skynesher/E+ via Getty Images

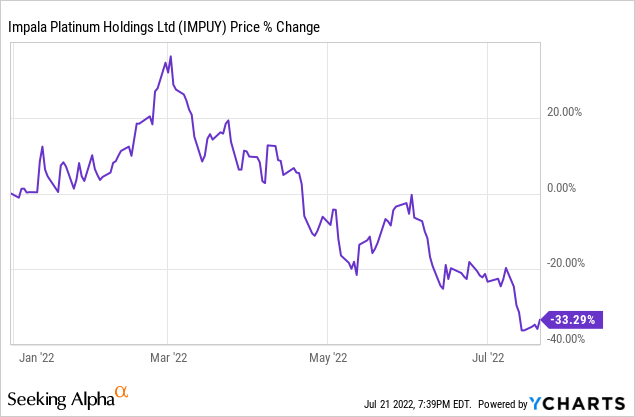

Impala Platinum (OTCQX:IMPUY) has experienced a torrid year with factors such as refinery congestion and acquisition challenges frustrating its investors. Also, an array of systemic headwinds, such as an implied slowdown in core global demand and pandemic lockdowns in China, have dented the company’s year-to-date progress.

However, considering the various inflection points in pockets of the economy, it’s likely that this platinum group metals miner could rebound towards the back end of 2022 and draw its stock price along with it; here’s why.

Key Metrics & Operational Overview

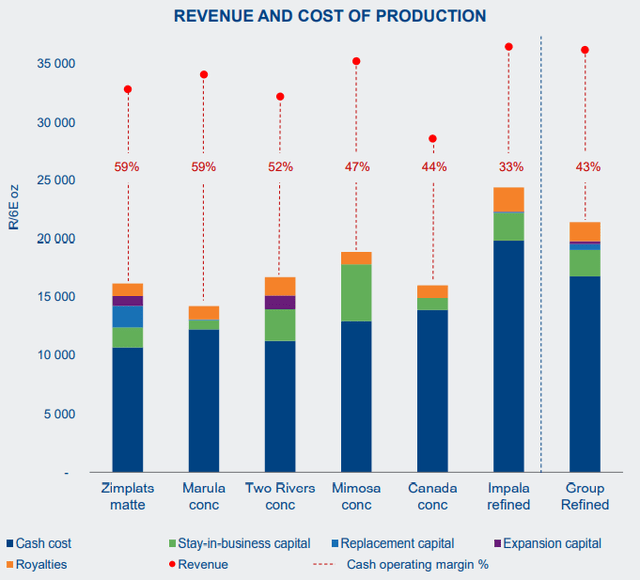

South Africa is incredibly blessed with deep mines that last an eternity, and Implats’ flagship Impala mine falls within that category. The chart below illustrates the tremendous gross margins on its mines, particularly its Impala mine, which span operations across the Merensky and UG2 reefs in Rustenburg, South Africa.

Furthermore, Implats is benefiting from its Canada mine, which produced a lucrative $13 million in free cash flow in the first half of this year. Additionally, Impala Platinum’s refinery operations assist with vertical integration, allowing the firm to present a product at a competitive price.

Notably, Impala Platinum has sunk a large quantity of expansionary capital into its Two Rivers and Zimplats mines. The company’s Two Rivers mine is Rhodium rich, with the mineral making up approximately 58% of its output, which bodes well considering its service to the automotive market. The firm’s Zimplats mine is more palladium orientated, with the mineral making up 44% of the asset’s production mix. Despite a slowdown in global economic growth, palladium remains a very addressable market with a CAGR (compound annual growth rate) beyond 6%.

Holistically speaking, with lower than usual export activity from Russia, a possible $220 billion stimulus of the Chinese economy and global pandemic re-openings, we could see Implats fill a critical supply gap in the PGM (platinum group metals) space in the coming years.

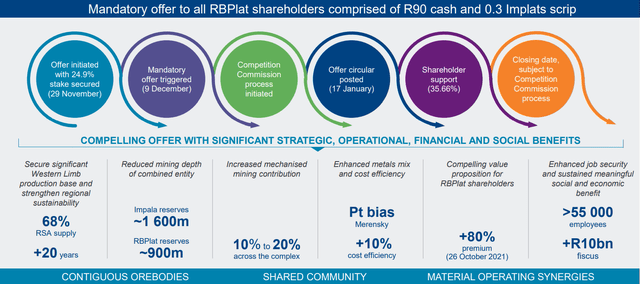

Furthermore, Implats is set to finalize a deal to acquire RBPlat as part of a mandatory majority control offer. The deal is expected to close on September the 16th, which would see RBPlat shareholders receiving R90 (approximately $5) per share and 0.3x shares of Impala Platinum.

The acquisition includes additional exposure to the Royal Bafokeng Asset. The asset is said to have a life longer than 20 years with substantially accretive cost-saving potential. I believe the Royal Bafokeng addition could serve Impala Platinum well as it could expand the firm’s horizontal integration and, in turn, its market share.

