BlackJack3D

Oil is still a hot topic. Overall, the data that we were paying attention to some months ago seem to have been accurate. Conditions favor the oil price and product margins at refiners. Capacity isn’t really there it seems. However, we are worried about macro, and US producers aren’t particularly advantaged outside of refiners. With the iShares North American Natural Resources ETF (BATS:IGE) offering a pretty small earnings yield, perhaps money can be better parked elsewhere.

Quick View on Oil

The price is high and will likely stay that way. There isn’t much spare capacity, and Biden did not unlock any with his Middle East visit. Product margins have fallen a bit, and this has helped inflation figures, as has a decline in crude, but both still remain at very elevated levels compared to what we were used to prior to COVID-19. Product margins have actually received a boost thanks to concurrent declines in crude, keeping crack spreads up. The environment is still good for both refiners and crude producers thanks to a secular period of underinvestment, and in the case of refineries even the demising of capacity in favor of things like renewable diesel, much the rage with blending requirements in California and Minnesota.

IGE Breakdown

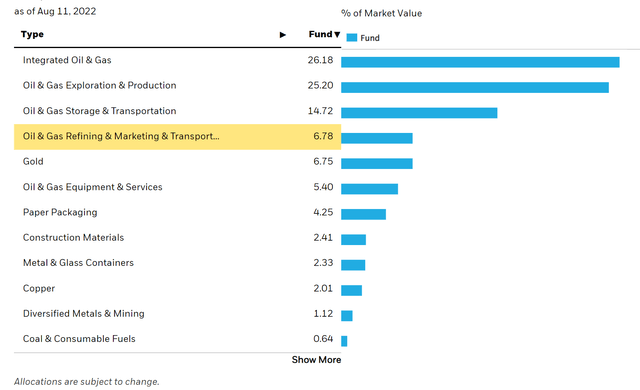

IGE owns across E&P and refiners, including integrated oil.

They also own things like pipelines. Lacking commodity exposure, they remain perennially attractive.

The bigger discussion is around the state of oil. They are making lots of money right now, but the concern comes from the macro environment. If we see a hit to the demand side of the economy pass back up the value chains, starting already among consumer facing businesses, things like product margins are going to take a hit. They already have and the run-cuts that result from decreasing productivity eventually hits crude prices. Refiners have quite a bit of recession resistance in that regard because those crude prices falls which dampens the unit margin impact because crack spreads rise back up. But those volumes stay lower and profitability still declines. Crude oil eats that residual demand hit, and won’t be immune in a macro downturn, especially if it hits back at aviation and other discretionary travel after a pretty sharp reopening recovery in those markets.

Conclusions

IGE trades at around a 16x PE, which implies a 6.25% earnings yield. It’s not that great compensation for the equity risks that come with owning a substantially commodity-levered portfolio. While the supply dynamics are very supportive for oil and for refinery margins, we still see some exposure to macro risks which have absolutely not passed. We feel that while oil can be a great investment in the current environment, where you can bet on these favorable dynamics, there are better ways to do it. Rubis (OTCPK:RBSFY) is way cheaper and yields over 10% on earnings with similar refinery plus pipeline economics that don’t have commodity downside. Alternatively, Japan Petroleum Exploration (OTCPK:JPTXF) trades almost at a negative value.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment