niphon

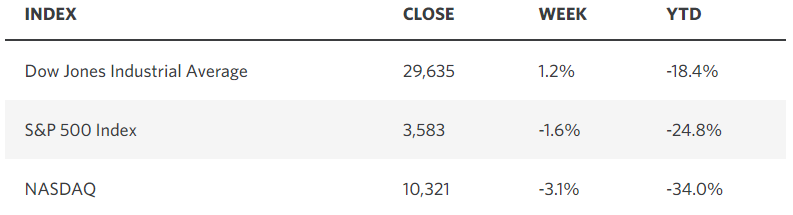

The message from markets last week was that tops and bottoms are both processes and not events. The bottom I speak of is the one forming in the major market averages, while the top is the one progressing in various measures of inflation. What we know from prior market cycles is that bottoms in stocks coincide with tops in the rate of inflation. Last week’s Consumer Price Index report showed another modest decline in the headline number from 8.3% in August to 8.2% in September, both of which are well off the high in June of 9.1%. The core rate, excluding food and energy, rose to a new high of 6.6%, but each component of the inflation indexes peaks at different times, and there are more indications of lower prices in the months ahead than higher ones. In the same manner, while the S&P 500 notched a modestly lower close in October than it did in June, the Russell 2000 held its June low and looks poised to move higher. My bottom line is that these processes of topping and bottoming should be complete during the fourth quarter, setting the stage for a profitable 2023.

Edward Jones

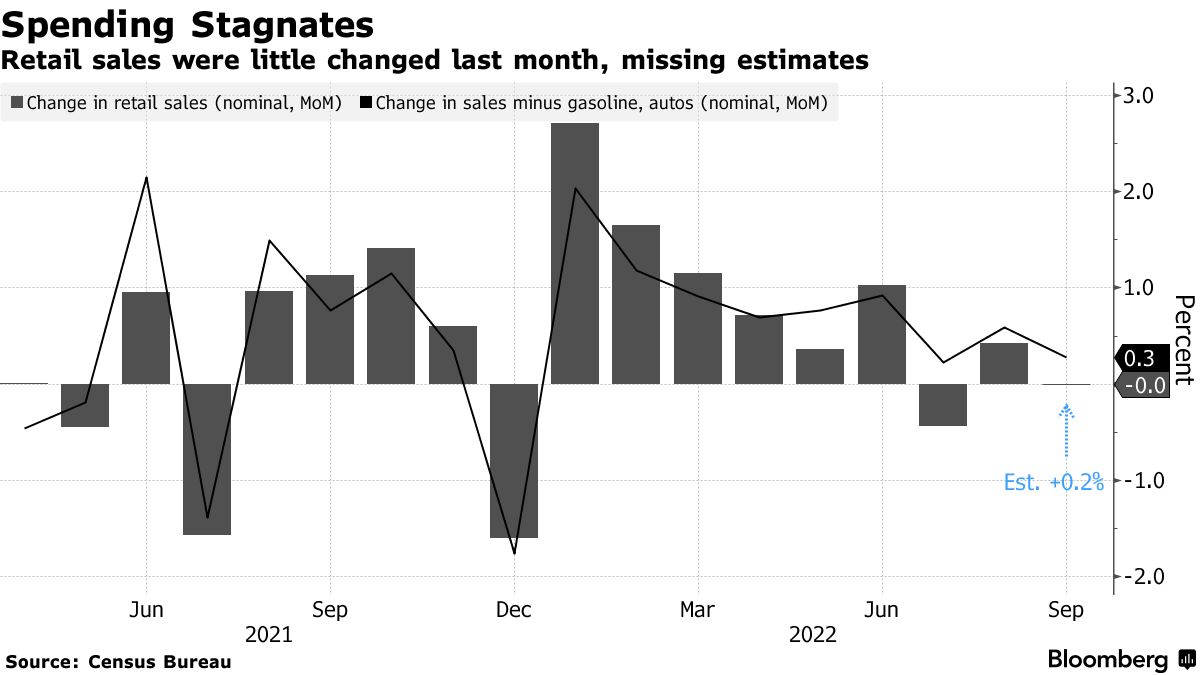

Critical to my outlook is a continuation of the expansion that began in 2020. We had more good news on that front from Friday’s retail sales report. While the headline number showed no growth compared to estimates for a gain of 0.2%, sales are up 8.2% over the past year, which is in line with the Consumer Price Index. More importantly, core sales, which exclude autos, gas, and building materials, rose 0.4% in September and saw upward revisions to prior months. The core sales figure is the number used to calculate GDP. These numbers are neither too hot nor too cold, but just right to help navigate the soft landing I expect to see in 2023.

