JamesBrey

The first half of the year 2022 has been very tough for all stripes of investors. In fact, it has been the worst first half of the year since the early 1970s. The turmoil in the stock market is likely to continue into the rest of the year, as there are a lot of unresolved issues and uncertainties in the economy. The biggest overhang is the possibility of a looming recession. Obviously, 40-year high inflation, fast increasing interest rates, high energy prices, and a much-delayed monetary tightening by the Fed (lagging the curve) are some of the big factors that may push the economy into a recession. The bigger question now is if that happens, will it be a short one, or will it be a prolonged one like the one in the early 2000s. All that said, in the short term, the market may be forming a bottom here, but it still remains on the edge.

Even though most investors have become accustomed to a constant cycle of boom-and-bust events, we are always looking for ways and strategies that would lower the volatility (hence stress), preserve capital during the tough times, but not short-change on growth during the good times. With the backdrop of the current state of the stock market, a great many folks would want an investment strategy that could avoid the roller-coaster ride of the stock market, works largely on auto-pilot, and is relatively stress-free. In addition, we would want our strategy to deliver high income and a decent long-term growth of over 10%, beating inflation and building wealth over time.

Whether you are a retiree or you just want to be financially independent or simply looking to reduce your day-to-day stress, you need a strategy that should meet the following goals:

- Produce sufficiently high income to meet basic needs;

- Preserve capital in bad times (relatively speaking);

- Provide reasonably high growth for long-term wealth creation.

Let’s discuss each of the above goals in more detail:

When it comes to sufficiently high income, one size does not fit all. Obviously, different people have different needs. It depends upon the size of your assets, your lifestyle, and basic living expenses. If you could reduce your expenses, your need for income also gets lower accordingly. But not everyone likes to live on a lower budget, so it is a very personal issue. Nonetheless, you have to define your expenses in two parts; basic essential expenses and the second part for wants, discretionary spending, and some luxuries. So, as a first step, you should focus on generating enough income to meet your very basic expenses. If you are still working and plan to work for the foreseeable future and you are able to generate enough income to meet your essential expenses, well then, you have reached the point of financial independence. Now, in the second stage, you can save even more to generate additional income for non-essential expenses and some luxuries and hobbies that would make you happy.

However, if you are a retiree or going to retire soon, you must include the non-essential expenses as well in your calculations. But at the same time, you would probably have extra income in the form of social security or pensions that would reduce your income need from your investments.

Let’s see some basic calculations about savings, assets, yield, and income.

Percentage Yield required = 100 * (Yearly Expenses / Size of Assets)

In the above formula, retirees getting social security or any other fixed-income should reduce the yearly expenses by the amount of fixed income.

For example, a retiree couple needs $90,000 a year to meet their expenses, gets $55,000 in social security/pension income, and has $750,000 in retirement savings. So, the yield requirement would be:

Percentage Yield required = 100 * ((90,000 – 55,000) / 750,000)

= 4.67%

It’s a widely accepted notion that any portfolio that claims to produce more than 8% income would run the risk of depleting the capital. In fact, we would rather be more conservative and put the red line at 6%. Even a very high-income portfolio could prosper if any excess income over 6% is reinvested back into the portfolio. Withdrawing more than 6% of income from any portfolio would put the original capital at a higher risk of depletion, especially during tough times. We will provide one such example in a later section.

There’s almost no financial investment that can preserve the capital 100% of the time and in all kinds of situations. Even the cash losses value over time due to inflation and currency fluctuations, especially now when the inflation is running at a 40-year high. If we are invested in stocks, we must accept the fact that there will be some volatility; however, our focus should be on minimizing the volatility. The real test of capital preservation becomes apparent during times of high stress, something akin to what we saw in the year 2020 or during the 2008 financial crisis. Even the current market environment with the S&P500 recently falling into the bear market would test many portfolios. An event or correction like this can act as a real eye-opener to review and judge if your portfolio is meeting its defined goals, especially risk tolerance. If not, you should modify your strategy.

