MCCAIG/iStock via Getty Images

Inflation continues to increase, driven by a range of supply and demand side factors, which is increasing the probability of a contraction in economic activity. Many of these factors should moderate in the second half of the year, leading to an easing of inflation. It is likely that the combination of supply side shocks, tightening financial conditions and falling asset prices will cause a fall in consumer spending. If this leads to rising unemployment a feedback loop may be created, resulting in a recession. Assets with exposure to consumer spending or cyclical sectors could perform poorly going forward. The rapid drop in energy stocks in the past week is likely reflective of the increasing probability of recession and demand destruction.

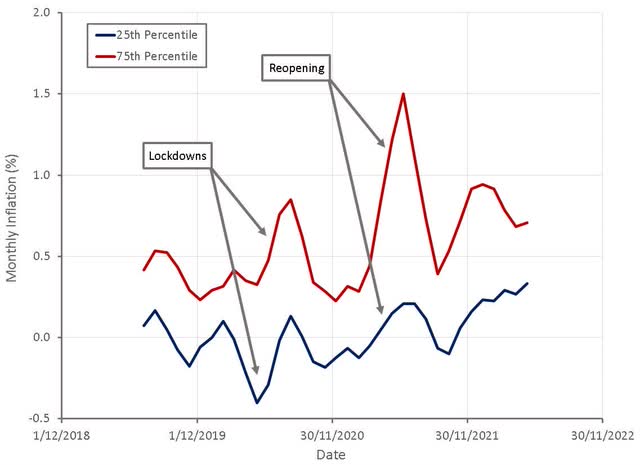

Figure 1: CPI Component Inflation by Percentile (source: Created by author using data from BLS)

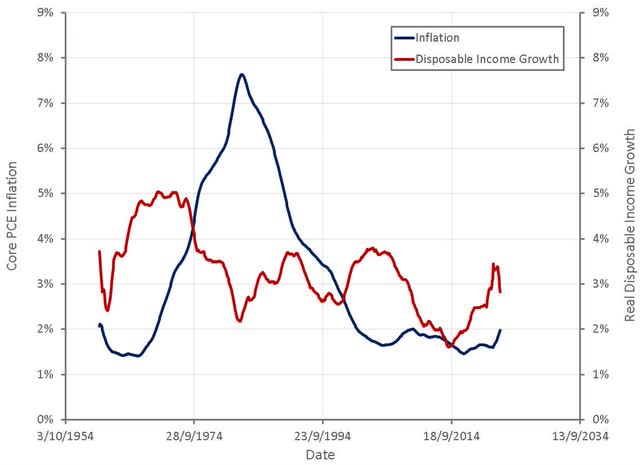

Inflation is currently driven by a combination of supply and demand factors, although is quite different to the inflation experienced in the late 1970s. Growth in consumer spending power during the 70s was strong due to a combination of rapid population growth (baby boomers moving into the workforce) and rising wages. Population growth in most developed countries is now relatively weak and wage growth modest. There is unlikely to be the sustained demand side pressure necessary to cause high inflation rates going forward.

Figure 2: Inflation and Income Growth (source: Created by author using data from The Federal Reserve)

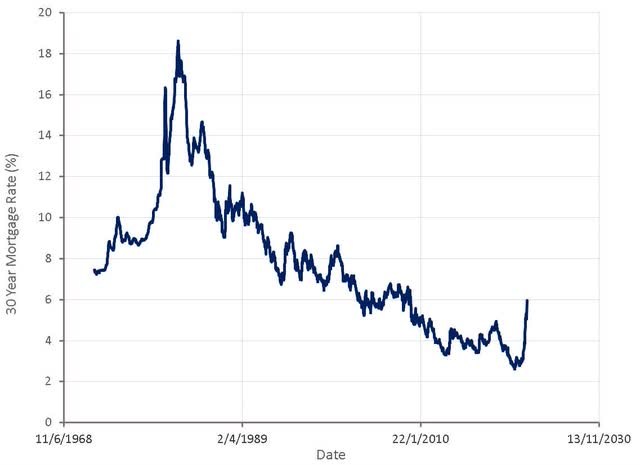

Lower interest rates also have the potential to bring forward future demand, and declining interest rates over the past 40 years has led to an increase in debt fueled spending. With current debt levels, even a relatively modest rise in interest rates acts as a large headwind to economic growth.

Figure 3: 30 Year Mortgage Rates (source: Created by author using data from The Federal Reserve)

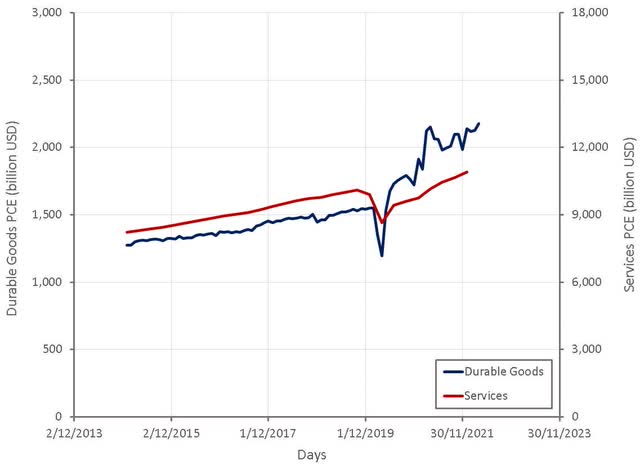

More than increased demand, a shift in demand across categories has been responsible for recent inflation. Until spending patterns normalize or supply chains have time to adjust, inflation is likely to remain elevated.

Figure 4: Durable Goods and Services PCE (source: Created by author using data from The Federal Reserve)

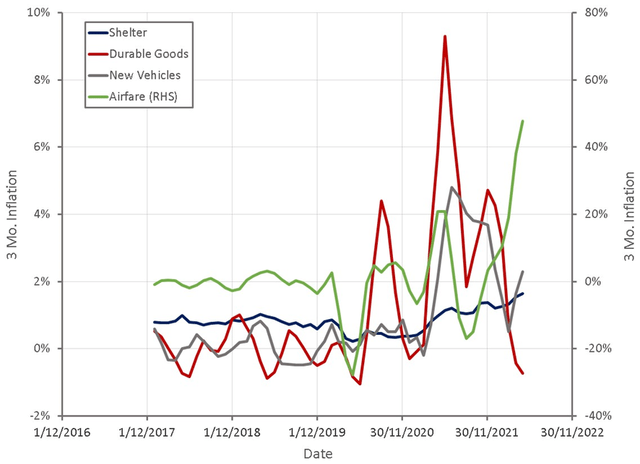

Inflation in categories like new and used vehicles, shelter, durable goods and airfares are illustrative of the impact of the pandemic. While inflation in categories like durable goods and vehicles is beginning to normalize, inflation in others like shelter and airfares is increasing.

Figure 5: Pandemic Impacted Inflation Components (source: Created by author using data from The Federal Reserve)

Food and energy are beginning to dominate the inflation story though, with inflationary pressure building throughout 2021 and increasing after Russia’s invasion of Ukraine. Demand for food and energy is relatively inelastic and the ability of the Fed to control food and energy inflation without crashing the economy is likely limited.

Figure 6: Energy and Food at Home Inflation (source: Created by author using data from The Federal Reserve)

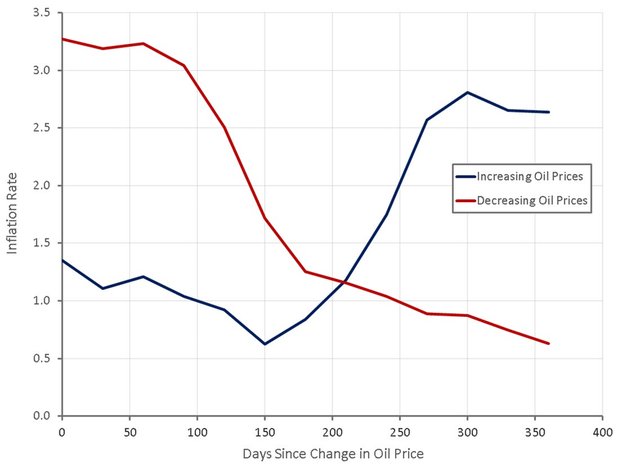

Inflation in energy prices is particularly important as energy costs feed through to most other items. Past occurrences of large changes in oil prices illustrate both the impact of energy prices on inflation and the time required for them to be fully felt. If past data is a guide, it may not be until June-September before the impact of higher oil prices has fed through to inflation figures.

Figure 7: Impact of Oil Price Changes on Inflation (source: Created by author using data from The Federal Reserve)

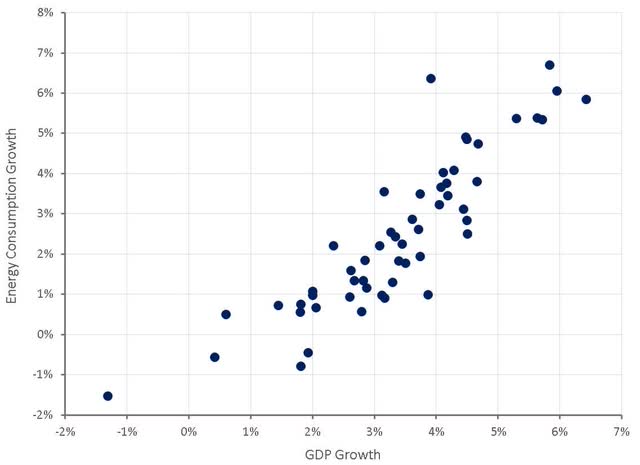

Absent the impact of sanctions on Russia, it is difficult to see how energy prices will contribute to inflation over a multi-year period. Energy consumption is closely related to GDP growth, and with GDP growth likely to be weak going forward, so will be energy consumption growth.

