Leestat

The iShares Core MSCI Europe ETF (NYSEARCA:IEUR) is a broad exposure to major European companies and a good way to track the state of European equity markets. Firstly, it shows a discount to US markets. Often in the past, this could be attributed to generally lower prices of equity markets outside of the US, in turn, attributable to different skews in market exposures. IEUR has a lot of financials, which typically turn out lower valuations. We think that being harsher on Europe right now makes quite a lot of sense now, and the IEUR in particular, whose financial exposures are less advantaged than US financials. Geopolitics and a more severe European recession are the key reasons.

IEUR Breakdown

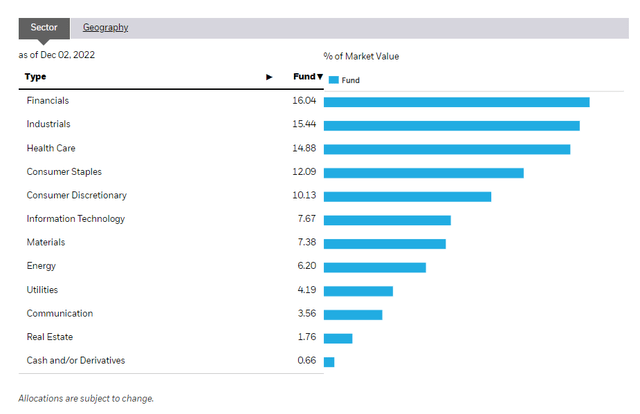

The sectoral breakdown is pretty important for evaluating IEUR.

Sector Exposures (iShares.com)

There are a lot of financial and banking exposures within the ETF. They are somewhat favorable in that the rate hiking cycle supports some growth in net interest margin, but the nature of Europe’s economic issues, primarily that they relate to more concrete supply chain issues, makes them less attractive relative to US issues. The effect of rate hikes to solve inflation is even less in Europe than the US, and the ECB likely knows it. Rates are half in Europe what they currently are in the US, and that differential will mostly persist in our view, with the ECB being way more sheepish about monetary policy because they already know it probably won’t do much.

The other issue is that in general, Europe is seeing a recession while the US is still seeing growth. Pressure in European business has been felt by any company that sells in those markets from the US, beyond just the FX effects. Volumes in EU facing businesses are going to be generally down whenever there is any cyclicality. IEUR has quite a large consumer staples exposure at 12%, and this somewhat insulates them from economic pressures, but the larger 10% allocation to consumer discretionary, as well as the 15% allocation to industrials, are likely to see pressure, save for those that are exposed to the EV trend.

Bottom Line

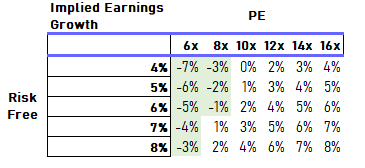

The expense ratios are extremely low for IEUR at 0.09% and the ETF PE is 13.2x. It’s an efficient portfolio, but the multiple is too high in absolute terms. The 13.2x ratio implies an earnings yield barely above 7%. Risk-free rates in the safest treasuries in the world are now 3.7% net of hedging costs, which gives a minimal equity risk premium just above 3%. Since there’s little chance of earnings growth for many of the IEUR companies right now, earnings yield is a generous enough metric of value.

There is a discount in the PE of IEUR compared to broad US ETFs at 19x, but the discount is justified when you consider the differences in economic growth prospects for US businesses compared to EU businesses. The US is a lot more favorably positioned in the current economic environment with a stronger dollar, self-sufficiency, and the ability for the American consumer to win back the share of purchasing power as European woes take the throttle off the supply chain for the US facing enterprises to benefit. The US is winning big this decade, and markets don’t seem to realize that their maneuvering makes a soft landing pretty likely.

PE Chart (VTS)

While the US market may be overvalued in absolute terms, with implied growth rates not being very achievable at given risk-free rates, the EU will likely be in negative territory, and the current multiple reflects that even less.

Thanks to our global coverage, we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment