bjdlzx

Summary

I believe IHS Holding Limited (NYSE:IHS) is worth a lot more than it is today. IHS is a business that allows people in its target market to enjoy mobile communications coverage and connectivity. In terms of scale, IHS is the biggest telecommunications business. Also, its strong market base makes it more than a match for other companies in the same business.

Company overview

Through the acquisition, operation, and development of a unified telecommunications network, IHS grew to become the behemoth it is today. IHS provides the infrastructure that affects the coverage and connectivity of mobile communications in this huge and growing market for telecommunications.

IHS is a telecommunications giant that offers NOs and other clients’ access to its shared network infrastructure. They carry the baton forward by offering their subscribers and customers wireless voice, data, and fiber access services.

IHS operates in nine growing telecommunication markets

IHS operates in nine structurally advantageous markets with a combined population of over 600 million. These regions have expanding middle classes but still relatively low mobile usage, especially on 4G and 5G networks. For instance, there is a significant opportunity for growth in the African market because of its low penetration compared to the European and American markets, and a growing appetite for 3G and 4G services has made those sectors attractive investment opportunities.

As of the end of 2020, statistics show that 55% of SIM cards are 3G, while only 9% are 4G. To give further context, over the period between December 2020 and December 2025, the industry needs to commit more than 22,000 new towers and 30,000 new MNO points of presence to accommodate the anticipated expansion of the telecommunications industry in its African markets. In addition, there may be a rise in demand for fiber connectivity and data centers as a result of the development of modern telecommunications networks, which presents further opportunities for IHS. (All data figures cited are from F-1.)

IHS dominates in six of its nine markets

IHS is the dominant tower operator in six of the nine markets it serves. To give further context, IHS controls 65% of the Nigerian telecommunications market, making it the largest in Africa in terms of subscribers. Even in terms of IHS is the largest tower operator in Africa in terms of tower count, and this position it has held since at least 2014. Also, by successfully completing the Kuwait Acquisition, it became the first independent tower company to operate in the Middle East. As of now, IHS is the only independent tower operator in five of its markets. These staggering numbers clearly demonstrate why IHS is the market leader in so many categories.

Due to a dearth of nearby competitors, their towers enjoy robust demand from their existing customer base and are in pole position to attract new customers. This dearth of competition can be traced back to the lengthy time it takes to bring a product to market as a result of construction, as well as the high costs involved, the need to comply with regulations, and so on.

Another reason why scale is important is because IHS is able to increase its margins and return on invested capital as a result of its size by taking advantage of colocation opportunities to attract and retain a larger number of tenants and by amending existing leases. The main reason for this is that IHS doesn’t usually offer discounts to new tenants, and adding new tenants through colocation and lease amendments doesn’t add much to its costs.

IHS is in a strong position to expand its market share

I believe that IHS’s size, scale, and history of growth and customer service put it in a strong position to maintain and expand its market share, particularly as its customers are secured through long-term agreements. IHS’s strong market position is demonstrated by its presence in all of Nigeria’s states and its coverage of approximately 80% of the country’s population.

As mentioned above, IHS benefits from the industry’s high entry barriers, as new brands would have to invest heavily to compete with IHS. I should point out that even if competitors replicate the same number of towers, this does not directly translate to revenue, as IHS still has a cost advantage due to its colocation strategy. Overall, I believe IHS’s dominant market position has been reinforced, and the company is poised for growth as a result of these factors.

Strong customer base reduces risk from operating in emerging markets

Every emerging market comes with its own inherent risks. However, IHS has been able to mitigate most of them by offering MNOs reliable services in exchange for monthly lease fees over a long contract. The contracts, in most cases, provide for limited customer termination rights, inflation-linked revenue escalators, and power indexation clauses to guard against increases in diesel prices. In some cases, contracts include provisions for foreign exchange risks, such as periodic reset mechanisms to compensate for local currency depreciation. In addition, knowing that the bulk of IHS’s revenue comes from MNOs that are subsidiaries of large, publicly listed MNOs like MTN Group, Orange Group, Telecom Italia, etc., gives me peace of mind.

Successful M&A strategy in place to further juice IHS growth

IHS has, since its inception, completed transactions for more than 20,000 towers across different countries. These transactions have helped it build a robust in-market positioning, enabling high-quality services and the sustainability of business fundamentals. Recent acquisitions have shown, in explicit terms, the desire of the brand to expand into less developed markets around the world.

The strategy of mergers and acquisitions makes sense to me as well. IHS’s plan is to expand into promising emerging markets with strong fundamentals. A significant contributor to this inorganic expansion is IHS’s plan to cultivate each new market it enters. IHS plans to use its newly acquired operational platform to further consolidate its position in the market and realize cost synergies across its extensive asset base. I believe this strategy has allowed IHS to better serve customers by capitalizing on their robust platform, in addition to increasing market presence.

Valuation

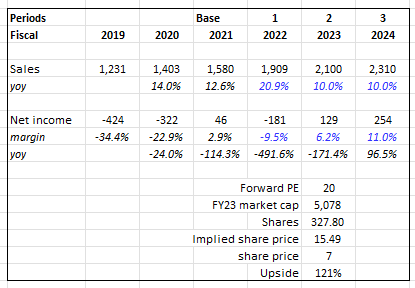

I believe the current valuation is an attractive entry point. It is easy to model out IHS financials given that a large part of the business is on long-term contract basis.

I expect IHS to continue growing at a similar historical rate after FY22, making $2,314 million in sales in FY24, and achieve a net margin of 11% as incremental margin flows through. This would give it a market cap range of $5 billion and a stock price of $15.49 in FY23, assuming it trades at the current multiple (I assumed no change).

Own calculations

Risk

High FX risk

Since IHS operates in developing economies, it is paid in the native currency of those countries. The existence of various foreign exchange markets can have an impact on the exchange rates applied to customer contracts and the rates applied to the conversion of subsidiaries’ financial results into US dollars for group reporting purposes. Financials could be distorted optically when investors do not look deeper.

Adoption in emerging markets may take longer than anticipated

Although there is a high demand for data in developing economies, there is no surefire method of ensuring rapid uptake. It may take much longer for widespread adoption to occur. Investors might get nervous if IHS overestimated and front-loaded its CAPEX, which could lead to periods of low FCF.

Conclusion

I believe IHS is worth a lot more than it is trading for today. Seeing its prospects in the world of telecommunications, the value of IHS is one to be realized in the future. With its robust customer base and enormous scale, IHS Holding Limited is capable of disrupting and dominating the telecommunications market.

Be the first to comment