I can assure you, inflation is still high in the rearview mirror. We don’t need to look at any other windows. This mirror is working great. – Note: This is NOT an actual quote from Jerome Powell. Drew Angerer/Getty Images News

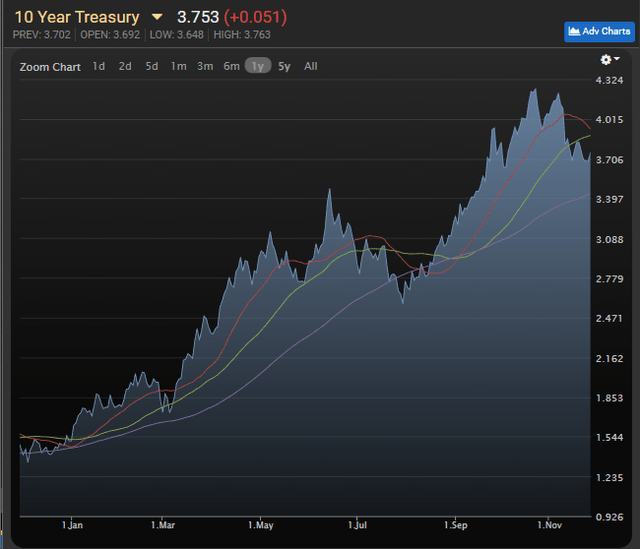

Can one man push bond markets? Absolutely. Chairman Jerome Powell has proven the Federal Reserve can move more than the 1-year to 2-year rates. He’s had less impact on the 10-year Treasury than the short-term Treasury rates, but he has still managed to shove it higher:

Inflation still generates headlines, despite the month-over-month rates falling. That’s demonstrated using the official CPI release (the link will automatically update itself to the latest report).

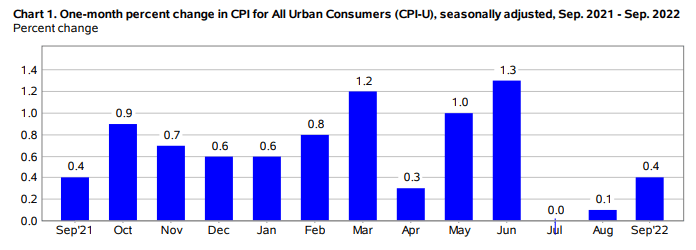

From the October report:

BLS.gov

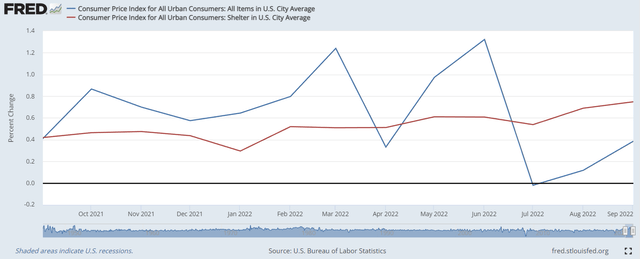

The 0.4 reading for September 2022 matches the reading from September 2021 and it is the fourth-lowest reading of the last 12 months.

We’re using month-over-month comparisons to avoid overemphasizing prior inflation. To get year-over-year inflation down to 2% in one month, we would need severe deflation. Consequently, watching trends in the month-over-month data provides a much faster reading. So long as we’re looking at a year or more of data, we can still recognize the annual impact also. If we were annualizing each quarter, Q3 2022 would only annualize to 2.0%. Year-over-year readings are hot, but the trend is already broken. As it stands there’s one factor really supporting “inflation” over “deflation” today.