Valuation and Price Level

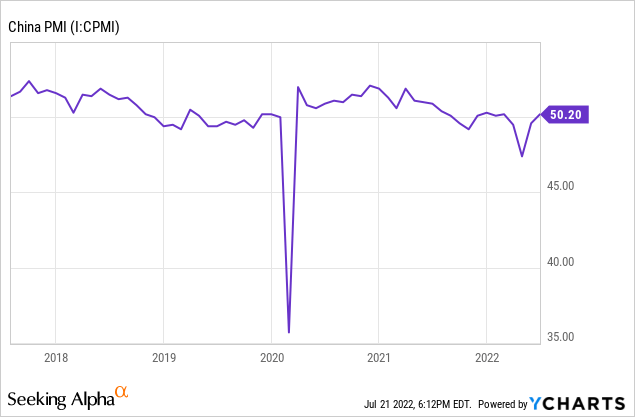

Before I delve into the stock’s valuation, I need to emphasize activity in China. Although the nation’s COVID-zero policy remains intact, the signs are that productivity in the region is recovering, with the PMI index exceeding 50 once more. Additionally, the $220 billion possible stimulus check I mentioned earlier signifies the government’s willingness to re-ignite the nation’s economic output.

Therefore, with activity in China seemingly picking up, it’s likely that global industrial reproduction could have a softer landing than we all initially thought, sustaining demand for PGMs.

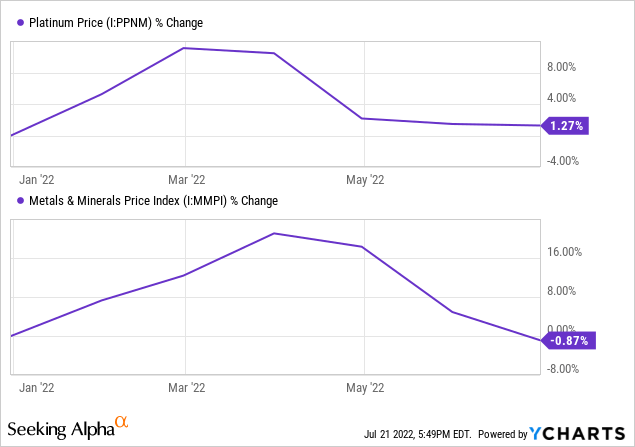

Furthermore, precious metal prices are holding firm. A combination of push-side inflation factors has undoubtedly contributed. If the world can see a gradual transition from push-side inflation to moderate demand-side inflation, we’ll likely see a scenario where metal prices remain elevated for a prolonged period.

Now let’s delve into Impala Platinum’s valuation metrics. At face value, the stock’s price-to-sales and price-to-earnings ratios convey hope as they’re at normalized discounts of 92.28% and 99.81%, respectively. In my opinion, Impala Platinum won’t see a tremendous slump in sales anytime soon. As such, the stock’s undervalued based on a top-line cash and accrual basis.

What’s concerning for me to see is the stock’s book value of 1.23x. The stock’s clearly trading at a fair equity value surplus, and the book value could be overstated with elevated commodity prices.

| Price-to-Sales | 0.92x |

| Price-to-Cash Flow | 3.28x |

| Price-to-Book | 1.23x |

Source: Seeking Alpha

Risks

Global economic headwinds such as resilient inflation in the United States and the Eurozone could hinder industrial reproduction and, in turn, suppress the demand for industrial metals. As such, investors need to be wary of systemic risk when considering Implats as an investment.

Furthermore, as mentioned in the valuation section, Implats stock is trading at a price-to-book surplus, meaning that its overvalued relative to its equity value. In addition, if a PGM price slump had to occur, the company’s book value could further erode, subsequently exacerbating the price-to-book ratios stance.

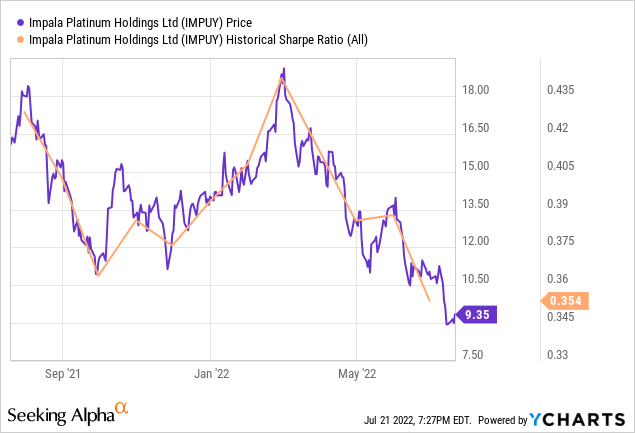

Lastly, Impala Platinum is a high-beta (1.70) asset, meaning that it’s exceptionally volatile and susceptible to bear markers. The stock’s poorly skewed beta sensitivity in relation to the broader market risk is conveyed by its unfavourable Sharpe Ratio (below 1.00).

Concluding Thoughts

After a severe slump this year, Impala Platinum stock is back in an investable region. The company’s blessed with lucrative long-life mines that produce at favourable gross margins. Additionally, Implats’ Royal Bafokeng majority buyout could add significant value to its portfolio.

Although trading at a surplus to its book value, the stock’s undervalued on a relative basis and exhibits an attractive price level.

Be the first to comment