libre de droit/iStock via Getty Images

The iShares Latin America 40 ETF (NYSEARCA:ILF) is a Latin America equity index ETF. Latin American countries focus on commodities, energy, and resource extraction, industries which have seen booming demand and skyrocketing prices these past few months. Latin American stocks have benefitted from these trends, leading to significant dividend growth, a strong 6.7% yield, and market-beating returns. The trend is set to continue, as worsening supply chains and the war in Ukraine lead to even higher commodity prices.

ILF offers investors a strong 6.7% yield, and the potential for significant market-beating returns if commodity prices remain elevated. The fund is a buy, but only appropriate for more aggressive investors.

ILF – Basics

- Investment Manager: BlackRock

- Underlying Index: S&P Latin America 40 Index

- Expense Ratio: 0.48%

- Dividend Yield: 6.7%

- Total Returns CAGR 5Y: 2.7%

ILF – Overview

ILF is an equity index ETF, tracking the S&P Latin America 40 Index. The fund invests in the 40 largest Latin American stocks, subject to a basic set of liquidity, trading, etc., inclusion criteria. As per S&P, preference is given to developed market listing of the different index constituents, meaning ADRs and similar. It is a relatively simple index, with a simple methodology.

As per S&P, as the Latin American equity market is quite small, ILF’s underlying index captures approximately 70% of the region’s total market-cap, in spite of its small number of holdings. As a comparison, the S&P 500 captures 85% of total U.S. market capitalization. As such, investors should consider ILF to be a relatively broad-based Latin American equity index. It might seem small due to its low small number of holdings, but this is mostly a reflection of the small size of the region’s equity markets. ILF invests in most relevant companies by market-cap, there are simply very few of these.

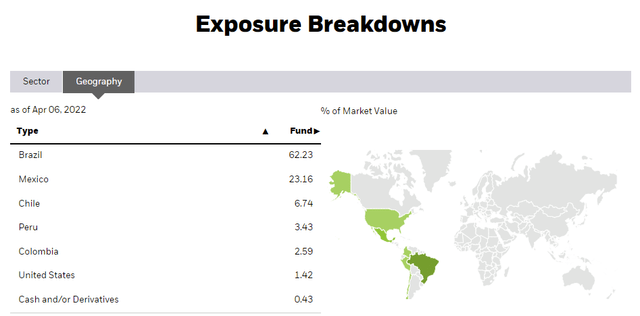

ILF technically invests in five different regional markets but, in practice, focuses almost exclusively on Brazil and Mexico, due to the large size of their economies.

ILF Corporate Website

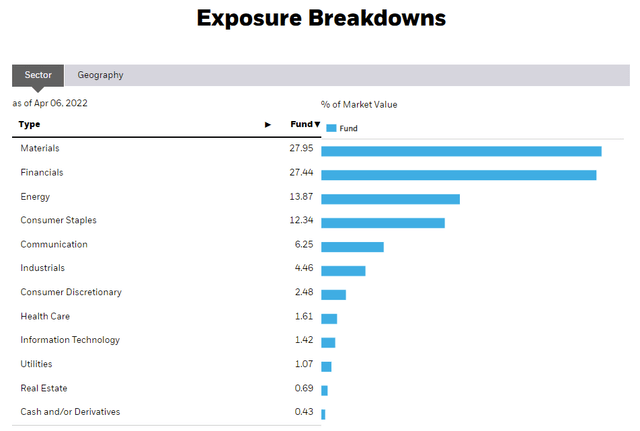

ILF’s industry exposures are more diversified, with investments in most relevant industry segments.

ILF Corporate Website

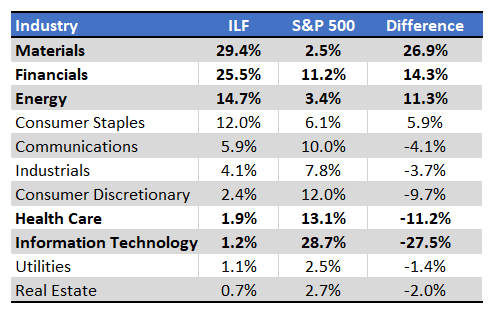

ILF’s industry weights differ markedly from those of most broad-based equity indexes, including the S&P 500. A quick comparison table.

