Khanchit Khirisutchalual

The June CPI data came in at 9.1%, a four-decade high that is sending the S&P 500 (NYSEARCA:SPY) and Nasdaq (QQQ) into another downdraft.

While the ramifications of accelerating year-over-year inflation are certainly not positive, and include the increased likelihood of a full 100 basis point Federal Reserve rate hike at its next meeting, there is potentially light at the end of the tunnel.

In this article, we will share five reasons why we think inflation may have peaked in June, why we think inflation will still remain at an elevated level for the foreseeable future why real interest rates will remain negative, and what we think this will mean for the S&P 500 moving forward.

Why Inflation May Have Peaked In June

Reason #1: Falling Commodity Prices

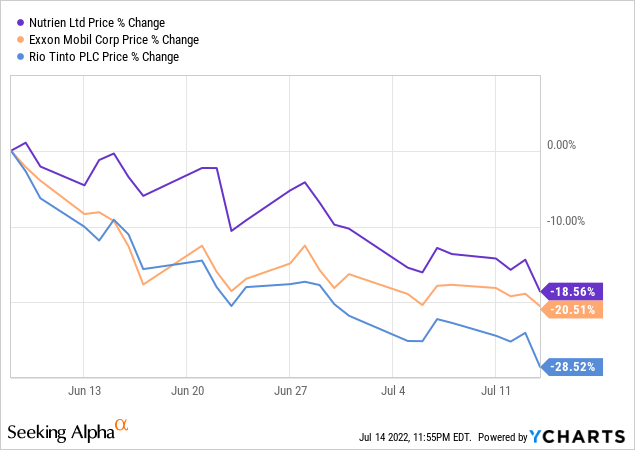

The biggest green shoot for a peaking of year-over-year CPI increases is the fact that commodity prices have been falling in recent weeks. Energy, agricultural, and industrial commodities have all begun to pull back sharply. Not only that, but the market seems to be pricing in substantial further declines given how it is pricing businesses in those industries. For example, energy giant Exxon Mobil (XOM), agricultural giant Nutrien (NTR), and mining giant Rio Tinto (RIO) have all seen their prices plummet in recent weeks.

As Deutsche Bank recently wrote:

Futures prices are falling despite physical markets still being tight, suggesting that demand destruction is taking hold, which will be key to getting inflation back on target

In fact, the pullback in these key commodity sectors has prompted Barclays to reduce its year-end CPI forecast by 600 basis points to 5.7%, which is a far cry from the robust high single digit first half numbers we have been seeing so far in 2022.

Reason #2: Supply Chain Backlogs Clearing

Shipping costs are falling and product delivery times are improving according to Pantheon Macroeconomics. This is the result of gradual efforts to combat backlogs finally taking effect, continued reductions in COVID-19 related headwinds, and demand destruction resulting from higher prices.

Reason #3: Reduced Inflation Expectations In Bond Markets

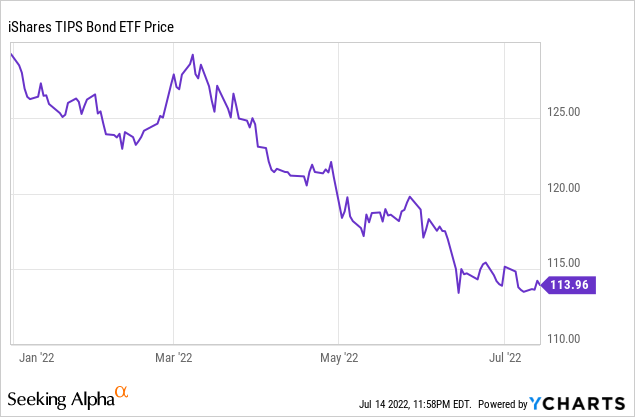

The performance of the iShares TIPS Bond ETF (TIP) year-to-date says a lot about expectations for inflation. Despite inflation rates soaring this year, TIP has had a rough performance year-to-date. That is because bond market investors are not expecting inflation levels to stick around and TIP’s performance is dependent on long-term inflation levels, not necessarily just the short-term performance.

While bond market investors are not always right, where they put their money often sends a powerful signal of where things may be headed.

