Funtap

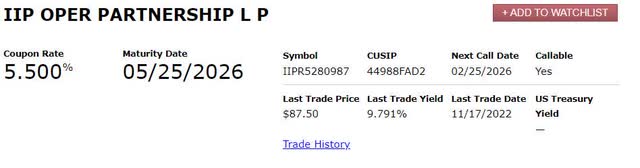

Innovative Industrial Properties (NYSE:IIPR) is a REIT specializing in leasing properties to the growing cannabis industry. The company has engaged in an aggressive growth plan over the last couple of years, but has recently stalled due to higher interest rates in the macro environment. While income investors may be attracted by the company’s 6.4% dividend yield, the company has a preferred share trading above par yielding 8.6%, and an even more attractive bond trading at a yield to maturity of 9.7%.

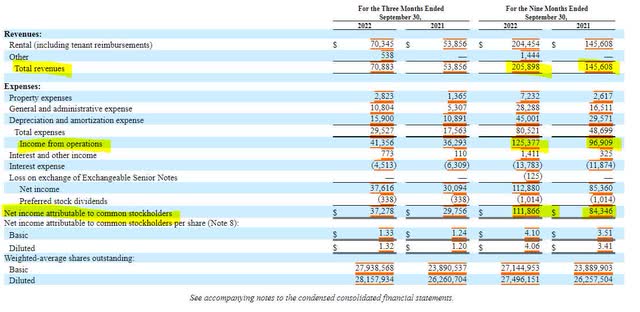

Innovative Industrial Properties continues to see positive results from its growth strategy, as indicated in the company’s third quarter results. While revenue and expenses both jumped by a large amount, the company’s income from operations increased year to date by almost $30 million compared to last year. Despite the company’s large capital raise this year (they issued common shares), Innovative Industrial Properties managed to increase its earnings per share by approximately 10% compared to the same quarter a year ago.

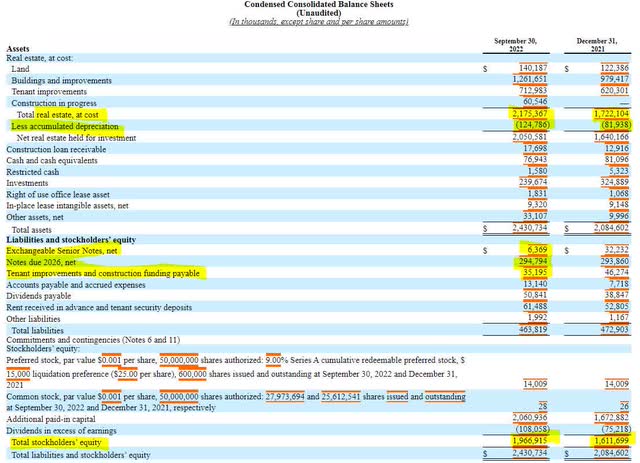

Innovative Industrial’s balance sheet paints an even brighter picture. The company has invested $450 million into new and existing buildings without increasing its debt. Shareholder equity has increased by $350 million in the last nine months. One item of note is accumulated depreciation. While Innovative Industrial does not report capital expenditures on current assets, a typical rule in real estate is to have one year’s worth of depreciation invested in existing assets. Based on the $15 million increase in depreciation for the quarter, I’m allotting $80 million as an estimated capital expenditure.

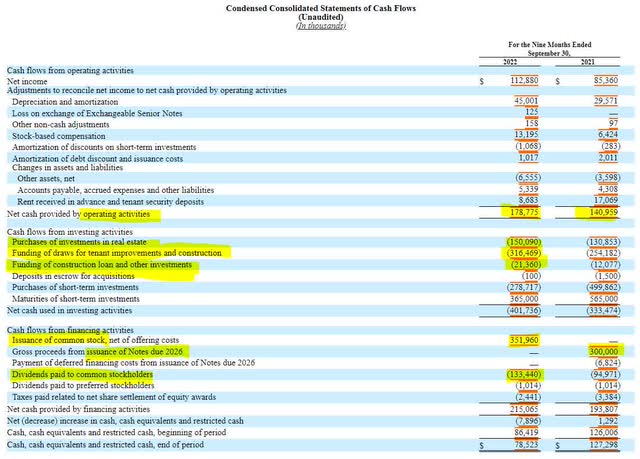

In terms of cash flow, Innovative has increased its operating cash flow by $38 million from the same nine month period a year ago. Where I get concerned for the common share dividend is the $45 million in cash remaining after dividends. This is insufficient to support the company’s physical assets without incurring new debt. I do believe that higher interest rates threaten Innovative’s growth prospects, but if they would slow asset purchases, they should have sufficient free cash flow to support their preferred dividend.

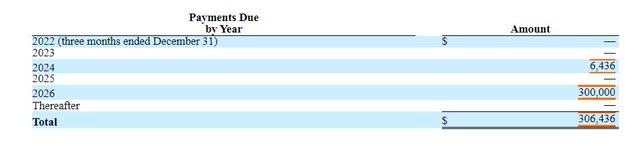

Innovative’s debt structure is very manageable. The company has a small number of exchangeable notes coming due in the next couple of years, but the 2026 notes represent a vast majority of the company’s debt. The company has a majority of the debt balance ($239 million) in liquid investments. Should refinancing costs be very high when the debt maturity comes, Innovative could use some of its cash to downsize its refinancing.

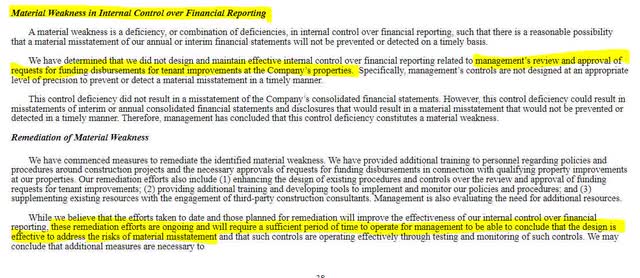

Two areas of concern outside of the higher interest rate environment should be acknowledged by investors. First, the company disclosed an internal control weakness regarding the approval process for funding of tenant improvements to properties. The company has identified the problem, begun making process improvements, and should quantify any financial impact in subsequent reports (they have found no financial impact yet).

Secondly, and most importantly, the company has disclosed $128 million in improvement allowance commitments to its tenants. These commitments can be requested at any time by the tenants during their multi-year lease. This creates additional pressure on the common share dividend as those commitments may hamper the company’s ability to pay dividends at their current level.

Overall, I think Innovative Industrial Properties debt is trading at a discount, while I believe the preferred shares and common shares are trading at fair value. The 9.7% yield on the safer debt is higher than the common or preferred dividends, and despite not having a credit rating, the company’s debt is trading 80 basis points higher than the average B rated corporate debt. Innovative Industrial Properties is nowhere near default, therefore fixed income investors should feel confident in the company’s high yield debt.

CUSIP: 44988FAD2

Price: $87.50

Coupon: 5.5%

Yield to Maturity: 9.791%

Maturity Date: 5/25/2026

Credit Rating (Moody’s/S&P): Not Rated

Be the first to comment