Elena Perova/iStock via Getty Images

Brian Dress, CFA — Director of Research, Investment Advisor

A major theme in 2022 has, of course, been the widespread inflation in the global economy and the associated rise in interest rates. This theme has driven the trajectory of financial markets almost exclusively and the headline Consumer Price Index (CPI) and Producer Price Index (PPI) figures released this week brought inflation right back to the top of mind for investors.

This week we saw US 10-year treasury rates make a fresh high, a 52-week low list dominated by “safe” fixed income products like municipal bonds, and profound strength in the US dollar against major currencies. All the while, many of the trends we have identified so far in 2022 have continued to outperform (energy, metals/mining, health care).

As inflation and rates again take center stage, we see the return of the market dynamic of “interest rates up, stocks down” that had abated in recent weeks since the NASDAQ Composite index put in a temporary low on March 14. Obviously with interest rates on the rise and showing few signs of slowing, this dynamic is potentially damaging for stock market investors in the near term. We continue to look for the signal that this relationship is decoupling as one sign that would make us more optimistic for stocks, especially in growth.

To say this year has been a challenge for investors would be to understate the case. However, we think there are valuable lessons to be gained from the way markets have performed. We remain dedicated to the underlying principles that promote a solid portfolio: investing in stocks with the strongest underlying businesses, which operate in accelerating markets.

Though market trends have forced us to widen our scope as relates to the type of investments we favor, it is important to remember that a short-term dip in valuation does not necessarily change the trajectory of a business.

This week marks the beginning of earnings season, starting as usual with major financial institutions like money center banks and investment houses. In this week’s newsletter, we give you a brief recap of the few earnings reports that have already trickled in, while also giving you a preview of next week’s scheduled earnings reports. Though the money center banks that have reported thus far have disappointed, we think there may be another way to get financial exposure that will hold up better to recessionary pressures, should the economy have a hard landing in the face of the Federal Reserve’s scheduled interest rate hikes in 2022.

As always, we provide you with our list of “What’s Working?” and “What’s Not Working?” for the most part, the trends have continued throughout all of 2022 into last week, but we also noticed a few securities that outperformed and underperformed that are bucking those tendencies.

With that all being said, let’s get into it!

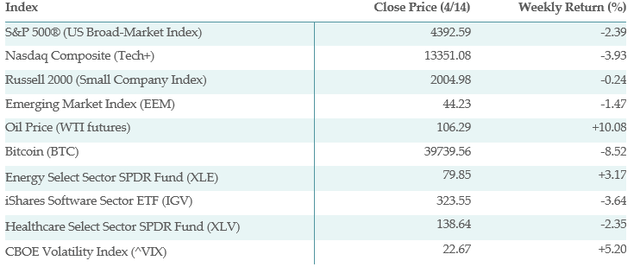

Below is the performance data of key indices, ETFs for the five trading days between 4/8/22 and 4/14/22:

What’s Working?

At the risk of sounding like a broken record, energy dominated the “What’s Working” list this week, driven by a $12/barrel rally in the price of crude oil over the past three days. Of our top 20 performing ETFs this week, 11 are directly or indirectly invested in oil. Natural gas commodity prices remain on an absolute tear, with United States Natural Gas Fund, LP (UNG) up more than 10% this week after the 13% increase from last week. With Western nations continuing to sanction Russian imports, natural gas remains in short supply.

We will speak a bit more on this later, but ETFs betting against the prices of fixed income instruments like bonds continued to perform this week, as rates remain on the rise. The ProShares Short 20+ Year Treasury (TBF) gained nearly 4% in value this week.

We took a look at the 52-week high list this week and again, we were less than surprised that this list has been dominated by commodity-related securities like pipeline-focused fund ALPS Alerian MLP ETF (AMLP), SPDR S&P Metals and Mining ETF (XME), and SPDR S&P Oil & Gas Exploration & Production ETF (XOP). From the single-stock perspective, we saw new highs in defense contractor Raytheon Technologies Corporation (RTX) and Dollar Tree, Inc. (DLTR). We posited early in the year about the so-called “January effect”, which holds that the strongest performers in January often follow through with outperformance for the remainder of the year. We have certainly seen that story play out this year in energy, metals/mining, defense stocks, and consumer staples, as evidenced by the names making new highs.

What is not Working?

With the broad market S&P 500 down more than 2% this week and the tech-heavy NASDAQ losing nearly 4% in value, it should not come as a surprise that “risk on” sectors performed the worst this week. We saw the price of Bitcoin itself fall more than 8.5% over the last week. As a result, the 6 worst performing ETFs in the list we follow came from the crypto space.

Other measures of “risk on” struggled mightily this week, including the ARK Innovation ETF (ARKK), AdvisorShares Pure US Cannabis ETF (MSOS), SPDR S&P Biotech ETF (XBI), VanEck Vectors Semiconductor ETF (SMH), and iShares S&P 500 Growth ETF (IVW).

