SinanAyhan/iStock via Getty Images

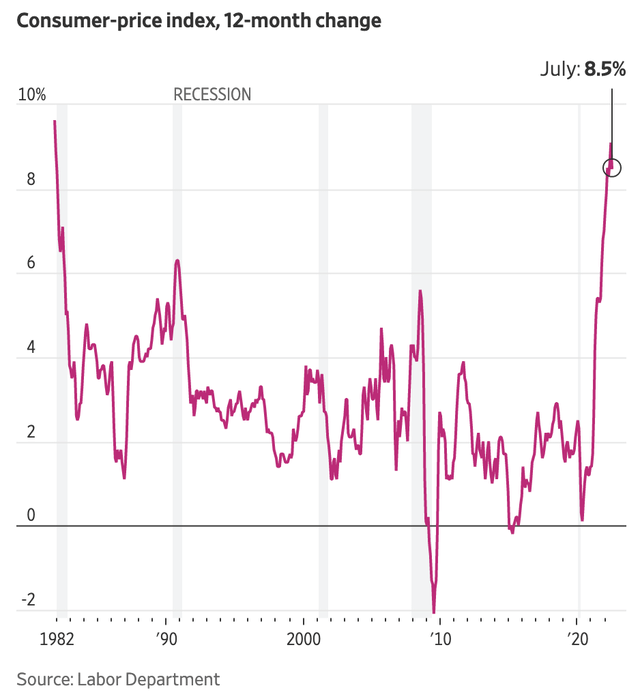

Consumer price inflation, year-over-year, came in at 8.5 percent, downs from 9.1 percent in June.

Consumer price inflation, not including food and energy prices, rose 5.9 percent in July, remaining at the level achieved in June.

Consumer Price Inflation (Wall Street Journal)

Yes, if you want to save that the inflation picture has improved, you can certainly say that.

However, inflation remains a major problem for the American economy.

And, inflation remains a major problem for the world economy.

The chart looks as if there exists bookends to the events of the past forty years.

And, this raises the big question, are we entering a “new Age” for the U.S. economy?

I have just written about the possibility of entering a new “Age”.

The chart above can be used to discuss this possibility.

The New Age

Andy Kessler writes about this new Age in the Wall Street Journal.

“The bull market started 40 years ago this week.”

“On August 12, 1982, the Dow-Jones Industrial Average bottomed at 776.91….”

“It peaked on January 4, 2022, at 36,800, a gain of 47 times, or a 9.6 percent annual rate, until inflation slew the super bull.”

Note that it appears like the trend in consumer price inflation is downward.

Once the U.S. got through the price inflation of the early ’80s, the general drift of the inflation rate was to smaller and smaller increases in the price level.

One of the explanations given for this downward slope is that the continued efforts of the Federal Reserve System to generate positive growth over this period of time saw money going into asset prices and not into consumer prices.

That is government policy, both fiscal and monetary policy, was created to generate rising asset prices and not consumer prices.

As investors and corporations bought onto this approach, based upon Keynesian economic theory and the statistical relationship referred to as the Phillips Curve, they saw that the best, and safest, way to build up greater wealth was to go into assets: assets like stocks, gold, and other commodities and real estate.

This approach to economic policy I have titled “credit inflation.”

What happened was that the stimulus monies created by the government went more and more, during this time period, into assets and not into real investment expenditures.

Thus, the annual rise in consumer prices became smaller and smaller and smaller over time. The compound annual rate of increase in the consumer price index was around 2.3 percent for the entire period between the end of the Great Recession and the Covid-19 Recession.

This is the lowest bout of inflation in the post-World War II period.

The rise in asset prices became greater and greater over time. Just look at what happened to stock prices over the past ten years or so. The stock market was constantly hitting higher and higher new historical highs.

This continued until the start of this year. The Standard & Poor’s 500 Stock Index hit its all-time historical high on January 3, 2022, and the Dow Jones Industrial Index hit its all-time historical high on January 4, 2022.

But, because the stimulus money was primarily going into asset prices and not into real capital expenditures, the growth of labor productivity dropped into a range between zero-percent and one-percent.

The direct effect of this was that the growth rate of real GDP during this period of expansion was the lowest rate of any period of economic recovery since World War II.

This explains the chart between 1982 and 2020.

The “New” Age?

This is a major reason why economists are asking whether or not we might have moved on into a “New” Age.

Money is flowing into consumer prices. Consumer price inflation is hitting levels not seen since 1980.

Asset prices are wavering.

Could it be that the time period of “credit inflation” has ended and something new has begun?

The Federal Reserve would like to have the answer to this question.

Unfortunately, I don’t think we are going to have the answer to this question in the near future.

This is because the period we are in is one “radical uncertainty.”

As I have written elsewhere, there are so many markets, there are so many organizations, there are so many investors that are facing situations of disequilibrium at this time, that few people, if any, have a grasp of what is in store for us.

The rise in consumer prices to 40-year highs is a sign that we may be moving away from a focus on asset prices.

Yet, the volatility in stock prices indicates that investors may not be willing to give up on their picture of the Federal Reserve as the underwriter of rising stock prices.

With the information that the July inflation rate has declined, stock prices have taken off. Investors are saying, “Maybe the period of ‘credit inflation’ is not over.”

Maybe the Fed will continue to underwrite rising stock prices going forward.

But, then again, maybe not.

The “New Age”

I believe that the bottom line on this issue is that we are, in fact, entering a new age, an age whose foundation is the growth and spread of information.

Not only does the economy have to face all of the dislocation mentioned above, much of it created by government policy, but the economy has to face the transition into a world of information technology that is also driving us into the future.

I don’t see how the policy of credit inflation can survive the turmoil we are now going through.

Furthermore, I believe that the government is going to have to get away from demand-side fiscal and monetary policies and focus more on supply-side policies that build on intellectual capital and spur-on creativity and innovation.

It looks as if the Federal Reserve is going to have to continue to step up its policy of monetary tightness to combat consumer price inflation.

This will move it away from sustaining the policy of credit inflation any further.

Furthermore, the federal government is going to have to get away from policies that emphasize generating more and more aggregate demand.

The federal government is going to have to push supply-side policies, policies that will substantially increase the growth of labor productivity.

Just one final comment: if the United States is going to continue to be a world leader, it is going to have to put more focus on the growth and spread of information than it does on stimulating the increase of consumer spending.

Be the first to comment