 6x over fiscal 2013-2022), INFY shares offer plenty of downside protection at the current price.

Defying the Industry Headwinds with a Guidance Lift

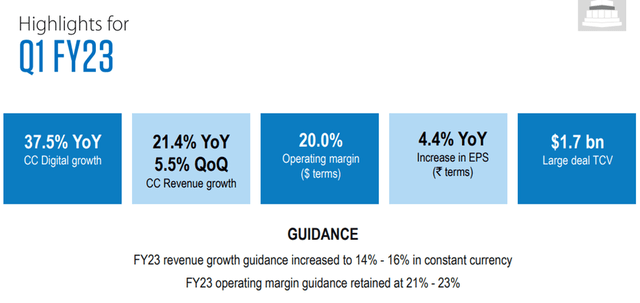

INFY started fiscal 2023 with above-consensus revenue growth at 3.8% Q/Q and 17.5% Y/Y in USD terms. By vertical, energy and utilities led the way at +7.3% Q/Q, while manufacturing was also strong at +6.5% Q/Q, likely on account of the Daimler (OTCPK:MBGAF) deal. The remaining communications and retail verticals grew at 5.5% and 5.3%, respectively, with financial services the underperformer at a relatively muted +1.5% Q/Q. While the order book was soft at $1.7 billion (down 25% Q/Q and 34% Y/Y), due to the lack of mega deals this quarter, INFY did disclose an impressive large deal TCV (“Total Contract Value”) of $1.7 billion for the quarter. This brings the net new deals component up to c. 50%, the company’s highest in years, with representation from both deal categories in the pipeline (i.e., growth-directed initiatives and cost-cutting projects). While the pipeline is robust and management remains confident in broad-based demand in the upcoming quarters, the slowdown in retail, mortgages, and financial services is a concern.

The biggest surprise was INFY management’s optimism on near-term revenue growth, however, as it raised its growth guidance for fiscal 2023 from 13-15% Y/Y in constant currency terms to 14-16% Y/Y. While the strong execution this quarter and the healthy deal pipeline were major positives, the guidance lift was nonetheless a positive surprise considering the prevailing macro concerns. However, management’s caution of certain pockets of weakness, like the mortgage business in the BFSI vertical (likely due to rate hikes), could signal downside surprises ahead. Nonetheless, Q2 (and 1H) is typically a strong revenue growth quarter from a seasonal point of view, which should help. Also worth noting are the secular tailwinds from digital transformation and cloud migration which remain intact. Digital is now contributing c. 61% of INFY’s overall revenues (+33% Y/Y and 7% Q/Q in Q1 ’23), as INFY’s longer-term strategy to leverage its Cobalt offering to create standardized digital solutions appears to be yielding benefits. And with INFY also in the midst of building industry-leading digital capabilities through its Metaverse Foundry offering, which offers a range of use cases to its clients, there is plenty of room for growth-related surprises to the upside.

EBIT Margin Recovery Path Remains Unclear

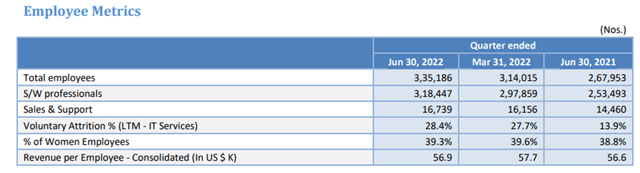

In contrast with the resilient revenue performance, INFY posted an underwhelming EBIT margin at 20.1% (down 150bps Q/Q). The miss was partly due to salary increments (-160bps Q/Q), lower utilization (-40bps Q/Q due to increased hiring), and higher subcontracting expenses (-30bps Q/Q), while currency benefits of +30bps Q/Q provided a partial offset along with 50bps Q/Q from the reversal of Q4 ‘22 client provisions and RPP (“registered pension plan”) benefits. Infosys also added c. 21k employees in Q1 ‘23, as its voluntary attrition percentage rose to 28.4% (vs. 27.7% in Q4 ’22). This was a seasonally high attrition quarter, however, and the fact that its quarterly annualized attrition declined by c. 1%pt on a sequential basis is a notable positive. The strong employee additions should also help subcontracting expenses come down in the upcoming quarters.

The near-term guidance was officially retained, but I would note management’s commentary that it would end up at the lower end of the 21-23% margin range was an implied guidance cut. However, INFY retains several key levers which could likely lead to margin improvement in the upcoming quarters, including lower subcontracting costs, higher utilization, higher offshore mix in revenue, and price hikes. Also, attrition is projected to normalize over the next few quarters, with more freshers getting billed to the clients. Any margin recovery could be gradual, however, with material headwinds from salary increments to senior-level management (note that the senior management salary hike will be reflected in Q2 ’23 numbers). Meanwhile, improved utilization and contract-level price increases are likely to be gradual. As such, I see a margin recovery only materializing beyond fiscal 2023, and therefore, investors will have to be patient in the meantime.

Final Take

The Indian IT services results season is now behind us, leaving a clearer picture of the near-term headwinds. On the one hand, the net impact on growth numbers has been minimal, although INFY’s strong top-line growth momentum (as evidenced by the upgraded near-term growth guidance this early in the fiscal year) was the most impressive among the big four players. Deal wins have also been resilient, with the book-to-bill ratios broadly in line and strong pipelines remaining intact, reflecting the limited economic impact so far. Yet, inflationary cost headwinds are weighing on the margins, and it could take some time for a margin recovery to materialize.

The YTD de-rating of INFY shares, however, seems unjustified. Despite INFY’s financial strength and track record of resilience (relative to peers) in times of an economic downturn, its current valuation at c. 24x fiscal 2025 numbers is well below where shares have historically traded. Also, considering the structural increase in global tech intensity in recent years and the improved shareholder return payout, investors get plenty of downside protection at these levels.

Be the first to comment