bloodua

Ever since its recent spin-off from StealthGas (GASS), I have urged investors to steer clear of Imperial Petroleum (NASDAQ:IMPP, NASDAQ:IMPPP) given the company’s strategy to pursue growth at the expense of common equity holders and repeated involvement in related-party transactions.

Since the beginning of the year, Imperial Petroleum has diluted common shareholders relentlessly, raising approximately $156 million in new capital thus causing outstanding shares to increase by more than 3,500%.

While my perception of the company hasn’t changed by any means, I recently established a trading position in the common shares which I intend to hold going into Imperial Petroleum’s anticipated, very strong third quarter earnings report around the end of next month.

Outlining Q3 Expectations

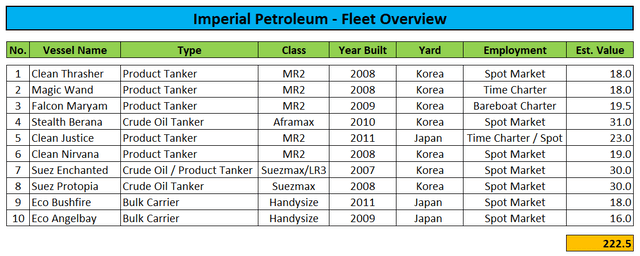

With the entire tanker fleet in operations for the full quarter and plenty of favorable spot market exposure, I would expect revenues to almost double sequentially to well above $20 million and EBITDA to triple to almost $10 million even with the MR2 product tankers Magic Wand and Falcon Maryam still operating on weak legacy charter rates and the recently acquired dry bulk carriers Eco Angelbay and Eco Bushfire unlikely to contribute meaningfully to the bottom line.

Company Press Releases / Compass Maritime

But ongoing strength of both the crude oil and product tanker markets should result in the company generating substantial free cash flow for the first time since its spin-off from StealthGas late last year.

Shares Trading At A 75% Discount To Net Asset Value

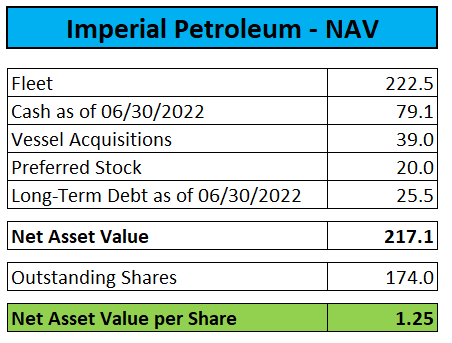

In addition, secondhand vessel values in the tanker segment have continued to increase thus lifting the company’s estimated net asset value (“NAV”) per share by almost 15% from my June 15 assessment:

Company Press Releases / Compass Maritime

Admittedly, a 75% discount to NAV isn’t exactly mind-boggling when compared to other relentless diluters like Top Ships (TOPS), Performance Shipping (PSHG), OceanPal (OP), Globus Maritime (GLBS) and United Maritime (USEA) but there’s not much sense in discussing value that is unlikely to be shared with common equity holders anyway.

Momentum Rally In The Cards?

But it takes just one look at Wednesday’s violent trading action in shares of peer Top Ships to get an impression of the momentum that could be ignited by a perceived strong earnings report.

Risks

While shares of Imperial Petroleum are well known for a number of outsized momentum moves earlier this year, the vastly increased share count has made it more difficult for meme stock traders to move the price up.

Also keep in mind that the company will likely be required to conduct a reverse stock split until December 14 to regain compliance with the Nasdaq’s $1 minimum bid price requirement.

Bottom Line

While my negative perception of Imperial Petroleum hasn’t changed, the company’s common shares might represent a decent trading opportunity going into an anticipated, very strong third quarter earnings report around the end of next month.

As the company has been established to pursue growth at the expense of common equity holders, I wouldn’t expect management to seriously consider share repurchases but nothing seems impossible anymore after closest peer United Maritime recently bought back 20% of outstanding shares shortly after diluting shareholders substantially following its spin-off from Seanergy Maritime (SHIP) not even three months ago.

Given the powerful short-term catalyst, highly speculative investors and traders should consider a trade in the common shares going into the company’s Q3 earnings report.

Investors looking for a considerably less risky way to benefit from Imperial Petroleum’s very strong financial condition should consider the company’s 8.75% Series A Preferred Shares (IMPPP) which at current price levels offer a rather safe 11% annual yield.

Should the company indeed decide to make use of its right to redeem the preferred shares, investors would be rewarded with an approximately 30% short-term capital gain. Unfortunately, management’s commentary on the most recent conference call makes me think that odds of an early redemption are thin at best at this point.

Be the first to comment