Charly_Morlock/iStock Editorial via Getty Images

Just over six months ago, I wrote about IAMGOLD Corporation (NYSE:IAG), noting that while the board shake-up and CEO change were positives, there was no margin of safety above $3.00 per share, meaning investors should not chase the stock above US$3.50. Since then, Iamgold has suffered a more than 70% drawdown and continues to be one of the worst performers year-to-date.

While its headline Q3 results might make this seem unjustified, the elephant in the room is the funding gap at Cote, which will require more than a Rosebel sale to fix. Given that Iamgold continues to see declining production growth per share and could see further share dilution to push Cote past the finish line, I see the stock as an Avoid at US$1.70.

Cote Construction (Company Presentation)

Q3 Production & Sales

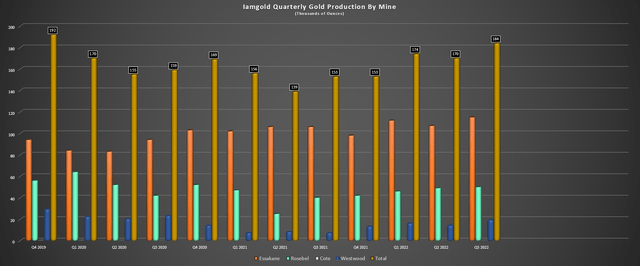

Iamgold released its Q3 results this week, reporting quarterly production of ~184,000 ounces, an 8% increase from the year-ago period. The higher production was driven by a strong quarter from Essakane and an improvement in production levels at Westwood, offset by a mediocre quarter at its now-divested Rosebel Mine in Suriname. This solid quarter has pushed Iamgold’s full-year production to ~528,000 ounces, prompting the company to raise its FY2022 guidance to 650,000 to 705,000 ounces, well above its previous range of 570,000 to 640,000 ounces. Normally, this would be commendable, but Iamgold provided a very low bar for the year that it was able to step over after a significant miss in 2021 (601,000 ounces produced vs. 665,000-ounce mid-point).

Iamgold – Quarterly Production by Mine (Company Filings, Author’s Chart)

At Essakane, production was up 9% on the back of higher grades and a significant improvement in recovery rates (90% vs. 83%). This looks to be due to processing less ore with higher graphitic content. Although all-in-sustaining costs [AISC] at the mine were higher year-over-year ($1,248/oz vs. $1,033/oz), this was largely due to much higher sustaining capital in the period. Moving to Westwood, production increased by over 170% to ~19,000 ounces, helped by higher throughput and head grades due to increased tonnes and grades mined from the underground. Finally, at Rosebel, production was up, but its performance is less important, as this asset will no longer be in the portfolio next year.

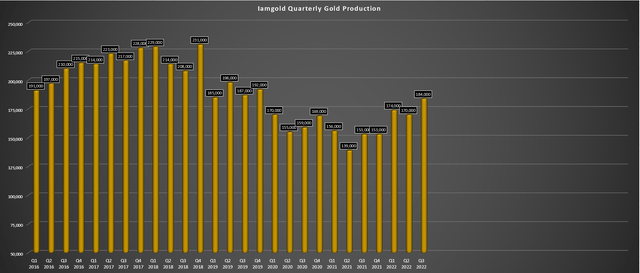

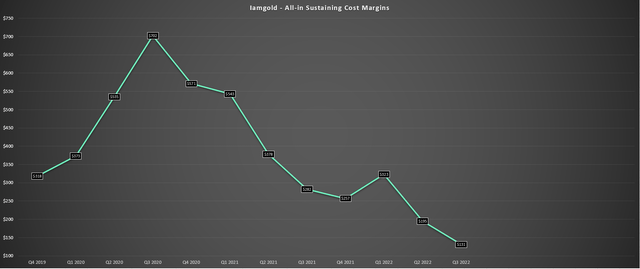

Iamgold – Quarterly Gold Production (Company Filings, Author’s Chart) Iamgold Shares Outstanding (TIKR.com)

While the higher production results at continuing operations might please some investors, it’s important to put them in context. As we can see, Iamgold has seen steadily declining production on a trailing five-year basis, and its share count has continued to climb in the period, leading to a sharp downtrend in production per share. Some investors might point out that this will change dramatically when Cote comes online, but this is no longer the case. The reason is that I’m less optimistic that Iamgold can keep its share count below 600 million regarding capital needed to complete construction at Cote. Plus, the sale of Rosebel will offset future production growth from Cote.

