Main Thesis

The purpose of this article is to evaluate the iShares U.S. Utilities ETF (IDU) as an investment option at its current market price. In the short term, the utilities sector continues to push to new highs, and it is actually the second best performing sector so far in 2020. With this bullish momentum, and an increasingly clouded outlook for global growth, investors may be thinking to increase their exposure to this area.

However, I would caution against optimism at these levels. While continued coronavirus concerns may be a catalyst for defensive sectors like utilities, I see limited upside potential right now. IDU, and the utilities sector in general, are quite expensive, compared to both the broader market and their historical trading ranges. This tells me IDU may be ripe for a correction, even if growth concerns persist. Furthermore, investors who are hoping for further Fed action on interest rates to help utilities, which have an above-average dividend, move higher may be disappointed. Recent remarks from Fed officials suggest there is little appetite for sending interest rates lower at the moment. Finally, for those who still consider utilities to be a safe bet, IDU may not be the best option. The fund has a high expense ratio for a passive ETF, and comparable options exist at cheaper prices.

Background

First, a little about IDU. The fund’s stated objective is “to track the investment results of an index composed of U.S. equities in the utilities sector” and it is managed by BlackRock (BLK). The fund trades at $175.45/share and yields 2.50% annually. This is my first review of IDU, and has come about because I am growing increasingly concerned with the valuation of the utilities sector. While I generally favor utilities, as a defensive hedge and also as a long-term core holding, I believe the sector’s rise has been too far and too fast. As such, I see little chance for continued outperformance by IDU, and expect the fund to tread water in the months ahead. Therefore, I believe a neutral rating is most appropriate for the fund, and I will explain why in detail below.

The Good: Utilities Are Leading The Market

To begin, I want to touch on one of the positive attributes of utilities right now, and that is performance. Ultimately, this is what investors are after, and utilities have been delivering. While the fundamentals surrounding the sector, in terms of weak earnings growth and an expensive valuation, have been headwinds for a while, this has not stopped utilities from driving to higher highs. As we sit almost two months into the new year, utilities are the second best performing sector in 2020 so far, as shown below:

Source: Charles Schwab

Clearly, investors have been willing to bid up the utilities sector, despite an escalating cost to own. While IT continues to lead the market, it is striking that Real Estate and Utilities have posted the next best results so far, as these are both mostly domestic-oriented, defensive sectors. That should give investors a level of caution going forward, as more cyclical sectors are lagging, despite the broader market sitting near all-time highs.

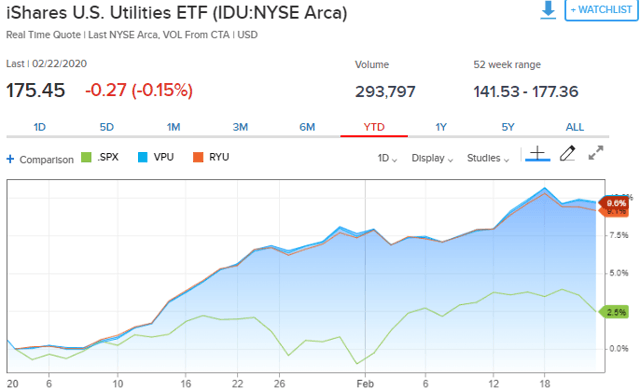

Further, IDU has been following the utilities sector higher, in line with alternative ETFs that have a similar focus. To illustrate, consider the year-to-date returns of IDU, Vanguard Utilities ETF (VPU), and Invesco S&P 500 Equal Weight Utilities ETF (RYU) against the S&P 500, as shown below:

Source: CNBC

My takeaway here is, despite the concerning rise in price to own the utilities sector, the outperformance over the broader market is telling. Further, the focused ETFs that track this sector all seem to be sharing in the upside, as the performance spread between the three is very narrow. Therefore, while I have my concerns, which I will discuss next, the overall performance so far in 2020 is a reason why I am neutral on IDU, as opposed to a more bearish stance.

Outperformance Has Pushed Up The Cost To Own

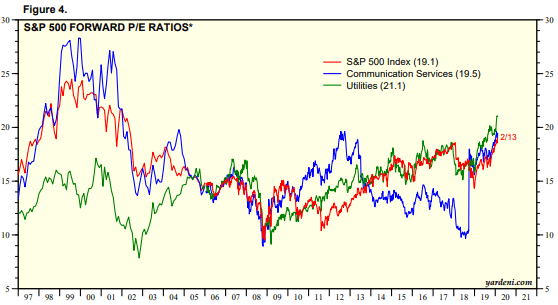

As noted above, IDU’s performance in 2020 has been stellar. While this has been very positive for current investors, there is a downside to the recent price action as well. Specifically, this has pushed up the utilities sector’s valuation to a new high. In fact, the forward P/E for the sector is higher than it has been in decades, as shown below:

Source: Yardeni Research

As you can see, while the broader market (as measured by the S&P 500) has also seen its forward P/E rise, due to depressed earnings growth and rising stock prices, the utilities sector has seen a larger move higher. This makes sense given the sector’s outperformance in the short term. Clearly, this concerns me as a more conservative investor, although it is also clear from the graph that utilities and IDU by extension have been above their historical trading ranges for some time. Therefore, this in and of itself is not a reason to sell in isolation.

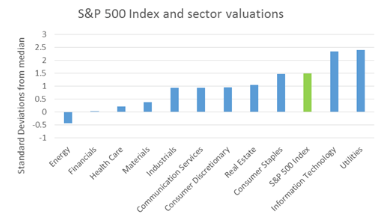

However, when we dive deeper into the historical valuations for each sector, utilities in particular raises a red flag. To see why, consider the current valuations for each market sector and the S&P 500, as measured in terms of standard deviations from the median, shown below:

Source: Charles Schwab

As you can see, the utilities sector is currently the furthest away from its median, in terms of standard deviation, than any other sector. While the sector has been expensive for a while, logic would tell me that when a reversion to the median happens, the move is going to be quite substantial given how far from the norm the current valuation is. My takeaway here is that the defensive hedge the utilities sector provides, while usually quite valuable, may not be worth it at the present valuation. The downside risk, as measured by the distance from its median valuation, appears quite large. While the sector will likely continue to hold up better on down days than the broader market, I can’t see much room for further upside action here. The sector is so far above its typical trading range that I have to recommend caution at this time.

IDU Specifically Is An Expensive ETF

While I just laid out a case for why the utilities sector appears too pricey for my liking, I want to take a moment to discuss why IDU is also an expensive way to invest. While this is a simple exercise, it is an important one, because investors who want broad utilities exposure have multiple options, so overpaying for a passive ETF is not a logical move. To this point, consider the expense ratios and holdings for the three ETFs I highlighted earlier, as shown in the chart below:

| Fund | Expense Ratio | Top 5 Holdings | Yield |

| IDU | .43% | NextEra Energy, Inc. (NEE); Duke Energy Corp. (DUK); Dominion Energy, Inc. (D); The Southern Company (SO); American Electric Power, Inc. (AEP) | 2.50% |

| VPU | .10% | NEE; DUK; SO; D; AEP | 2.61% |

| RYU | .40% | Pinnacle West Capital Corp. (PNW); Eversource Energy (ES), NEE; Evergy, Inc. (EVRG); American Water Works Company, Inc. (AWK) | 2.36% |

Source: iShares, Vanguard, Invesco

As you can see, IDU and VPU have almost identical make-ups at the top, yet IDU’s expense ratio is more than four times VPU’s. This likely contributes to the slightly lower yield as well. While RYU has the lowest current yield of the three, its make-up is noticeably different, and it still has a lower expense ratio than IDU to boot.

My takeaway here is that while I am cautious on Utilities broadly going forward, I wouldn’t choose IDU as a way to play this sector even if I had a more optimistic outlook. For someone interested in this fund, VPU seems like a more logical choice, as it would give an investor cheaper exposure to the same players in this space.

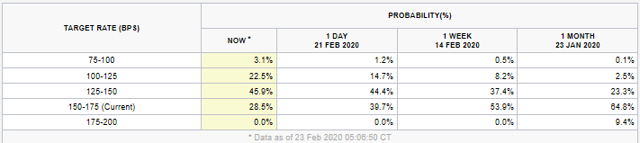

The Fed May Not Be The Next Catalyst

My final point concerns market sentiment right now, and specifically in an area where I disagree with prevailing expectations. Looking ahead through June 2020, investors are beginning to suspect the Fed will take action to lower interest rates. While investors have been anticipating Fed action since the end of last year, global uncertainty surrounding the spreading coronavirus is raising expectations for action in the short term. To illustrate, consider that by the June 10th Fed meeting, investors are placing only a 28.5% probability that rates will stay at current levels (the other 71.5% is a bet on a decrease). This probability of maintaining current rates is down from almost 65% in just a four-week period, according to data compiled by CME Group, as shown below:

Source: CME Group

My point here is that investors are clearly beginning to bank on further Fed action. While the odds were in favor of a neutral policy back in January, the odds have shifted dramatically towards the expectation of further easing.

With respect for IDU, this is good news on the surface, because investors are likely to be drawn to the fund’s above-average, consistent dividend stream in a declining rate environment. This is a primary reason for the utilities sector’s outperformance in 2018, and continued strength through 2019 as well. If these odds continue to increase, and if a rate cut does materialize, this will be a bullish tailwind for IDU, and utilities as a whole.

While this could be good news for current investors, the problem is that I believe the market is getting too optimistic with respect to Fed action. Personally, I do not expect any Fed action in the first half of 2020, and I view recent statements by Fed officials as support for this thesis. Specifically, the coronavirus was already making headlines when the Fed had its first meeting of the year at the end of January. At that time, the Fed noted the risks involved in its press release, but ultimately decided against any rate cut by citing a “strong” labor market and economic activity that has been rising at a “moderate rate.” While the situation involving the coronavirus has undoubtedly worsened since that time, Fed officials are still expressing a desire to keep rates unchanged, despite the changing investor sentiment.

To illustrate, consider a statement made last Friday (2/21) by Raphael Bostic, President of the Federal Reserve Bank of Atlanta. When asked about the coronavirus’ impact on the U.S. economy, he stated:

I think this is going to be a short-time hit. We’ll get the economy back to its usual level. I have no impulses really to think that we need to do anything with our policy stance different than what we are today”

Source: CNBC

This sentiment was echoed by St. Louis Federal Reserve President James Bullard, on the same day, when he stated:

There’s a high probability that the coronavirus will blow over as other viruses have, be a temporary shock and everything will come back”

Source: Reuters

My takeaway here is that while lower interest rates will undoubtedly help IDU, I don’t see that developing in the short term. While the market is anticipating a cut, Fed officials have been rejecting that idea pretty consistently. With utilities sitting at historically high levels, if further cuts do not materialize and the Fed disappoints the market in the first half of the year, I envision a disproportionate downside reaction.

Bottom line

IDU has been a winner in 2020, but I see this as an unsustainable trend. While the fund will perform modestly well if coronavirus and other trade fears continue to dominate headlines, further upside appears limited from here. This is due to the fact that the utilities sector is trading well above its historical norms, in terms of valuation, and investors buying in now would be paying quite a premium to own this exposure. Further, IDU specifically has a lower yield and a higher expense ratio than VPU, a direct competitor of the fund. Finally, while further Fed easing would be a tailwind for IDU, and utilities as a whole, I see little chance of a rate cut in the first half of the year. Therefore, I am not very optimistic on IDU going forward, and would recommend investors approach any new positions very cautiously.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment