Edgar Joel Ipanaque Maza/iStock via Getty Images

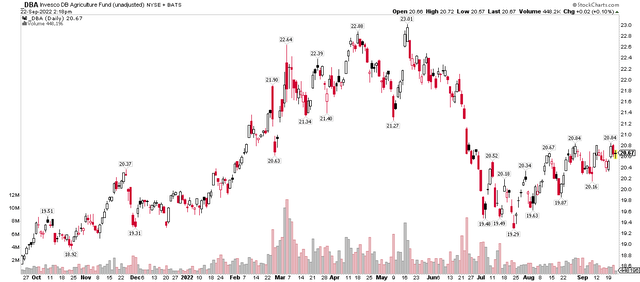

Agricultural commodities were on fire to kick off 2022. The Invesco DB Agriculture Fund (DBA) jumped from near $20 to above $23 over the first handful of months this year, but then shares cratered to a low in July.

Ag commodities have found some buyers amid broader market turmoil in the last two months, though. One foreign Chemicals industry stock has seen its share price get taken to the woodshed, but I see an opportunity here.

DBA Agriculture Fund: Rising After A May-June Drop

According to Bank of America Global Research, ICL Group (NYSE:ICL) is no. 6 in the global potash industry, with about 7% of total capacity, selling mainly into agriculture. It is also the no. 2 name in the bromine industry, with roughly 30% of global capacity, selling brominated flame retardants, clear brine fluids, and other industrial applications. ICL also has a significant phosphates business (fertilizers, food ingredients, and industrial applications) and a specialty fertilizer division.

The firm’s management team continues to work toward growth via organic means and through M&A. ICL benefits from higher bromine and potash prices and stronger demand for bromine and fertilizers. Unfortunately, currency headwinds via a strong U.S. dollar pressure the company and pose risks ahead. On the flipside, the ongoing Russia/Ukraine crisis generally benefits bromine and potash prices.

The Israel-based $11.2 billion market cap Chemicals industry firm within the Materials sector trades at a low 6.5 trailing 12-month price-to-earnings ratio and pays a small 1.8% dividend yield, according to The Wall Street Journal.

On valuation, earnings are forecast to peak this year amid surging commodity prices and EV demand. Though a recent settlement with the Israeli government means a greater tax expense for the company. Nevertheless, the stock would still trade at a below-market multiple of less than 13 by 2024, per BofA’s forecasts. Dividends may fall sharply by then, though. ICL’s EV/EBITDA ratio still looks somewhat cheap, and its free cash flow yield is strong.

ICL Earnings, Dividend, Valuation and Forecasts

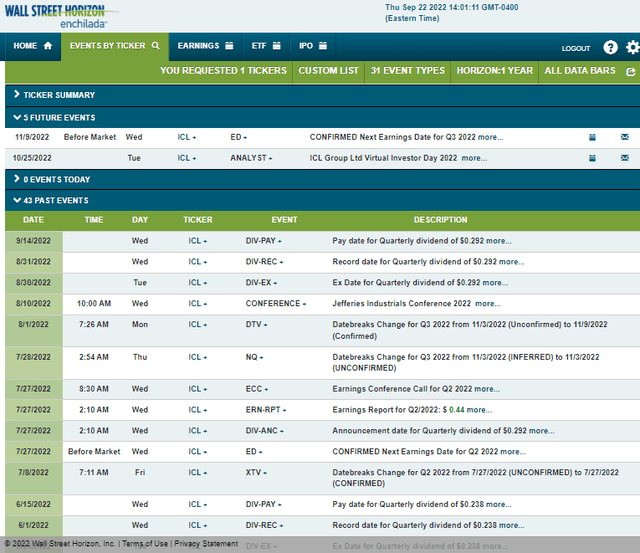

With so much going on both at the company level and in the macro economy, ICL Group’s October 25 investor day will be one investors should keep on their calendars. Expect share price volatility around that event.

Then comes the firm’s Q3 earnings report which is confirmed by Wall Street Horizon to take place on Wednesday, November 9 before market open.

Corporate Event Calendar

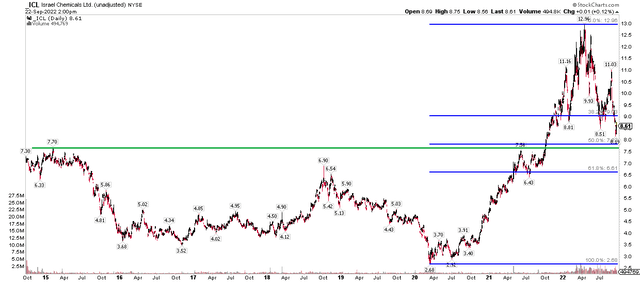

The Technical Take

ICL could be near an interesting buy point. Notice in the chart below that shares have pulled back sharply to the crucial $7.50 to $8 range. That has been a big spot dating back to 2015. A breakout late last year from that point helped send shares to an all-time high near $13. Fundamentally, surging agricultural commodity prices no doubt helped fuel the bull run.

The stock then pulled back almost 40% to near $8 just recently, bringing the Materials name to support. The big decline seems to have paused at the 50% retracement of the March 2020 to April 2021 rise. I think shares could be a buy here with a stop under $7.50. Resistance could be seen at $11.

ICL: A Confluence of Support Near $8

The Bottom Line

Many agriculture stocks were the darling of traders’ eyes during the first few months of the year, but then bears roared through much of the summer. While ag commodities perk back up, shares of ICL are at support despite uncertain earnings. I think now is a good time to go long ICL but keep your eye on the upcoming investor day and earnings report to see how the fundamentals are looking.

Be the first to comment