cagkansayin

Based on current valuations, U.S. bonds are highly likely to outperform U.S. stocks over the next decade while suffering far less volatility and providing the added benefit of upside potential in the event of further weakness in the economy. The iShares 7-10 Year Treasury Bond ETF (NASDAQ:IEF) yields 4.1% versus just 1.7% for the S&P500, which is close to the highest spread since 2007. The main risk is continued elevated inflation, but even then, the IEF should still outperform, providing positive real returns with little drawdown risk.

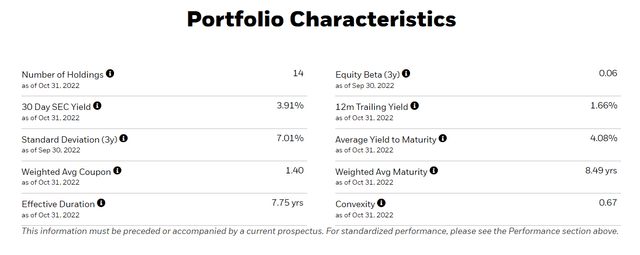

The IEF ETF

The iShares 7-10 Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between seven and ten years. The fund is highly liquid and has weighted average maturity is 8.5 years and the effective duration is 7.75 years, which is far lower than the duration of U.S. stocks and implies far less volatility. The fund charges an expense fee of 0.15%.

10-Year Bond Returns Likely To Be Higher Than The S&P500

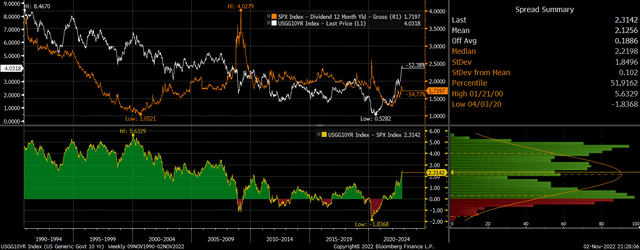

Regardless of the valuation metric that one uses for the S&P500, the surge in yields has left U.S. Treasuries at their most attractive levels relative to stocks in at least a decade. One way to measure this is with the dividend yield as shown below. The current 10-year UST yield is 230bps above S&P500 dividend yield, which is the highest since 2007.

10-Year Bond Yield Vs SPX Dividend Yield (Bloomberg)

A more apples-to-apples comparison can be made by comparing the S&P500 dividend yield with the yield on 10-year inflation-linked bonds which factor in the expected inflation rate over the next decade. This takes into account the fact that positive rates of inflation add to equity returns by raising nominal dividend payments. On this metric, the outlook for bonds is slightly less attractive, with the 10-year currently yielding 20bps lower than the S&P500 in real terms, although this is still the highest level since 2010.

10-Year Real Bond Yield Vs SPX Dividend Yield (Bloomberg)

It may be tempting to think that with the yield on the S&P500 still higher than the real yield on 10-year bonds, stocks should still outperform. After all, we should expect positive real GDP growth to allow equities to growth their dividends even faster than the rate of inflation, allowing cash flows to outstrip Treasury interest. After all, over the past 10 years the S&P500 has outperformed by almost 11% annually.

However, this 11pp annual outperformance has been driven by three factors which should reverse over the next decade.

The first is the rapid growth of real dividends. Dividends have risen by almost 6% over the past decade, which can be broken down into 2% real GDP and sales growth and a 4% annual increase in dividends relative to GDP.

The second contributor to the outperformance of stocks over the last decade has been the rise in equity valuations, where the fall in the dividend yield has contributed a further 3pp annual gains for the S&P500.

The third contributor to equity outperformance relative to bonds has been the favorable starting yields on stocks relative to bonds that we saw in 2012, when the yield on the S&P500 was over 2% higher than the real yield on 10-year bonds.

As I have argued in a number of articles over the past two years, there are major headwinds facing both real GDP growth and profit margins, which should see real dividends grow at roughly zero over the next decade. If this were the case, if inflation comes in at the 2.5% level implied by 10-year breakevens and the yield on the S&P500 remained at current depressed levels, stocks and bonds should be expected to perform on par. Even a slight rise in the dividend yield back to the 2.2% figure seen 10 years ago would see bonds outperform by around 3% annually.

Inflation Risk Runs Both Ways

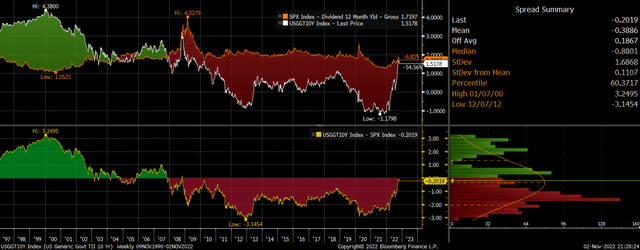

The main risk facing the bond market over the long term of course is inflation, and the higher the rate of inflation, the greater the likelihood that bonds will underperform stocks. The chart below shows the performance of the S&P500 over 10-year bonds relative to 10-year breakeven inflation expectations. This makes sense given that stocks are real assets.

Ratio Of SPX Over IEF Vs 10-Year Breakevens (Bloomberg)

However, it is not necessarily the case that even continued elevated inflation would cause stocks to outperform bonds. The main reason for this is that as we have seen since the start of the year, high inflation tends to undermine equity valuations, and these are a major contributor of equity returns. Given how extended equity valuations remain, any further inflation shocks could be just as negative for stocks as they are for bonds.

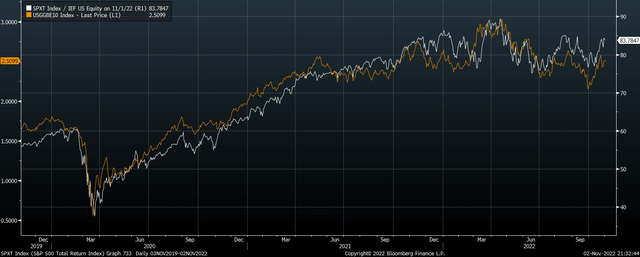

Lower Risk Is Another Key Factor Supporting Bonds

As a final point, while I believe that expected returns are higher on bonds than stocks over the next decade, my reason for favoring bonds extends beyond this as it factors in the strong likelihood of much less volatility. Even the surge in bond yields this year has only seen the IEF sell off by 20%, which pales in comparison to the declines we have seen in the S&P500 in the past. Furthermore, the IEF has the added benefit of performing well during recessions and equity market meltdowns. While current correlations between bonds and stocks are strongly positive, I expect the next wave of selling in stocks to drive up bond safe-haven demand for bonds as it becomes clear that a deep recession awaits. Holding the IEF should therefore act as a means of portfolio diversification for long-only investors.

Be the first to comment