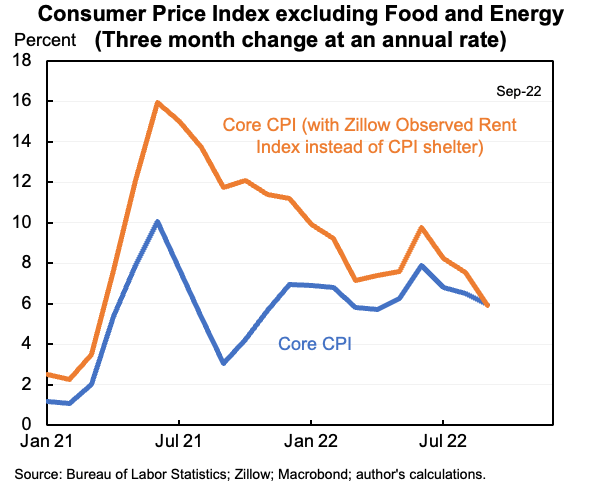

The role of CPI: Shelter has changed. Previously, CPI: Shelter was artificially reducing the year-over-year metrics. However, over the last 3 months it is carrying the inflation value:

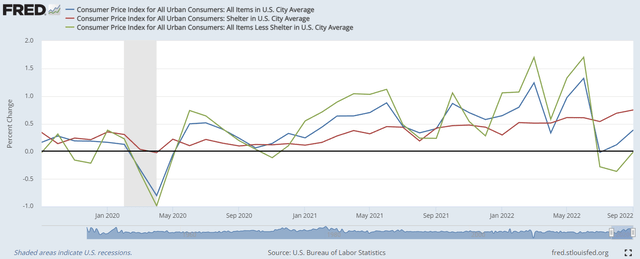

If we excluded CPI: Shelter, we would’ve had three consecutive months with deflation. That’s right, even September would’ve seen deflation by a hair if we excluded CPI: Shelter. You can easily visualize the difference over the last few years if we simply zoom out a bit and add in another line for inflation excluding shelter:

Apartment rent growth has decreased dramatically, yet CPI: Shelter for September and August scored the highest month-over-month increase since January of 1991. CPI: Shelter is a broken measure. It’s so severely broken, that the green line which excludes CPI: Shelter is actually a far superior tool for reading the real level of changing prices in the economy. It correctly reported a much higher rate of inflation during early 2021. Rents were actually increasing much faster than other expenses at that time. Yet, excluding CPI: Shelter gave a much higher (more accurate) reading.

Despite ongoing issues with global supply chains, like Apple announcing a reduction in shipment of premium iPhone 14 models due to problems in China, month-over-month inflation came in flat to negative for three months in a row.

When we separate out “inflation” from the actual change in market prices, we get a very different chart.

I think anyone would appreciate having a Harvard economics professor in their corner.

Jason Furman tweeted the following chart:

Jason Furman

As you can see, the enormous price spike actually comes through around the middle of 2021.

Why is there a huge difference?

- Rents were soaring higher.

- CPI: Shelter is severely lagged.

Using CPI: Shelter as a major input causes the entire Core CPI value to become lagged. It wouldn’t matter if rents were climbing at a steady rate over a long period. However, when rental rates increase rapidly or stabilize abruptly, it is extremely relevant.

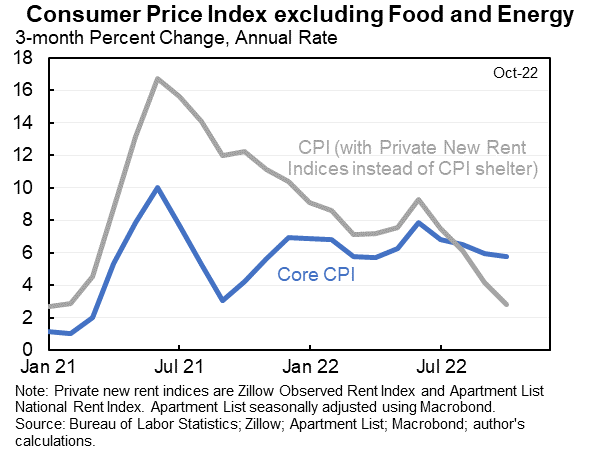

Jason Furman provided recently provided an updated chart:

Jason Furman

There you have it. CPI growth using actual market data on rental rates plunged. So what did the official report say in the November release (for October data)? I’ll give you two quotes:

“The index for shelter contributed over half of the monthly all items increase, with the indexes for gasoline and food also increasing.”

“The shelter index continued to increase, rising 0.8 percent in October, the largest monthly increase in that index since August 1990.”

There you have it. The severely lagged CPI: Shelter data is giving providing information that is worse than useless. It dramatically understated inflation in early 2021 and severely overstates inflation today.

Are Higher Rates Slowing Inflation?

It’s one factor. Not the biggest factor, but still one factor. Fear of higher rates (including layoff expectations) encourages some people to cut back on consumption.

However, there are other important factors as well:

- Deficit reduced from extreme to merely massive (lower demand).

- Increased rental rates (or insurance + property taxes) taking more cash out of consumer’s pockets (lower demand).

- Improvements in supply chain management relative to a year or two ago (higher supply, though not actually fixed).

- Reduced capital investment (lower demand), which reduces demand for labor and materials today at the cost of reducing supply in the years to come.

Expected Near-Term Impact

Expect CPI: Shelter to continue propping up inflation metrics on average over the next few months at least. To fully adjust for changes in rental rates that already occurred, it will take more than a year.

Investment Implications

The growth in market prices for goods and services is already dead. Expect CPI to be propped up by lagged values from CPI: Shelter. Expect Chairman Jerome Powell to continue arguing for higher rates as the Federal Reserve focuses on the rearview mirror. This is the same error that caused them to deny inflation for so long.

Investors may find TIPS (Treasury Inflation-Protected Securities) attractive due to CPI: Shelter propping up inflation. However, the rest of the index is already falling off dramatically.

Recessionary risk remains elevated with a major cause being policy mistakes from the Federal Reserve. When it comes to equity REITs, we have a strong preference for REITs with lower debt since it is easier for them to withstand a recession. Industrial real estate was strongly exposed to prior recessions, but the growth in market rents over the last several years should ensure significant growth in AFFO per share due to strong leasing spreads even if the current recession deepens.

Yes, I said “current recession.” I believe we’re already in a recession, despite it not being officially labeled as a “recession.”

Valuation on equity REITs implies a significant decrease in the market value of real estate. However, real estate values so far have been pretty strong. I think we’ll see some pressure on real estate values due to higher interest rates creating a huge hurdle to financing real estate with debt. However, many great REITs trade at a significant discount to the current market value of their assets. Even if those real estate values decline moderately, the current prices would still imply an attractive discount.

While we see opportunity in REITs, we absolutely would not be buying directly into real estate here. Would you want to buy part of a $50 million apartment building at market value? Probably not when you can get it at a 20% to 30% discount by buying the REITs instead. Besides the huge discount, the REITs also have debts locked in at dramatically lower rates than you could access today. Sorry, platforms like Fundrise look absolutely awful today.

Ignore commentary from banks that stand to gain billions annually in additional net interest income from higher interest rates. Somehow that is referenced in their investor presentations, but it isn’t disclosed every time their analysts try to sell the public on the idea that “we” need higher interest rates.

While short-term rates remain elevated due to the Federal Reserve, we’ve seen a severe inversion of the yield curve. When the 2-year yields 4.48% and the 10-year yields 3.74%, that’s money managers all over the world betting that the Federal Reserve is making a significant mistake and will need to lower rates.

Want a few picks for REITs that trade at discounts to net asset value? Apartment REITs: AvalonBay (AVB), Camden Property Trust (CPT), Essex Property Trust (ESS). Large discounts on each. As investors saw headlines about declining leasing spreads, panic set in. We predicted this well in advance. They look cheap now.

MH Park REITs: Equity LifeStyle (ELS), Sun Communities (SUI). Smaller discounts, but still very unusual for these REITs. These are great REITs to have as core positions in a long-term portfolio.

Industrial REITs: Rexford (REXR), Prologis (PLD), and Terreno (TRNO). To be fair, TRNO is actually slightly above the “consensus NAV” estimate. However, I still think it’s an attractive pick and I think the consensus NAV estimate for TRNO is too low. To be fair, the analysts feeding in estimates don’t agree with each other either. The highest estimate is 41% above the lowest estimate. That is a huge disagreement between analysts.

Ratings: Bullish on AVB, CPT, ESS, ELS, SUI, REXR, PLD, TRNO. We went over more picks in our prior Portfolio Update for REIT Forum Members.

Be the first to comment