Reason #4: Decelerating Wage Growth

While wages continue to grow at a strong pace relative to history, June’s 5.1% year-over-year increase was a deceleration from earlier in the year and lags 400 basis points behind the inflation rate. This implies that the current inflation rate is not only unsustainable given that it significantly exceeds the growth in workers’ income levels, but it also means that cost pressure growth on businesses is beginning to subside, which is also a deflationary signal.

Reason #5: Inventory Growth

Last, but not least, as was already mentioned the supply chain is finally catching up with the post-COVID demand explosion, leaving retailers with demand surpluses. On top of that, rapidly rising interest rates are making it more difficult for buyers to finance products that have typically been purchased on credit. A big example of this is the housing sector, where home builders are having to slash prices in order to move inventory. Similar things are being predicted for the used car market. With housing and vehicle prices looking like they have almost certainly peaked, this should take a major bite out of inflation’s momentum.

Why Interest Rates Will Remain Negative

Despite the mounting evidence that June may have been – or at least near – the peak of the current inflationary wave, we still believe inflation rates will remain above their historical averages and that interest rates will remain firmly in negative territory for the foreseeable future.

The reason for this is quite simple: massive government debts and ongoing deficit spending require it. The U.S. government debt has now eclipsed the country’s GDP and the budget deficit is so wide and Americans’ appetite for ever-growing government programs continues unabated. Meanwhile, soaring geopolitical tensions and demands ranging from China’s accelerated military build-up in the South China Sea and ever-present threat of invading Taiwan to Russia’s invasion of Ukraine, will continue to force Washington to spend aggressively on its military.

On top of that, big-spender Donald Trump appears increasingly likely to be the next GOP nominee for President and the Democrats are pretty much universally in favor of more government spending than we are already doing, regardless if Joe Biden runs again in 2024 or not. As a result, it appears to be a virtual lock that the U.S. national debt will continue to grow at a much faster rate than the U.S. economy for years to come.

This means that the only way for the U.S. to sustain its foreign commitments, keep pace with the Chinese, and satisfy the domestic demands of its citizens while remaining solvent is to print money aggressively. More specifically, it means that the U.S. will need to print money at a rate that is higher than the interest rate it pays on its debt. As a result, negative real interest rates over the long-term are a virtual certainty.

Implications For The S&P 500

While sustained high inflation rates are never a good thing for the economy or investors, all is not lost. In fact, there are growing reasons for optimism here.

First and foremost, consumer spending and the jobs market remain healthy, at least on the surface. The housing market seems to have finally cooled off, but is not showing signs of crashing either. These three trends all bode well for the middle class, which is generally the lifeblood of the American economy.

If inflation has truly peaked and can settle in to a 4-5% range for the next several years, the Federal Reserve will feel at liberty to back off its ambitious rate hiking program and interest rates will likely settle around 3-4% and the economy will probably be ok. Then, as innovation in deflationary technologies like artificial intelligence and robotics pick up in the coming years, inflation should drift back down towards its historic level of ~3% and interest rates can potentially fall even further. Alternatively, the U.S. Government may take advantage of this wave of innovation to print more money to help dilute the burden of its debt and deficits, in which case inflation rates will likely remain in a mid-single digit range.

Either outcome is unlikely to be catastrophic for the economy, and we believe that negative real interest rates – where interest rates are in a low-ish band and inflation remains at a reasonable level – in conjunction with strong technological innovation will be conducive to solid economic growth and a resumption of strong stock market gains, especially among the technologically savvy giants of the SPY.

Investor Takeaway

Inflation remains at the forefront of most consumers’ and business’ concerns and for good reason. CPI remains at four-decade highs and has accelerated thus far this year. However, there are several clear evidences that its momentum is declining and in fact CPI might have actually peaked in June.

That said, there are also reasons to believe that the government has a strong incentive to continue printing massive amounts of money to keep funding its runaway spending and service its massive debt burden. As long as the economy suffers no more major supply shocks and can continue to iron out its imbalances, inflation should settle at a more reasonable level in the near future and remain there until deflationary technological innovations can bring it down still further. This in turn should help to relieve some of the pressures that the market is feeling from the Federal Reserve’s aggressive interest rate hiking course.

The end result is that – barring a severe recession – the forward outlook for stocks looks brighter than recent market sentiment seems to indicate, especially for technologically savvy companies that make up the lion’s share of the S&P 500. As a result, we are cautiously bullish on SPY at the moment, though we are still being highly selective in which specific stocks we buy at the moment.

Be the first to comment