Clearly this was a tough week for markets overall and especially growth-oriented sectors. The relationship between higher rates and lower prices for growth securities appears to have returned with a vengeance. What we did want to point out is the contrast of this week’s action to the sell-off we observed in February and early March. On March 7, the so-called “fear index”, the VIX, traded as high as 37. We have seen a more orderly form of selling this week however, with the VIX ticking up just one turn from 21 last week to 22.67 this week. Though markets are showing weakness, we are not seeing that same type of indiscriminate selling as we observed earlier in the year.

More Commentary on Rates and Inflation

Every time we receive a new inflation report from the Bureau of Labor Statistics, it seems that prices continue to come in at record levels. The reports we received this week for Consumer Price Index (CPI) and the Producer Price Index (PPI) were no exception. On Tuesday, we learned that consumer prices rose in March by 8.5% year-over-year. However, there was a bit of a silver lining in this report, as we learned that prices (excluding food and energy) ticked up just 0.3% since February, well below the consensus expectation of 0.6%. This led to a temporary surge in stocks. On Wednesday, we received the PPI results, which stated that producer prices rose by a staggering 11.2% since March 2021, the largest rise since 2010.

There is plenty of debate surrounding whether we are getting closer to peak inflation. We are unwilling and unable to step out and make a definitive call like that at this time, especially considering the evidence of higher prices all around us. The question for investors is: “how does this impact the way we should position portfolios?” We have been consistent with our view that energy and metals/materials would perform in an inflationary environment. Interestingly, we have seen plenty of earnings growth in commodity-producing companies, but multiples remain reasonable in many cases. This means to us that there is still upside in these sectors.

More interesting is what is happening in the fixed income/bond space, as persistent inflation has led investors to the exits in so-called “safe” bonds. While we think high-quality bonds like US Treasuries, municipal bonds, and investment grade corporate bonds remain extremely unlikely to default, we understand that the purchasing power of the principal repaid to investors on bond maturity dates continues to deteriorate. From our point of view, it will be hard for investors to justify allocation to high quality bonds in the near term, as interest rates continue rising.

Investors seem to be voting with their feet in the fixed income markets and that appears to be accelerating. As we study the Refinitiv Lipper US Fund Flows for the past week, we observe that investors pulled more than $4 billion from high yield bond funds over the past week, the largest weekly outflow since March 2021. Another $4.5 billion came out of investment grade bond funds and just over $4.3 billion came from municipal bond funds.

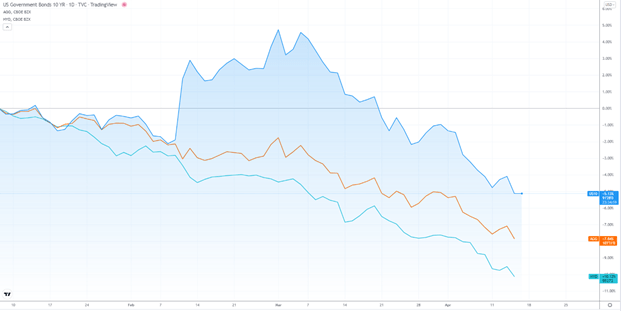

Municipal bonds, with VanEck High Yield Muni ETF (HYD) as a proxy, reached a 52-week low this week. As we have stated over the past few weeks, there is really nowhere to hide funds in bonds, as interest rate risk takes hold. We remain bearish overall of high-quality bonds and encourage you to watch the recording from our April 3 event to hear our thoughts of alternative income strategies. As of now, US 10-year treasuries (blue) are down 5% year-to-date, with investment grade corporates (orange) down nearly 8%, and municipals (teal) down more than 10%.

Trading View

Earnings Season Begins: Financials

Those of you who have followed us for some time will know that we value earnings season as a wonderful opportunity to tune out the noise in the markets and to learn what is really going on at the individual business level. Earnings season began this week with rapid fire reports from some of the world’s largest banks, including JPMorgan Chase & Co. (JPM) and Wells Fargo & Company (WFC).

Financial stocks had been out of the gate quickly in 2022, with the Financial Select Sector SPDR Fund (XLF) gaining 5% in the first two weeks of 2022. Investors’ view was that financials like banks would benefit from a rising rate environment, as they have historically done. However, fears of a recession have weighed on bank stocks since mid-January and the Financial Select Sector SPDR Fund now stands at -6.68% for the year.

We think the JPM earnings report was especially interesting and that investors need to take note of what CEO Jamie Dimon and his management team said on the conference call. The company delivered $2.63 in earnings per share for the 1st quarter, which came in below analyst estimates, though revenues of $30.7 billion were higher than expected. The first point that we noticed was that revenue was down 4.8% when compared to last year’s first quarter figure. Revenues were down across the company for a number of reasons, all related to slower economic activity. First, investment banking revenues fell 28%, as the number of IPOs and mergers fell sharply in the midst of a lower stock market. Asset/wealth management revenues were higher, but profits fell 20% as compensation and other expenses rose sharply.