Preservation of capital (at least on a relative basis) is of critical importance for retirees and older investors. So, our focus is always on how to achieve lower volatility and smaller drawdowns than the broader indexes while not compromising on growth during good times.

It’s debatable as to how much growth is reasonable. It can vary based on your personal expectations and factors like the rate of inflation and interest rates. But assuming an average of 3% rate of long-term inflation, in our view, a 9%-10% overall annual growth of the capital (including the income withdrawals) would be very reasonable. However, more recently, inflation has been running at a much higher clip, which makes things a bit more complicated for savers.

Being financially independent is a goalpost that retirees or prospective retirees must achieve, preferably prior to retirement. However, it could be a highly desirable goal even for younger folks. You could be in your 40s and still be financially independent. You could be pursuing a great career, whatever that may be, and still, be financially independent. Just like many things in life, the meaning of this term could vary from person to person. However, the way we see it is all about sustainable income on a regular and consistent basis, even if you have no need for that income today. So, your investment portfolio should be able to safely generate enough income to sustain your basic needs (not including luxuries or vacations, etc.) if any need arises.

For example, your annual earnings are $100K, but if your basic needs (excluding wants, luxuries, some of the discretionary spending, savings, etc.) are only $40K, then your investment portfolio should generate at least $40,000 annually. Obviously, retirees would like to add back some discretionary spending, but then they would also have additional fixed income like social security or pension.

Investment Strategy

In this article, we will present a multi-basket strategy that attempts to meet most of the above goals. As such, we focus on income-producing strategies that also preserve capital during times of crisis but still meet the growth goals.

We will provide as many as five sub-strategies (or buckets), but as an individual, you would just do fine by picking and mixing up to three sub-strategies. We also will provide some backtesting examples for each sub-strategy and how they would have behaved during the 2020 crisis or during the 2008-09 financial crisis. Most of our backtesting is provided with a start date of January 2008 so that we are able to include a couple of periods of high stress. Also, it makes up almost 15 years, which is a long enough period to judge the efficacy of any strategy.

Please note that we manage most of these strategies/portfolios in our Marketplace service that has live performance records at least since 2018 and for some limited portfolios since 2014.

Brief Description of Multi-Basket Strategy

Our regular readers know that we are fans of the multi-basket investment approach. The main advantage of a multi-basket approach is that each of the baskets can have a unique set of goals in terms of income, growth, drawdown limits, and risk levels. One of the buckets that we always like to include is specifically designed to provide the hedging mechanism to bring down the volatility and minimize the drawdowns. At the basic level, the strategy requires three baskets with an overall yield greater than 5%. For investors who may not need a high income (yield requirement less than 3.5%), they could just invest in two buckets (avoid the high-income bucket).

Below we will provide several investment buckets for consideration, along with their performance overviews. Depending upon your personal situation, you can pick and choose various baskets and assign them the allocation percentages.

DGI Basket 1: (With Individual Stocks)

Allocation: 35-50%

We believe that a diversified DGI (Dividend Growth Investing) portfolio should hold roughly 15-25 stocks. We like to invest in individual stocks, and that’s what we are going to focus on in this bucket. The best part of owning individual stocks is that once you have acquired the position, there are no ongoing fees or expenses.

For our sample portfolio presented below, we will look for companies that are large-cap, blue-chip, relatively safe, and have solid dividend records. For our list below, we will try to select stocks that are likely to provide a high level of resistance to downward pressure in an outright panic situation.

We must put emphasis on diversifying among various sectors and industry segments of the economy. A selection of roughly 15-25 stocks could provide more than enough diversification. We will present 20 such stocks based on our past research, current dividend payouts, and a high level of dividend safety.

For this part of the portfolio, we will try to select the majority of stocks that tend to do well in both good times and during recessions/corrections. This is especially important if you are a retiree. However, a couple of them are selected for their higher yield, but they are still considered safe stocks. Please note that this is just a list for demonstration purposes, and there can be many other stocks that could be equally qualified.

Stocks selected:

Lockheed Martin (LMT), PepsiCo (PEP), Clorox (CLX), Unilever (UL), Enbridge (ENB), T Rowe Price (TROW), Prudential (PRU), AbbVie (ABBV), Johnson & Johnson (JNJ), 3M (MMM), Preferred ETF (PFF), National Retail Prop (NNN), Easterly Govt Prop (DEA), Main Street Capital (MAIN), Home Depot (HD), Microsoft (MSFT), Texas Instruments (TXN), Verizon (VZ), Altria (MO), NextEra Energy (NEE).

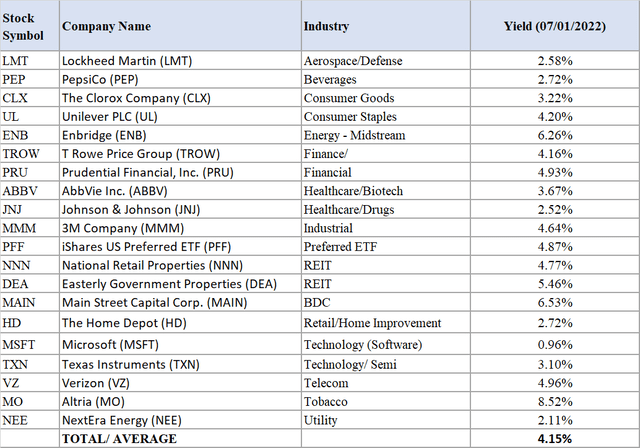

Table-1:

The average yield from this group of 20 stocks is reasonable at 4.15% compared to 1.55% from S&P 500. If you still have some years before retirement, reinvesting the dividends for a few years would take the yield on cost up to 5% easily.

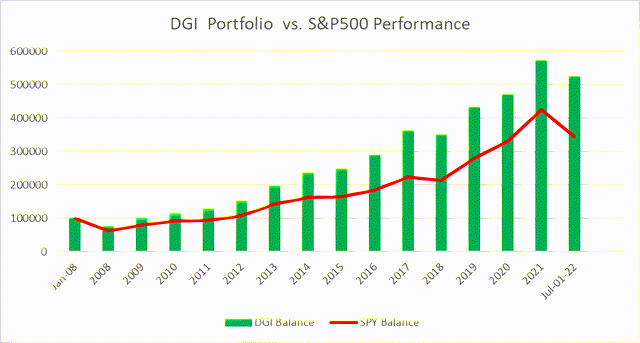

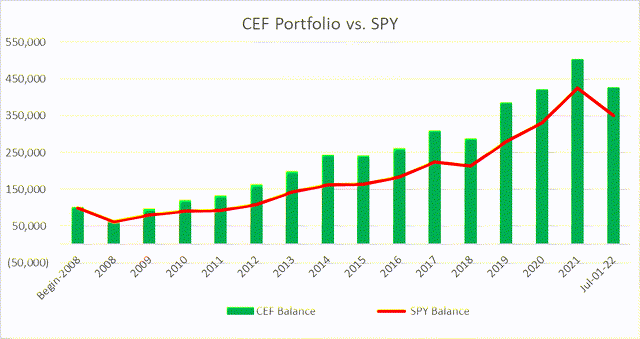

Chart 1:

The below chart provides a backtested performance comparison with the S&P 500, starting Jan. 2008 until July 01-2022.

Note: For performance analysis backtesting, ABBV was replaced with its parent co. ABT, prior to the year 2013 (prior to spinoff).

Alternate DGI Basket: (With ETFs And Funds)

(Allocation: 35-50%)

This bucket is an alternative to the DGI bucket with individual stocks.

Many folks do not like to own individual stocks. Some do not have enough time, while others may not have an interest in researching individual stocks. Then there are folks who just want to have a very simplified way of investing. So, keeping in mind the interests of such investors, we will provide two options for the DGI portfolio based solely on funds or ETFs. Even though constructing a DGI portfolio of individual stocks is not a complicated process, in this bucket, we will make it even simpler.

