DarrelCamden-Smith/iStock via Getty Images

2021 was a year to forget for investors in the precious metals space, with the Gold Miners Index (GDX) sinking ~11% vs. a gain of more than 25% for the S&P-500 (SPY). Relative to most other intermediate producers, Iamgold (IAG) managed to outperform, down just over 14% last year compared to a 25% decline for Agnico Eagle Mines (AEM). However, on the back of a pathetic FY2021 performance and an even less impressive 2022 outlook, this outperformance is not likely to continue. At a P/NAV multiple of ~0.75, Iamgold is reasonably valued, if it were an adequate intermediate producer. However, there is a difference between high-quality on sale and cheap for a reason, and Iamgold has proven it’s the latter.

Cote Project Construction Company Presentation

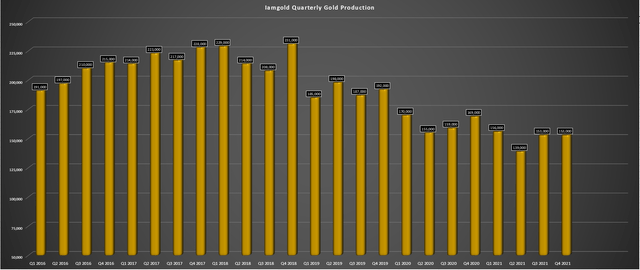

Iamgold released its Q4 and FY2021 preliminary results last week, reporting quarterly production of ~153,000 ounces, which pushed annual production to ~601,000 ounces for the year. While this was in line with its updated guidance, the only reason the company met this guidance was that it moved the goalposts by more than 10% mid-year (585,000-ounce mid-point vs. 665,000-ounce mid-point). If we compare the results to the initial guidance mid-point of 665,000 ounces, Iamgold missed by nearly 10%, resulting from a massive miss at Rosebel (154,000 ounces vs. 233,000 ounces) and a large miss at Westwood. Let’s take a closer look at the results below:

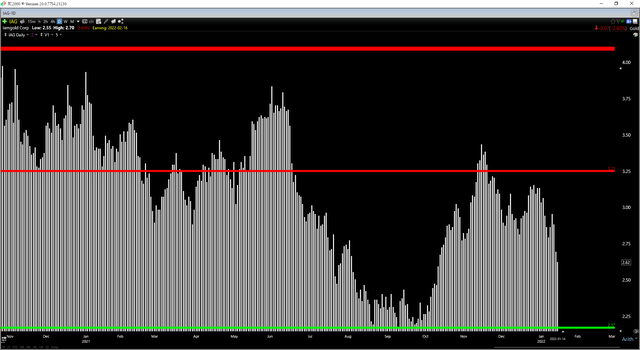

Iamgold Quarterly Production Company Filings, Author’s Chart

As the chart above shows, Iamgold has been the definition of mediocre, as investors have watched production decline from ~228,000 ounces in Q4 2017 to ~153,000 ounces in Q4 2021, translating to a negative 9% compound annual growth rate. In the same period, the best producers like Agnico Eagle have managed to grow production at a 6% compound annual production growth rate and production per share: the more important metric that investors should be watching. This poor performance for Iamgold has been attributed to a massive decline in production at Westwood, with seismicity making it more difficult to mine underground safely, and continued disappointments at Rosebel, which has been unable to perform anywhere near expectations, affected by heavy rainfall, and rising COVID-19 cases in Suriname last year.

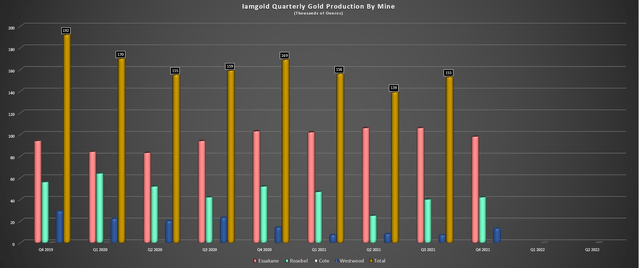

Iamgold Mine by Mine Production Company Filings, Author’s Chart

The one bright spot for the year worth pointing out was Essakane, which produced ~98,000 ounces in Q4 and ~412,000 ounces for the year, a record year for the mine. This helped to pick up the slack from Rosebel and Westwood, which produced a combined ~189,000 ounces vs. their initial guidance mid-point of ~288,000 ounces. However, while Essakane buoyed the 2021 results due to its strong performance, the mine is expected to produce just 372,000 ounces in FY2022 at much higher costs. This is due to increased operating costs related to inflationary pressures, as well as increased costs for security and capitalized waste stripping.

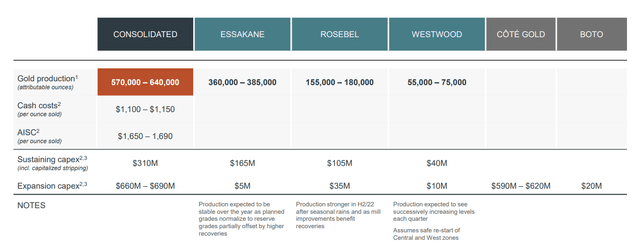

If 2021 was in the rear-view mirror and a much brighter year was on the horizon, it might be worth taking a close look at Iamgold, given that it’s slid 20% since I warned against chasing the stock two months ago above $3.20. However, the 2022 outlook is about as dreary as the company’s lifeless earnings trend, with FY2022 guidance of ~605,000 ounces with all-in sustaining costs of ~1,650/oz to $1,670/oz.

If the company cannot beat this guidance mid-point, this would represent an 18% increase in costs from the FY2021 guidance mid-point of $1,415/oz. It’s important to note that this FY2021 guidance was already revised more than 12% higher from a previous outlook of $1,255/oz. The increased costs can be attributed to inflationary pressures and much higher sustaining capital ($310 million) related to waste stripping and underground development.

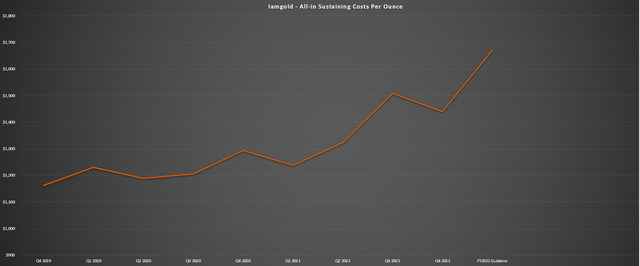

2022 Guidance Company Presentation Iamgold All-in Sustaining Costs Company Filings, Author’s Chart & Guidance

As shown in the chart above, these estimated cost increases for FY2022 have continued the trend of steadily rising costs for Iamgold, making it one of the highest-cost producers sector-wide. At a time when the gold price is struggling to stay above the $1,825/oz level, costs of $1,670/oz are not excusable and don’t inspire much confidence when it comes to generating any meaningful growth in earnings per share next year.

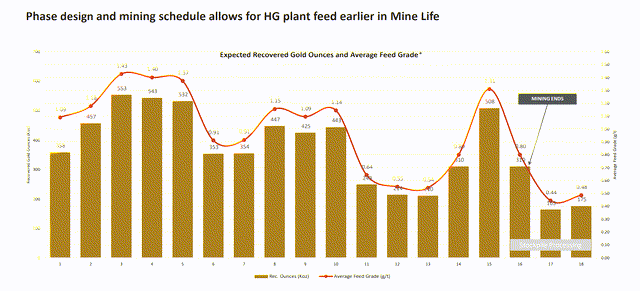

Finally, when it comes to the Cote Gold Project in Ontario, construction is 43% complete, and commercial production remains on track to begin in H2 2023. As discussed in early 2021, this is a transformative asset for Iamgold, with attributable production of ~325,000 ounces for the first five years at all-in sustaining costs below $800/oz. However, this was before a blow-out on capex estimates, inflationary pressures coming in higher than expected sector-wide, and a massive miss on guidance, with the view that Cote would complement a satisfactory operating portfolio.

Cote Production 100% Basis Company Website

With Westwood looking like a ~60,000-ounce per annum operation at best, Rosebel seeing improving production post-2023 but at very high costs ($1,377/oz from 2024/2028), and Essakane being the only asset that’s performing reasonably, Cote looks like more like a band-aid for an inferior operating portfolio. Hence, once Cote comes online, Iamgold simply gets an upgrade from being a clear sector laggard to a sector performer at best. For this reason, I continue to see Iamgold as un-investable.

