gchapel McCoy Cove Project (Company Presentation)

Gold Mining in Nevada

Newmont (NEM) poured its first gold bar at Carlin in 1965, and this was the first gold mine to open in the United States in over 50 years. The mine produced 3.0 million ounces of gold over its first 15 years and has been a major contributor to Nevada being one of the most productive gold districts among the Witwatersrand of South Africa, Murantau in Uzbekistan, Kalgoorlie in Australia, and the Timmins Camp in Canada. Later, in 1980, Newmont began processing material below 0.80 grams per tonne of gold, thought to be uneconomic at the time, by using heap leach pads with leaching technology similar to what was being already being used in the copper industry. This was a breakthrough for the company, which allowed it to extend the mine life of this flagship operation, also helped by new technology and economies of scale.

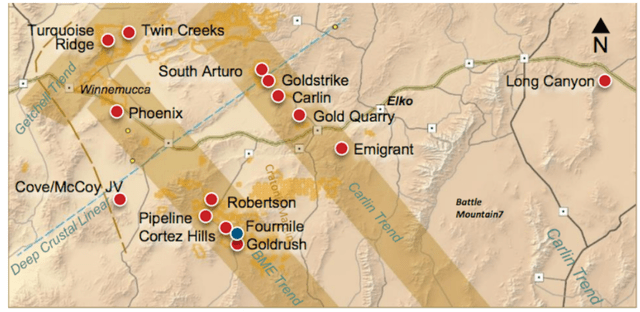

Nevada Gold Trends (Barrick Gold Presentation)

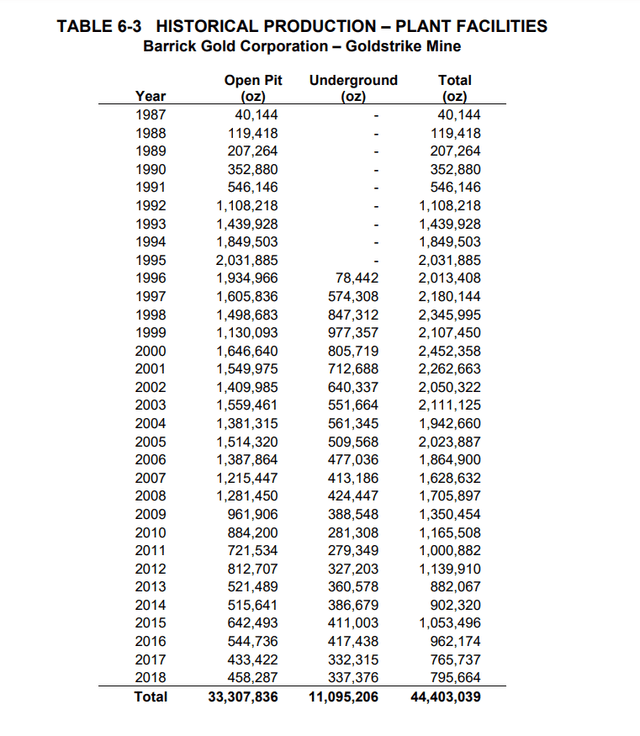

Shortly after Newmont expanded its processing abilities, Meridian Gold and Freeport-McMoran (FCX) developed the Jerritt Canyon property and began mining in 1980. Freeport sold its interest to Minorco (1990), who then sold its interest to AngloGold (AU) in 1998, and ownership was passed around until it finally landed in the hands of Sprott Mining and finally now First Majestic (AG). Around the same time, in the 1980s, Barrick (GOLD) acquired Goldstrike on the Carlin Trend, changed its name to American Barrick Resources, and produced an incredible 16 million ounces of gold in just over 13 years (1986-1999).

At the same time, Newmont had added a refractory ore treatment plant at Carlin, with the roaster heating ore to over 1,000 degrees to burn off the carbon and sulfides that encase ore that wasn’t oxidized. This ended up being an expensive endeavor and going well over budget at more than $300 million but allowed Carlin to continue producing after its initial focus on the low-hanging fruit in its first two decades. This roaster ultimately reached its design capacity of 8,000 tonnes per day in 1997.

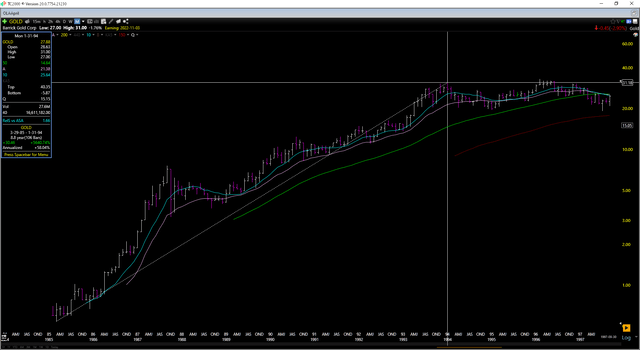

Barrick Gold Chart – 1985-1997 (TC2000.com) Goldstrike Historical Production (Barrick Technical Report)

Given the considerable mineral endowment at Betze-Post, Meikle, and Rodeo, and the fact that Goldstrike was a company-maker for Barrick, with the stock returning 58% annualized from 1985 – 1994 (shown above), we saw many new entrants into the state, many of which developed mines, and others have been looking for economic deposits. However, the focus of other operators (mining, exploration) has been mostly on the Carlin Trend, given its incredible endowment vs. the Battle Mountain Eureka Trend. In fact, I80 Gold’s predecessor company (Premier Gold, before its spin-out of i-80 Gold following take-over in 2021), actually held a 40% interest in a mine on the Carlin Trend, South Arturo (40% Premier Gold, 60% Barrick), which was part of the prolific Carlin Complex.

The problem for new entrants from an exploration standpoint in Nevada is that Barrick and Newmont, even before they merged their Nevada operations (creating Nevada Gold Mines LLC), held a near oligopoly on the district (in addition to Veris at Jerritt Canyon) given that they had the autoclaves/roasters, allowing for the processing of refractory ore. In short, this meant that although operators in the district were more than welcome to hunt down refractory mineralization/sulfides on their properties, there was no benefit to following up on sulfide mineralization because they had no way of processing the material. Refractory ore contains minerals/carbon compounds that trap encapsulated gold, making extraction by leaching difficult, hence why it’s critical to have sulfide processing capabilities in Nevada.

Nevada Gold Mines Operations (Barrick Gold Presentation)

This meant that while exploration/development companies could deliver blow-out headlines with high sulfide grades, there was no way to turn this into gold production and get a re-rating from being a junior to a producer. The pathway to success would be getting a toll-milling agreement with Barrick’s Goldstrike, Newmont’s Carlin Complex/Twin Creeks, or Veris’ facilities, with the latter being the least desirable given how far it was off the trend for most juniors. While this isn’t impossible, Barrick/Newmont are aware that if a junior has zero path to production without their help, they’re better to decline toll-milling agreements and see the juniors’ share price sink if they were to maintain a sulfide focus in Nevada and then buy them out if they truly do have high-grade enough mineralization that’s worth trucking to these processing facilities.

Two things have resulted from this:

• It’s been very difficult for producers to grow in Nevada, the #1 ranked mining jurisdiction, because you can’t grow to Barrick/Newmont’s size, given that it’s much harder to build a 500,000-ounce to 1.0-million-ounce production profile with solely oxide material, that’s often much lower grade.

• The focus for nearly all juniors in the state of Nevada has been on oxide mineralization, which provides for relatively low-capex and easily permittable heap-leach operations, with the drawback being that you’re looking at ~200,000-ounce operations at best with $1,000/oz + costs in most cases, given the sheer volume of rock that must be moved each year – Marigold and Bald Mountain are examples, as is Gold Standard’s Railroad South Project, that was recently acquired by Orla Mining (ORLA).

Enter i-80 Gold

Getting back on track, this is where i-80’s (NYSE:IAUX) story gets interesting and, I believe, is misunderstood. Before starting i-80 Gold, Premier Gold held a 40% interest in the South Arturo Mine (Barrick: 60%), believing that this could be a key asset for Barrick (now Nevada Gold Mines LLC), even though at the time it contributed just ~30,000 ounces of gold annually (attributable portion). It’s possible that Barrick was not scaling up production immediately at South Arturo, given that it would be harder to negotiate to buy out the minority interest of this asset from Premier the larger the production profile became.

Simultaneously, Premier was sitting on one of the best assets in Nevada, McCoy Cove, with over 1.5 million ounces of gold at 10+ grams per tonne gold. Since the creation of i-80, it acquired the Getchell Project (now renamed Granite Creek), which is host to a very high-grade underground deposit (Granite Creek Underground) and a high-grade open pit deposit (Granite Creek Open Pit). However, it had no way of processing the sulfide material from the Granite Creek Underground or McCoy Cove deposits without refractory processing capabilities. As such, i-80 received lesser value for these assets.

With Equinox (EQX) stepping in to acquire Premier Gold, primarily for its Greenstone Project (a massive gold mine now being built in Canada), i-80 Gold’s CEO Ewan Downie had the foresight that he might be able to work something out; it seems. Based on this, he negotiated a deal where he kept the Nevada assets by spinning out i-80 Gold while Equinox parted with Greenstone, Hasaga, and Mercedes.