Figure 8: Global Energy Consumption and GDP Growth (source: Created by author using data from The Federal Reserve and BP)

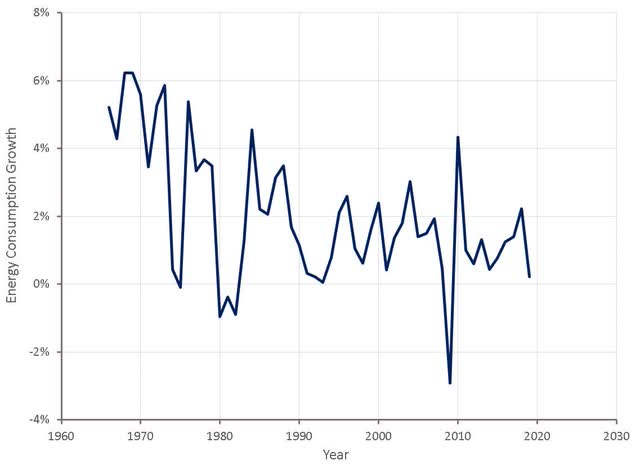

Excluding China, energy consumption growth has averaged less than 1% in recent years and could moderate further, particularly if prices remain high. The late 1970s are illustrative of how a period of high energy prices can lead permanent demand destruction (increased efficiency, shift away from energy intensive activities, etc.)

Figure 9: Global (ex-China) Energy Consumption Growth (source: Created by author using data from BP)

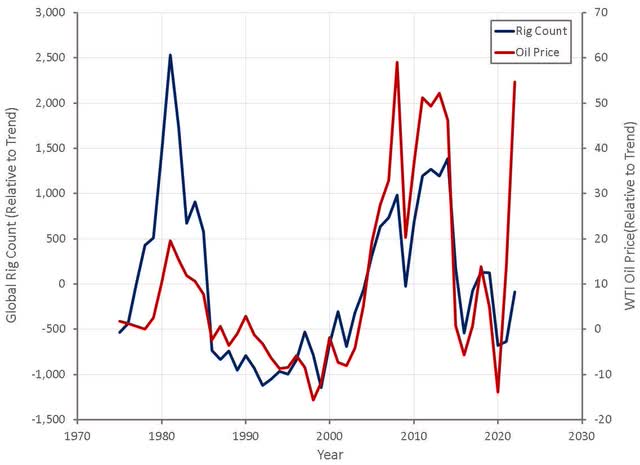

An expectation of weak demand growth may explain why the reaction of the oil and gas industry to higher prices has been muted. While upstream activity is picking up, the increase in drilling rigs, frac spreads, etc. is lower than what might have been expected given oil and gas prices. There are also midstream and downstream bottlenecks to consider, and in some cases, these likely make an increase in upstream activity futile.

Figure 10: Global Rig Count (source: Created by author using data from Baker Hughes and The Federal Reserve)

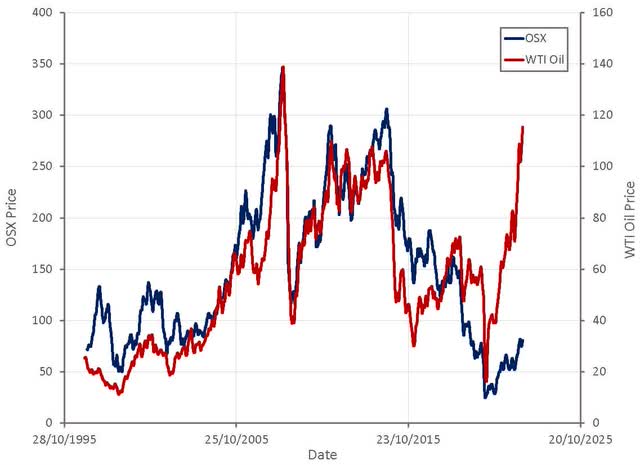

The lack of a supply response to higher oil and gas prices can also be seen in the oilfield services sector, where many stocks have struggled to recapture pre-COVID levels or higher. The sharp drop in many energy stocks over the past few weeks likely reflects growing concern that there will be significant demand destruction in the short term, both from higher prices and tighter financial conditions.

Figure 11: OSX Index (source: Created by author using data from Yahoo Finance)

Fertilizer prices have been another important contributor to inflationary pressures, but they are now down approximately 30% from their peak. There are suggestions that some of this is demand destruction, but also reflects the declining cost of ammonia production as European natural gas prices fall.

Conclusion

Inflation is forcing the Fed to tighten into a downturn, and this may have severe consequences over the next 12 months. Inflationary pressures are likely to moderate in the second half of 2022, independent of financial conditions. The combination of demand destruction from tighter financial conditions with normalizing supply chains should lead to a fall in inflation. While many stocks have already fallen significantly, there are stocks with cyclical exposure that do not appear to reflect the likelihood of falling profits. For example, Apple’s (AAPL) stock has yet to price in a return to pre-COVID trend profits, let alone a recession. Home Depot (HD) is still above pre-COVID levels despite the fact that a housing market contraction and a fall in durable goods spending are likely. With earnings estimates set to fall, it appears likely that stock markets still have further to fall before finding a bottom.

Be the first to comment