Finally, and most worrying, was the 28% decrease in commercial banking profits. This was mostly as a result of the bank setting aside $1.5 billion for potential credit losses. CEO Jamie Dimon noted that “[flagging consumer confidence, inflation] are storm clouds on the horizon that may disappear, they may not” and that JPM is remaining cautious in order to prepare for a potential recession, should it come along in 2022. We expect that other money center banks are facing similarly difficult decisions. Weak results from Wells Fargo & Company (WFC) released on Thursday seem to echo that viewpoint. As regards financial exposures, we are becoming more bearish on banks and shifting focus to insurance firms, who will benefit from higher rates, just like banks, but have less exposure to credit losses and may perform better in a recession due to strong pricing power.

Next week we expect earnings from other financial firms Bank of America (BAC) and Charles Schwab (SCHW), as well as Lockheed Martin (LMT), Netflix (NFLX), Johnson & Johnson (JNJ), Las Vegas Sands (LVS), Tesla (TSLA), Freeport-McMoran (FCX), and Schlumberger (SLB) as Earnings Season gets into full swing.

Takeaways from this Week

This week marked a second negative week in a row for markets. The inverse relationship between interest rates and stock prices is back with a vengeance, which is negative given the upward trajectory of rates. Inflation dominated the headlines with the hot CPI and PPI prints. Unsurprisingly, energy and materials stocks were the big winners this week, with “risk on” sectors like technology, crypto, and semiconductors lagging.

With rates rising, we saw continued pressure on “high quality” fixed income investments like bonds and we saw municipal bonds make a 52-week low. Our view is that traditional bonds will continue to struggle in the context of higher rates. Earnings season began in earnest this week and the news we heard from banks like JPM didn’t exactly get things off to a great start. We will see if the pattern continues as results continue to pour in next week.

DISCLAIMER: This report contains views and opinions which, by their very nature, are subject to uncertainty and involve inherent risks. Predictions or forecasts, described or implied, may prove to be wrong and are subject to change without notice. All expressions of opinion included herein are subject to change without notice. Predictions or forecasts described or implied are forward-looking statements based on certain assumptions which may prove to be wrong and/or other events which were not taken into account may occur. Any predictions, forecasts, outlooks, opinions or assumptions should not be construed to be indicative of the actual events which will occur. Investing involves risk, including the possible loss of principal. The opinions and data in this report have been obtained from sources believed to be reliable; neither Left Brain nor its affiliates warrant the accuracy or completeness of such, and accept no liability for any direct or consequential losses arising from its use. In addition, please note that Left Brain, including its principals, employees, agents, affiliates and advisory clients, may have positions in one or more of the securities discussed in this communication. Please note that Left Brain, including its principals, employees, agents, affiliates and advisory clients may take positions or effect transactions contrary to the views expressed in this communication based upon individual or firm circumstances. Any decision to effect transactions in the securities discussed within this communication should be balanced against the potential conflict of interest that Left Brain, its principals, employees, agents, affiliates and advisory clients has by virtue of its investment in one or more of these securities.

Past performance is not indicative of future performance. The price of securities can and will fluctuate, and any individual security may become worthless. A high or favorable rating, rating outlook, gauge, or similar opinion is not indicative of future performance, and no user should rely on any such rating, rating outlook, gauge, or similar opinion to predict performance or potential for return. Future performance may not equal projected or forecasted performance or potential for return. All ratings and related analysis, as well as data, statistics, analysis and opinions contained herein are solely statements of opinion and are not statements of fact or recommendations to purchase, hold, or sell any security or make any other investment decisions.

This report may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will materialize. Reliance upon information herein is at the sole discretion of the reader.

THE REPORT IS PROVIDED ON AN “AS IS” AND “AS AVAILABLE” BASIS WITHOUT REPRESENTATION OR WARRANTY OF ANY KIND. Left Brain Investment Research LLC DISCLAIMS ALL EXPRESS AND IMPLIED WARRANTIES WITH RESPECT TO THE REPORT, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

The Report is current only as of the date set forth herein. Left Brain Investment Research LLC (LBIR) has no obligation to update the Report or any material or content set forth herein.

LBIR is an affiliate of Left Brain Wealth Management LLC, an investment advisor registered with the Securities and Exchange Commission. LBIR is an affiliate of Left Brain Capital Appreciation Fund, L.P., Left Brain Capital Appreciation Offshore Ltd, and Left Brain Capital Appreciation Master Fund, Ltd., all of which are hedge funds managed by Left Brain Capital Management, LLC. The general partner of these hedge funds, Left Brain Capital Management, LLC, is an affiliate of LBIR. LBIR is also an affiliate of the Left Brain Compound Growth Fund (LBCGX), a registered fund subject to the Investment Company Act of 1940.

© 2022, Left Brain Investment Research LLC. All rights reserved. Reproduction in any form is prohibited.

Be the first to comment