simonkr/E+ via Getty Images

Investment Thesis

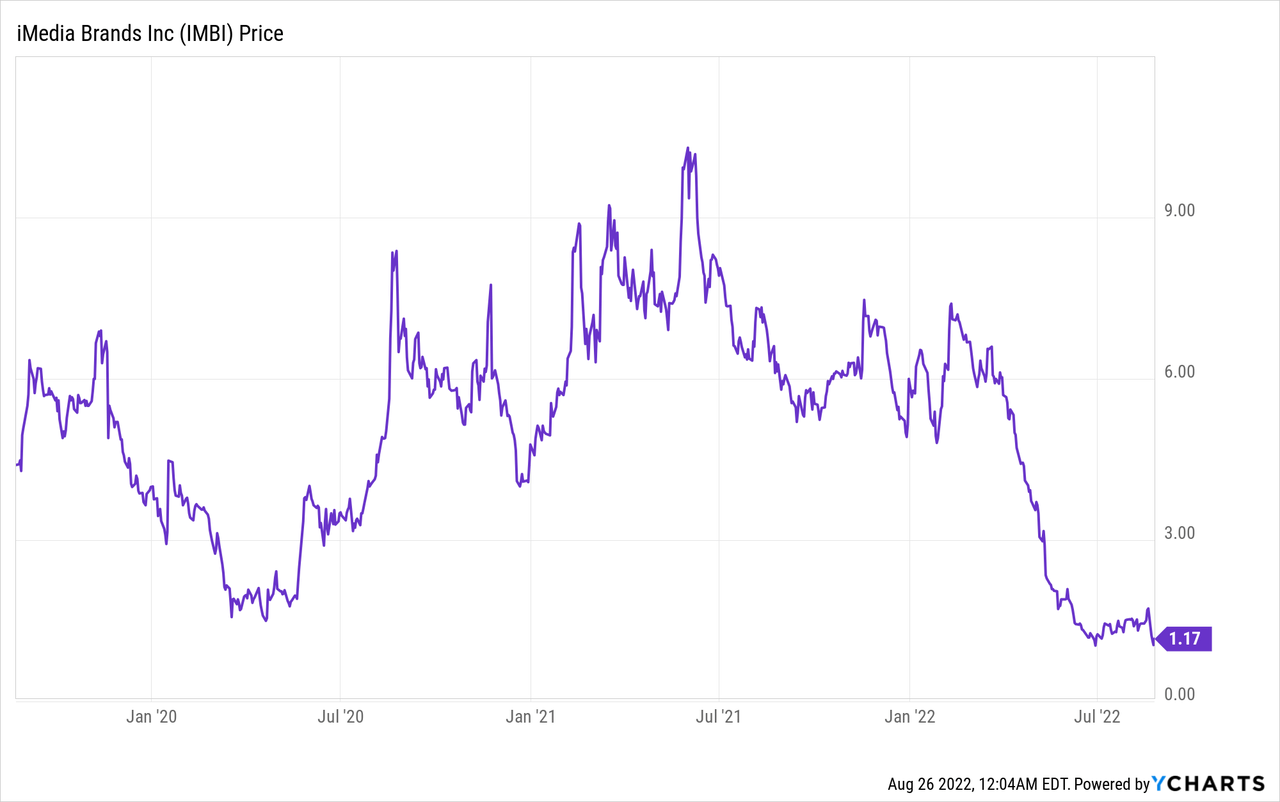

iMedia Brands (NASDAQ:IMBI) is an undervalued interactive media enterprise built upon extracting synergies from leveraging lifestyle television networks, consumer brands, and media commerce services to build an interdependent social commerce platform. While IMBI had been plagued by years of underperformance and mismanagement, new leadership has been executing on a dynamic growth strategy, ignited by opportunistic global acquisitions. The ultimate success of this plan will depend on how quickly IMBI can generate substantial free-cash-flow to reduce its debt burden. With shares trading near $1 and at approximately 3.5x our 2023 EBITDA forecast, we think IMBI is priced at option value, having been washed out following issuance of its second quarter results and full-year guidance revision. In our view, iMedia Brands offers a compelling asymmetric risk/reward profile for patient investors with a 12 to 24 month time horizon, during which we think the stock at least doubles. In our view, IMBI has essentially been de-risked.