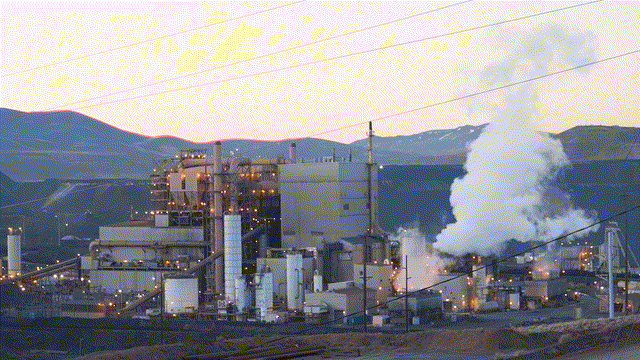

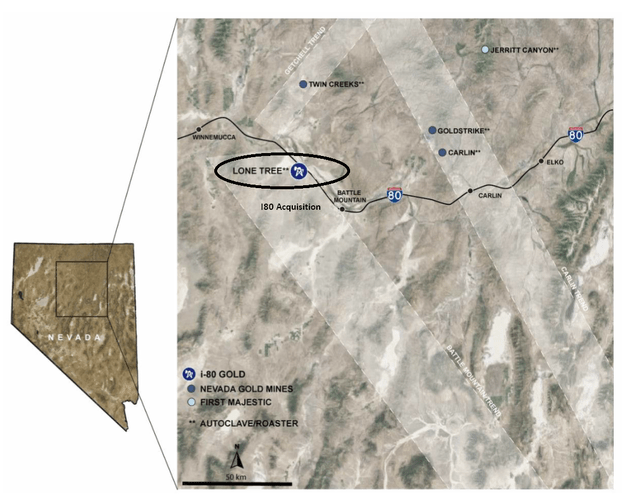

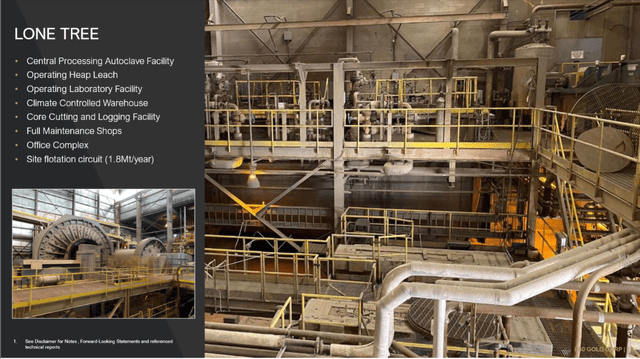

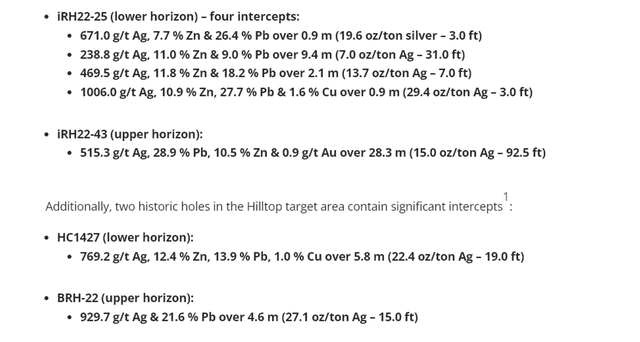

Lone Tree Facility & Other Nevada Autoclaves/Roasters (Company Presentation) Lone Tree Facility (Company Presentation)

Fast-forward to late last year, i-80 Gold used its strategic asset as a bargaining chip: the 40% interest at South Arturo to acquire the Lone Tree Facility on the north end of the Battle Mountain Trend. On the surface, this deal appeared to be giving up a cash-flowing asset, but the results were transformational. The reason is that, unlike every other junior that is processing-constrained and can only hunt down oxide material in Nevada, i-80 Gold has become one of only three companies (First Majestic, Nevada Gold Mines LLC, i-80) with the capability to process sulfide ore with a facility that is in a much better position than First Majestic, given that its plant is more strategically located on the main highway in north-central Nevada, with Jerritt Canyon being in the middle of nowhere compared to Goldstrike, Carlin, Twin Creeks, and Lone Tree (i-80’s newly acquired plant).