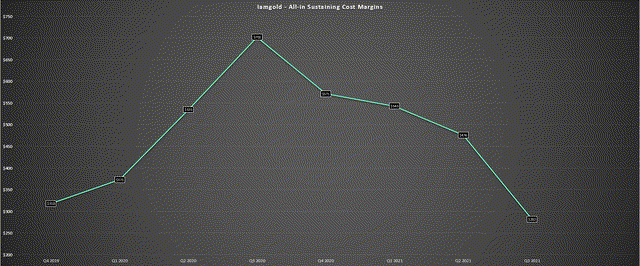

Margins & Earnings Trend

Moving over to margins, we can see that Iamgold already saw a steady decline in margins in FY2021, and this is expected to continue into 2022. This is because all-in sustaining cost margins will be lucky to come in above $225/oz in FY2022 unless the gold price can spend the year above $1,900/oz. If we compare this figure to trailing-twelve-month AISC margins of ~$400/oz, margins should see another nice haircut going into next year, making it even harder for Iamgold to generate meaningful free cash flow or earnings per share. As the next chart will show, this is not an aberration from a strong earnings per share growth trend that can be excused.

Iamgold AISC Margins Company Filings, Author’s Chart

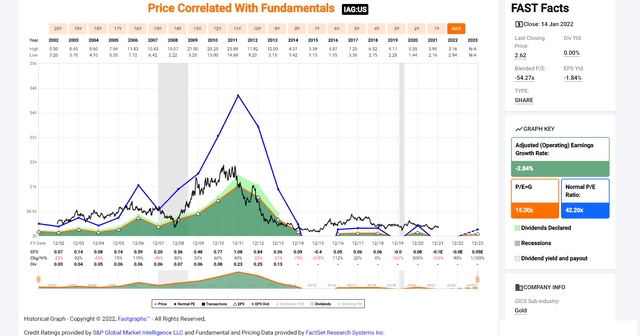

Looking at the below chart, we can see that Iamgold continues to have one of the worst earnings trends among its peers, with annual EPS down more than 90% from FY2011 levels ($1.08) relative to FY2023 estimates ($0.05). While many don’t like using earnings per share for miners, I find it a helpful tool because it tells us whether the company has seen a steady improvement on a per-share basis like production per share. As is clear from the below chart and forward estimates, this earnings trend remains pitiful and is not improving, with FY2023 annual EPS estimates of $0.05 – $0.08. This figure is in line with FY2017 levels ($0.06), when the gold price was below $1,400/oz.

Iamgold Earnings Per Share FASTGraphs.com

Even if we assume a beat on FY2023 earnings estimates and annual EPS of $0.10, this still leaves Iamgold trading at more than 25x 2-year forward earnings estimates. In comparison, investors can buy producers with a strong track record of production per share with industry-leading margins for less than 15x FY2023 earnings estimates, like Agnico Eagle Mines.

Valuation & Technical Picture

Iamgold doesn’t waste an opportunity to remind investors of how cheap it is on a relative basis to its peers. However, I don’t know what the company has done in the past four years that would justify it commanding a multiple in line with peers. In fact, its P/NAV or price to cash flow multiple doesn’t belong in the same neighborhood as peers, given that it’s seen a 30% decline in production from FY2017 levels, while costs have risen from $1,003/oz to estimates of $1,670/oz in FY2022.

Iamgold Valuation Company Presentation

So, while Iamgold trades near 0.75x P/NAV based on an estimated net asset value of ~$1.70 billion and a market cap of ~$1.24 billion, I would argue that this is actually a generous multiple given the company’s track record. Based on what I believe to be a fair multiple of 0.70x P/NAV, Iamgold looks close to fully valued at current levels assuming a gold price of $1,800/oz. At a time when we’re seeing the sector on sale, and more than 50% upside to fair value in some of the best names, owning Iamgold is a massive opportunity cost.

IAG Technical Chart TC2000.com

Finally, looking at the technical picture, the outlook isn’t much better here, with Iamgold trading in the middle of its trading range, with no support until $2.17. When it comes to sector laggards, I prefer to buy at support or lower and would never chase a sector laggard in the middle of its trading range. So, even after the 20% decline, I do not see this as a low-risk buy point for the stock. For Iamgold to become even remotely interesting from a swing-trading standpoint, the stock would need to dip below $2.15 per share.

Iamgold Operations Company Presentation

While many producers like Torex Gold (OTCPK:TORXF) have put up incredible performances despite the global pandemic and executed near flawlessly at their operations from an operational and safety standpoint, Iamgold has failed miserably in the operations department. This is evidenced by another massive miss on guidance, a FY2022 cost outlook that points to further margin compression, and consistently over-promising and under-delivering. Given the poor track record of earnings per share growth and production per share growth, I continue to see Iamgold as un-investable and an inferior way to buy the dip.

Be the first to comment