Alihan Usullu/iStock via Getty Images

Much ado about dividends. Some investors swear by them, and others want nothing to do with them. Others just want to beat the market by any means necessary.

Fortunately, we can have our dividends and beat the market too. That’s exactly what the iShares International Select Dividend ETF (BATS:IDV) is trying to do. Not only does it have a 7% dividend, but it also may be poised to outperform the total ex-U.S. market in the long term.

What You Get With IDV

IDV is an iShares fund. Right away, this means you’re going to see reasonable fees. Its expense ratio of 0.49% is high compared to what index investors are accustomed to, but it’s still significantly cheaper than the mutual fund average. According to Vanguard, the average for this category is 0.98%. IDV’s fees are exactly half of that.

IDV’s turnover ratio is around 36%, which we can expect to add 0.36% to our annual fees. However, fees are only part of the story. In the same way we expect higher quality food from an expensive restaurant, here we are paying for a high quality exchange-traded fund (“ETF”). We will show this with a risk factor analysis later on.

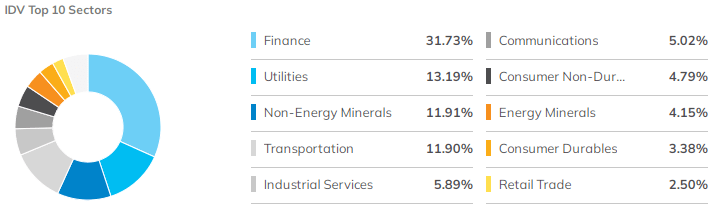

Tracking the Dow Jones EPAC Select Dividend Index, IDV holds 124 stocks across virtually all market sectors. This index tends to include large cap and robust profitability businesses, which are always a nice bedrock to any well-diversified portfolio. But, compared to the total market, IDV is overweighting the finance sector. It just so happens that these dividend-paying firms tend to be finance firms. Still, I would say that IDV’s sector diversification is reasonable.

IDV has passable sector diversification. (ETF.com)

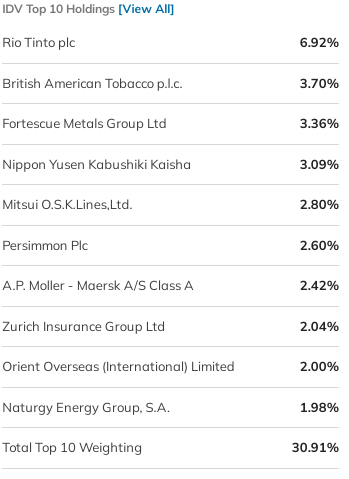

The fund’s top 10 holdings constitute a little bit over 30% of the fund’s overall holdings. This is not so bad, especially considering a few of these companies are name-brand even to U.S. investors. The fund’s holdings are trading at an average P/E ratio just around 5, which is notably cheaper than what the S&P 500 is trading for these days.

IDV is somewhat concentrated in its well-known top 10 holdings. (ETF.com)

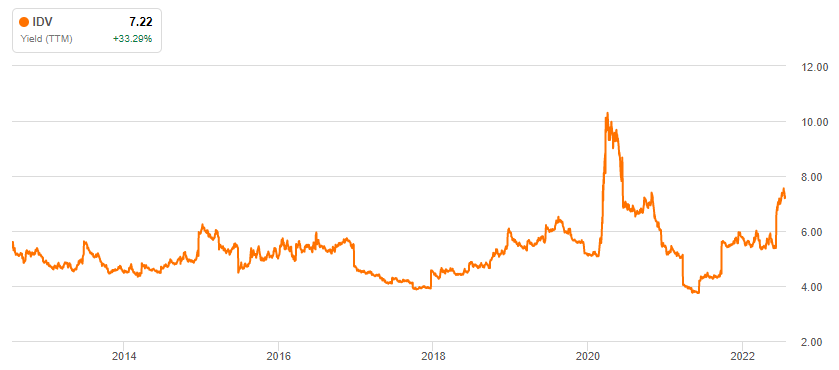

And, of course, the dividend is a quarterly paid 7%. We should note, however, that the dividend yield is not continuously growing. It sways with the macroeconomic climate. For example, IDV’s dividend was slashed in response to the coronavirus pandemic.