Company Overview

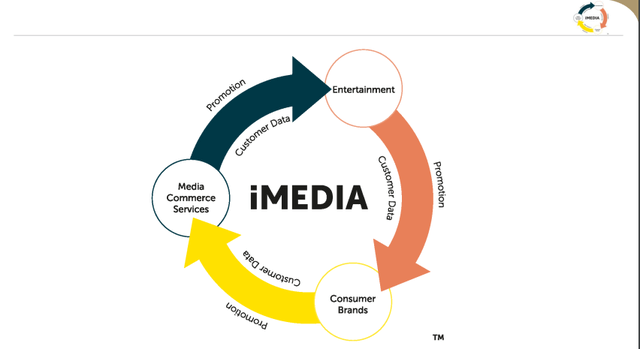

iMedia Brands is an interactive media company positioned to capitalize on the convergence of entertainment, ecommerce, and advertising. IMBI owns a global portfolio of lifestyle television networks, consumer brands, and media commerce services.

Company Overview (iMedia Brands Investor Presentation)

History

iMedia Brands has a checkered history, with corporate and brand name changes, leadership shake-ups, numerous failed strategies, and a volatile stock price that often dropped to pennies. Previous names include ShopNBC and Evine Live. The company was unprofitable, given significantly higher operating costs than Home Shopping Network and QVC and an undifferentiated merchandising strategy. As a result, the old strategy simply couldn’t generate sufficient scale and/or margin, resulting in dilutive equity capital raises to stay afloat.

The turning point came in May 2019, when IMBI announced a comprehensive restructuring that included: (1) Tim Peterman, formerly chief financial officer and chief operating officer, returning as chief executive officer; (2) raising $6 million in equity financing from Eyal Lalo, chief executive officer of The Invicta Watch Group, the company’s most important vendor, and Peterman; and (3) a board of directors shake-up that included Lalo being named vice chairman. A few months later, the Company completed a ten-for-one reverse stock split.

New Leadership

Tim Peterman initially joined IMBI in 2015 as chief financial officer and was promoted two years later to chief operating officer (while remaining CFO), resulting in the company’s first profitable year in 10 years. Peterman left the company in 2018 to take a similar position with Amerimark Interactive, a multichannel marketer for retail goods. However, a year later, Peterman was lured back to IMBI with the opportunity to be chief executive officer and transform the company. Peterman built his career primarily at interactive media companies, including The E.W. Scripps Company (SSP), IAC (IAC), Sinclair Broadcast Group (SBGI), and Tribune Media.

After Peterman joined, IMBI eliminated 11 senior positions and other full-time positions amidst a broad-based “cost optimization event” that reduced 20% of the corporate and executive staff. Within six months after being appointed CEO, Peterman oversaw a 10-for-1 reverse stock split. However, during the past three years, while developing and building a new operating strategy under the iMedia Brands name, Peterman has built his executive team, in part by promoting his best talent.

Jean Sabatier joined as chief commerce officer concurrent with Peterman being named CEO. Sabatier has been instrumental in transforming the company’s pricing, merchandising, programming, and planning strategies. Similar to Peterman, Sabatier rejoined the company. Sabatier brought 10 years of experience in sales and product planning from QVC.

Cassie Anliker was appointed senior vice president – merchandising in March 2020, after serving in various merchandising roles since 2012, and earlier this year was promoted to the additional role of President – ShopHQ Networks.

In May 2022, Tom Zielecki was promoted to chief financial officer, after joining the company earlier in the year to lead finance for the ShopHQ brand. Earlier in his career, Zielecki spent 16 years at Kmart/Sears Corporation in financial leadership roles. Monty Wageman, the company’s former CFO, now serves as treasurer.

Entertainment

iMedia Brands currently operates four shopping television networks: ShopHQ, 1-2-3.tv, ShopBulldogTV, and ShopHQHealth. Collectively, IMBI groups these together as its “entertainment” division. This programming is delivered upon distribution agreements with cable, satellite, telecommunication companies, and over-the-top platforms, as well as on over-the-air broadcast television stations. In addition, programming is streamed live online on each network’s digital commerce platforms. Moreover, programming and products are marketed on mobile devices and by leveraging social media channels.

ShopHQ reaches approximately 85 million television homes, offering a mix of proprietary, exclusive, and name-brand merchandise in the categories of jewelry & watches, home & consumer electronics, beauty & wellness, and fashion & accessories. ShopHQ is the third largest television shopping network in the United States. In fiscal 2020, ShopHQ generated $437 million in net sales, representing 96% of total net sales for IMBI.