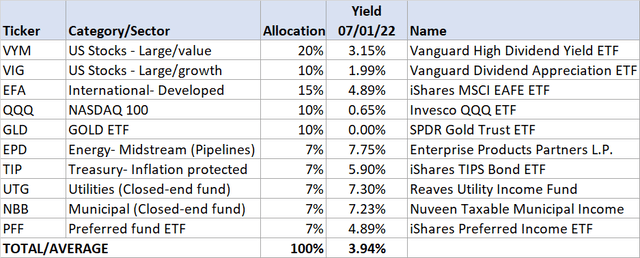

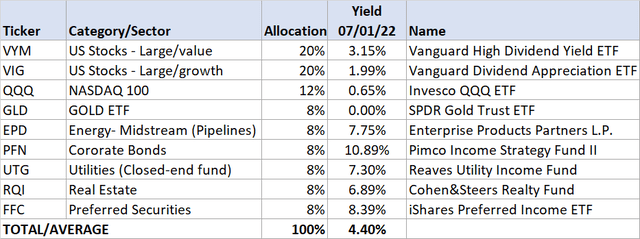

In this option, we will not pick individual stocks. We will select a few low-cost ETFs and mix them with a few high-yield closed-end funds. We provide two options, a conservative one and another one that is a bit aggressive. Please note that option-1 may underperform the market (during bull runs), whereas option-2 should match the market performance. But in both options, the distribution yield is very respectable and more than double of S&P 500.

Please note that in option 1, we allocate up to a total of 21% to high-yield securities that include two CEFs and one energy partnership. In option 2, we allocate up to 40% to high-yield funds, including four CEFs and an energy partnership.

Table 2: Option 1 (Moderately Conservative)

VYM, VIG, QQQ, EFA, GLD, EPD, TIP, UTG, NBB, PFF

Table 2B: Option 2 (Moderately Aggressive):

VYM, VIG, QQQ, GLD, EPD, UTG, PFN, RQI, FFC

Notes:

- If this portfolio is within a taxable account, instead of NBB, one could choose a Tax-exempt Muni fund like Nuveen Municipal High Income Opportunity Fund (NMZ).

- EPD is a partnership and provides K-1 statements at tax time instead of the usual 1099-div.

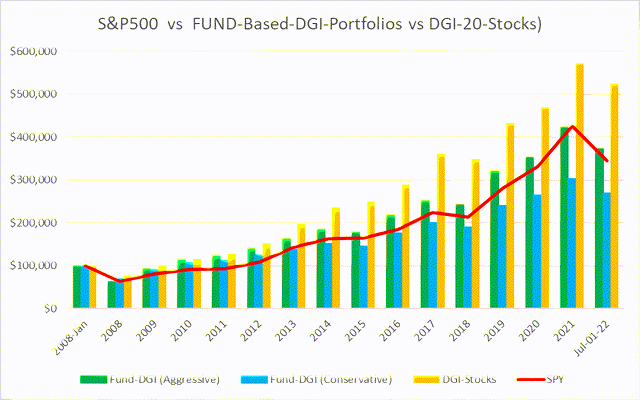

Here is the comparative performance since Jan. 2008 for three options of the DGI portfolios in comparison to the S&P 500. As you can see, ETF option-1 (conservative) has underperformed the market during the bull runs, whereas ETF option-2 (aggressive) is more or less the mirror image of the broader market. However, what is noteworthy is the relative outperformance of the individual stock DGI portfolio (shown in gold-orange bars).

Chart-2:

Rotational Risk-Adjusted Basket:

(Allocation 35% – 45%)

This is our hedging or insurance bucket. Sometimes, investors associate hedging with additional costs and lower growth. But with this strategy, there is none of that. In fact, by no means is the strategy short on growth. Here, in the article, we are providing one such strategy. We believe these strategies invariably work in the long term, with the emphasis on the long-term. Also, even though the strategy described below does not generate income specifically, due to low volatility, one can safely withdraw up to 6% of income on an annual basis. Since the Rotational strategies have very limited drawdowns and low volatility, withdrawing income does not risk depleting the portfolio at the wrong time.

Please note that we do not recommend moving a very large chunk of money in one lump sum to these strategies. What we recommend is that if you are a beginner, start with a small amount and test the waters for a few months. Thereafter, one should increase the allocation gradually over a long period of time.