Bloomberg

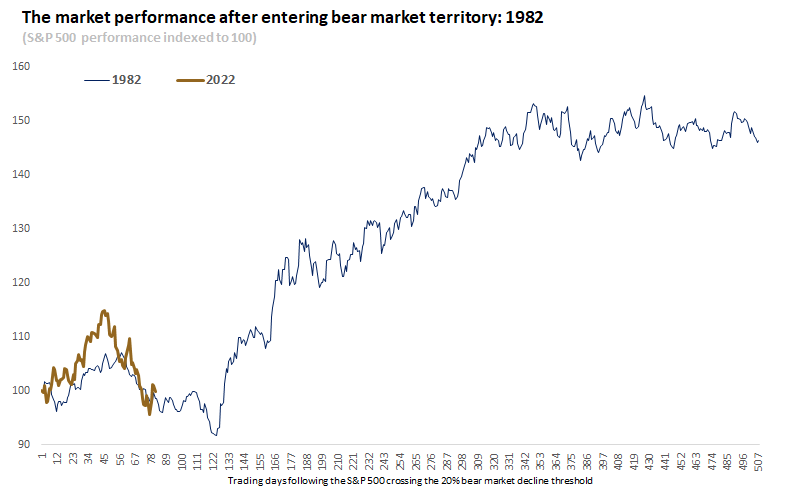

Last week, there were a couple of statistical milestones struck in markets that support my outlook for much better market performance ahead. We had the enormous intraday swing of 5.6% in the S&P 500 that started with a loss of more than 2% and finished with a gain of more than 2% in reaction to Thursday’s inflation report. That was accompanied by a buying panic, in which 45% of all the stocks on the NYSE traded on an uptick the day after the S&P 500 notched a new 52-week low. These are rare events over the past 30 years that have been associated with extremely bullish price action in the weeks and months that followed. I think their reoccurrence suggests the market is starting its rebound similar to what we saw in 1982 after the last hyper-inflationary period.

Edward Jones

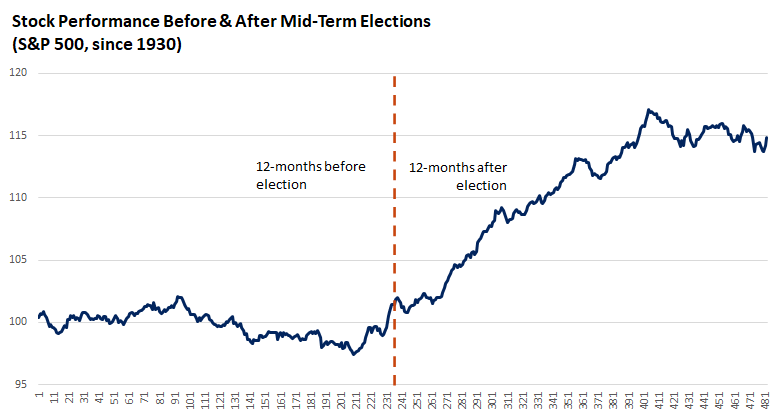

The difference is that we have another historical tailwind in the midterm elections rapidly approaching. The S&P 500 has performed extremely well in the months following the midterms, as the uncertainty of the election is behind us. This comes on top of what has been the seasonally strongest months of the year for market performance.

Edward Jones

If you look over your shoulder, there are countless negatives to focus on. Yet markets look forward, reflecting outcomes in the real economy that most of us can’t see on an individual basis. They seem obvious only after the fact. Markets also respond to rates of change, which can also be difficult to identify once they start to occur. One day we may receive data that supports the idea that the peak rate of inflation is behind us, while the next we receive data that refutes it. The same can be said for market bottoms. If we stand back from the day, week, or month, I think the picture becomes a lot more clear. The rate of inflation will be significantly lower in 2023 than it is in 2022, which means that stock prices should be meaningfully higher. Therefore, investors should position portfolios today for the next bull market to come.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment