SolStock/E+ via Getty Images

By Alex Rosen

We rate iShares Europe ETF (NYSEARCA:IEV) a hold, given the broader global equity market outlook. However, we consider it a long-term buy, with the understanding that this will never be a dynamic ETF – but it should show steady returns.

Strategy

The ETF offers investors access to a broad range of European legacy stocks across many sectors. The main holdings include such stalwarts as Nestlé (OTCPK:NSRGY), Roche (OTCQX:RHHBY), Shell (SHEL), Novartis (NVS), and Louis Vuitton (LVMH). These are all name brands with strong backgrounds and solid prospects. The ETF has shown minimal turnover (5%) and seeks to track the top 350 companies in Europe.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Non-U.S. Equity

-

Sub-Segment: Europe

-

Correlation (vs. S&P 500): Moderate

-

Expected Volatility (vs. S&P 500): Low

Holding Analysis

IEV’s equity portfolio, much like Europe itself, has shown very little turnover as it seeks to mimic the broader European economy. Its historical turnover rate is 5%, which means that what you see is what you get. The fund follows 350 different European companies, and as a result has a very high degree of redundancy. No single stock comprises more than 4% of the entire holding, and 50% of its holdings are in three sectors: finance, health technology, and consumer non-durables.

Strengths

This is not an ETF focused on emerging markets or infant economies. There is a reason Europe is referred to as the “old world.” This ETF consists of well established businesses with very transparent financials. Many of the holdings are deeply embedded in the fabric of the countries, and are considered “too big to fail.” This makes IEV’s portfolio of blue-chip names something that might give comfort to less aggressive investors.

Weaknesses

The very thing that makes IEV a strong stable collection of stocks also prevents it from being a dynamic investment. Europe is no longer looked upon as a cutting-edge growth region. Rather, it’s a safe bet for those looking to protect assets. In some respects it can be considered the world’s money market. You know what you’re going to get, unless of course they break the dollar.

Opportunities

As we see it, in a time of great market volatility IEV has become a victim of the tide. As the broader global economy has suffered a downturn, so has IEV. However, IEV’s holdings have sound fundamentals and will make a return. After all, the world will always need chocolate and handbags.

Since inception in 2000, IEV has shown a marginal increase, which is consistent with the makeup of the fund.

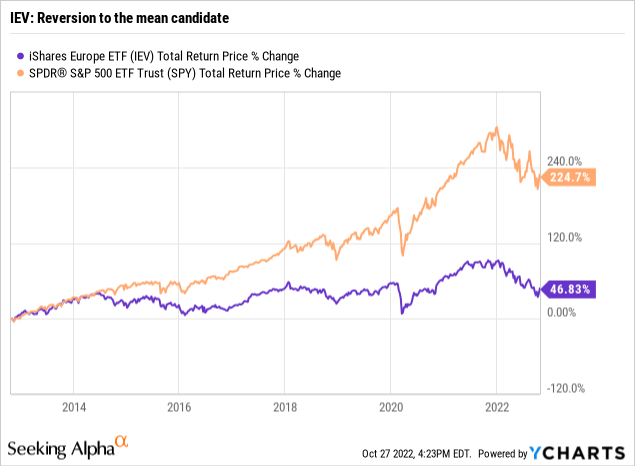

IEV: Reversion to the mean candidate (Ycharts)

Threats

Europe is potentially facing its worst winter in decades. With war raging on the eastern front, Europe has been unified in its condemnation of Russia. Unfortunately, that condemnation has come at a high cost. Russian oil and natural gas, which has kept the chocolate melting on cold winter nights, has been cut off. Soaring fuel prices are forcing Europeans to choose between heating their homes or buying food this winter. It remains to be seen how this will play out, but the manufacturing sector might take a hit as costs rise. The one saving grace is that a weak euro makes exports less expensive, meaning the demand for durable goods abroad should increase.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Buy

Conclusions

ETF Quality Opinion

IEV is made up of some of Europe’s most well-established companies, and will continue to be a solid, but not dynamic, investment in the long term. However, we do like its straightforward structure and access to European industry leaders, many of whom are among the most prominent global businesses.

ETF Investment Opinion

We value IEV as a strong addition to a broader portfolio. While the market might not have bottomed out yet, in the long run an ETF based on broader European markets is likely capable of weathering the ebbs and flows of the broader market. IEV will never hit the ball out of the park, but it can be a solid, long-term performer as part of a broader global equity allocation.

Be the first to comment