ijeab

A Quick Take On Envestnet

Envestnet, Inc. (NYSE:ENV) recently reported its Q2 2022 financial results on August 4, 2022, missing revenue estimates.

The company provides a suite of wealth management software and services to investment advisors and institutions.

ENV needs to continue its modernization efforts despite a choppy market environment.

I’m on Hold for ENV in the near term until we see progress on both fronts.

Envestnet Overview

Chicago, Illinois-based Envestnet was founded in 1999 to provide a variety of wealth management software applications to investment managers, traders and institutions.

The firm is headed by co-founder and Chief Executive Officer Bill Crager, who was previously a Managing Director at Nuveen.

The company’s primary offerings include:

-

Wealth Solutions

-

Data & Analytics

-

Tamarac

-

MoneyGuide

-

Retirement Solutions

-

Portfolio Management Consultants

-

Trust Services

-

Insurance Exchange

-

Advisor Services Exchange

The firm seeks clients among registered investment advisors, broker-dealer representatives, and various types of institutional investors in the U.S. and internationally.

ENV recently announced its plans to expand into the small and mid size market through offering “data and digital solutions” to business owners by partnering with upSWOT, a platform that connects over 150 SaaS products with SMB clients.

Envestnet’s Market & Competition

According to a 2019 market research report by Grand View Research, the global wealth management software market is projected to reach $5.8 billion by 2025, growing at a CAGR of 15.3% between 2019 and 2025.

The main factor driving market growth is the growing need for digital tools that can automate the wealth management process.

The financial advice and management segment is anticipated to grow at the fastest CAGR of 16.0% during the period due to growing demand for tools to manage finances.

Major competitors that provide or are developing wealth management solutions include:

-

Fiserv

-

Temenos Headquarters

-

Fidelity National Information Services

-

Profile Software

-

SS&C Technologies

-

SEI Investment

-

Finantix

-

Comarch

-

AssetMark Financial

-

Dynasty Financial Partners

Envestnet’s Recent Financial Performance

-

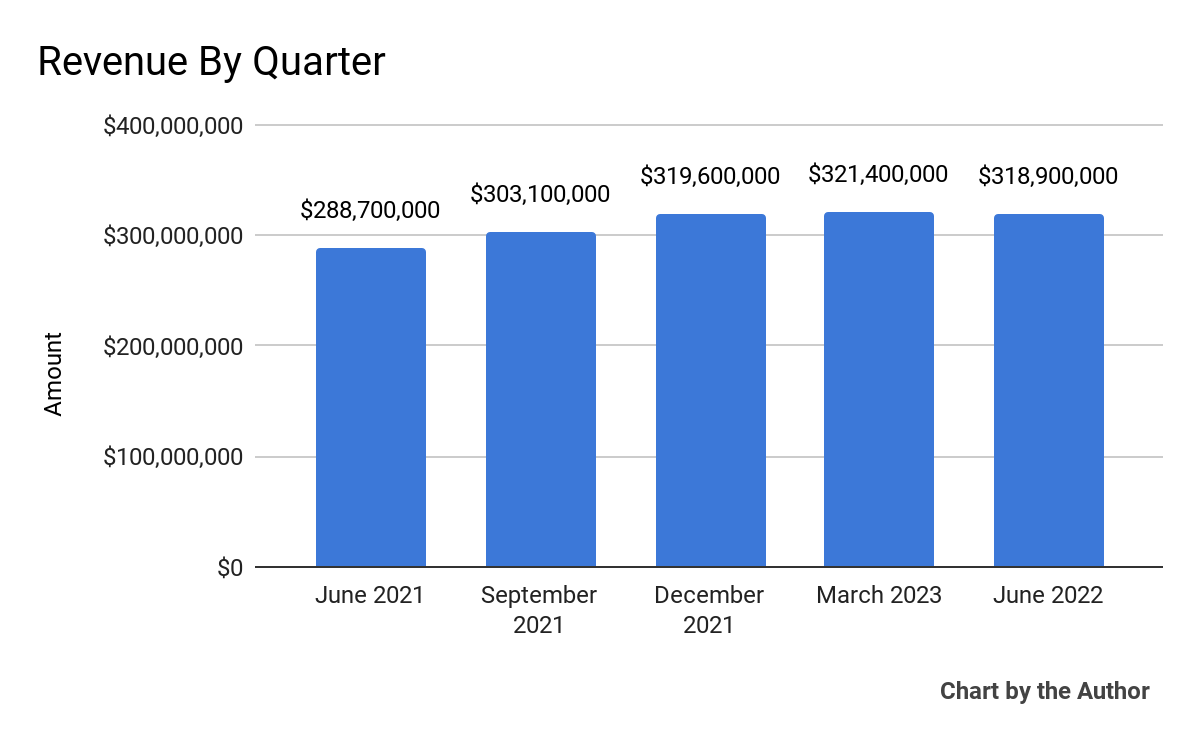

Total revenue by quarter has grown but recently plateaued:

5 Quarter Total Revenue (Seeking Alpha)

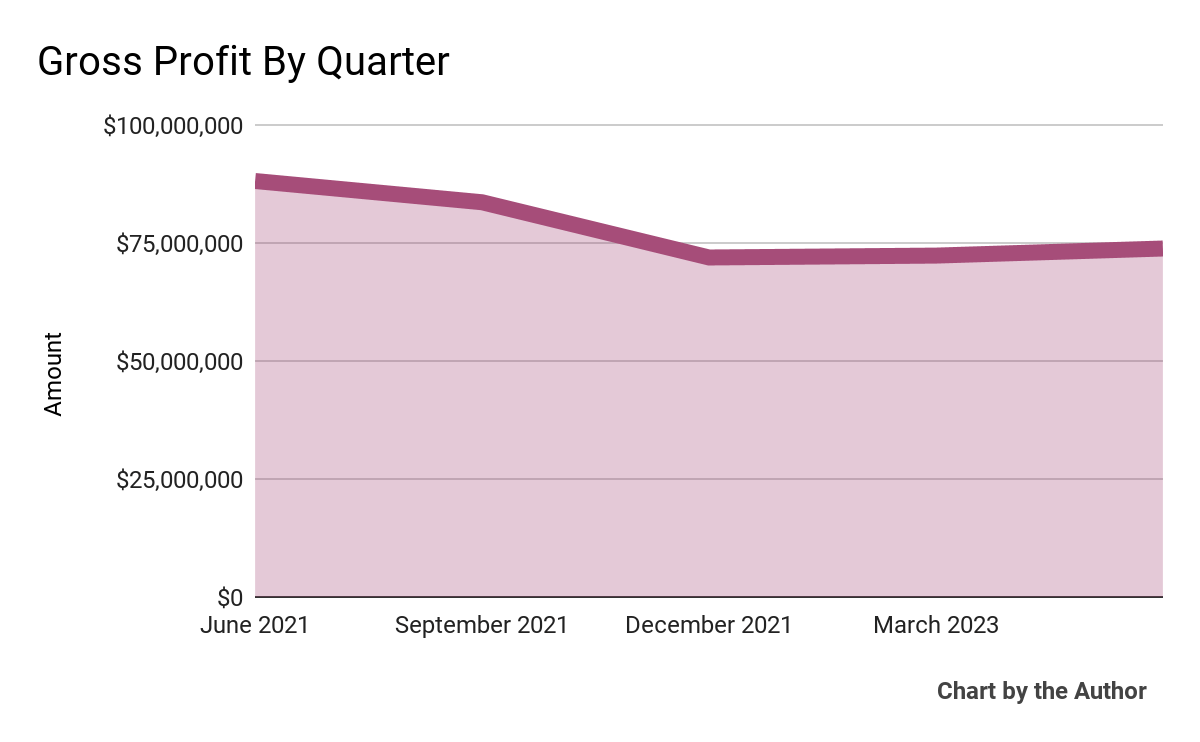

- Gross profit by quarter has dropped over the past 5 quarters:

