Cristian Storto Fotografia

Investment Thesis: While sales growth has been encouraging, Carrefour SA might see modest growth in the short to medium-term.

In a previous article back in August, I made the argument that Carrefour SA (OTCPK:CRRFY) could see a longer-term rebound ahead, on the basis of growth across convenience and other format stores across the French market along with sales growth remaining broadly resilient in the face of inflationary pressures.

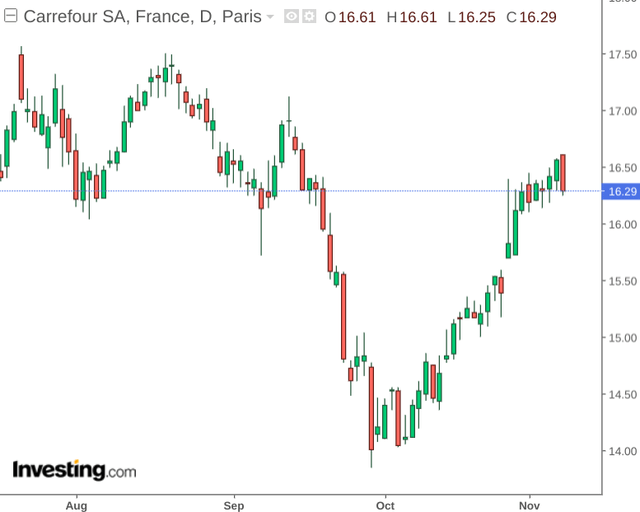

While the stock saw some downside heading into the autumn months, price has since recovered to levels seen back in August:

The purpose of this article is to assess whether Carrefour could have the capacity to see further upside from here – particularly taking Q3 2022 sales performance into consideration.

Performance

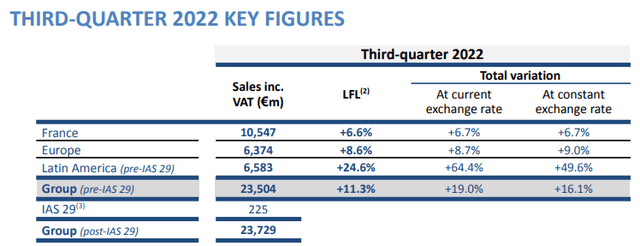

When looking at most recent sales performance – we can see that growth across France and Europe continued to trend upward – with sales growth across Latin America being the strongest on a percentage basis.

What is also notable is that Carrefour-branded products now account for 33% of sales, which meets the goal as set out by the Carrefour 2022 plan and reflects increasing brand loyalty on the part of customers.

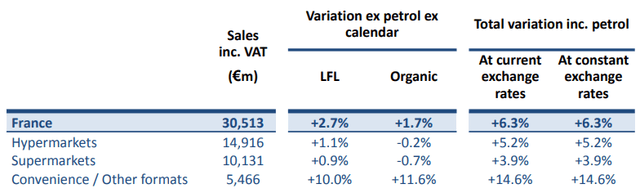

Additionally, hypermarkets in France appear to have been thriving in an inflationary environment – benefiting from offer, price and promotional attributes, along with overall market share continuing to rise by 0.5% in volumes for the most recent quarter. This segment accounted for the majority of sales across France, with supermarkets and convenience/other format stores also showing strong growth:

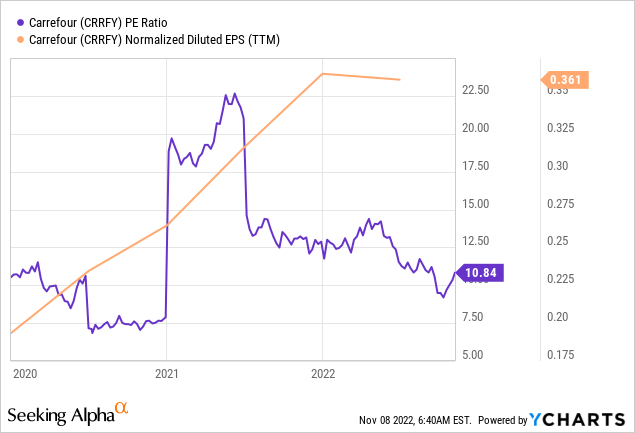

When looking at the stock’s earnings from a valuation standpoint, we can see that normalised diluted EPS has seen significant growth over the past three years – while the company’s P/E ratio has fallen back to levels seen in 2020.

ycharts.com

This might indicate that the stock may be trading at more attractive value from an earnings standpoint as compared to last year:

Looking Forward

To date, the sales growth we have been seeing in the face of inflationary pressures has been encouraging.

Going forward, I take the view that investors will start to pay more attention to whether the company can translate such sales growth into cash flow growth going forward.

For instance, when looking at the company’s quick ratio (calculated as current assets less inventories all over current liabilities) – we can see that Carrefour’s quick ratio has remained below 1 and has decreased slightly from December 2019 to June 2022.

| December 2019 | June 2022 | |

| Current Assets | 18875 | 19586 |

| Inventories | 5867 | 7227 |

| Current Liabilities | 23061 | 24417 |

| Quick Ratio | 0.56 | 0.51 |

Source: Figures sourced from Carrefour December 2019 Consolidated Financial Statements and 2022 Half-Year Financial Report. Figures provided in € millions, except the quick ratio. Quick ratio calculated by author.

This means that Carrefour’s ability to meet its current liabilities with its current liquid assets has declined slightly over this period.

Additionally, while seeing a slight decline, long-term borrowings to total assets remains at virtually the same level as seen in December 2019:

| December 2019 | June 2022 | |

| Long-term borrowings | 6303 | 5915 |

| Total assets | 50802 | 52755 |

| Long-term borrowings to total assets ratio | 0.12 | 0.11 |

Source: Figures sourced from Carrefour December 2019 Consolidated Financial Statements and 2022 Half-Year Financial Report. Figures provided in € millions, except the long-term borrowings to total assets ratio. Long-term borrowings to total assets ratio calculated by author.

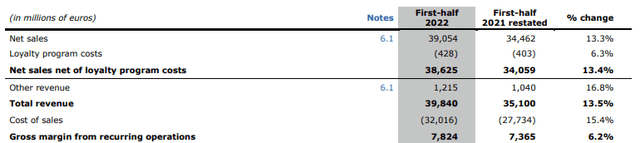

Taking the above into account, one potential risk for Carrefour is that cost of sales continues to rise significantly and significantly reduces profitability that would have resulted from top-line sales growth. For instance, we can see that the first half of 2022 showed a 15.4% growth in cost of sales as compared to the previous year, which was higher on a percentage basis than the 13.4% growth in net sales that we saw over the same period:

Carrefour: 2022 Half-Year Financial Report

In this regard, I take the view that investors will want to see evidence that Carrefour can control the rising costs that accompany sales growth to ensure that profitability can sustainably grow over the longer-term.

Conclusion

To conclude, Carrefour has seen strong sales growth in the face of an inflationary environment, which is encouraging. However, I take the view that investors will look for evidence of growth in cash flow and reassurance that inflation will not result in cost of sales growth ultimately affecting profitability. For this reason, I take the view that Carrefour might see modest growth in the short to medium-term.

Be the first to comment