Andrii Yalanskyi/iStock via Getty Images

There has rarely been a worse time to invest in treasuries than 2022 – and this is not cheap rhetoric.

Long-term government bonds (VUSTX) have been in their deepest drawdown of the past 35 years at least (i.e., as far back as I can verify). The current pullback has been unfolding since treasury prices peaked as early as three months after the start of the COVID-19 pandemic, which feels like two lifetimes ago. Down 12% so far in 2022, and assuming status quo in the next several months, treasury bonds could be on track for their worst year of returns in post-1930s Great Depression history.

With inflation white-hot and the Federal Reserve still unclear on its roadmap to higher short-term interest rates, holding high-quality fixed income instruments sounds like a terrible idea. But for the reasons presented below, now could be an opportunity to own a fund like the iShares 3-7 Year Treasury Bond ETF (NASDAQ:IEI) at a price that makes sense.

What is IEI?

First, let’s start by very briefly reviewing the basics of this ETF. The iShares 3-7 Year Treasury Bond fund currently holds over 60 treasury notes and strips of varying maturities that range from 2.9 to 6.9 years. The effective duration of the fund is nearly 5 years, and the average yield to maturity is 2.59%.

IEI charges a management fee of 15 bps that is neither outrageous nor a bargain, considering the low risk-return profile of the fund. The ETF, with AUM of $10.5 billion, trades an average of around 1.75 million shares or $210 million per day, which makes it highly liquid.

Good yield, low risk, diversification

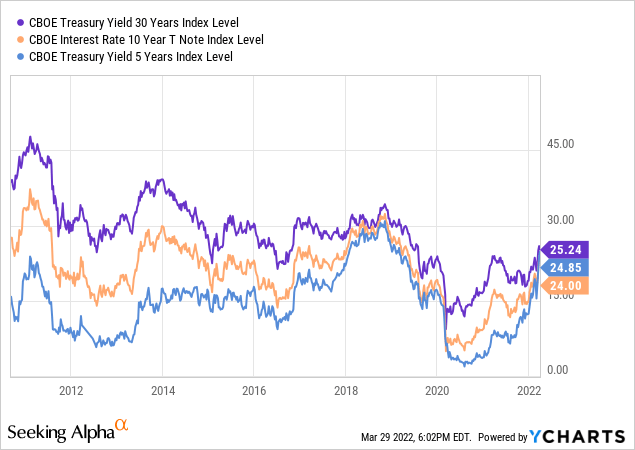

A couple of months ago, I explained how the returns in bond funds tend to track yields very closely over the long haul. Today, the five-year treasury yield stands at 2.49% (see blue line below), which is both the highest in the post-pandemic era and higher than it has been through most of the past 10 to 12 years – with the exception of a few months in 2018. Therefore, an investor that buys IEI and holds the position through 2027 can reasonably assume above-historical average annual returns of around 2.5%.

To be fair, the low-single-digit expected gains in IEI are far from being exhilarating. But keep in mind that the five-year yield is currently higher than the 10-year rate of 2.40% and nearly as high as the 30-year rate of 2.52%. For much lower duration risk, and despite inflation that is still projected at a rich 3.4% through 2027, the gains here could be considered decent given so much geopolitical and macroeconomic uncertainty today.

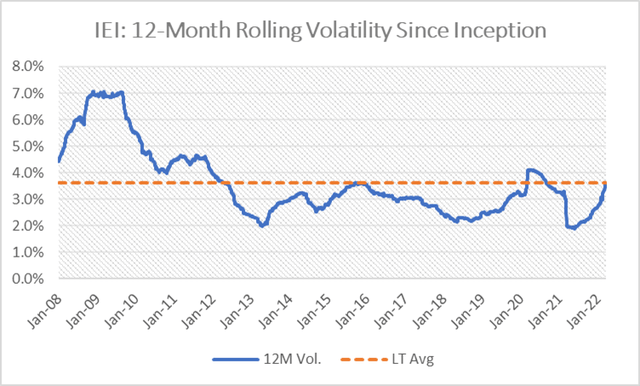

While IEI’s projected absolute returns may not look great to many, the ETF’s risk-adjusted performance could be better than what investors might be able to find elsewhere. Historically, the five-year fund has produced a rolling twelve-month volatility of 3.6% since inception and 2.9% over the past decade (see graph below), which even includes periods of fairly aggressive monetary tightening. At those low levels of risk, projected returns of 2.5% and a Sharpe ratio of around 0.5 to 0.7 may start to look compelling.

Dip buyers may also see an opportunity here. As recently as late last week, on March 25, IEI reached a drawdown of 8.4% from its early August 2020 all-time high. That was the sharpest pullback in the fund’s 15-year-long history. Worth noting, IEI has never produced one-year forward returns that were lower than 6.7% following a pullback of 5% or more.

IEI: 12-Month Rolling Volatility Since Inception (DM Martins Research, data from Yahoo)

Lastly, I find IEI compelling for its diversification benefits. Not unlike intermediate- and long-term treasury funds, this ETF has historically been negatively correlated with stocks: -0.33 since inception and -0.27 in the past decade. Combining IEI with the S&P 500 (SPY) or adding it to a portfolio that has exposure to leveraged stock funds could result in better returns, both in absolute and risk-adjusted terms.

Be the first to comment