5 Quarter Gross Profit (Seeking Alpha)

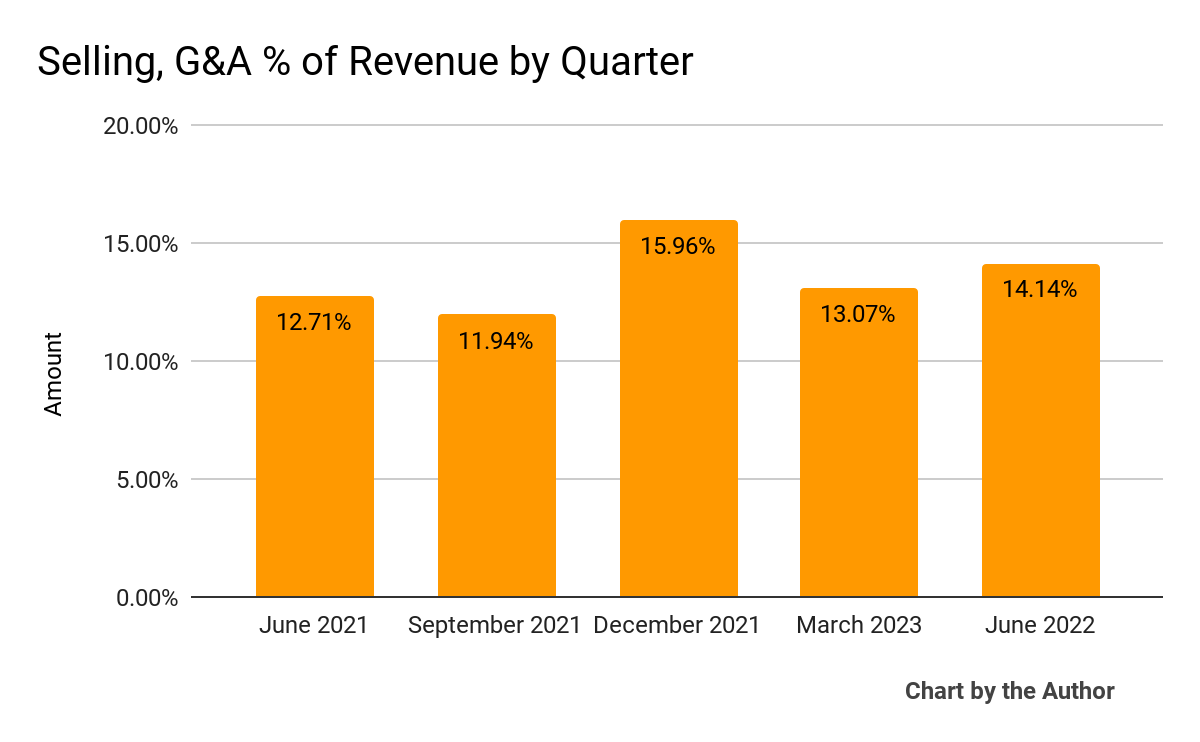

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

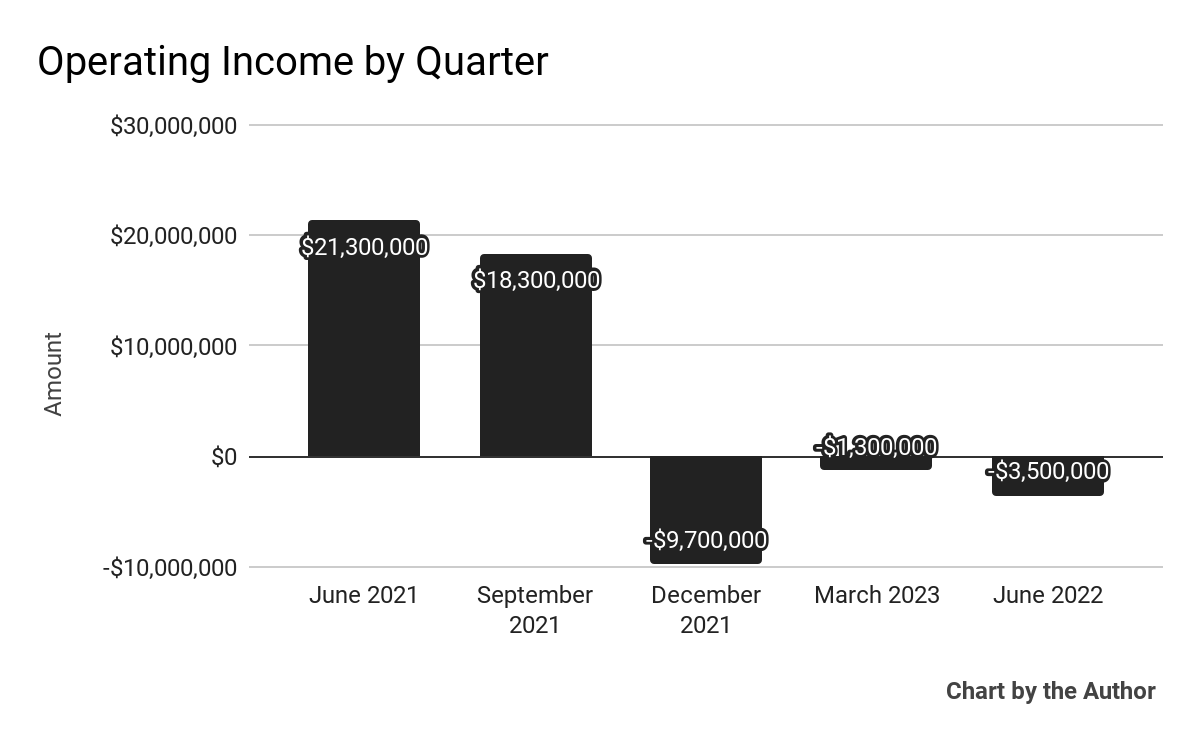