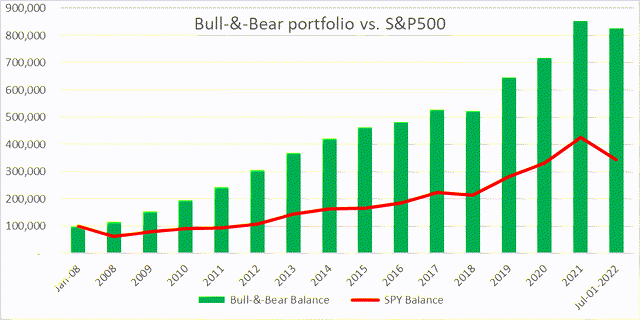

Bull-N-Bear Risk-Adjusted Rotation Model

This portfolio is designed in such a way that it will preserve capital with minimal drawdowns during corrections and panic situations while providing excellent returns during bull periods. Due to much lower volatility, this portfolio is likely to outperform the S&P 500 over long periods of time. However, it may underperform to some extent during the bull runs.

The strategy is based on eight diverse securities but will hold any two of them at any given time, based on relative positive momentum over the previous three months. Basically, we will select the two top-performing funds. The rotation will be on a monthly basis. The eight securities are:

- Vanguard High Dividend Yield ETF (VYM)

- Vanguard Dividend Appreciation ETF (VIG)

- iShares MSCI EAFE Value ETF (EFV)

- iShares MSCI EAFE Value ETF (EFG)

- Cohen & Steers Quality Income Realty Fund (RQI)

- iShares 20+ Year Treasury Bond ETF (TLT)

- iShares 1-3 Year Treasury Bond ETF (SHY)

- ProShares Short 20+ Year Treasury (TBF)

Please note that TLT and SHY are long-term and short-term Treasury funds, which are used as hedging securities.

The backtesting results going back to the year 2008 are presented below. The fund TBF was not available until 2009, so it was not included for the years 2008 and 2009.

Growth Chart With No Income Withdrawals

Chart-3:

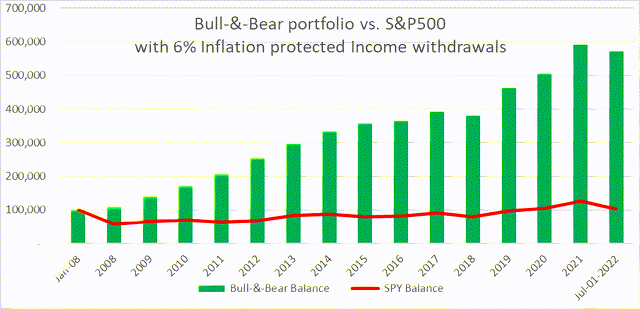

A Must See Chart: Comparison of B&B with S&P500, with 6% Income Withdrawals

The below chart is different from the previous one only in one aspect; in this case, we will withdraw 6% income every year.

Nothing can demonstrate any better than the below chart of the dangers of sequential risk (the risk of sequential returns) that it poses to retirees. This chart demonstrates how devastating a deep correction can be at the onset of retirement (if you are to draw income). So, yes, drawdowns matter a lot, especially if you are a retiree who needs to withdraw income and a correction happens early in your retirement years. Due to a deep drawdown and a 6% income withdrawal, the S&P 500 never got a chance to make a comeback in spite of the extraordinary growth of the S&P 500 in the last 12 years.

If you had invested 100,000 in Jan. 2008 in S&P 500 and withdrew 6% income (with 3% raise every year), you would be barely above water with a balance of less than $105,000, in spite of the recent multi-year bull run. However, the same amount invested in the Bull-&-Bear strategy with similar withdrawals would have resulted in a balance of more than $575,000.

