Sundry Photography/iStock Editorial via Getty Images

Old school tech company IBM (NYSE:IBM) is a stock that I’ve had a hard time liking for years. I was very critical of the company’s “strategy” of just buying back as much stock as it could in the Rometty years, because it didn’t work. IBM’s new leadership team is actually working to improve the business, but I’m not sure it’s working. The stock is also not priced all that attractively at the moment, so as much as I’m trying, I simply don’t see any reason to want to own this stock.

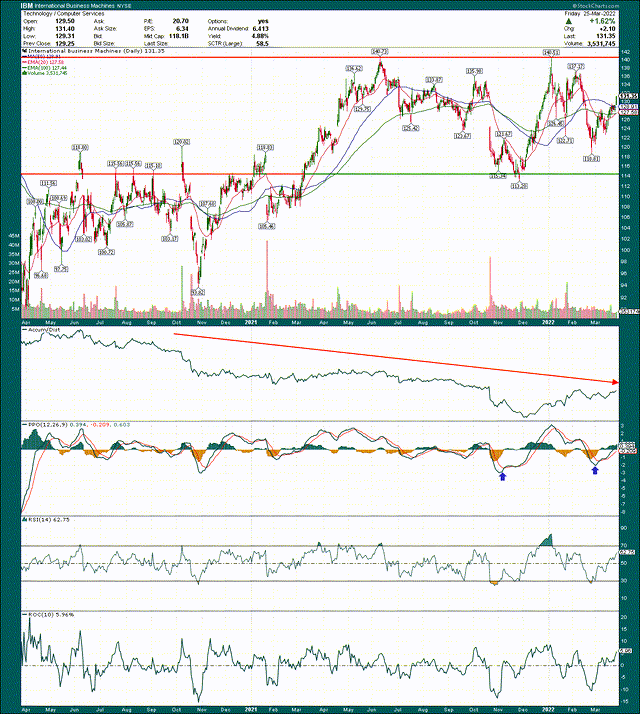

This is a two-year chart, and you can see the past year or so has been a massive sideways consolidation that could carry on for some time. The range is ~$115 to ~$140 until further notice, and we’re almost exactly in the middle of that right now. If we approach one side of the channel or the other, you can take long or short positions accordingly to bet on the stock staying in the channel. Based on what I see, plus the uninspiring fundamental outlook, I don’t see any reason IBM is going to be breaking out anytime soon.

One thing that makes me think it may consolidate for a while is that the accumulation/distribution line is very weak, and has been for the past couple of years. Investors are selling rips rather than buying dips, and that’s not what you want to see from a stock you own. It also makes it less likely the next big move is up.

The PPO is also in bearish territory and is attempting a fairly weak bounce at the moment, which means bullish momentum is weak. This looks more like a lack of bearish momentum, rather than the presence of bullish momentum. The RSI is showing a similar picture but the point is that there is no reason to think this thing is going meaningfully higher, and if it does test the top of the channel, I would be interested in aggressively shorting it via put options.

Now, let’s take a look at the fundamental picture.

Weakness on top of weakness

IBM’s core issue is that many years ago, it was far too late to adapt to changing technology needs of its customers. It held onto its old fashioned server business and related technologies that made it great in the 80s and 90s, but borderline obsolete in the 2010s. The company is trying its best now to undo some of that damage, with the RedHat acquisition being one way it is adapting, but the fact is IBM fundamentally remains a very weak company.

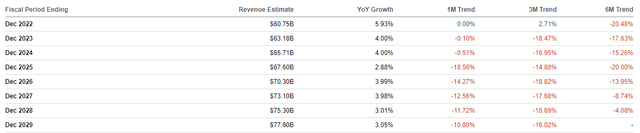

Below we have revenue estimates in the years to come, as well as the revision schedule for each year’s estimates for some context.

That’s a lot of red, and it isn’t just that revisions are lower; it’s the magnitude of the moves down. This has been going on for a decade or more, so it certainly isn’t a new thing. But the fact that IBM’s strategic moves haven’t arrested these declines should be extremely concerning for shareholders. This company simply hasn’t been able to figure out how to compete in a modern IT world.

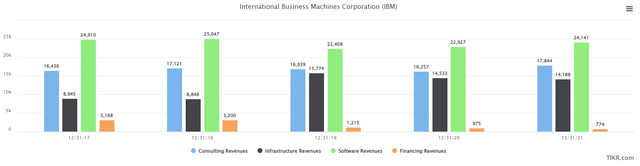

Below, we have a historical look at revenue with the company’s three new segments, post-Kyndryl (KD) and adjusted as such.

Consulting revenue finally put in an up year in 2021, but was flat-to-down before that. Software revenue has been flat for years, and Infrastructure has been down each of the last two years. Forget about Financing revenue, which has fallen off a cliff.

In other words, there isn’t one problem IBM has, or one weak segment; this company has struggled for years, and with many of its lines of business. While getting rid of the stuff nobody wants via Kyndryl will help, it doesn’t appear to be enough.

Now, as with any company that is trying to enact a turnaround, it is possible that IBM figures it out and begins to grow again. I’ll reiterate that the company started years behind its competition in most areas, but the new management team under Arvind Krishna is doing a much better job than what IBM shareholders have experienced in recent years. Given enough time, the company’s software revenues in particular could move higher again, and IBM isn’t afraid to go make a big acquisition. In addition, software is the big money maker for IBM, so if the team can figure out how to arrest the declines the segment has seen, my bearish thesis could be at risk.

Where Kyndryl should help is with margins, as IBM spun off some undesirable businesses into Kyndryl that somehow didn’t make the cut, in the context of the mess we just looked at. Anyone buying Kyndryl stock should view the company’s business in that vein; it isn’t like those businesses were spun off from some superstar market leader.

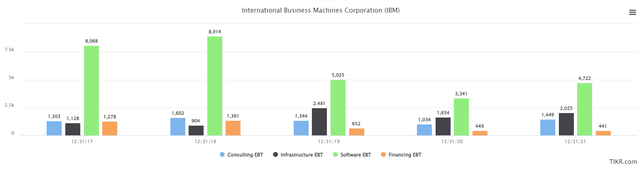

At any rate, below we have earnings before taxes, or EBT, for each of the segments since 2017 on an annual basis.

IBM’s software segment has been the cash cow for many years, and that remains the case today. But even that segment is in a bit of a rebuilding process as Financing EBT has plummeted, Consulting EBT is about flat, and Infrastructure has made slight gains. Kyndryl is full of low-margin, undesirable businesses, so IBM’s overall margin profile should be lifted by the spinoff. The problem is that the numbers we’re looking at above are already adjusted for Kyndryl, so we will see no difference from that. Again, shareholders should be very concerned.

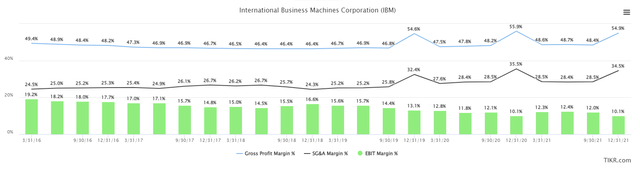

If you want to see what this looks like for the consolidated company, below we have trailing-twelve-months gross margins, SG&A costs, and resulting EBT for the past few years.

IBM’s margin profile has continued to melt over the years, and while there have been moves higher at times, it is never sustainable. EBT is down from 19.2% to just 10.1% since 2016, which means IBM has to produce nearly double the revenue it did in 2016 to produce the same amount of EBT. That’s why margins are so critical, and why IBM has managed to perform so terribly during the greatest bull market in history.

Valuing a melting ice cube

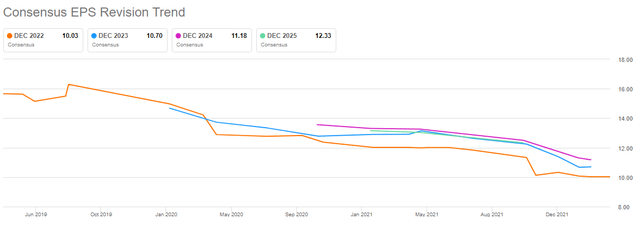

Given IBM hasn’t been a growth stock in decades, it makes sense that it should be assigned a low valuation. However, the problem is that because the company perpetually underperforms expectations, which is evidenced by what we saw above, valuing it becomes more challenging. Below, we have EPS revisions for the past few years to give us an idea of the magnitude of the issue.

When a company’s EPS estimates look like this, you should run for the hills. This is not a bad quarter, or bad year; this is poor execution and/or a dying business. I don’t think IBM is a dying business, but I’ve said repeatedly here on SA that I do think IBM perpetually executes poorly. Given the above, I’m not sure how anyone would be able to argue against that.

I don’t want to own any stock that has EPS like this, but some people love a bargain, so let’s see if IBM at least is cheap.

As it turns out, it isn’t. Shares are going for 13.1X forward earnings today, which is near the top of the range for the past five years. Why would I want to overpay for a company that has proven unable for a decade or more to be able to get anywhere near EPS estimates? It’s incomprehensible to me.

Given all of this, we have a stock that is overvalued for a company that has had a very difficult time growing for years. The one saving grace is that IBM does pay a nice dividend, which we can see below.

The nearly-5% yield is outstanding in today’s environment of a low-1% S&P 500 average yield, but is it enough to buy IBM? Nope, because that 5% dividend won’t save you from years and years of market underperformance, as we’ve seen from IBM in the past.

The bottom line here is that there is little to like from a fundamental perspective, there is little to like from a technical perspective, and I don’t think Kyndryl is the saving grace of what’s left of IBM. Looks to me like we’re going to get more of the same in the years to come, and for that reason, you’re better off just about anywhere else.

Be the first to comment