benedek/E+ via Getty Images

Ian’s Million Fund, “IMF,” is a real-money portfolio that I’ve written about monthly since January 2016 here at Seeking Alpha. The portfolio is a largely buy-and-hold group of ~130 stocks. Each month, I buy 10-20 of the most compelling stocks available at then-current prices, deploying $1,000 of my capital plus accumulated dividends. If things go according to plan, this portfolio, which began when I was 27, will hit one million dollars in equity in 2041 at age 52. I intend it to serve as a model for other younger investors.

I made this month’s purchases on March 8. That was a reasonably well-timed move, as markets subsequently went on to rally significantly in the latter half of the month. Regardless, many of the below stocks are still on offer at attractive prices as we head into April. Here’s what I bought for March:

Portfolio buys (Interactive Brokers / Author’s work)

You may notice this adds up to significantly more than the usual $1,000 per month.

That’s largely because I sold natural gas utility South Jersey Industries (SJI), which is being acquired at $36/share of cash. Shares can presently be sold around $35, which is fair given the time between now and when the deal closes, and also the small possibility that the deal might break. Given how much the market as a whole corrected to start 2022, I preferred to get my SJI money back and reinvest it into discounted stocks today rather than waiting months to get the last buck off the trade.

South Jersey ended up being a 52% capital gain from the portfolio’s cost basis, along with paying an attractive 5.3% yield on cost during the ownership period. Not bad for a low-beta defensive utility stock. Selling SJI stock raised nearly $900 for the portfolio, giving it $1,900 for this month’s buys plus the usual accumulated dividends.

Speaking of those dividends, they were invested into Ecolab (ECL), as is likely to be the case for quite a while going forward. I’m eager to build up the size of the Ecolab position as quickly as possible for the reasons I recently outlined.

Continuing Purchases From February

Many of February’s buys were repeated in March, as prices continued to come down. So, given that I had more capital to work with this month thanks to the South Jersey buyout, it was an easy decision to keep adding to many of February’s picks.

American Tower (AMT) is another of my recent write-ups; it’s a long-term compounder with steady demand growth around the world currently down sharply from its highs.

Honeywell (HON) and 3M (MMM) are both attractive industrial firms that have come down a long way in recent months. Last year, the defense contractors part of the industrial sector were out of favor and the portfolio took advantage of that. Now defense names are out of the buy zone so I’m happy to shift to names like 3M to keep adding more blue chip industrials at P/E ratios well below the market.

In the industrial space, I bought more Rotoplas (Mexico-AGUA) (OTCPK:GRPRF) as it’s dipped another couple of percent. I absolutely love the water theme and Mexico is a particularly compelling market for water infrastructure given the high levels of water scarcity and lack of existing solutions there locally.

Rotoplas in particular focuses on installing water pipes and equipment in neighborhoods that previously had to use trucked-in water. Hauling in water is terrible for the environment given just how heavy it is and how much water people use in everyday life. Throw in soaring diesel prices, and there’s a massive opportunity for Rotoplas to install permanent water infrastructure in many Mexican neighborhoods and towns.

As Rotoplas’ earnings normalize post-pandemic, I expect this will become an emerging ESG superstar and trade at a far higher multiple.

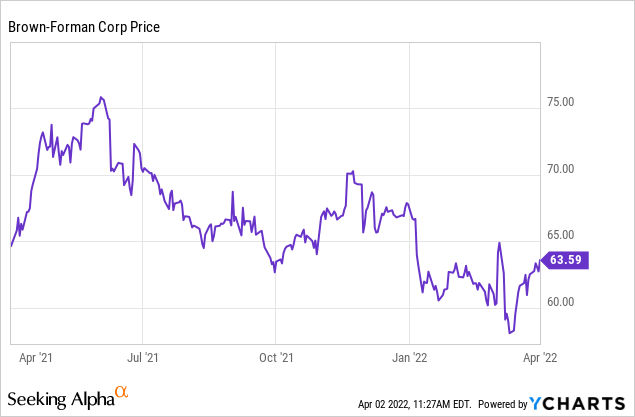

I also continued adding to Brown-Forman (BF.A) which announced stellar earnings, surged for one day earlier in March, and then went back to doing nothing.

Brown-Forman is operationally back to full steam ahead and yet the stock is lingering near 52-week lows, caught up in a wave of high-quality/compounder stock selling.

Turning to another Dividend Aristocrat, V.F. Corp (VFC) came down even more since last month and is up to a 3.7% dividend yield. That’s quite generous for a diversified apparel firm such as this one with exemplary capital allocation. I have little doubt they’ll work through the short-term supply issues and be back on track in due time.

Spotify (SPOT) continues to attract my interest as well; it’s one of the most well-known and liked millennial brands out there and has an absolutely massive market share for music streaming in most markets other than the U.S. If you’d wanted to own a Spotify or similar stock like that which got to inflated prices in early 2021, now is the time to be buying.

Salesforce (CRM), like Spotify, had been going down virtually every day as well to start 2022 before the recent bounce. As the software bear market drags on, my focus is moving mostly to the industry-leading companies such as Salesforce.

The temptation to buy more aggressive names largely goes away when the industry leaders sell near their lowest relative valuations in a decade. In my view, this is now a bear market rather than a bull for tech, so valuations can end up much lower than anyone is anticipating before we bottom. So be it, the IMF portfolio is a dollar-cost-averaging exercise so I carry on.

Finally, Compania Cervecerias Unidas (CCU) stays on the buy list. Chilean stocks are dipping again around concerns around mining policy from the new government. I’m a broken record here, but if you’re buying the Chilean beer company, the specifics of mining legislation are not particularly important. The price of copper is going up, lithium is going up, Chileans will have more money, beverage consumption will be strong. Don’t overthink it.

Additions To The Buy List For March

There were no outright new positions for the portfolio this month, however there were some buys on names that we haven’t talked about in a little while.

Coca-Cola FEMSA (KOF), for example, pulled back in early March. At one point, the leading Mexican coke bottler was back under 15 times earnings and paying out a nearly 5% dividend yield. One of my favorite macro themes for the 2020s is being bullish on Mexico, and KOF stock is the perfect sort of sleepy name with not much downside that could suddenly explode higher when sentiment picks up.

Shares of Coca-Cola Femsa quintupled between 2009 and 2013 the last time Latin American stocks had a pulse. With both Mexican manufacturing and broader commodity prices soaring, names like Coca-Cola Femsa are ready to run.

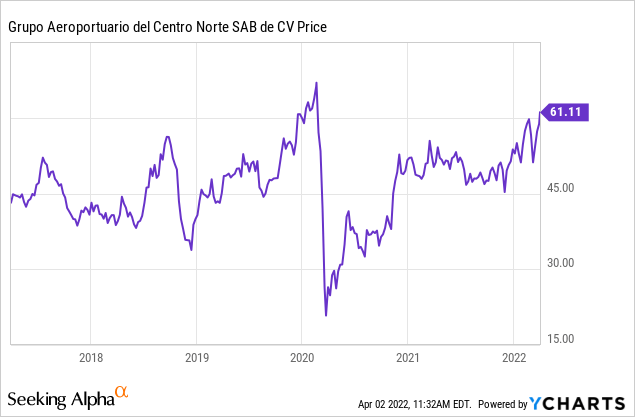

Grupo Aeroportuario del Centro Norte (OMAB) was also back on my agenda in March. Shares pulled back briefly thanks to the surge in oil prices, which will presumably be bad for aviation. This is why we hold a diversified portfolio; the IMF’s oil names have absolutely been on fire the past six months, so it’s an acceptable trade-off to have the airports pull back a bit. Anyway, as the pendulum goes back and forth, it creates opportunities to buy the temporarily out-of-favor one.

That said, OMAB stock already advanced 20% off the March lows. The dips are getting shorter and shorter on every kneejerk sell-off. Mexican airport peer Pacifico (PAC) has already blasted 55% higher over the past year to leave its old all-time highs in the dust. I expect this is the last time Centro Norte will be below its pre-pandemic peak as well.

If you like technical break-outs, a big one should be coming momentarily on OMAB stock.

As for higher oil prices, it will hurt airlines to some degree. But a ton of traffic at OMAB airports is from discount airlines with low cost structures so they should be relatively in good position. And since much of OMAB’s traffic is driven by manufacturing and industry, it’s more essential than leisure visits anyway. Also, as Mexican airlines still compete heavily against buses on domestic routes, higher fuel prices also hurt the bus companies, leading to a more level playing field than you might expect.

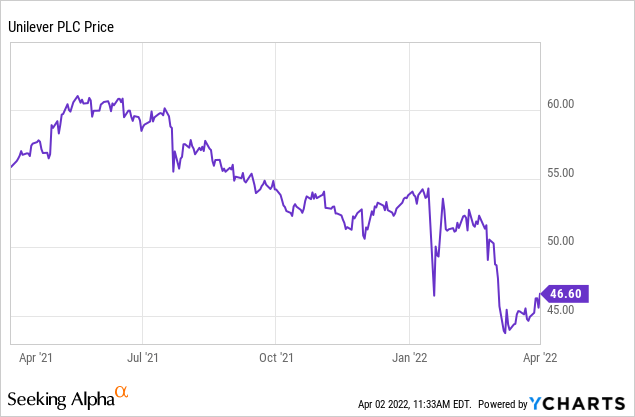

Unilever (UL) has slid off the side of a ski slope in recent months, putting it on my radar again. Its structural problems remain but it generates so much cash and is so large that you have to think activists will make something happen from this price point:

It’s funny; the high-quality consumer staples companies that have handled inflation well are all making new 52-week and all-time highs. Look at Hershey (HSY), McCormick (MKC), and Hormel Foods (HRL), for example, all of which hit new 52-week highs already in March. Meanwhile, the staples that are not besting inflation are getting absolutely trashed. It’s quite the disparity.

It goes without saying that McCormick is a far better company and management team than Unilever, but one is now at a 32x PE and the other is at 15x. Hard to think the gap between two companies like that stays quite this wide. That’s not to say I have any interest in selling my precious McCormick shares at this price — they’re an asset I fully intend to pass on to my heirs someday. But for fresh capital adding to a portfolio today, it’s hard to pass on the really cheap really beaten-up staples like Unilever.

Switching gears, there’s several companies linked to international travel that slid thanks to the Russian market disappearing and fuel prices putting a pinch on things. Visa (V), for example, slumped again following the rise in geopolitical tensions. Russia was a tiny portion of their business so I’m not too worried about that. Loss of international travel more broadly due to high jet fuel prices is a concern, but Visa’s business is so large and diversified that it will be fine.

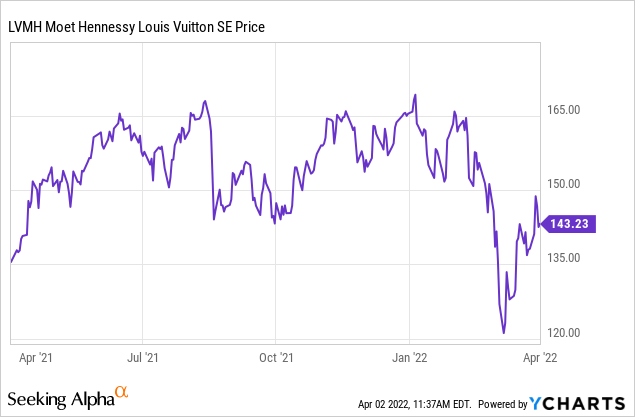

LVMH Moet Hennessy (OTCPK:LVMUY) was also back on the buy list in March. Shares plummeted over the past month, finally bringing the valuation back to something that is halfway decent, though I bought at $120 this month and they’re already back up a lot since then:

For more context, I last bought LVMH for the IMF back in the $90s in 2020 and I thought it was already not cheap then. Subsequently, shares went as high as $170. The rush into luxury goods stocks after Covid-19 was simply breathtaking. Now, however, with the high-quality compounder stocks taking big tumbles, there’s was finally a (short-lived) dip on these names.

Was that the bottom? From a valuation perspective, you could easily argue to wait for a buy price closer to $100. However, this falls in the bucket with something like Brown-Forman that is perpetually expensive, so if you want to buy, adding a little on sudden dips probably makes sense, even if you never get an outright cheap entry point.

Japanese cosmetics company Shiseido (OTCPK:SSDOY), by contrast, is becoming outright cheap. Following the plunge in its shares, it’s now selling at an estimated just 22 times estimated 2023 earnings. Normally its rivals like Estee Lauder (EL) and L’Oreal (OTCPK:LRLCY) trade closer to 35 or 40 times earnings. There’s the usual concerns around international travel and the health of the Chinese economy and consumer, but that’s all baked into Shiseido’s price here and then some.

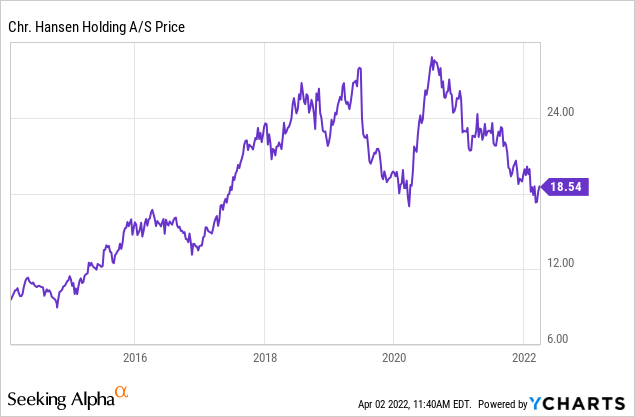

Rounding out the month’s buys, we have Chr. Hansen (OTCPK:CHYHY). The specialty chemical company primarily makes enzymes and other ingredients used to flavor dairy products such as cheese and yogurt. It has massive market share in its niche industry, and a massive moat. Customers such as yogurt companies can’t leave Chr. Hansen without losing the unique flavor of their dairy products.

It’s a classic winning formula where Chr. Hansen can earn high profit margins since it has little competition and the cost of the enzymes that go into a cheese is miniscule compared to the end product. Its customers won’t rock the boat to save a few pennies, ensuring that Chr. Hansen can earn fat profit margins. In addition, the company is growing in the animal nutrition market as well.

There’s the usual concerns around cost inflation and supply chain issues for the company at the moment. In addition, European quality stocks have been selling off more aggressively than their American counterparts, leading to this amazing slide in Chr. Hansen’s stock price back to the Covid-19 lows. Note that the below chart is for the US-Dollar ADR and thus is an even bigger bargain since the Euro has been diving against the dollar lately:

Be the first to comment