As I’ve discussed in previous articles, one is usually better off owning physical gold than owning producers that aren’t growing production per share, given that their leverage to gold is continuously declining, which is the whole point of owning producers. So, with Iamgold continuing to have a poor track record of production growth per share, I don’t see any reason to be elated with the stronger Q3 production results, which have changed nothing in the bigger picture.

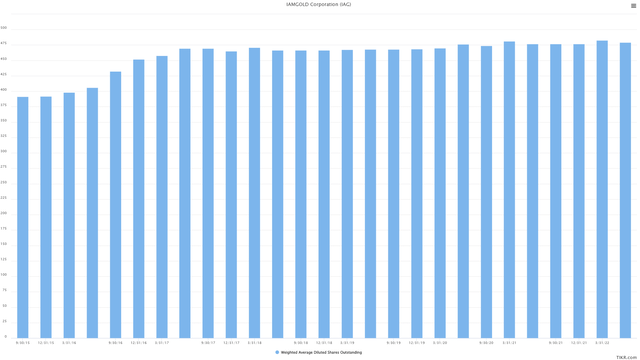

Margins & Financial Results

If we look at margins, the results were much less pretty. Iamgold’s AISC came in at $1,559/oz, which was only down year-over-year (Q3 2021: $1,604/oz) due to being up against brutally easy year-over-year comps. However, with a lower average realized gold price ($1,690/oz vs. $1,799/oz), AISC margins plunged to just $131/oz vs. $195/oz in the year-ago period. These are razor-thin margins, especially since this was a very strong quarter for the company, with higher sales and a higher denominator. Hence, from a margin standpoint, Iamgold continues to be much weaker than its peer group (average AISC margins of ~$470/oz in FY2022).

Iamgold – All-in Sustaining Cost Margins (Company Filings, Author’s Chart)

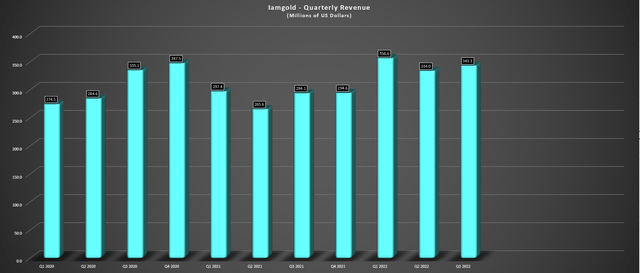

Moving to revenue, Iamgold reported revenue of $343.3 million in the period, an improvement from $294.1 million in Q3 2021. This was related to an increase in ounces sold offset by a lower average realized gold price in the period. Meanwhile, mine-site free cash flow improved to $59.2 million, up from $42.8 million in the year-ago period. However, despite the stronger financial results, money continues to go out the door due to higher sustaining capital and elevated expenditures related to the Cote Project construction. At the end of Q3, Iamgold had net debt of $409 million, up from $223.1 million last year, and liquidity of ~$640 million.

Iamgold – Quarterly Revenue (Company Filings, Author’s Chart)

Recent Developments

Iamgold noted that construction at Cote is now 64% complete, with the first production from the massive Tier-1 jurisdiction mine expected in early 2024. While this is expected to be a transformative asset from a cost standpoint with a much lower AISC than its current production profile, it will have less of an impact from a production standpoint, with nearly 200,000 ounces per annum shaved off its annual production profile from the Rosebel sale. For those unfamiliar, Iamgold announced the pending sale of Rosebel for $360 million in cash and $41 million in equipment lease liabilities.

For a Tier-2 jurisdiction asset with 3.83 million ounces of reserves, Iamgold got a wonderful price at a value of ~$105/oz, well above what I had expected for an asset that’s expected to produce at an average cost of $1,350/oz (pre-2022 inflationary pressures). While not apples to apples, given that Hope Bay needed more work, this was a very favorable acquisition price compared to the ~$65/oz paid by Agnico Eagle Mines (AEM) for assets in a Tier-1 jurisdiction (TMac in Nunavut) and an estimated net asset value for Rosebel ($1,750/oz gold price) of less than $275 million. The favorable terms for the Rosebel deal have helped close some of the funding gap on its Cote Project construction. Still, with barely $600 million in liquidity and up to $1.1 billion in required attributable spending to completion, I still see share dilution as a risk. Let’s take a look at the valuation next.

Valuation

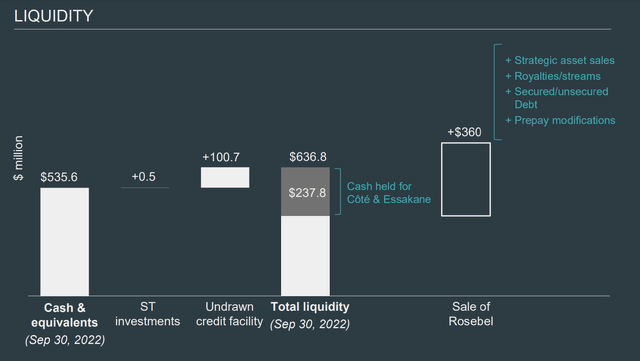

Based on ~484 million fully diluted shares and a share price of US$1.70, IAMGOLD trades at a market cap of ~$823 million and an enterprise value of $870 million when accounting for net debt and the receipt of $360 million from the Rosebel sale. This figure compares favorably to an estimated net asset value of ~$1.31 billion (Cote [+] Gosselin upside [+] Essakane [+] non-core assets [-] corporate G&A), which leaves Iamgold trading at just 0.63x P/NAV. While this figure may appear cheap compared to intermediate and senior producers that trade at closer to 0.90x P/NAV, it’s important to note that the above share count can’t be relied upon, given that there is a meaningful funding gap in place for Iamgold currently ($1.1 billion left to spend at the high end of range attributable to Iamgold and current cash/investments of $536 million).

Iamgold – Liquidity (Company Presentation)

Assuming that Iamgold was to raise $300 million to help reduce its funding gap at a share price of US$1.60, this would lead to ~38% share dilution (~188 million shares a US$1.60), and I don’t imagine this would be received well by the market. So, with this significant risk of share dilution, given that Iamgold has already sold its most significant non-core asset (with only the Boto Project left to sell), I see it as difficult to justify owning the stock here. Based on what I believe to be a fair multiple of 0.85x P/NAV and an estimated net asset value of ~$1.31 billion divided by the current share count, I see a fair value for IAG of US$2.30. However, suppose we assume a more conservative share count of ~625 million shares minimum to address the funding gap. In that case, the fair value drops to US$1.78, pointing to a limited upside from current levels.

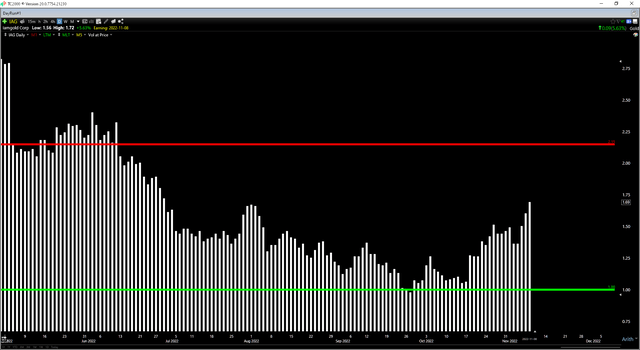

While the current valuation leaves much to be desired after this 70% rally unless Iamgold finds a way to wriggle its way out of this funding gap with minimal share dilution, the technical picture has also become unattractive. This is because IAG now sits in the upper portion of its expected trading range ($1.00 – $2.15), resulting in a reward/risk ratio of 0.64 to 1.0. When it comes to small-cap producers, I prefer a minimum of a 5.0 to 1.0 reward/risk ratio, meaning that this is nowhere near an attractive buy point for investors looking to buy Iamgold.

Summary

In a market where several high-quality producers are on the sale rack and are aggressively buying back shares such as Barrick Gold (GOLD), I don’t see any reason to stoop to owning a company with a risk of significant share dilution and a poor track record of delivering on promises. Besides, companies like Barrick and Agnico Eagle are more diversified and are paying attractive dividend yields to boost total returns.

So, given the opportunity to own exceptional companies at an attractive price or a mediocre company at a mediocre price, I don’t see any way to justify paying up for Iamgold here at US$1.70. In fact, I would view rallies above US$1.88 before year-end as profit-taking opportunities.

Be the first to comment