ILF Corporate Website / S&P 500 Index Website

As can be seen above, ILF is massively overweight materials, as Latin American economies tend to focus quite strongly on commodities and resource extraction. The same is true for energy, with both Brazil and Mexico boasting significant quantities of oil. ILF is also overweight financials, as it is common for large regional financial institutions to trade on public equity markets, while the same is not true for regional corporations in other industries.

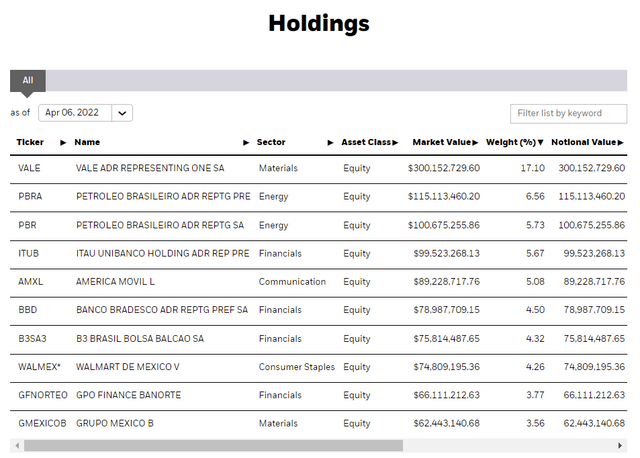

ILF’s largest holdings broadly reflect the above.

ILF Corporate Website

As can be seen above, ILF’s largest holdings include Vale (VALE), a Brazilian iron ore producer, and Petrobras (PBR), the country’s national oil company. These two companies account for just under one-third the value of the fund, and help explain ILF’s overweight materials and energy position. The other holdings are more varied, but you do see lots of financial institutions, and a lone communications company.

On the flipside, the fund is significantly underweight the tech and health care industries, as Latin American countries tend to lack the human and institutional capital required for these high-tech industries. There are simply few tech and biotech corporations in the region, and the fund reflects that reality.

ILF’s industry weights have important implications for the fund and its shareholders. Let’s have a look.

ILF – Materials, Energy, and Commodities Play

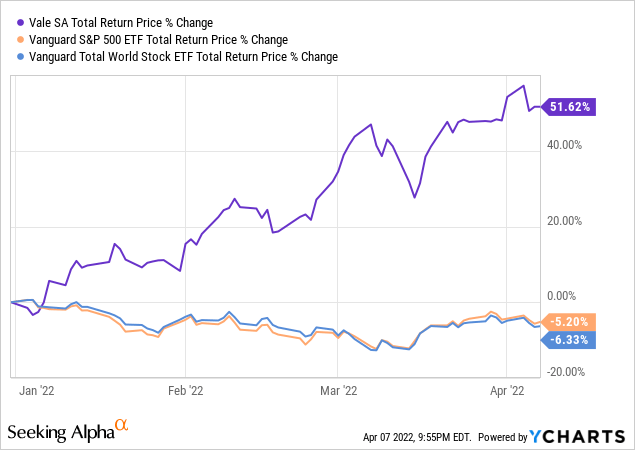

ILF focuses quite heavily on the materials and energy industries, two industries with significant exposure to commodity prices. ILF’s underlying holdings tend to perform particularly well when commodity prices are high and rising, as is currently the case. As an example, Vale has significantly outperformed YTD, as ongoing supply chain issues and booming demand in developed markets lead to higher metal prices, boosting market sentiment, ultimately resulting in higher share prices for the company, and strong capital gains and returns for its investors.

Importantly, company fundamentals are also seeing rapid improvement. Higher metal prices lead to higher revenues, earnings, and cash-flows, all of which ultimately lead to strong, growing dividends. Vale boasts a 7.1% dividend yield, and dividend growth of more than 500% since 2020. Elevated commodity prices should help sustain further dividend growth in the coming months too.

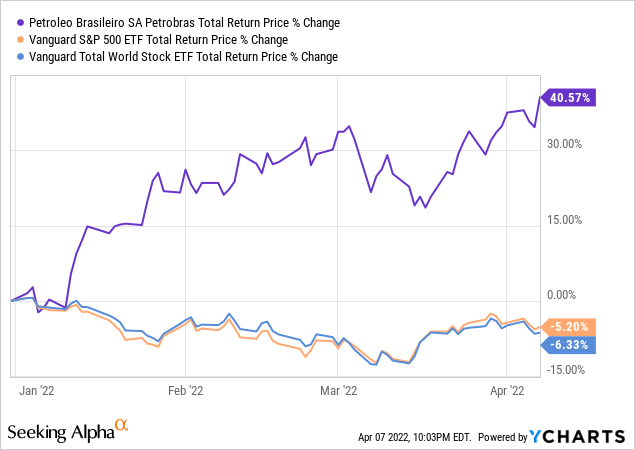

Petrobras shows a similar pattern. Oil prices have significantly increased YTD, due to booming demand and the ongoing war in the Ukraine, leading to strong, market-beating returns for the company and its shareholders.

Petrobras also recently hiked its dividend to around 6.1% yield, and further hikes are likely.

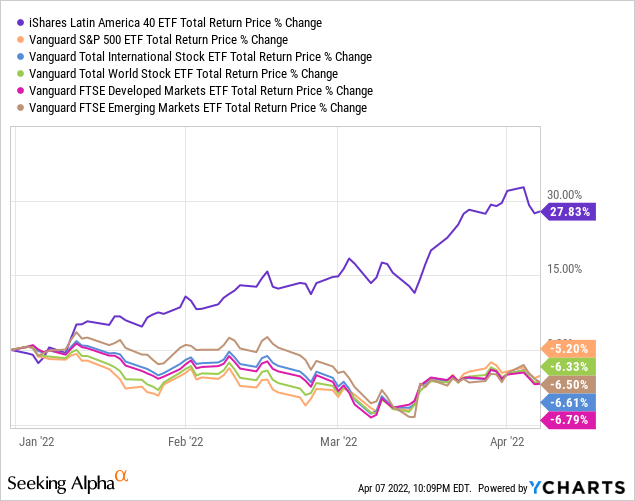

ILF focuses on companies with significant commodity price exposure, most importantly Vale and Petrobras, and so the fund tends to perform particularly well when commodity prices are high and rising. This has been the case YTD, with ILF outperforming relative to most broad-based equity indexes, including those focused on U.S., global, international, developed markets, and emerging markets. Stocks are down almost everywhere except Latin America, due to the region’s significant materials and energy exposure.

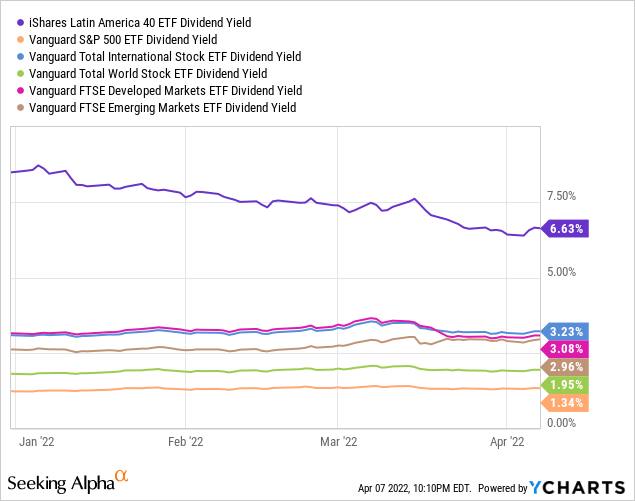

As with Vale and Petrobras, high and rising commodity prices also lead to strong, growing dividends for ILF and its investors. The fund currently boasts a 6.7% dividend yield, quite strong on an absolute basis, and significantly higher than that of most broad-based equity indexes.

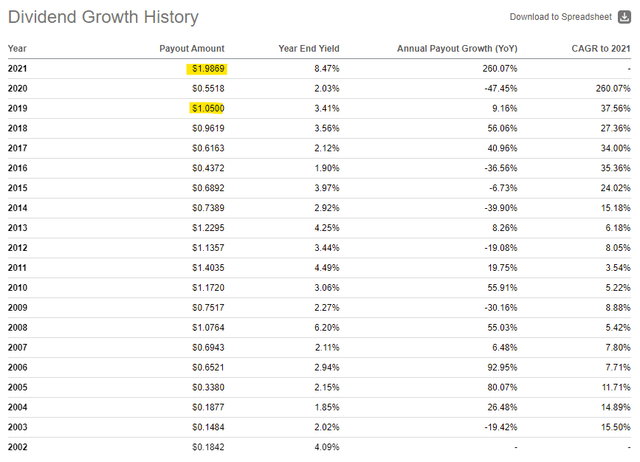

ILF’s dividends have also seen solid growth since inception. Growth has been particularly strong these past few years, with the fund’s dividend almost doubling since 2019.

Seeking Alpha

Let’s summarise the above. ILF performs particularly well when commodity prices are high and rising, as is currently the case. The fund offers investors a strong 6.7% yield, and the potential for market-beating returns, a solid combination.

ILF – Risks and Negatives

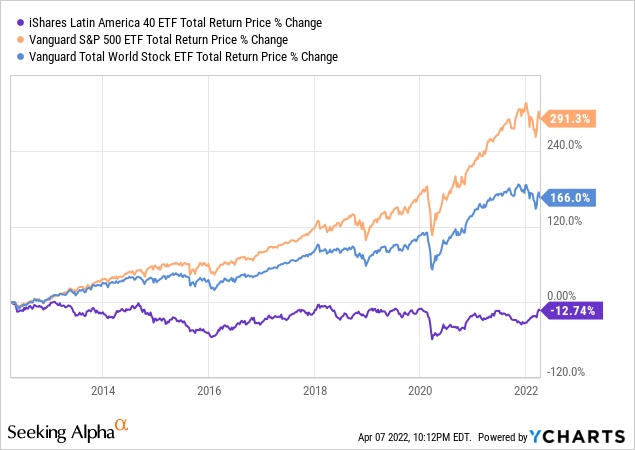

ILF’s significant commodity price exposure is a benefit when commodity prices are high and rising, but a negative when these stagnate, which is a relatively common occurrence. Commodity prices have mostly stagnated for the past decade or so, mostly being mostly flat since after the aftermath of the financial crisis / housing bubbles. ILF has underperformed for the past decade or so, and by quite a large margin. Recent outperformance is barely a blip in the chart.

Although I don’t see a short-term catalyst for lower commodity prices, the fact that ILF significantly underperforms when these occur is a massive risk and negative for the fund and its shareholders. ILF will almost certainly underperform when commodity prices normalize, and I do believe that this is a question of when, not if. As such, ILF is only an appropriate investment for more aggressive investors. At the same time, I strongly believe that it is an investment that requires more vigilance than most. ILF is a worthwhile investment under current conditions, but conditions might change, and investors need to be prepared to sell if this happens.

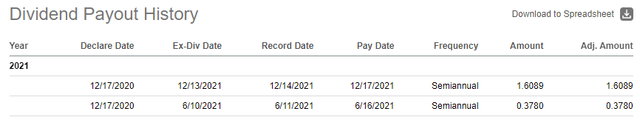

As a final note, the fund’s dividends are significantly more volatile than those of most U.S. equity funds, and paid semi-annually. Both are mostly the result of differences in dividend policies between U.S. and Latin American corporations.

In my opinion, ILF’s dividends are volatile and infrequent enough that investors should not depend on these to fund their short-term spending needs. Investors in ILF will very likely receive strong dividends in 2022 and beyond, but investors should not expect these to be smooth, stable, or easy to forecast. As an example, ILF paid the majority of its 2021 dividends late in the year, with a small dividend payment earlier in the year. The same could be true for 2022.

Seeking Alpha

In my opinion, ILF’s strong yield and dividend growth more than outweigh the irregularity and volatility of its dividends. Still, this is an important negative that investors need to be aware of.

Conclusion – Strong Investment Opportunity

ILF offers investors a strong 6.7% yield, and the potential for significant market-beating returns if commodity prices remain elevated. The fund is a buy, but only appropriate for more aggressive investors.

Be the first to comment