JHVEPhoto

In the history of information technology, there are not many companies that have reinvented themselves after missing out on seismic changes. IBM (NYSE:IBM) missed the cloud revolution, but the company has reinvented itself with the acquisition of Red Hat. The company’s turnaround is just gaining speed. This decade will be an exciting one for IBM. I am looking to add to my holdings at $130, with the stock yielding 5% at that price.

Red Hat Acquisition is a Success

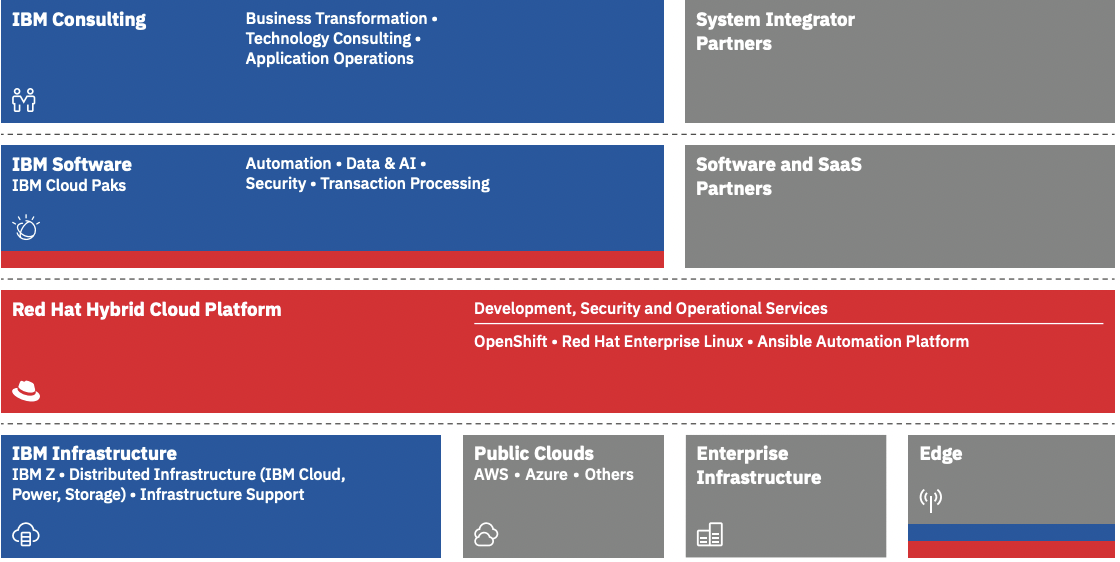

In 2017, I called Red Hat the “next cloud giant” in my article on Seeking Alpha. My prophecy has come true in many ways. First, IBM paid a massive 60% premium to acquire Red Hat in 2019. Then IBM CEO Ginni Rometty had to defend the acquisition’s high cost publicly. IBM then made the Red Hat open source stack the centerpiece of its hybrid cloud and AI strategy [Exhibit 1] to capture market share in the $1 Trillion hybrid cloud opportunity. IBM used its vast sales and marketing teams to increase the reach of Red Hat.

IBM’s management has done a great job pivoting its strategy by acquiring Red Hat. The hybrid cloud is a general-purpose software environment that provides the foundation to run any application. After spending over 15 years in oblivion, IBM is finally relevant again. They now have a competitive set of software and services that can help companies modernize their on-premise application stack while gaining the capability to leverage the near infinite compute and storage in the cloud.

At the time of my 2017 article, the prospects for hybrid clouds were cloudy (no pun intended) at best. The IT industry expected the three significant clouds (Amazon’s (AMZN) AWS, Google’s (GOOGL) GCP, and Microsoft’s (MSFT) Azure) to take over almost all the workloads running in on-premise datacenters. Mark Hurd, the late CEO of Oracle (ORCL), even predicted that 80% of enterprise apps would move to the cloud. Maintaining on-premises data centers was considered labor-intensive and expensive. But, a migration to the cloud came with its challenges. A company can get very closely tied to a cloud vendor’s API that is incompatible with the other clouds. A migration proved expensive and time-consuming for many traditional companies, especially in banking, insurance, and financial services.