Chart-3B:

High-Income (8% Income) Basket:

(Allocation: 15% – 25%)

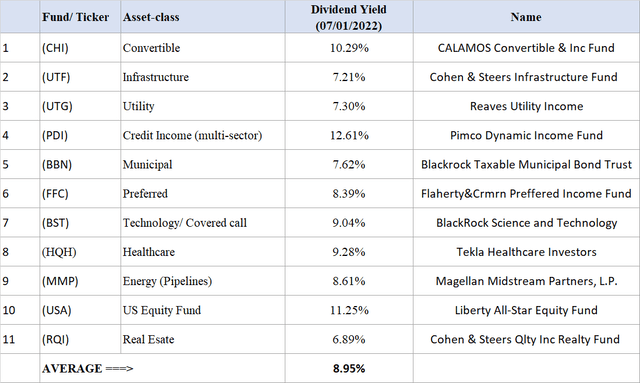

This basket is recommended for investors who need significant income either in their retirement or otherwise. But our recommendation is not to go overboard; a limited allocation is good enough and can bring wonderful results. The main advantage of this basket is that it can lift the yield of the overall portfolio significantly while limiting the risk to a relatively small bucket. As always, diversification can solve many problems, so we recommend selecting one closed-end fund from each of the 10-12 asset classes that are available. We publish a monthly article on CEF funds and also manage an “8%-CEF-Income” portfolio in our Marketplace service. Below are the eleven funds that we have selected based on our research. In the energy midstream (pipelines) segment, we prefer individual partnership names like Enterprise Products Partners (EPD) and Magellan Midstream Partners (MMP).

These 11 funds are:

(CHI), (UTF), (UTG), (PDI), (BBN), (FFC), (BST), (HQH), (MMP), (USA), (RQI).

Table-3:

Note: MMP is a partnership and issues a K-1 statement for taxes instead of the usual 1099-div.

For the purpose of comparing the performance of this basket vis-à-vis the S&P 500, we will assume that we invested equally in these eleven funds as of Jan. 1, 2008. Now we will compare the performance of this portfolio with the S&P 500 from 2008 until July 01, 2022. A couple of these funds did not exist all the way back to 2008, so suitable replacements were made for those years.

Please keep in mind that many of these funds use leverage, and this portfolio does not provide any downside protection. That’s why we recommend an allocation of no more than 25% but preferably less. The only purpose is to boost the income yield of the total portfolio.

Chart-4:

Alternate High-Income Bucket (Options-Income)

(Allocation: 15% – 25%)

This is one of the most active baskets and may appear to be a bit complex for readers who have never worked with options. In a way, it needs initial learning (by trial and error) and practice to gain confidence. So, in that sense, it may NOT be for everyone.

Nonetheless, if done conservatively, an options bucket has the potential to provide 10-15% income on a rather consistent basis. Just like any other strategy, there are risks involved with Options, but with some experience, the risks can be mitigated. Also, we do not recommend allocating more than 15-25% of the investment capital to this bucket.

If you do not have prior experience with options, we recommend reading some primer on Options, having a trial account (without real money) with your broker, and gaining some experience before committing to real money. You could also read our periodical articles on Options. For the purpose of this section, we will assume that the reader has prior experience with stock options and is well-versed in how to write/sell cash-covered PUTs or CALL options.

We can use this bucket to sell some BUY-WRITE CALL options that would have a long-term expiry, roughly one year out or less. You could also use PUT options (selling cash-covered PUTs) to achieve similar results. You can buy or sell options as one contract or more, each contract representing 100 shares of the underlying security.

As diversification is important, we will recommend using a number of underlying stocks from different sectors/industry segments and selling BUY-WRITE CALL options. That means that we submit an online order to buy 100 shares of the underlying stock and sell the covered-call option for one contract at the same time. If you already own 100 shares (or more) of the specific stock in question, you may choose not to use BUY-WRITE but simply sell covered-CALL.

We are going to choose strike prices that are near or below the prevailing prices (ITM or in-the-money) not only to get the best premiums but also to lower the cost of owning the stock. Also, by doing so, the chances are that majority of options will be CALLED away, though that would depend on the market direction. Our purpose here is to earn premiums (income) and not to own the stock long-term. Please note If your purpose was to retain the stock long-term, then this strategy will not be appropriate. Here, with our strategy, there are probably four likely scenarios that could emerge:

- The market (as well as our stock) moves up from here substantially. In this situation, we can close our positions prematurely by buying back the call options and selling the shares at much higher prices, netting a 10-15% or more annualized gain.