123tv, an interactive media company acquired in the fourth quarter of fiscal 2021 for $93 million, is a disruptor in Germany’s television retailing marketplace. This television network reaches more than 40 million German and Austrian television households and focuses on proprietary, Dutch auction style live and automated auctions for its compelling merchandise mix. In fiscal 2020, 123tv generated $184 million in net sales.

ShopBulldogTV, which launched in fourth quarter fiscal 2019, is a men’s shopping and lifestyle television network that primarily merchandises fashion, watches, jewelry, collectibles, healthcare products.

ShopHQHealth, which launched in third quarter fiscal 2020, is a shopping television network exclusively focused on health and wellness. This network merchandises products and services for the physical, spiritual, and mental health of consumers and their families.

For fiscal year 2021, the entertainment segment generated $479 million of revenue, with 40% derived by jewelry & watches, 22% by health, beauty & wellness, 16% by home, 12% by fashion & accessories, and 10% other (primarily shipping & handling). Gross margin was 40%, while operating margin was (3%), resulting in a $14 million loss. (Given the timing of the 123tv acquisition, these results do not include 123tv’s full-year results.)

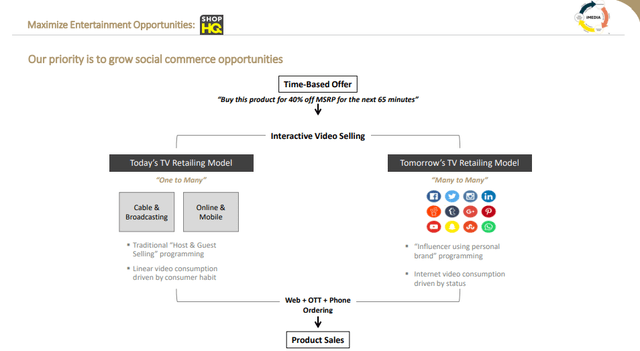

Social Commerce (iMedia Brands Investor Presentation )

Consumer Brands

iMedia Brands owns several consumer brands that are prominently featured on the television shopping networks and digital commerce platforms. These brands include: Christopher & Banks (women’s apparel), J.W. Hulme (leather goods), Cooking with Shaquille O’Neal (kitchen products and watches).

In early fiscal 2021, IMBI acquired Christopher & Banks through a licensing agreement with ReStore Capital, a Hilco Global company. Christopher & Banks is a specialty retailer of value-priced women’s apparel and accessories that caters to women of all sizes, from petite to missy to plus-size. In our view, this was a strategic acquisition after Christopher & Banks filed for bankruptcy in fiscal 2020, since iMedia Brands is rebuilding the brand across its platforms.

We think Christopher & Banks and “Cooking with Shaquille O’Neal” are the two most valuable brands in the IMBI portfolio, especially given the growth potential for each brand.

Media Commerce Services

iMedia Brands operates iMedia Digital Services (iMDS).

iMDS is a video advertising platform and was acquired from Synacor in the first half of fiscal 2021. iMDS facilitates the monetization of more than 200 million monthly users for online publishers, multichannel video program distributors, and internet service providers by leveraging proprietary technologies and interactive websites to drive engagement, traffic, and conversion. After this acquisition from Synacor, IMBI folded Float Left into iMedia Digital Services banner. Float Left is an over-the-top (streaming) technology provider to build dynamic applications.

Growth Strategy

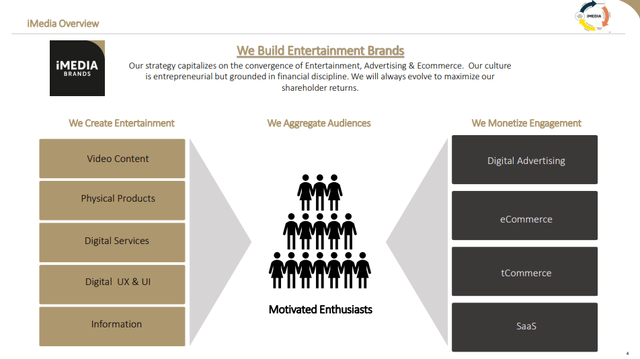

The vision for iMedia Brands is to capitalize on the convergence of entertainment, advertising, and e-commerce. The company’s entertainment (video content, physical products, and digital services) for which audiences are aggregated to then monetize engagement on digital advertising, e-commerce, t-commerce (smart digital television), and SaaS platforms. Management believes, and we agree, that the company’s competitive advantage is these entertainment brands promote and provide first-party data to consumer and digital advertising brands. Across all segments, IMBI is focused on the baby boomer demographic (age 55-plus).