5 Quarter Operating Income (Seeking Alpha)

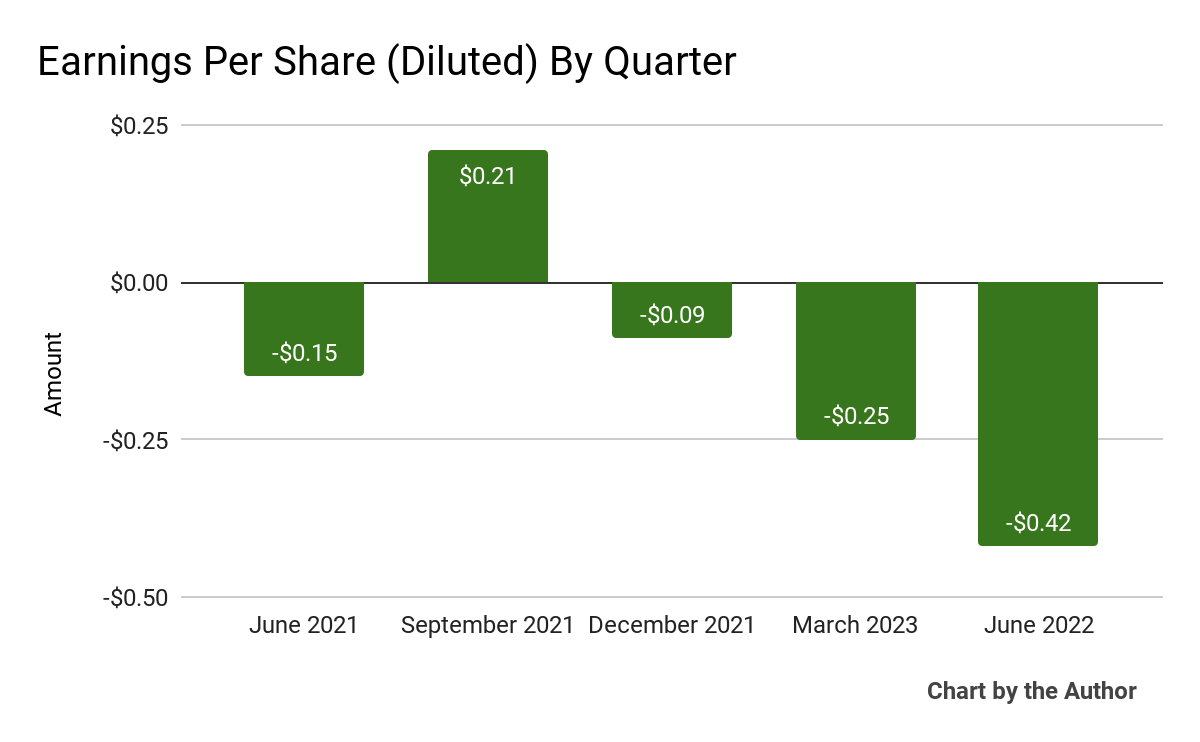

5 Quarter Earnings Per Share (Seeking Alpha)

-

(All data in above charts is GAAP)

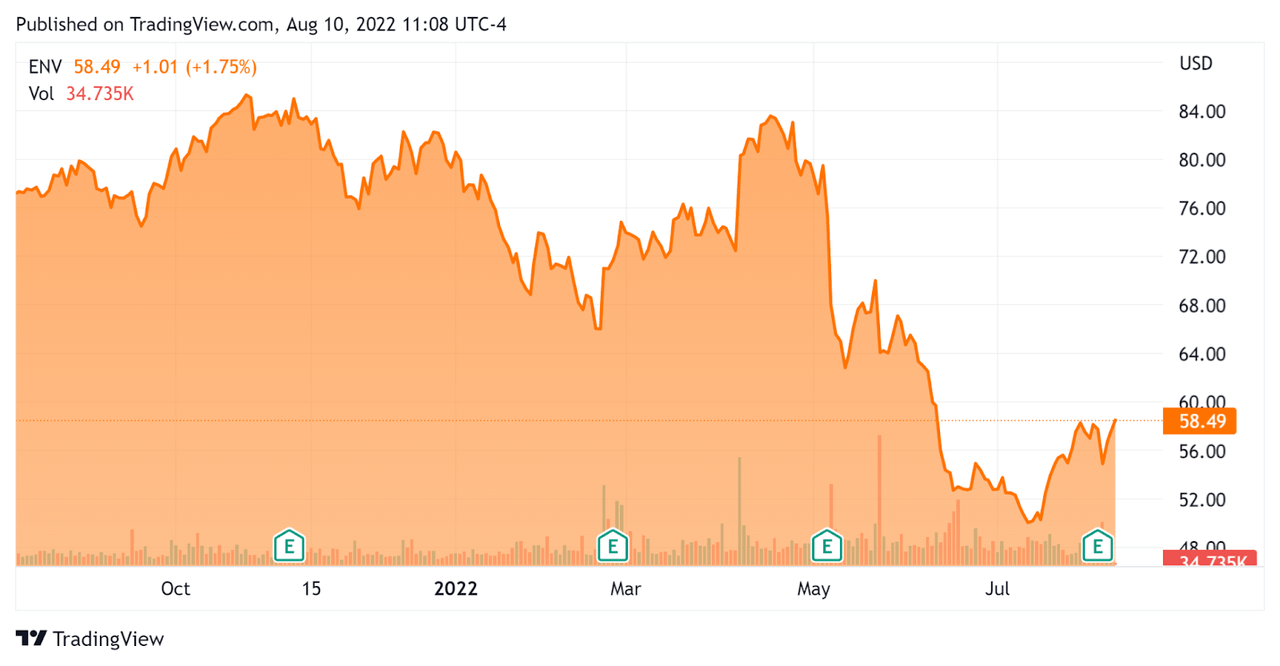

In the past 12 months, ENV’s stock price has dropped 24.0% vs. the U.S. S&P 500 index’ fall of around 5.0%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Envestnet