- The market stays flat for almost the entire year (highly unlikely); we can then let the options run their entire course of one year. Chances are, 50% of our trades will get called away, and we can write fresh options on the remaining.

- The market dips 5-10% from here and muddles thru’ there for some time. In that case, we get to own shares at a nearly 10% discount from already lower price points, earn dividends, and write fresh options next year.

- The last and the worst scenario is that market (and our stocks) enters into a full-blown bear market from here. We will have to be patient in that case and keep earning nearly 3% dividend. The consolation will be that we own some of the best and most stable dividend-paying companies, and we got to buy them at nearly 10-30% lower than their 52-week highs. It should serve us well in the long term. During a market recovery, these companies have the best chance of recovering faster than most others.

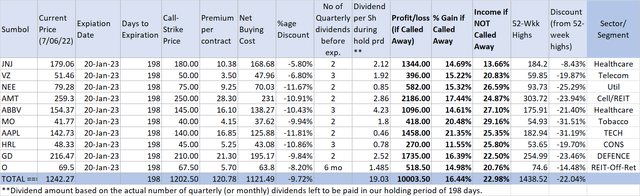

A suggestive and sample list of trades is presented below:

Table-4:

* Premium and prices during market hours of 07/06/2022.

If we were to write one contract on all ten trades (as above), we would need roughly $112,149 to buy these shares (buy-price minus premium earned back immediately). Let’s say we do nothing until the expiration date:

- If all the stocks/shares are called away at expiration, we will earn a very decent 16.44% annualized (including dividends);

- If none of the shares are called away, we will earn an income of 22.98% during this time (including dividends);

- In reality, we will have many positions called away, probably more than half, as the strike prices are lower than the current prices on average. For the rest, we can write new options. However, most likely, we will get plenty of opportunities to close most of these positions early and earn roughly 12% to15% (annualized).

Note: Please note that you should only write/sell options on stocks at strike prices that you would not mind owning long-term. Otherwise, there could be significant risks involved with writing options.

Income Construction For 2022

Let’s assume you have a portfolio of $1 million invested in broad indexes or in some mix of funds and individual stocks. The figure of $1 million is assumed for the sake of simplicity. It does not matter if you have half that amount or double that amount. The question is, what is the level of confidence that you have in your portfolio strategy or holdings? If the markets were to start falling 30% or more tomorrow, would your level of confidence remain the same? These are important questions that you need to ask.

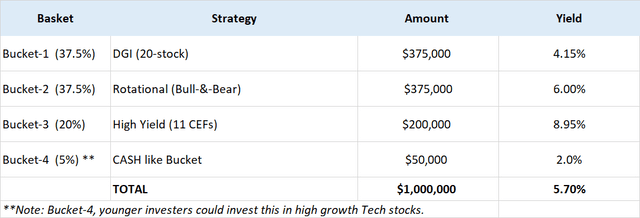

So, the question is, what should we do now to prepare for whether we are in a bull market or a bear market. Based on several options that we have presented above, here is one strategy that we think should work well for many do-it-yourself investors. Divide your capital into three parts or buckets as detailed below. If you are a retiree or otherwise a conservative investor, a small fourth bucket with cash-like investments could be desirable. We also call it an NPP (Near Perfect Portfolio) Strategy.

Table-5: Structure of an NPP Portfolio

Concluding Thoughts

The ups and downs of the market are unavoidable in investing. The boom-and-bust cycles have always been part of the market, but they may have become more pronounced due to the constant intervention of the central banks. Obviously, the current market turmoil is no different. The intent of this article was to present a strategy (or a set of strategies) that an investor could use to form an investment portfolio that helps the investor to avoid the roller-coaster ride of the market to a significant degree but also provides stable income and a decent growth trajectory.

We have presented five different types of portfolios, and investors can pick and choose at least three of them to make a multi-basket portfolio. We recommend a certain allocation to the Rotational bucket to provide the necessary hedge, lower volatility, and drawdowns, and smooth out the returns.

Be the first to comment