Korovin/iStock via Getty Images

Earnings Alert

IAMGOLD (NYSE:IAG) is penned in to present Q3 earnings on 9 November before the open. For traders interest in positioning into the event, options prices currently are factoring in a +/- 11.7% move.

Historically, the stock has moved to the downside on the even 83% of the time with an average return of -5.1%. The downside is more accentuated however, with a max drawdown of -23.3% during Q1’s recent report.

Expected earnings move for IAMGOLD is historically skewed to the downside.

Analysts expect the company to post $71M in EBITDA for the quarter.

Analysts estimate sales of ~$277M and EBITDA of ~$77M . Expect the narrative to be very much about Côté Gold’s progress and keep an eye on any signs of project creep, cost over-runs, or other exogenous factors that could adversely impact project inception.

Macroeconomic Perspective

IAMGOLD is Canada’s premier mid tier gold player. The firm boasts balance sheet strength, a compelling new project, despite undertaking a strategic U-turn in its asset portfolio. But save a bullish macro environment, alpha maybe somewhat fleeting. My outlook remains neutral on the company’s current prospects.

Gold’s legacy as the asset go-to during times of economic tension have been lately called into question. A military conflict in the Donbas, extensive Chinese Covid shutdowns, and market volatility from both fiscal and monetary policy should have sufficed to buoy the precious metal.

In conjunction with inflationary pressures, little telegraphed gold’s recent decline. Surely there was enough volatility and inflationary headwinds to witness an all-out investor flight to the safe-haven? Possibly not.

Price action in 2022 has been chaotic but since a fleeting spike at the onset of the Ukraine crisis, the fear hedge has tracked markedly to the downside.

Perhaps anchored by $USD strength which has put a glass ceiling on commodity prices, gold has essentially been range bound between $1600 and $2000 USD/oz since the SARS-COV2 pandemic.

Gold prices have traded in a holding pattern between $1600 to $2000 USD/oz since the onset of the SARS-COV2 pandemic. No obvious upside catalysts appear on the horizon save an easing in US monetary policy.

Any capital deployment in mid tier mining firms needs to be accompanied with a strong outlook on the commodity. Cash flows, project internal rates of return and superlative risk adjusted returns all depend on a positive macro environment.

Increasingly, that appears perhaps limited, particularly considering abundant volatility and risk, consequently leaving gold bugs scratching their heads.

Brief Company Introduction

IAMGOLD is the famed mid tier Canadian gold miner. The ~$720M gold mining venture benefits from a diversified project base, assets in different project life cycle phases, and an enticing new project to boot. Its Côté Gold has promise, on the proviso project economics stack up.

The company’s production, tallying North of 500K oz/ year, relies heavily on deposit rich assets found in Northern Burkina Faso. In combination with its Suriname based Rosebel asset, the lion’s share of revenues are derived from just two projects. Rosebel is penned in for divestiture to fund its new Canadian Côté Gold project geared to deliver investor returns well into the future.

Cost profiles for IAMGOLD assets are on the high side, reflective of the inherent risks linked explicitly to Burkina Faso, with a security situation constantly evolving.

Recurrent military coups forcing changes in government and relentless violence in the Sahel have not only displaced large swathes of the population but made mining ventures both highly risky and incredibly onerous.

Current operating results signal dependence on volumes out of Burkina Faso to sustain company production targets. Rosebel’s divestment & a progressive move towards a new Canada focused project underscores a possible loss of risk appetite.

Essakane

Essakane is essentially the present crown jewel in IAMGOLD’s project portfolio, underpinning some fundamental portfolio diversification issues. Its open pit operation provides most gold production, with estimated life of mine into the back end of the decade.

The firm’s current project profile remains somewhat limited and exposed to political volatility, and a heavily deteriorating security environment in Burkina Faso.

The mine’s position in the far North of Burkina Faso, deep into the red zone, makes for an incredibly risky project. Continued regional violence make personnel movements costly and supply chain design complex and onerous.

Such a project risk profile puts upwards pressure on required returns, emphasizing perhaps reasons why the firm appears to be focusing on its Canadian Côté Gold project for future returns.

This could be perceived as a strategic U-turn by the company or corporate prudence given an extremely fluid political and economic situation at its West African venture.

IAMGOLD Investor Presentation

The Essakane project – IAMGOLD’s current cash cow is in the far North of Burkina Faso, arguably one of the most dangerous places in West Africa prone to extremist violence & lawlessness. Fighting between Islamic militants in the North & Burkinabe government forces have displaced tens of thousands and killed considerably more.

Rosebel

Rosebel essentially makes up the remainder of production. Its Suriname based asset, in the Northern reaches of the South American continent, tallies about 150K oz of gold production. This asset is planned for divestiture as the company looks to secure financing for its Côté Gold project.

The Latin American Rosebel gold play is IAMGOLD’s prime divestment to finance project cash requirements for Côté Gold in Canada. Volumes remain marginal for a surface gold mining operation.

Côté Gold

Côté Gold is the standout in the project portfolio. IAMGOLD’s fledgling Canadian gold mine due for first gold in 2024 will contribute meaningful volumes (~500K oz) following project inception.

Its ~$1.2B project price tag requires solid project economics matched with robust gold prices to drive the bottom line. Any positioning in the stock is synonymous with a wager on IAMGOLD’s ability to retreat from more risky international plays and return to its roots with this marquee gold project.

The company’s flagship Côté Gold play is where present bets are being hedged. IAMGOLD expects this project to deliver multi-decade gold production. Investment in Canada perchance highlights a lack of risk appetite for more perilous African gold projects.

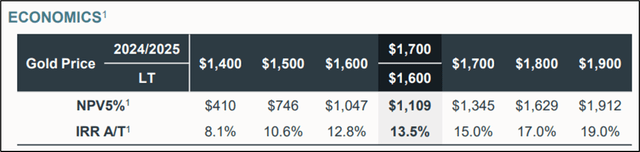

Achieving this seems doable, provided sustained gold prices into the future. The project posts a net present value North of $1B with a double-digit after tax internal rate of return and a payback period before the end of the decade.

The biggest question mark regarding project viability are economic assumptions made by the company. Given persistent upwards pressure on interest rates and a company WACC printing at 6%, using a 5% assumption on cost of project capital could be challenged.

While the project is less risky than its international assets, upping cost of capital assumptions could be merited, dampening overall project economics.

The Côté Gold Project is IAMGOLD’s standout project & a possible drop-the-mic moment as the company retreats from more risky gold plays to the sanctity of Canada’s gold belt.

The project benchmark to calculate an after-tax net present value of 5% seems aggressive given IAMGOLD’s present weighted average cost of capital (~6%) and monetary policy in both Canada & the United States continues to substantively tighten.

The final investment decision implies stable gold prices, rock bottom project capital costs, and best-in-class operational excellence. Not mission impossible, but any changes in scenario will ultimately directly impact economic feasibility and company share price.

Project rates of return assume an aggressive cost of capital number. Naturally, this tends to push rates of return to the upside. Any increase in the discount rate will mechanically lower project net present value.

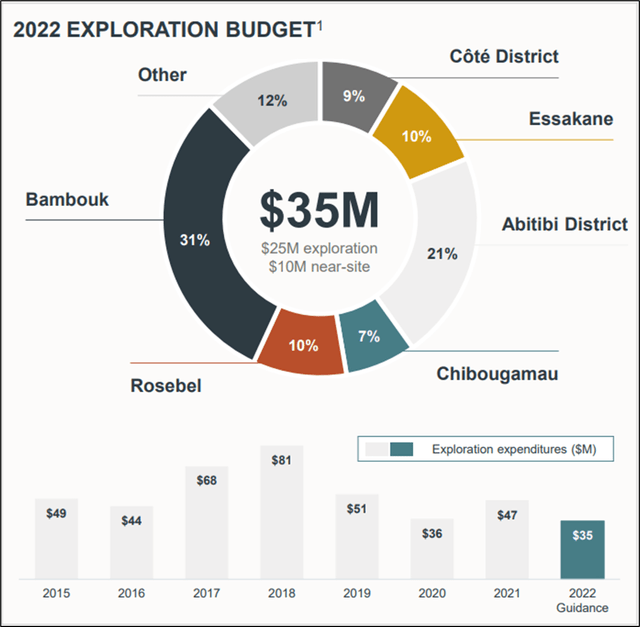

Exploration expenditure has taken a back seat as the company focuses on bringing Côté Gold online. The $35M spend, one of the lowest in recent company history, speaks tellingly for any life extension projects.

This correlates with a focus on new project execution, strategic divestment of select international assets, and a U-turn on company risk appetite. Speculatively forecasting a sale of Essakane once Côté Gold is up to speed does not appear impossible.

Development & exploration expenditure are relatively subdued with $35M in exploration spend being among the lowest for the company in the past decade.

Simplified Income Statement

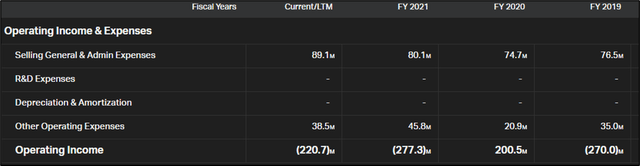

The past 3 years have witnessed annual sales top out at around $1B – $1.2B with volatile net income margins subject to shifting assumptions in depreciation & amortization.

Operating income has swayed accordingly from -$270M in FY 2019, to +$200M the year later. A focus on strategic realignment is likely to see pressure on operating margins until Côté Gold is in full swing.

All-in Sustainable Costs have posted on the high side for comparable gold miners, with the company guiding in the region of $1,545/ oz. 2022 guidance is North of $1,500/oz making price action in gold prices increasingly impactful on the corporation’s bottom line.

IAMGOLD has posted operating losses over two of the past three years. New project expenditure is likely to weigh down company financials until go-live.

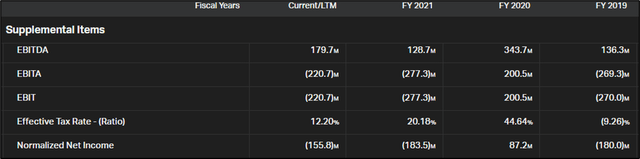

IAMGOLD currently posts EBITDA of ~$150M annually. Volatility in those numbers matched with fluctuating operating income points to assumptions in depreciation of fixed assets as being a contributing factor. This has perhaps been done to optimize the present corporate tax situation.

Positive EBITDA numbers suggest that a sizable part of the firm’s losses are linked to assumptions regarding depreciation of fixed assets.

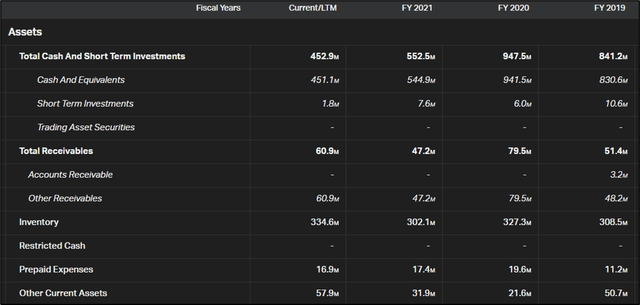

Simplified Balance Sheet

The balance sheet has been beefed up in anticipation of significant Côté Gold project-related capital outflows. Almost $500M is immediately accessible cash with another ~$350M credit facility on tap. Rosebel’s sale to Zijn Mining primed for a Q1, 2023 closure should provide an additional $360M cash injection. Liquidity is undoubtedly a strong point.

IAMGOLD has maintained meaningful liquidity in anticipation of future project expenditures to get the Cote gold project online.

Additional financing will be required to foot the >$1.2B Côté Gold project bill, underscoring meaningful project risk in a tightening credit environment. The firm has hedged major cost inputs linked to foreign currency and oil derivatives.

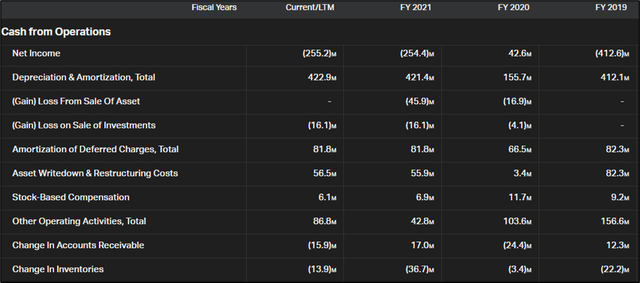

Simplified Cash Flow Statement

IAMGOLD has printed positive operating cash flow given $400M depreciation add-ons over past years. Other operating activities merit additional foot note scrutiny in management discussion and analysis.

Details pertaining to asset write downs & restructuring costs will provide clues on the strategic roadmap for the company in the future.

Future risks

A position in IAMGOLD is steeped in risk, albeit changing. From an international gold miner with productive assets in risky Burkina Faso to a firm with a long-term future in Canada, the company’s strategic ambition paints a retreat from more volatile mining jurisdictions.

Such a strategy can play out positively, provided Côté Gold fires on all cylinders and the project economics are conservative enough. The later seems highly questionable to me, specifically due to changes in the cost of debt.

US dollar strength could be perceived as a double-edged sword – a retreat in the greenback is likely to push gold prices higher but may also adversely impact any revenue streams defined in US dollars.

In summary, in addition to the macro risks facing the gold mining community, IAMGOLD is heavily exposed to a costly gold project in a credit environment swiftly changing. It is highly likely that price action for the stock is intrinsically linked to the success of this project moving forward.

Key Takeaways

IAMGOLD is a mid tier Canadian gold miner with ~500K/oz of production on tap, delivered mainly from mines in Burkina Faso & Suriname. Its pending sale of its Suriname asset underpins a strategic U-turn aimed at financing new projects in less risky jurisdictions.

The Côté Gold project fits the bill, with big production potential at a competitive rate, project success will meaningfully impact the firm. However, questions need to be asked about project economics and assumptions used to cost the project, specifically as credit markets have dried up.

Nothing indicates a meaningful upside in gold prices will take place in the next couple of years. Accordingly, it remains difficult to endorse a company attempting to garner increased operational rewards through a lowering of project risk with substantial changes to the asset portfolio.

Be the first to comment