IDV’s dividend payouts are high, but they can be inconsistent at the worst times. (Seeking Alpha)

Overall, by buying shares in IDV, you’re buying good companies at cheap prices. The tradeoff is that while your fees are guaranteed, your performance is not.

The Theoretical Case Against IDV (And Why I Don’t Subscribe To It)

No discussion about dividend investing is complete without addressing its fragile empirical basis.

It has been shown since Miller and Modigliani’s work that dividends aren’t a driver of total returns. Mathematically, a company giving money to its shareholders needs to subtract that money from its net assets. This is reflected in the company’s share price. Because money is conserved, the idea of investing in a dividend-centric mutual fund is not directly beneficial to the investor. That much I agree with.

However, it just so happens that firms that pay dividends tend to trade at a discount. Discounted cash flowers are drivers of expected returns. We already see that IDV’s P/E ratio of 5 and book-to-market ratio of 1 make it an attractive value investment.

Critics are quick to point out that in this case, it’s preferable to directly target value exposure instead of inadvertently stumbling across it by targeting something else (i.e., dividends). Ideologically, this is true, but does it really matter how you’re getting value exposure so long as it’s achieved? There are reasons to prefer dividends, and if you’re getting exposed to favorable risk characteristics in the process, then that’s just a nice bonus.

Comparing IDV To Similar Funds

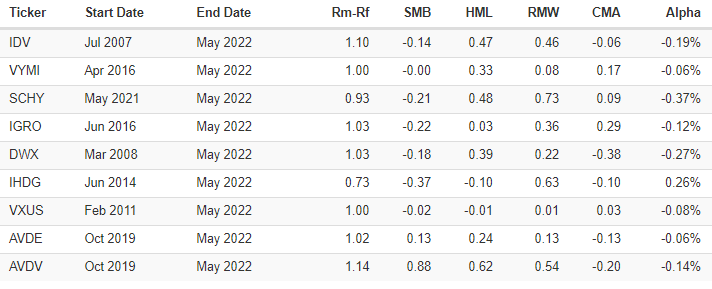

We turn to Portfolio Visualizer’s Fama-French five factor regression for IDV and comparable funds using the ex-U.S. international stock market as our benchmark. We should note the many and serious limitations of regression analysis, particularly the limited time periods we have in our samples. It’s far from perfect, but this analysis can give us an idea of what these funds have been and will be doing with our money.

In addition to IDV, we have the Vanguard International High Dividend Yield Index Fund (VYMI), Schwab International Dividend Equity ETF (SCHY), iShares International Dividend Growth ETF (IGRO), SPDR S&P International Dividend ETF (DWX), and WisdomTree International Hedged Quality Dividend Growth ETF (IHDG). For non-dividend comparisons, we’ll use the Vanguard Total International Stock Index Fund ETF (VXUS, VGTSX) which I recommended in this other article, Avantis International Equity ETF (AVDE) which is a value-tilted broad market fund, and Avantis International Small Cap Value ETF (AVDV) which I use in my own portfolio.

For the 6 years it has been around, IDV has had a pretty serious value and profitability tilt compared to the ex-U.S. global market.

Five factor regressions of common international equity funds. (Portfolio Visualizer)

To start, VXUS is unsurprising. You get your exposure to market beta, and that’s it. It is only by moving away from market cap weights that we observe factor tilting. For example, AVDE tries a bit harder to more intelligently target risk factors. AVDV tries much harder and has the deepest factor loadings as a consequence.

IDV has the largest value factor exposure on the list with the exception of SCHY and AVDV. SCHY is difficult to draw conclusions from because we have such little history for it, so we will have to wait a few years for better data. Amusingly, IDV appears to deliver deeper factor exposure than AVDE, a fund that intentionally value tilts a broad market index. Other than that, IDV has the most attractive factor loadings of all tested international dividend ETFs – in my opinion.

We should remember that while value tilts have historically beaten the market, they are not without risk of underperforming the market for long stretches of time. Not only do you need a strong value premium, you also need to have it for long enough to overcome your fees. I would think the best strategy is to buy and hold for at least 20 years, if not longer.

Thanks to the uncorrelation between independent risk factors, IDV’s value and profitability tilts make it less correlated to the total U.S. stock market than the ex-U.S. stock market itself. If only very slightly less correlated, it is still interesting to consider global diversification opportunities using this fund.

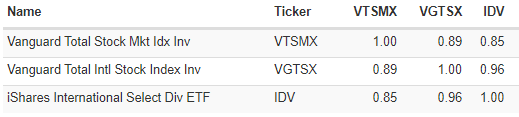

IDV is less correlated to US markets than the broad ex-US market itself. (Portfolio Visualizer)

IDV does all this with still having the largest trailing twelve month dividend of all funds addressed in this article.

Should You Buy IDV?

Generally, yes. IDV is a solid ETF if you’re seeking: 1) international diversification; 2) a value tilt; and 3) dividends. In a comedic twist, I would even say it’s better than some ETFs that intentionally invest in international value. Foreign tax credit and non-qualified dividends can be concerning in taxable accounts, but much of the damage is mitigated in a tax-advantaged account.

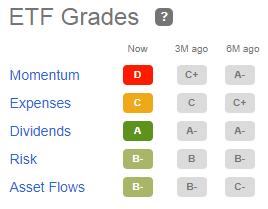

Seeking Alpha’s Quant gives IDV a Sell rating at the time of writing, but I’m still sticking with my Buy rating. Still, I don’t entirely disagree with the machine learning algorithm under current market conditions. Quant’s assessment is heavily influenced by the recent poor momentum of the overall stock market. If you’re a momentum trader, then it makes sense to avoid IDV and stocks in general at this time. Buy-and-hold investors, on the contrary, should be eager to purchase shares during such turbulent periods. IDV’s dividend rating even increased in the last 6 months, and asset flows are similarly larger. I would say that the market is taking notice and is buying up international dividend stocks.

It’s nice when the AI and the human agree. At least on the category ratings if not the overall rating.

Quant is happy with IDV apart from its recent momentum. (Seeking Alpha)

I do not own shares of IDV in my own portfolio. Instead, I obtain factor-tilted international value exposure through small cap stocks via AVDV. I prefer the excess factor exposure of AVDV to IDV’s dividend, but I also don’t need dividends. If I were investing in a tax-sheltered account, didn’t believe in the size factor, and needed dividends, I would prefer IDV.

How To Use IDV In Your Portfolio

You don’t want to go all in on IDV. That’d be crazy. Instead, I see IDV as a fund to complement a dividend-focused strategy. You might want to allocate as much to IDV as you would allocate any other international equity fund in your portfolio. For example, 20% of your total equities. If you invest exclusively in dividend-paying companies, I might suggest closer to 50% into international dividends to take advantage of the limited opportunity set you have.

A two-fund portfolio of the iShares Select Dividend ETF (DVY) and IDV, diversifying dividends across the global market, earns my recommendation. You get your dividends, from everywhere. It’s boring, but you get your dividends. There is beauty in this simplicity. Growth ETFs such as the Vanguard Total World Stock ETF (VT), which I recommended in this other article, may be used alongside a dividend-centric portfolio to diversify your portfolio across nearly all publicly traded equities.