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$3,810,000,000 |

|

Market Capitalization |

$3,170,000,000 |

|

Enterprise Value / Sales [TTM] |

3.02 |

|

Revenue Growth Rate [TTM] |

16.91% |

|

Operating Cash Flow [TTM] |

$184,060,000 |

|

Earnings Per Share (Fully Diluted) |

$0.29 |

(Source – Seeking Alpha)

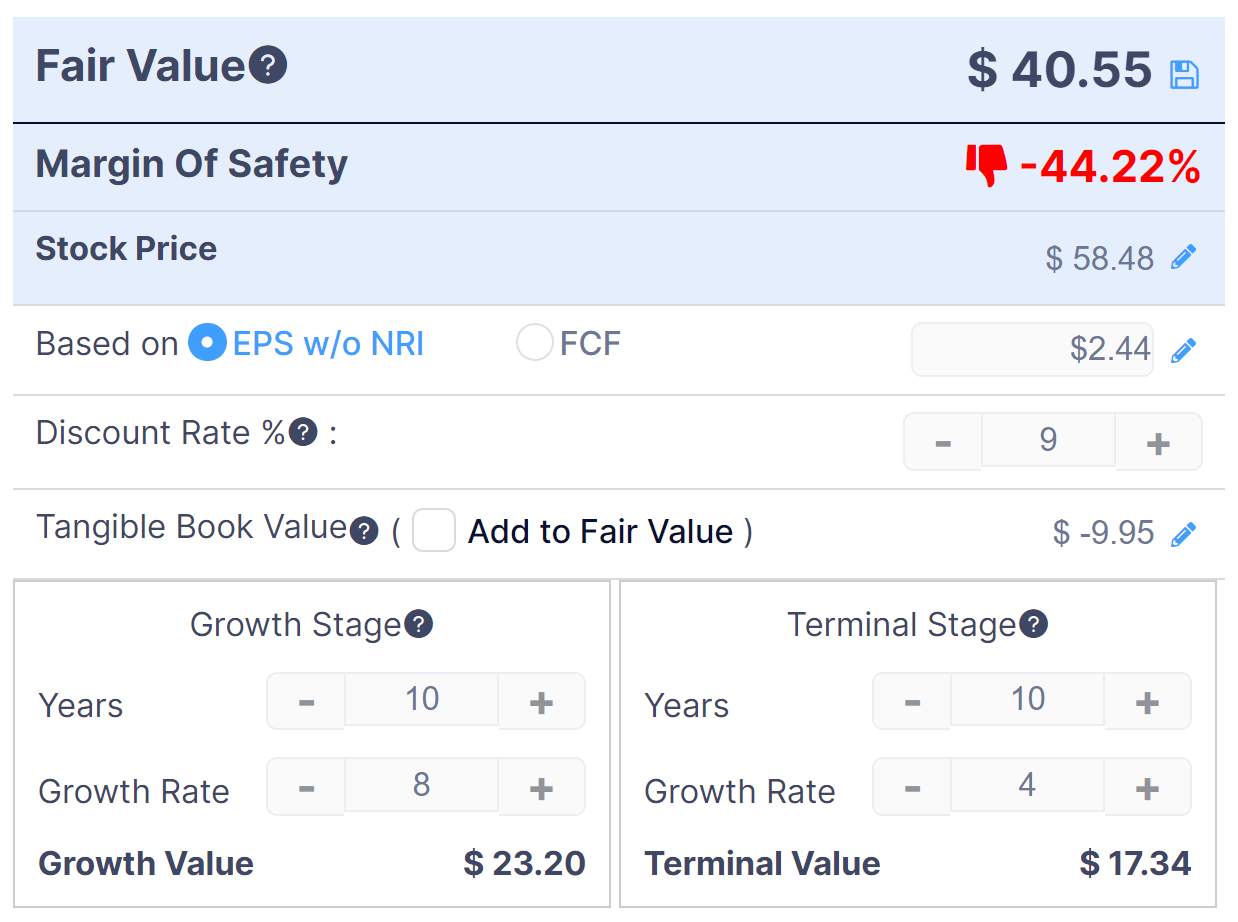

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

ENV Discounted Cash Flow Estimate (GuruFocus)

Assuming generous 2023 earnings DCF parameters, the firm’s shares would be valued at approximately $40.55 versus the current price of $58.48, indicating they are potentially currently overvalued, with the given earnings, growth and discount rate assumptions of the DCF.

As a reference, a relevant partial public comparable would be AssetMark Financial (AMK); shown below is a comparison of their primary valuation metrics:

|

Metric |

Asset Mark Financial |

Envestnet |

Variance |

|

Enterprise Value / Sales [TTM] |

2.61 |

3.02 |

15.7% |

|

Operating Cash Flow [TTM] |

$130,960,000 |

$184,060,000 |

40.5% |

|

Revenue Growth Rate |

25.3% |

16.9% |

-33.2% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

ENV’s most recent GAAP Rule of 40 calculation was 27% as of Q1 2022, so the firm needs some improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

17% |

|

GAAP EBITDA % |

10% |

|

Total |

27% |

(Source – Seeking Alpha)

Commentary On Envestnet

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the challenging investment environment in the first half of 2022.

Contributions to investment accounts were 20% lower than the previous quarter and do-it-yourself investors lowered their contributions by over 30%.

The value of the firm’s assets served dropped from $5.5 trillion to $5 trillion despite positive net inflows for Envestnet during the quarter.

The company grew its high net worth solutions which have been “outpacing even 2021 flows,” so management sees “accelerating adoption in these solutions and services [that] generate the highest revenue per asset we have at the company.”