Corporate Strategy (iMedia Brands Investor Presentation)

ShopHQ Market Share Growth

After years of underperformance, ShopHQ is finally turning around. By prioritizing its largest vendors and developing exclusive brands and products with suppliers, ShopHQ has transformed. Further, iMedia Brands is focused on increasing the quality and quantity of video distribution in both linear and CTV (connected television). To this end, IMBI entered eight of the top ten media markets with over-the-air distribution in high-definition by partnering with RNN (Regional News Network) last year. This initiative has resulted in a 15% to 20% revenue increase in those markets.

Christopher & Banks Revitalization

By leveraging ShopHQ’s promotional power and first-party data, iMedia Brands is reviving the Christopher & Banks brand with omnichannel growth. With the exception of a handful of physical stores (the highest performing locations remain), this digital retailing concept is primed for growth. By featuring the brand on ShopHQ, sales are driven to digital platforms, especially when leveraged by virtual stylists. Pre-bankruptcy, the brand generated more than $300 million in annual revenue. In 2021, IMBI generated $40 million in revenue and over the long-term, we think this concept can easily return to substantially higher than $150 million in annual sales.

123tv Synergies Unlocked

The growth strategy for 123tv is to expand its disruptive platform in Western Europe (primarily Germany) and introduce the unique approach of proprietary, live, automated auctions to digital marketplaces in the United States. This in turn will generate additional first party data that can further power iMDS. Moreover, IMBI intends to leverage ShopHQ’s vendor relationships, expand on-air and online shopping gamification, and increase overall content distribution for 123tv. For the United States market, the Company plans to utilize 123tv’s auction approach to disrupt the online travel marketplace with the launch of 123travel later this year.

iMDS As Digital Advertising Leader

iMedia’s goal for iMDS is to be one of the industry’s leaders as a “single source” online services providers to advertisers. This platform already monetizes more than 200 million monthly users for publishers by leveraging proprietary technologies, first-party customer data, and managed value-added services to drive engagement, traffic, and conversion.

Retail Media Exchange, the flagship product for iMDS, is an end-to-end programmatic advertising exchange that connects demand partners to publisher advertising inventory using machine learning technology to buy and sell advertising inventory with a data-driven purpose. Publisher partners include Buzzfeed, Vox, Warner Media, Arena Group, WebMD, and Major League Baseball. Retail Media Exchange will continue to scale by further leveraging IMBI’s first-party shopping data.

iMDS recently renewed its contract with Google (GOOG) (GOOGL), extending its direct revenue-sharing relationship that includes a Google-branded search tool on its managed portals. When a consumer searches using this tool, iMDS delivers it to Google, and Google returns search results that include advertiser-sponsored links. If the consumer clicks on a sponsored link, then Google receives payment from the sponsor and shares a portion with iMDS, which in turn shares a percentage with the publisher (i.e. the iMDS client).

Competition

Given diverse business segments, iMedia has various competitors within each business group. For ShopHQ, the primary competitors are the larger home shopping television channels, including QVC and HSN (Home Shopping Network) which are both owned by Qurate Retail (QRTEA). Within digital advertising, the primary competitor is Taboola (TBLA). In addition, within consumer brands, the key competitors are J.Jill (JILL) and Cato (CATO).

Second Quarter 2022 Report

While the iMedia Brands second quarter report was disappointing, particularly its outlook for the remainder of the year, we think this is clearly a scenario of short-term pain for long-term gain. The reduced outlook for 2022 was caused by (1) a proactive DISH network (DISH) carriage dispute; (2) non-core business divestitures; and (3) the Russia/Ukraine war impact on Germany. In sum, these issues have resulted in lower full-year guidance. As compared to the previous midpoints, revenue is expected to be $75 million lower (to $615 million) and adjusted EBITDA $14 million lower (to $41 million).

We applaud management for finally playing tough with DISH, especially since this television distribution partner is among the least profitable for iMedia Brands. Ultimately, either IMBI will reach a deal with DISH at more favorable terms, which would be accretive to profitability, or replace DISH with a more profitable partner.

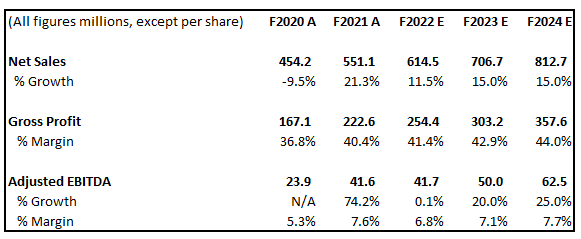

Earnings Model

EBITDA Model (The Bulls Bay)

Our EBITDA model is based on management’s recently scaled down guidance for fiscal year 2022 and conservative growth estimates of 15% on the top-line annually in fiscal years 2023 and 2024. We expect gross margin expansion of more than 100 basis points, based on stronger sourcing relationships and inventory management, as well as EBITDA growth of more than 20% in 2023 and 2024, as expense leveraging powers earnings growth.

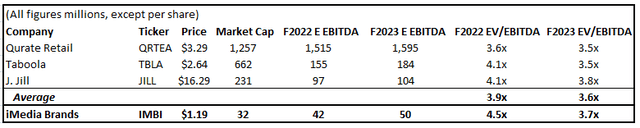

Comparative Valuation

Comparative Valuation (The Bulls Bay)

iMedia Brands currently trades in-line with its peer group based on fiscal year 2023 estimates. However, IMBI has transformed into a multi-faceted enterprise with multiple home shopping / lifestyle / entertainment networks, a major women’s apparel brand, and advertising platform, resulting in three revenue streams: e-commerce, advertising, and services. Therefore, we think IMBI deserves a premium valuation multiple of nearly 1x turn relative to peers. When considering IMBI, we also note that its market capitalization is less than 20% of its enterprise value, which creates a relatively unique opportunity whereby the stock price could significantly rise with only a marginal increase in its enterprise value on a percentage basis.

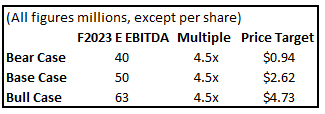

Therefore, as the below sensitivity analysis depicts, our base case assumption is that the IMBI is valued at 4.5x 2023 EBITDA, an 0.8x premium valuation to peers due to higher-than-average earnings growth potential, as well as its diverse business mix. We forecast $50 million of EBITDA, which equates to an approximate $2.60 stock price, more than double the current level. Our bear case assumes a recession results in 20% lower EBITDA in 2023 than our base case forecast. With this scenario, we assign the same multiple of 4.5x, resulting in an approximate $0.95 stock price, which implies nearly 20% downside. However, our bull case, predicated on a global “soft landing” from macroeconomic and geopolitical headwinds, anticipates 25% higher EBITDA than our base case, the same valuation multiple, resulting in an approximate $4.75 share price, which would yield nearly 300% upside.

Sensitivity Analysis (The Bulls Bay)

Catalysts

Monetary Policy

The easing of interest rate increases would be bullish for growth stocks in general, and consumer discretionary stocks in particular. This is likely to occur by mid 2023, in our view.

Russia / Ukraine Peace

A ceasefire in the Russia / Ukraine war would be significantly strengthen the economy in Germany, including the supply chain, and therefore significantly improve 123tv.

Balance Sheet

Debt reduction through free cash flow or asset monetization would be immediately accretive to equity holders. Management is planning to enter sale leaseback transactions by year-end for some of its real estate, which is expected to raise at least $45 million.

Risks

Inflation

Persistently high inflation may impede consumer discretionary spending, especially for middle-income consumers. A recession would likely place pressure on advertising revenue.

Dilution

Any equity financing at the current price levels or even up to $5 per share would be highly dilutive to shareholders. Given the approximate $155 million of net debt on its balance sheet, we think this is the most significant risk.

Geopolitics

Continued disruptions in the supply-chain and broader economy in Europe due to the Russia / Ukraine war is likely to be a headwind, given 123tv’s dependence on Germany.

Conclusion

iMedia Brands is a rapidly transforming global media enterprise with new leadership and a clear dynamic long-term growth strategy, synthesizing television commerce, consumer brands, and media commerce services. Early signs of success are highlighted by recent news that Christopher & Banks, its women’s apparel brand, posted a 79% increase in net sales for the 2022 spring season, driven by placement on ShopHQ television network and digital platforms. Despite the challenging European economy, business divestitures, and a carriage dispute with DISH that is pressuring 2022 results, we think management is positioning IMBI to achieve accelerating earnings growth beginning next year. With shares trading near $1, we think IMBI is essentially at option value. Either the stock will continue to flounder and shareholders will be diluted again with yet another equity offering or iMedia Brands will finally realize sustainable, earnings power and free cash flow. Therefore, we contend there is a significant asymmetric risk/reward profile. Our 12-month price target is roughly $2.60, representing more than 100% upside, with a relatively conservative 4.5x EBITDA multiple.

Be the first to comment