mbbirdy

By Rob Isbitts

Summary

There are at least three major “call the bottom too soon” situations going on as 2022 enters the holiday season. Stocks have been under water all year, yet investors continue to focus on when the Fed will “pivot.” Gold bugs are forever waiting for that rally. And then, there’s corporate bonds.

iShares 5-10 Year Investment Grade Corp Bd ETF (NASDAQ:IGIB) represents the best and worst of what is both intriguing and frustrating about this class of ETFs right now. Ultimately, I come out on the side of “too risky, too soon.”

Strategy

IGIB is not a fancy approach to this currently depressed sector of financial markets. It is run by BlackRock’s giant iShares ETF group, has nearly $10B in assets, and owns more than 2,000 securities. It is practically a corporate bond index itself. IGIB focuses on the 5-10 year maturity segment, and aims to track the ICE® BofA® 5-10 Year US Corporate Index.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Bonds & Cash Equivalents

-

Sub-Segment: Corporate Bonds

-

Correlation (vs. S&P 500): Low

-

Expected Volatility (vs. S&P 500): Moderate

Holding Analysis

A few key stats help summarize IGIB’s current portfolio. 54% of its bond holdings are rated BBB, which is the lowest level of “investment grade.” Another 39% is spread across the A-rated bond category. The fund’s yield to maturity is just over 6%, but its weighted average coupon is only about 3.5%. More on that later in this report. As would be expected, it limits its holdings primarily to bonds maturing in the next 5-10 years. About 76% of holdings are in bonds issued by companies based in the United States, with the rest spread across Europe (16%) and, to a lesser extent, Asia (8%).

Strengths

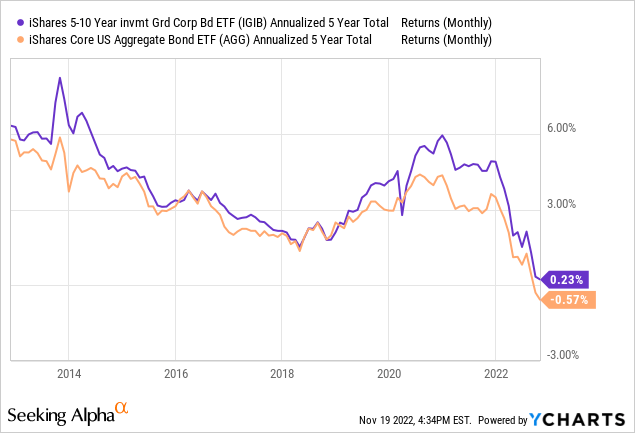

This is an adequate ETF from an iconic fund company, if you are looking for a way to add exposure to A and BBB bonds to your portfolio. As shown here, IGIB’s focus on corporate bonds has consistently bested the returns of the “Agg” Bond Index, which is a mix of High-Quality corporates and U.S. Treasury securities. In other words, when the wind is at its back, IGIB does what it should do, adding some alpha through owning bonds that are less credit-worthy than U.S. Government-issued paper.

Weaknesses

But as alluded to earlier and in the title of this article, there is a lot of “baggage” that IGIB and its corporate bond brethren have to grapple with in the current investing era. One of the biggest misconceptions about corporate bond funds is that they are primarily yield-seeking instruments. After four decades of falling interest rates, in which corporate bonds racked up enviable reward for the risk taken, attitudes toward bond investing are in the process of changing. 2022 has introduced a generation of investors to the fact that bonds can fall hard in price too, and it can take years of interest payments to make up for that. This makes bonds a very risky endeavor until rates stabilize and credit market risk is reduced. Neither is happening now, at least not with any lasting effect.

Opportunities

While my general concern that corporate bonds will remain a low reward-risk tradeoff for a while, there is a growing chance that the big dip in corporates is getting closer to being at least a very long-term buy. To be clear, that’s like improving to the odds of making a half-court shot in basketball, instead of a full-court shot. My concern is that many retirees and pre-retirees will assume that the decline in 2022 has made corporates a layup.

Threats

There are many threats to owning corporate bonds in this part of the bond cycle. While they are higher in the capital structure versus stocks, the fact is that there are a lot of bonds rated BBB which should probably be in the “junk” category. The Fed was buying corporates in recent years, and with corporate earnings likely to dive in 2023, the combination of weaker corporate cash flows and the preponderance of corporate bond issues hanging by a thread at that BBB rating, implosion is more likely than some grand, lasting “buy the dip” opportunity.

The other concern is, again, one of potential misperception. IGIB’s yield looks enticing. But that’s not what you get in cash flow. The average coupon is sub-4%, and that’s reflected by the fact that the average price of the bonds in the portfolio hovers around 88 cents on the dollar as of this writing. Translation: this ETF is more about price appreciation than a magically-high cash yield. So, don’t mistake the former for the latter.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

As described above, this ETF is what it says it is. iShares ETFs are solid from a business perspective. But that’s a much lesser issue than what the ETF owns. This one owns corporate bonds, and despite the apparent cheapness of that asset class, I’m still not sold, beyond a trading/tactical opportunity.

ETF Investment Opinion

We rate IGIB a Hold, but only because it is “hanging around” near its lows for the year. Another breakdown in price from Fed hikes, credit-busting activity or both would immediately make this one to avoid.

Be the first to comment