As to its financial results, revenue grew by 10% year-over-year, “slightly below forecast,” while adjusted EBITDA was slightly higher than previous guidance.

Notably, the firm grew net new accounts by 300,000 in the first half of 2022 over the previous year’s 1H period.

On the expense side, management said it is ‘fighting inflationary pressure’ with cost containment activities despite its technology and operational modernization efforts.

For the balance sheet, the firm finished the quarter with $338 million in cash and debt of $863 million.

Looking ahead, management expected adjusted revenue to be around $1.257 billion and adjusted EPS to be $1.87 at the midpoint of the range.

Regarding valuation, the market is valuing ENV at a slightly higher EV/Revenue multiple than comparable AssetMark, despite lower topline revenue growth.

My generous discounted cash flow analysis of ENV indicates the stock may be overvalued at its current price.

The primary risk to the company’s outlook is the continued choppy investment environment due to variable inflation conditions and continued interest rate hikes by the U.S. Federal Reserve.

An upside catalyst would be reduced cost of capital through a pause in rate hikes, boosting stock markets, asset values and ENV’s multiple in the process.

Reports indicated that Envestnet had been considering a buyout by interested private equity firms, but more recent reports said that the firms could not come to an agreement, possibly due to a difference of opinion on price.

While a buyout may still occur and may value ENV above $90 according to one analyst, the firm’s slow growth amid uncertain market conditions and its need to invest in its system modernization indicate the stock may tread water for an extended period ahead.

So, I’m on Hold for ENV in the near term until we gain greater visibility into market direction.

Be the first to comment