Alex Potemkin

The iShares Cohen & Steers REIT ETF (BATS:ICF) is a specialty REIT exposure that gets you into some of the best commercial real estate exposures on the market. The issue is that cap rates were already low here, and with rising rates they look even worse. The ETF has therefore traded down and is likely to be under pressure for the medium-term. Still, we believe there is hope for ICF as rates peak, which we believe they will at some point in the next 5 months, and eventually make their return. With the fundamental picture being so strong for these REITs, we think the asset value declines will be transient and that ultimately reversions could come for ICF. Still, rates are absolutely low. We’d go elsewhere.

Breakdown of ICF

ICF contains lots of specialty REITs in relatively high proportions, with the total number of REITs in the portfolio only being 29.

The firs 36% of the ETF is accounted for by mostly commercial real estate plus a holding that could be considered residential. Prologis (PLD) is a warehouse real estate company that benefits from ecommerce and logistics investment trends. American Tower (AMT) is a company that has real estate which is rented by telecoms companies like AT&T (T) for provision of wireless services, so telco towers and infrastructure. Crown Castle (CCI) does similar things to AMT. Equinix (EQIX) is a real estate owner of internet exchanges where networks peer to skip IP transit costs from the backbone. Finally Public Storage (PSA) is a specialty residential exposure that houses people’s things.

As you go down past the first 36% of the allocations you get regional casino real estate REITs, more telco infrastructure and even specialty residential REITs that focus on elderly markets. 43% of the ETF is explicit specialty, with lots of the residential REITs also being in specialty markets, not just simple multi-family or something like that.

Rates

YTD performance has been terrible so far at -29% and this reflects re-rating of real estate as rates grew. Commercial real estate broadly has fallen about 13%, and residential real estate has actually fallen at a similar rate. The skew towards specialty REITs has not played well for this ETF which has fallen at more than twice the pace. Part of this was the lower yields, which are an excellent proxy for the cap rates, that specialty REITs offered compared to broader real estate. A 5% rate is pretty reasonable as far as a typical residential asset might go, but the yields on ICF have stayed below 3%, as they continue to do now at 2.85% with a 0.32% annual fee.

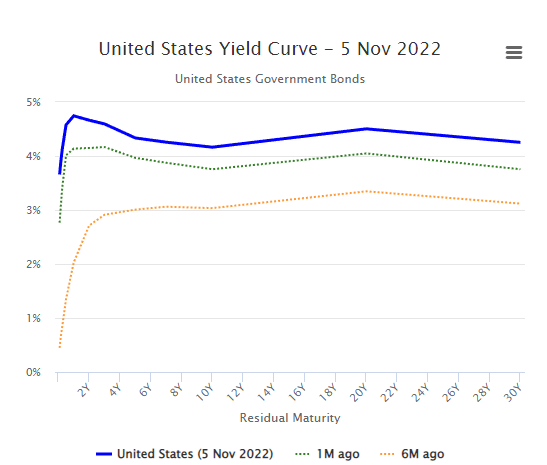

From a yield curve perspective, this is not very impressive.

Yield Curve (worldgovernmentbonds.com)

The yield curve is flat and the bond markets are pricing in risk-free rates at just below the 5% level for decades. This implies that the markets are assuming that the inflation we have is structural, that productivity cannot outpace secular demand growth, and that the current inflation is demand outpacing supply. These are all big assumptions, even that last one that seems almost definitional. Current inflation may just be the degree of wealth destruction coming from losing out to other economies whose commodities have become more valuable to the Western bloc – perhaps the intermediation costs from not dealing with Russia anymore. Indeed, 9% inflation isn’t far off from the 10% you might pay in commission to a system that will supply you products from more desirable sources. With real wages falling, there’s not wage price spiral and this may be the 2022 one-off.

With bottlenecks like logistics cooling, we may be at peak inflation and rates can come down. We don’t have a permanent supply chain problem – things have adjusted. A fall in rates would restore asset values of real estate broadly.

Still, current ICF yields trail risk-free rates. The only explanations are the single-digit rent growth within the contracts, the solvency of tenants, and the conditions being favourable for contract rollovers. While the duration is mitigated, the leases for these REITs, may be subject to harsh duration effects from a harsh yield curve, which decimates future cash flows at the same exponentiating base as near cash flows. This has explained the YTD declines up to the current yields that are protected by these positive features of the ICF portfolio. While the yield curve may shift, and the current YTD declines may be excessively discounting ICF considering historical levels, we still don’t like an ETF that doesn’t offer the same rate as a government yield. Peak yield as a thesis may mean a reversion in price for this ETF, but the cap rates implied by the yields are still quite low even if this real estate is rock solid and their leases valuable into perpetuity. Pass.

Be the first to comment