The financial services industry is highly competitive, with many highly regulated banks competing against fintechs that face no regulation. Even Jamie Dimon, the CEO of JP Morgan Chase (JPM), complained about how fintech is taking market share away from traditional banks and how the competitive scales are tilted in favor of fintech due to the heavy regulatory requirements imposed on banks. So, many traditional companies in the financial services industry needed a way to modernize their technology and provide a great customer experience without breaking the bank or taking years to deliver a digital transformation. These companies also had their data in the databases such as Oracle or IBM DB2, which can be expensive to modernize. Many traditional banks had also deployed their applications on mainframes that continue to be a mainstay technology at banks and insurance companies.

Enter containerization, microservices architecture, and Kubernetes. Containerization and Kubernetes allow a company to move from one cloud to another or even move their application to their own data center without rewriting the code. Red Hat’s Openshift software enables the hybrid cloud. Red Hat is not the only player in the hybrid cloud business. VMware (VMW) has built hybrid cloud features into its VMware vSphere virtualization technology, and the cloud providers have launched their own set of technologies involving containers that help customers run their applications in their datacenters.

Red Hat had total revenues of $3.36 billion at the end of its fiscal year ending in February 2019. FY 2019 was the last full fiscal year before IBM acquired the company. In FY 2021, IBM declared $24.14 billion in software revenue. Hybrid Cloud and Solutions accounted for $17.75 billion or 73% of that total software revenue. The company does not break out the revenue from Red Hat but mentioned that its year-over-year revenue growth was 30.6%. IBM also said they had 3,800 customers on their hybrid cloud platform at the end of FY 2021 and added 200 more new customers in Q1 FY 2022 to bring the total number above 4,000. In 2017, Red Hat had about 300 customers.

Exhibit 1: Red Hat is the Centerpiece of IBM’s Hybrid Cloud and AI Strategy

Red Hat is the Centerpiece of IBM’s Hybrid Cloud and AI Strategy (IBM Investor Presentation)

Dividends, Share Buybacks, and Financial Performance

The company suspended its share buyback program when it announced the Red Hat acquisition in 2019. The company had $62.8 billion in debt at the end of FY 2019. It ended in 2021 with a total debt of $51.7 billion. IBM issued $4 billion in debt in February to replace some of the debt due this year. This new $4 billion debt brings the total to over $54 billion. About $12.2 billion of the debt is related to its financing arm, which offers clients loans to purchase IBM products. The company’s debt to EBITDA ratio is a very high 4.6x. The company will likely not resume share buybacks until the debt to EBITDA ratio is closer to 3x. IBM’s total debt will have to fall to around $35 billion to reach the debt to EBITDA ratio of 3x. The company paid nearly $6 billion in dividends yearly and generated about $12 billion in operating cash flows in FY 2021. The stock yields a dividend of 4.7% with a payout ratio of 68%.

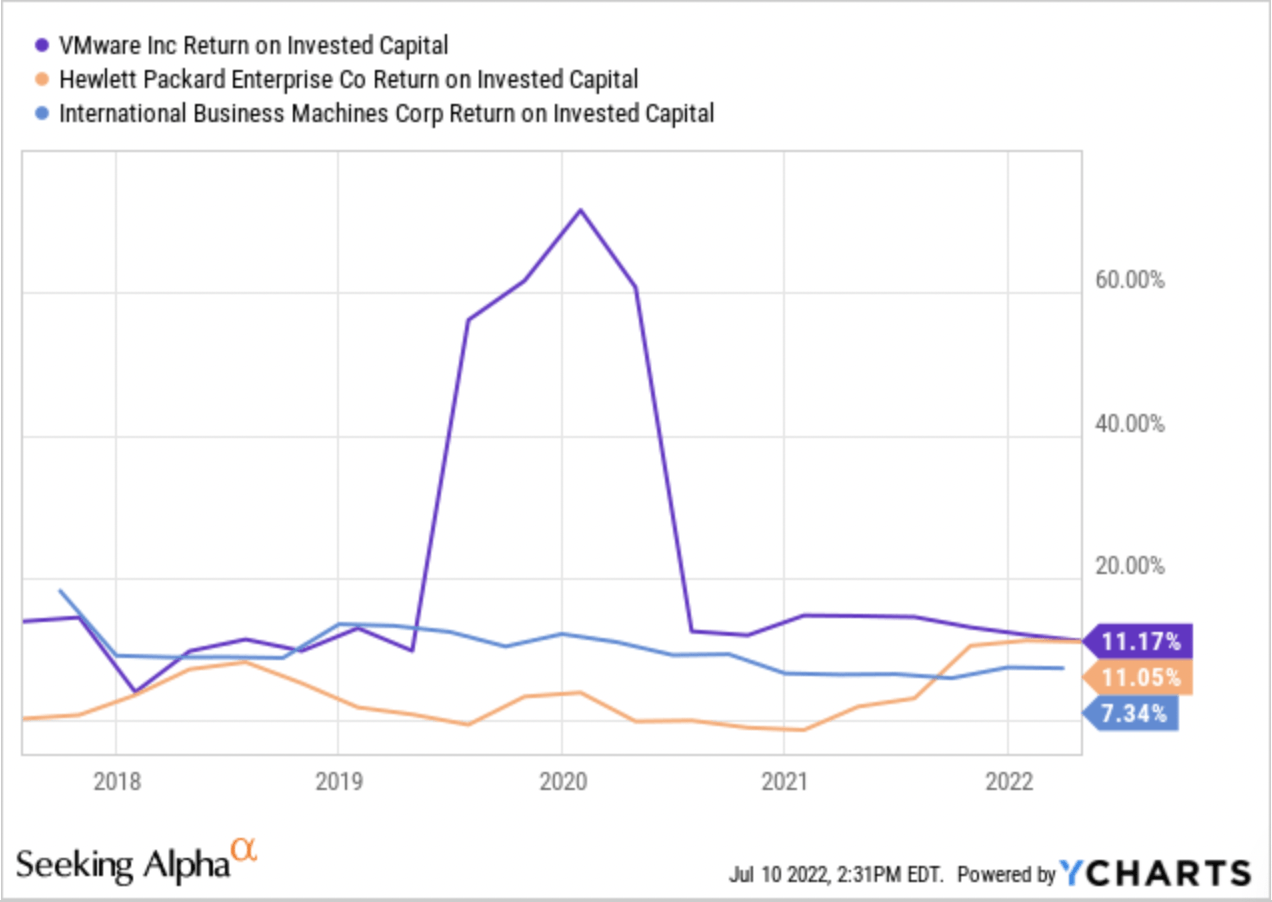

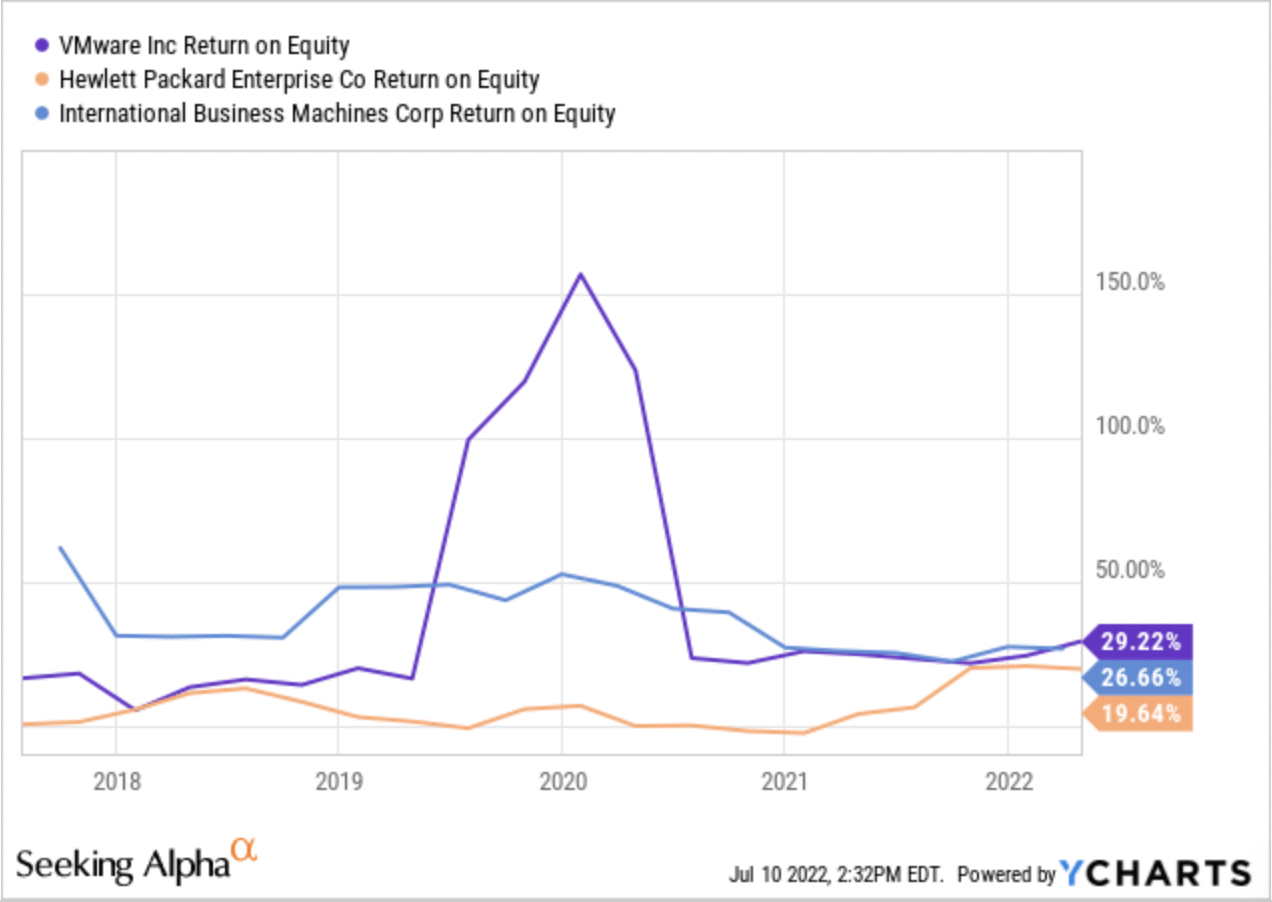

The company’s return on invested capital [ROIC] was 7.34% [Exhibit 2]. I have estimated that the weighted average cost of capital [WACC] for IBM is 7.16% at the current 10-year treasury rate of 3.08%. The company’s ROIC is just marginally better than its WACC. But, the company generated a good return on equity [ROE] of 26%. Hewlett Packard Enterprises (HPE) and VMware had an ROIC of 11% and an ROE of 19.6% and 29.2%, respectively [Exhibit 3].

Exhibit 2: ROIC for VMware, Hewlett Packard Enterprise, and IBM

ROIC for VMware, Hewlett Packard Enterprise, IBM (Seeking Alpha, YCharts)

Exhibit 3: ROE for VMware, Hewlett Packard Enterprise, and IBM

ROE for VMware, Hewlett Packard Enterprise, and IBM (Seeking Alpha, YCharts)

Daily and Monthly Price Return Comparison

Between June 3, 2019, and July 8, 2022, IBM’s daily price return data showed an average return of 0.031% or 3.1 basis points [Exhibit 5]. IBM’s daily return was below 0.86% or 86 basis points 75% of the time [third quartile in Exhibit 5].

IBM has returned an average of 0.5% per month since June 2019 [Exhibit 4]. The company’s monthly return was below 6.13% 75% of the time between June 3, 2019, and June 30, 2022 [third quartile in Exhibit 4].

Vanguard Information Technology ETF’s (VGT) and IBM’s monthly returns have a moderate positive correlation of 0.41. IBM’s strategic and market struggles over the past decade are reflected in this moderate correlation between IBM and the rest of the IT stocks. In fact, over the past five years, the Vanguard Information Technology ETF has returned over 139%, while IBM has returned a -4%. But, IBM has returned 4.49% in the past year compared to -15% for the Vanguard Information Technology ETF.

It is safe to say that IBM’s returns have been disastrous in the past decade. IBM has now turned around its business and has a clear strategic direction. This new strategy at IBM should yield positive returns for investors in the coming years, but I do not expect to double my money in the next three to five years. I do expect that IBM will have annual total returns in the low to mid-double digits.

Exhibit 4: IBM Monthly Price Change (%) [June 3, 2019 – June 30, 2022]

IBM Monthly Price Change (%) [June 3, 2019 – June 30, 2022] (iexcloud.io, author compilation)![IBM Monthly Price Change (%) [June 3, 2019 - June 30, 2022]](https://static.seekingalpha.com/uploads/2022/7/10/saupload_ylBi_yocgVntDcO0--uayno9GkZ9awLqUNAvp84rNB0VViEmn67n3UCVgMTbZs7az6OwsDlgmetsrjKvI1u7GlYKbpeXgSFC_O0I-nOVB8XzObl0uII6SebpBAaGmpxz0JJGfHXfFxizGXPCANc.png)

Exhibit 5: IBM Daily Price Change (%) [June 3, 2019 – July 8, 2022]

IBM Daily Price Change (%) [June 3, 2019 – July 8, 2022] (iexcloud.io, author compilation)![IBM Daily Price Change (%) [June 3, 2019 - July 8, 2022]](https://static.seekingalpha.com/uploads/2022/7/10/saupload_lOrKL-rQAUAwwem8-M14iRdK5P5Ok-KYwx6fusnk1aA8mtD03BH8RKR-9L-2b0WTui94mRFM4IcJhP1XwoyTV0D78cKE-zVe5PvytQWHfgQI5tweu_ks15fw9-HmXxTBLBe4AfwPoQQqItK1l4Q.png)

Future Looks Bright For IBM, Its R&D May Pay Rich Dividends

IBM is long admired for its investments in R&D projects which make risky bets on technologies that have potential. But, the company has not always capitalized on the fruits of its R&D projects. The company’s CEO discussed their quantum computing efforts in the recent earnings call by deploying “the world’s first 127-qubit processor”. Recently, McKinsey & Company highlighted various thorny problems in sustainability and green energy that can be researched using quantum computing. The management consultancy thinks quantum computing will arrive in the second half of this decade.

It also unveiled the first 2-nanometer chip technology that has the potential to pack 50 billion transistors on a chip the size of a fingernail. Many companies in IT invest their R&D dollars in making incremental product improvements. That conservative R&D investment does not yield any groundbreaking technologies or help the company gain much-needed hands-on experience in a specific area. In the end, those companies succumb to technology disruptions. Even though IBM has missed many shifts in computing in the past, the company has a better chance of winning in areas such as quantum computing and the latest semiconductor technologies when it has conducted deep-dive research.

Conclusion

IBM (IBM) has been a disastrous investment for the past decade. But, the Red Hat merger is a success, and the management has executed brilliantly. I am willing to bet that this decade will be prosperous for IBM. IBM’s monthly returns have varied widely over the past three years, with a standard deviation of nearly 7%. I will add to my IBM holdings at $130, which is, coincidently, 7% below current prices. The stock would yield an excellent dividend of 5% at $130. Also, economists expect the U.S. to enter a recession, so there is a reasonable probability that the price may get to $130 or below in the next few months.

Be the first to comment