braclark/E+ via Getty Images

Co-produced with Treading Softly

Oh, hey there! I almost missed you and walked right by. Come on in and sit down. I just finished watering my animals, ’cause dang it’s hot in this heat wave!

It’s been a few months since I tossed a rock into the calm waters of the Seeking Alpha’s reader base with my thoughts.

This quickly became my most read article in 2022, and still clocks thousands of re-reads monthly. Why? Because it struck at the heart of so many investors.

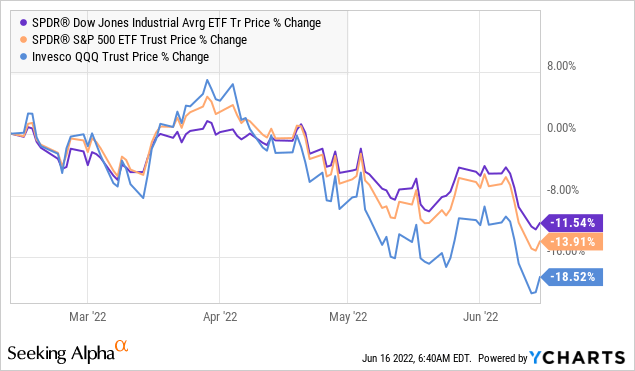

How has our beloved market performed since? Let’s take a gander.

Ah yes, it has kept on falling.

Great right? Well, maybe not for all of us. I acknowledged this too:

The stock market is a place where I find opportunities to add to my portfolio, but like my local flea market, I don’t need to keep going back if I don’t want to. I can keep all I have and not sell a thing, or even have to buy anything I don’t need.

Some of you are forced to go to the flea market, trying to sell your goods and wares to pay for your retirement, sometimes having to take terrible prices to get the money you need.

I offered every reader a different and better path forward, that before the market took another over 10% drop in value. For some of you, this market is wrecking your nightly rest.

Why is that?

You Bought Into The Greatest Lie

It’s true. So many of you were sold a bald-faced lie and unknowingly believed it. What was it? That you need to sell your assets to fund your retirement.

So many are trapped in fear, worry, and panic. They hopelessly cling to the coat sleeves of those who put them in that situation, hoping they can get them through it!

I have another idea, fire them.

The definition of insanity is doing the same thing over and over again, hoping for a different result. If you are forced to sell your assets to pay for your retirement, let this market teach you a valuable and timely lesson. It’s stupid, to put it in plain English. I won’t sugarcoat it. I won’t paint it up in pretty language and words.

Consider this for a second, did you know that nearly half of Americans struggle to save for their retirement, and by the time they decide to get their acts together, it’s an almost insurmountable effort. Why is that? People make all types of excuses for why they do not save for retirement, but often it boils down to two issues:

1. Ignorance, they don’t understand the markets and thus don’t approach them.

2. It simply doesn’t make sense. This is different than ignorance. These people have done some research and find that retirement saving plans, in which you pile up assets earning next to nothing, only to deconstruct that pile hoping its value rises and provides coverage for 30 years of erosion, seems like the dumbest idea on the earth.

Sadly, so many blindly follow it because “learned” individuals have been proclaiming it for decades.

Get Out Of The Present And Into The Past

Going backward often feels like capitulation. You’ve gone so far to go forward only to realize you must backtrack and go to square one. We’ve tried this as an investment community and sacrificed so many retirees’ livelihoods along the way.

By trapping yourself into 4% drawdowns of your portfolio to pay for retirement and hoping it lasts 30 years, you’ve sacrificed perfectly valuable holdings to pay for your meal at Taco Bell. Something you’ll regret twice, once when you’ve realized you sold something you never had to, and the second time will come later.

For many, it’s time to go further back in history to rediscover how you can and should pay for your retirement lifestyle. It shouldn’t be revolutionary, but for many, it will be.

For centuries, the single means to become wealthy was to build up passive and recurring income streams. Money in to cover all the money needing to go out.

Yes, it’s really that simple. That annoying often repeated saying of “live within your means” is based squarely on how to become wealthy for centuries of tried and true practitioners. It wasn’t until recent years that this turned into investing in non-dividend paying companies and hoping they’d double or triple in value rapidly. This fringe idea made some people extremely wealthy because it’s the vogue thing to attempt – who doesn’t like the dream of becoming suddenly wealthy with little effort? The sad reality is that most lose money when they start trying to find the next Netflix or Amazon, and that’s money that is hard to replace for them.

Bitcoin has become a new cautionary tale with various stablecoins collapsing and the Wild West feel of crypto causing retail investors to become the bagholders as the value disappears. So much for being an exceptional replacement for gold, right? Bitcoin has been revealed to be another Growth investment, not a commodity replacement.

This Market Is Your Friend

I wrote previously that I hoped the market dropped even deeper for your sake. It has, you’re welcome!

This market is not the Armageddon to your retirement that so many of you are worried it is going to be. It is a golden opportunity.

This is the perfect time to decide that the current ways are garbage and go back to what worked when you were working, and what worked for your grandparents, and their grandparents.

Invest for dividends and income. Get that passive recurring income and live on it. We are seeing yields elevated due to aggressive selling by panicked investors. The market is actively purging out the weaker-handed investors among us and opening opportunities to get high yields from excellent companies. Yields that only come around once or twice a decade. Yields that can make what’s left of your portfolio into an income-producing juggernaut.

I liken the stock market to a local flea market. Each investor is a vendor or customer. Those selling are looking to sell their wares and many are accepting fire sale prices simply because they’re forced to in an effort to simply put meals on their table. Instead, I can approach this flea market as a customer and enjoy the massive discounts and sales. How can I do this? I get paid for my stock ownership every month, every quarter, every year. My income goes up as I reinvest the excess. It’s going up faster as many of my holdings are raising their dividends like BrightSpire Capital (BRSP), Global Partners (GLP), and a dozen others have so far this year.

This is the key to making the most of a Bear market, or any market. I don’t need a big cash reserve, I don’t need to time the drop, so I can rebuy lower down. I simply buy and hold. I get dividends. I buy more. Repeat. Repeat. All along, my portfolio is growing like a weed.

Conclusion

I so desperately want us all to succeed in the market. Some of you are riding the Titanic into an iceberg and simply refuse to get off of it. That’s your call.

As an income investor, I have plenty of dividends pouring in and cash to buy what others are selling.

You can have this too. The freedom to control when and if you sell anything. The freedom to be financially stable and secure, all while others worry about gas prices and rising grocery prices.

Retirement should be a time of enjoyment, not fear or worry. I don’t need to watch the market’s every move. I don’t need to stress it. I can enjoy my fields, my animals, and my loved ones without ever checking my portfolio. Can you? If not, it’s probably time for a change.

Be the first to comment