We can go one step further. Allocating a fraction of your portfolio to bonds slashes your market risk while now providing monthly distributions. Allocating to long-term bonds in particular adds in a term risk premium, among other benefits I wrote about in this other article. An interesting idea is to create a dividend three-fund portfolio using DVY, IDV, and a long-term bond index fund. Don’t tell Taylor Larimore, though, because he won’t like what I did to his namesake three-fund portfolio.

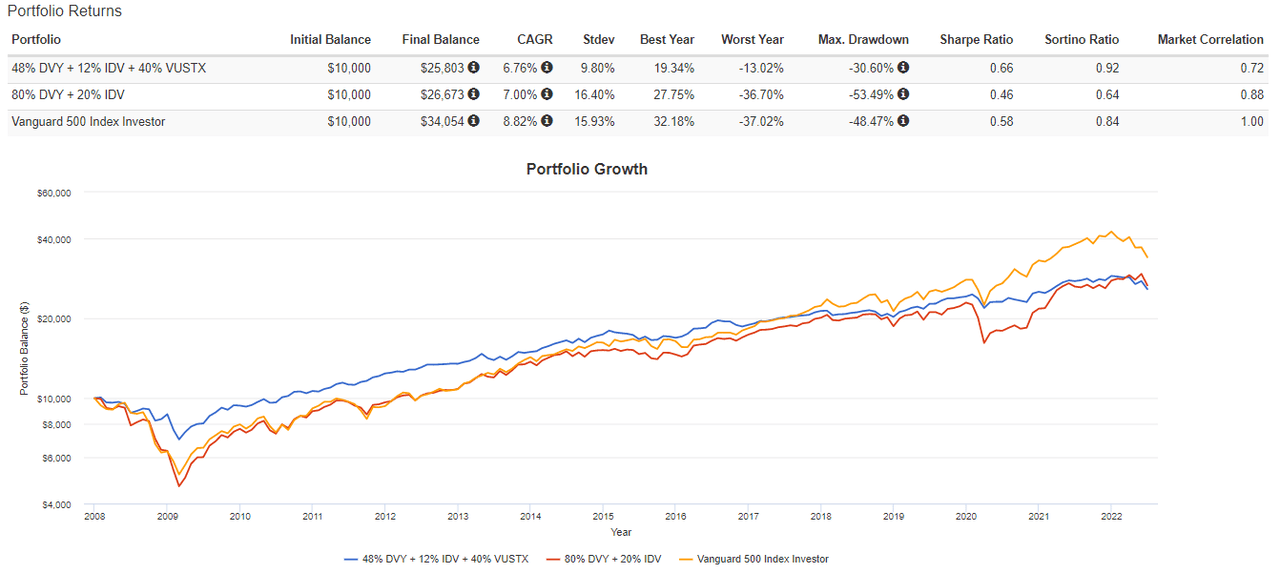

Such a dividend three-fund portfolio using the Vanguard Long-Term Treasury Fund (VUSTX) has shown reduced market correlation and higher risk-adjusted returns than comparable 100% stock portfolios. In the figure below, the blue line is a 60/40 three-fund portfolio with roughly global market cap weights of dividend index funds, the red line is the blue line but 100% stocks, and the yellow line is the S&P 500 (VFINX).

Anything but large cap growth tech investing over the last decade has been painful, so while the back-tested results may be a bit underwhelming, we might expect more promising future returns for dividend portfolios in the future. That said, the back-tested returns still seem reasonable to me. Earning 7% annualized returns with any portfolio at all… Well, that’s just a good deal.

A dividend three-fund portfolio suffers lesser drawdowns and boasts better risk-adjusted returns than the behemoth S&P 500 over its recent outstanding performance. (Portfolio Visualizer)

The bottom line is that these international businesses are trading at attractive prices and paying out like clockwork. I’d be buying into these companies anyway. They’re good stocks. I don’t see why anyone wouldn’t want to get in on this, whether through this fund specifically or another.

IDV is just making it easy.

Be the first to comment