bjdlzx

(Note: This article was in the newsletter on November 14, 2022.)

The market always has an answer to questions about where Europe will get natural gas to keep from freezing this year. Companies in the North Sea both the English part and the Norway part have shifted into high gear (and some results have already come in). But one of the biggest answers comes from Mozambique where Exxon Mobil (NYSE:XOM) is part of a group that just loaded the first LNG tanker to materially rebalance the natural gas supply. I cover other companies that have reported discoveries, like Africa Oil (OTCPK:AOIFF) and Africa Energy (OTCPK:HPMCF). But these Lundin Group-backed companies have a couple of years before shipments begin. Mozambique, on the other hand, has a major discovery that is ramping up just in time to fill a huge European need.

Exxon Mobil is participating in the offshore discovery. But there is likely to be a whole lot more possibilities for this African country in the future since major natural gas discoveries have been announced. Mozambique is going from basically zero production in the past to a major exporter. The Exxon Mobil project alone has cost $8 billion, and the country has more projects underway to increase future production.

The story here for Exxon Mobil is that it just happens to be ahead of a lot of major projects enough that cash flow from this (and a few others) project will begin. This is similar to the coverage in Guyana where cash flow has also begun from yet another major project.

Exxon Mobil also announced the first major discovery in about 20 years in Angola for more oil. These African countries are in an ideal position to help solve the European shortage issues. Now it is likely to be a little bit “messy” as these kinds of market solutions are often not exactly “synced”. But there clearly is a solution for Europe outside of Russia and that solution is further along than many thought.

Other Projects

Exxon Mobil has a huge project in Papua, New Guinea.

Exxon Mobil Description Of Papua New Guinea LNG Project (Exxon Mobil Company Website November 14, 2022)

The company had built the plant located here and then acquired InterOil to assure a sizable source for the plant. This is probably one of the major fields in the world that supplies a significant amount of LNG in this case to Asia. It likely can be expanded if the economics warrant that expansion should shortages continue.

Exxon Mobil Overview Of Operations In Qatar (Exxon Mobil Website November 14, 2022)

Similarly, Exxon Mobil has long been active in expanding the LNG business of Qatar. The LNG exposure that this company has is significant during a time when natural gas prices are high and likely to remain high. Furthermore, the company has significant relatively new projects like the one in Papua New Guinea and here that have begun to cash flow while many competitors are years behind.

So many investors think that a problem like the European natural gas shortage can be taken care of in 90 days or someone is holding out on them for more money. Exxon Mobil acquired InterOil back in 2016. The project has grown steadily since then. It is now in a position to contribute more to solving the natural gas and LNG issues because Exxon Mobil began planning this large project years ago. It is a similar story for the Qatar operation. These things do not happen overnight. They take years of planning.

Oil

Exxon Mobil is an operator in the largest basin discovery that is also the most recent discovery.

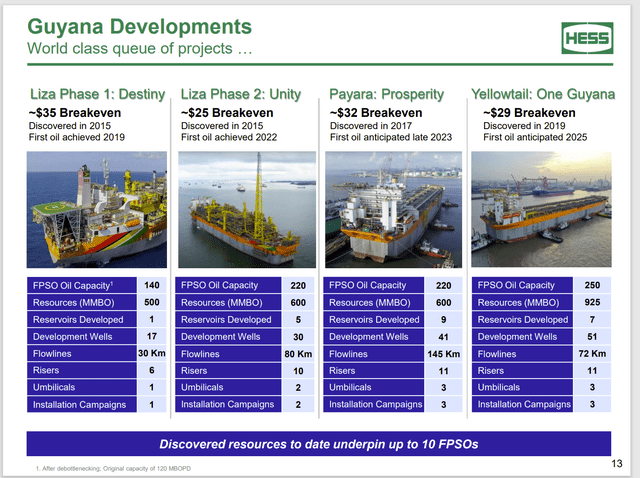

Exxon Mobil Operator Of Guyana Partnership Justifying 10 FPSO’s (Hess Corporation Presentation Of Guyana Partnership FPSO Approval Progress September 2022 Presentation)

Hess (HES) has presented the progress so far of the Guyana partnership. That partnership estimates 6 FPSO’s producing oil by fiscal year end 2027. Even for a company the size of Exxon Mobil that is going to be significant because Exxon Mobil has a 45% share of the production. If those six FPSO’s average, for example 200,000 BOD, then the company’s share of that production would be roughly 540,000 BOD.

There is additional upside here because the company has interests in blocks that have either not yet been explored, or exploration has just begun. This may become the single most important future project in the company portfolio.

As shown the presentation, the breakeven costs for a project with Brent pricing is in the $25 to $35 area for the price of oil.

Carbon Capture

Even in the emissions area, the industry and this company do not get credit for already putting carbon dioxide into the ground. It turns out that carbon dioxide is used to recover oil (and some natural gas) once the “easy” production is gone from wells or even whole fields. Here is a view on this from Vicki Hollub, CEO, Occidental Petroleum (OXY).

Occidental Petroleum Discussion On The Use of Carbon Dioxide And The Need For Oil And Natu (Occidental Petroleum Third Quarter 2022 Conference Call Transcript)

The industry has long forced carbon dioxide into reservoirs to recover remaining oil and to some extent natural gas. What is now changing, thanks to some recently passed legislation through congress (and signed by the president), is the ability to capture carbon dioxide in the air. The ability will now compete with the traditional method of recovering carbon dioxide from wells, as Kinder Morgan (KMI) does.

The industry has also made serious progress at reducing emissions and reusing carbon dioxide produced in this process (and other related processes).

The biggest deal is that the supporting infrastructure is not there for a mass movement to the green revolution. Out here in California, for example, it has quickly become apparent that there is not enough electricity for everyone in the neighborhood to quick charge an electric car. That is just the start of issues. There is so much planning to be done to successfully reduce pollution and climate change. We are really just getting started in that direction. Oil and gas is therefore projected to be around with growing demand for a long time to come.

The Future

Exxon Mobil is ahead of a lot of the industry in that management began to explore for significant discoveries a few years back. Many of these significant discoveries were preceded by a few years of homework and dry holes. But now, this company has not only found more resources, but it is years ahead of competition in Guyana and elsewhere in starting cash flow from the investments made.

This is one company that did not really slow down during the pandemic. As a result, the company has a cost advantage in several projects that will likely provide years of competitive advantages over other projects in the same basins. Costs were at rock bottom pricing during the pandemic. This company was one of the few with a balance sheet to take advantage of those costs. Now investors are likely to reap the rewards of those years.

This company will move from being an income vehicle to slowly become an income and growth vehicle in the future. Not many companies this large can successfully make that move. This farsighted management will treat investors well for years to come.

Be the first to comment