Sean Anthony Eddy

Investment Thesis

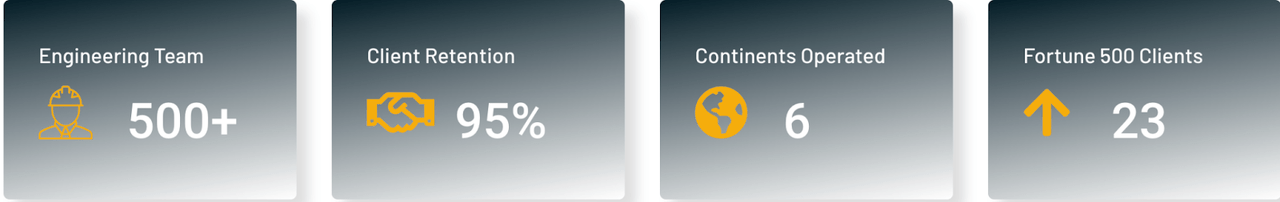

RCM Technologies, Inc. (NASDAQ:RCMT) is a leading provider of business and technology solutions intended to enhance and maximize its customers’ operational performance. Advanced engineering, specialty health care, life sciences, and information technology services are provided by the company. Over the past four decades, the company has established and compiled a large, diverse, and unique portfolio of skills and services.. Combined with RCM’s economical pricing structure, this combination provides clients a compelling value proposition. Engineering, Specialty Health Care, and Life Sciences and Information Technology are the three divisions that provide project management and consulting services (LS&IT) in which we will dive deeper into below. RCM is a well-run company with strong unit economics. The company is continuing to grow in a shrinking economic environment, indicating superior return on investment on asset allocation decisions. I believe RCM is a long term hold, with the potential for short term volatility.

Company Website

The Engineering Segment

RCMT’s services include mechanical, chemical, environmental, aeronautical, architectural, civil/structural, electrical, and electronic engineering analysis, design, drawing, and field services, with a particular emphasis on securing federal contracts.

The Company’s Engineering division continues to prioritize growth opportunities, mainly in the electric power, aerospace, maritime and transportation, commercial and industrial, oil and gas, and biofuel industries. Given the existing mix of its client base, the Engineering division’s segment performance is well-balanced through the lens of economic stability.

Company Website

The Energy Information Administration (“EIA”) projects that by 2050, 38 percent of the United States’ electric production capacity will consist of wind and solar assets. To link these renewable resources to the electricity grid, this development will necessitate substantial investments in the nation’s transmission infrastructure. Projects of this magnitude will need engineering and design knowledge, as well as EPC services.

Turning to our second quarter. Each unit demonstrated solid execution and performed well in our mostly recession-resistant end markets. Our engineering team continued to gain traction on multiple fronts and exceed our financial expectations for the quarter.

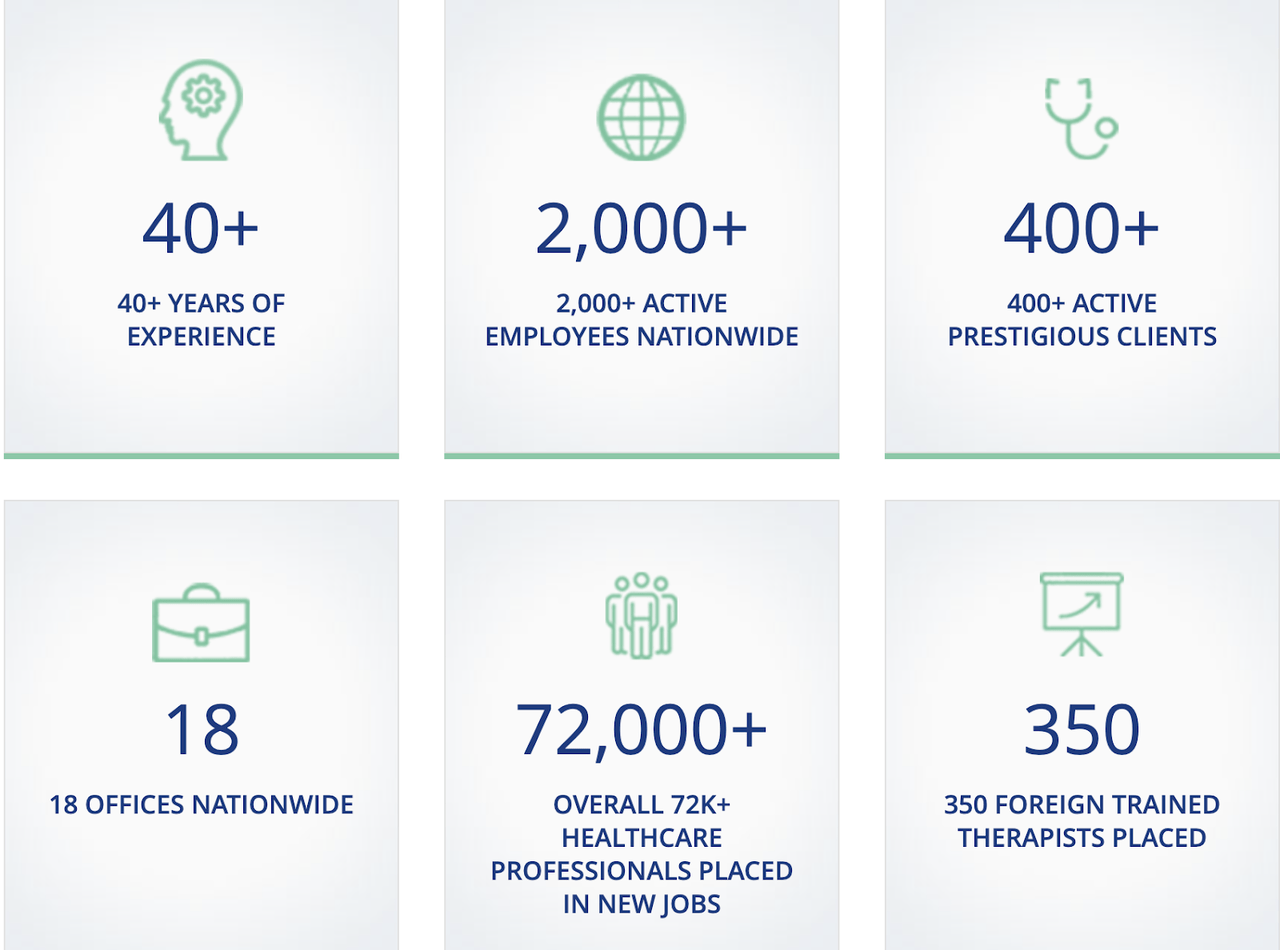

The Specialty Healthcare Segment

Due to a nationwide scarcity of nurses and other medical professionals, businesses providing health care services, such as the Company’s Specialty Health Care division, have seen an uptick in recent demand. In the next few years, a combination of factors-including an ageing population and advances in medical technology-are likely to keep up the need for certain types of health care workers, with an emphasis on making use of technology to provide access to treatment.

Company Website

Services include staff augmentation and placement for both permanent and temporary positions in healthcare, education, and long-term care institutions. Income for this division comes mainly from billing clients on an hourly basis at predetermined rates. This suggests that, with sufficient long-term contracts, RCMT can weather the recession without any trouble due to their ability to mark-to-market their hourly wages. However, because most of the firm’s contracts include a condition allowing customers to terminate the contracts based on ~75 days’ notice, revenue pressures in the sector may increase if the economy enters a recession.

Our health care services team continues to expand its strategic footprint within the education market and deliver against the backdrop where decades of underinvestment have left the country’s social infrastructure in disrepair.

Bradley Vizi, CEO

The IT Segment

In order to achieve their goals, businesses need to integrate and manage complex computer environments that include a wide variety of hardware, software, operating systems, databases, networking technologies, and commercial software.

Company Website

Technology is always evolving, and as a result, businesses must constantly upgrade their systems and staff to keep up. However, many businesses have reduced their IT management staff in recent years as they refocus on their core skills. This means that small businesses frequently lack the amount, quality, and variety of IT skills required to create and support IT solutions. Supporting increasingly sophisticated systems and applications with high strategic value is a major responsibility for IT managers, who often face limitations due to a lack of resources (both financial and human) and knowledge inside their own organisations.

Finally, our life sciences and IT group have made demonstrable progress in its journey toward a managed service and solution-driven model and has continued to show significant growth potential due to the tight labor market.

Bradley Vizi, CEO

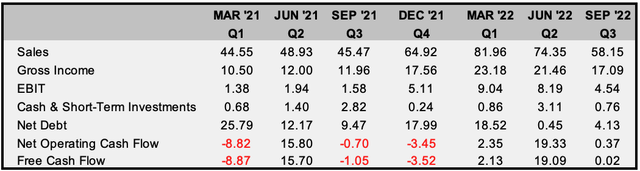

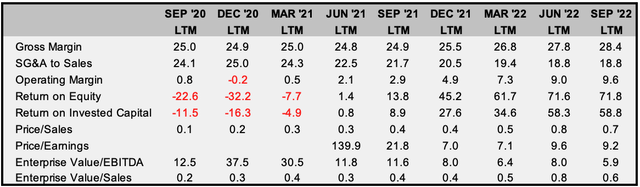

Financial State of the Company

RCM has demonstrated greater relative resilience than many of their select competitors, despite the fact that no company is completely protected from the effects of inflation and the correlated effects of bad markets. Despite the rise in the cost of living, the company has been able to keep its gross earnings on an upward trend. This, in addition to the synergies that exist within operational profit, demonstrates strong operating leverage.

In summary, while other companies are falling back to a defensive position, we continue to invest in the team and fill out our leadership ranks.

Bradley Vizi, CEO

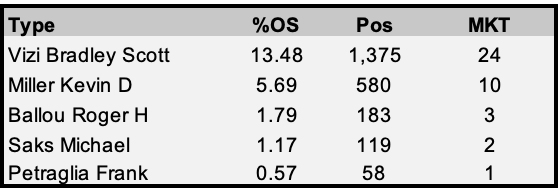

Management continues to invest in their products and teams during a time when businesses are forced to take drastic cost-cutting measures. The rarity of this type of management is a prominent theme in William N. Thorndike’s “Outsiders” – a book describing the unconventionally successful CEO. Bradley’s ability to significantly deviate from industry norms during the current period enables RCM to allocate cash to profitable segments during a period with substantial growth potential.

On the basis of management’s ability to pivot effectively and continue to generate significant operating leverage in a bleak economic environment, significant multiples would be anticipated. However, even after a significant stock price outperformance in 2022, the company’s shares are priced affordably. A price-to-earnings ratio below 10 and below the company’s historical levels indicates an excellent opportunity to purchase shares for the long term. During these volatile market conditions, the company continues to earn a high return on invested capital that is continually increasing.

Given much of the growth potential in earnings and management’s ability to align their interests along with shareholders as made evident by their substantial holdings in the company. This should also be viewed as a sign of management who, while unconventional, is able to take calculated risks to grow shareholder worth in lieu of following conventional norms.

FactSet, Author’s Work

Final Thoughts

RCM is involved in three vastly different businesses, but management has demonstrated the ability to independently allocate and manage the three segments at their optimal level. Management has deviated from industry norms and continued to invest capital in the business – an indication of strength and assurance. While it is important to understand the risks, the investment’s risk and reward profile indicates that the distribution is skewed towards the upside. The risks associated with this investment thesis revolve around the inability of management to facilitate further business expansion. Ultimately, the bear case suggests that the company will not be able to “hold onto” its profits. While this, like any other risk, must not be overlooked, the company’s ability to maintain significant operating leverage in the face of operating issues induced by the 2022 recession indicates to me that management is able to facilitate the protection of profitability in the long run. In light of RCM’s significant increase in 2022, I believe there is significant room for competition. This is exacerbated if the market bottoms and builds into a bull market.

Be the first to comment