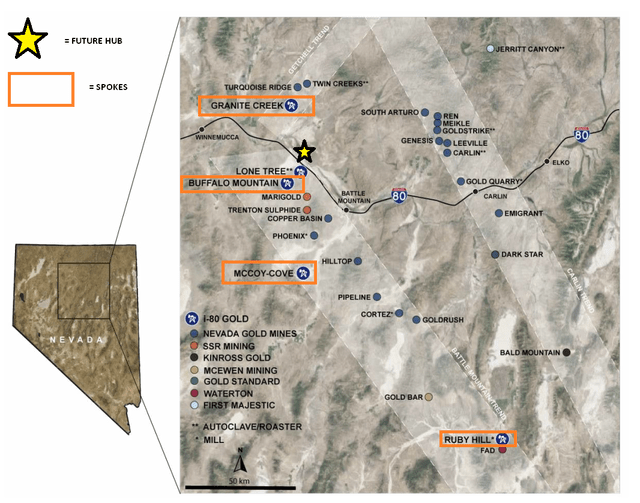

i-80 Gold – Projects & Lone Tree Facility (Company Presentation)

The company is targeting to have this operational by 2025 with refurbishment costs of $200 – $250 million, and a study is underway. i-80 should have no issue financing this, given that it has more than $100 million in cash and could be looking to issue debt to raise the remainder of the capital. Most importantly, though this is permitted infrastructure, and it has unlocked i-80’s ability to process material from Granite Creek (already being mined), McCoy Cove (decline at 650 meters with development underway and water rights secured), and Ruby Hill, that is currently being explored for its sulfide mineralization, that can be easily accessed due to being below an already mined out open-pit.

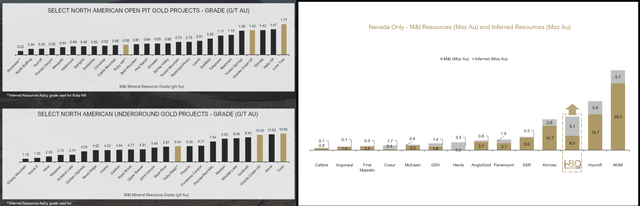

i-80 Gold – Resource Grades & Resource Size vs. Peers (Company Presentation)

As shown above, i-80’s projects rank among the highest-grade in North America, but the differentiator is that these mines (Cove, Granite Creek Underground, Ruby Deep) can be put into production for much less capital than most new mines where one of the main costs is mill capital – since i-80 is simply refurbishing its single acquired plant to process material from all three deposits. In an inflationary period like we’re in currently, this value cannot be overstated. For example, even Skeena’s Eskay Creek (SKE), which is a brownfields project (previous mine), requires more than $450 million to get into first production.

Hence, i-80 is the definition of a mid-tier producer (350,000+ ounces) in junior producer’s clothing (~20,000 ounces), with permits, existing infrastructure, and nearly a rapidly growing resource that already stands at 15 million ounces of gold.

At first glance, some investors might have assumed that the acquisition of Granite Creek was an aggressive move, especially with no processing capacity, as was the acquisition of Ruby Hill, even with processing capacity. However, with the acquisition of the Lone Tree processing plant, and given the exploration success i-80 is realizing at these properties, this could turn out to be the best acquisition sector-wide since Kirkland Lake’s acquisition of Fosterville. The reason is that Granite Creek was acquired for $50 million and Ruby Hill for ~$125 million, translating to a total purchase price of only $175 million for two extremely high-grade projects. Today, the estimated net asset value for these two properties combined sits at closer to $1.0 billion. The reason for this upcoming growth in value is two-fold:

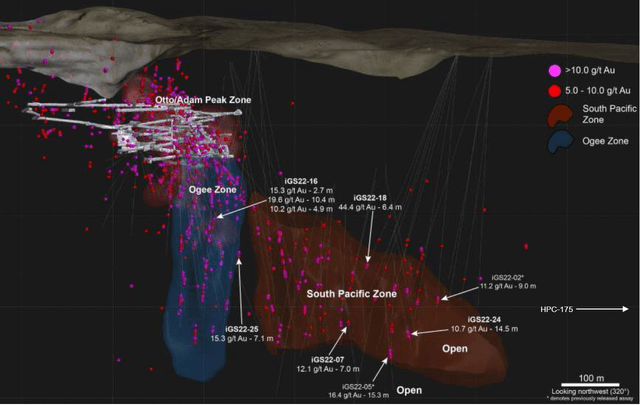

- At Granite Creek, the company has stumbled upon and begun delineating what appears to be a massive new zone, the South Pacific Zone, and has also been adding mineralization at the Ogee Zone. These zones have better ground conditions and appear slightly thicker than the Otto and Adam Peak horizons. Indications are that the South Pacific Zone could extend for another 400 meters to the north, potentially increasing this to a 1.0 kilometer strike, 5-meter width deposit with a minimum 250-meter dip length, suggesting the potential for Granite Creek to triple in size at similar or better grades than current resources. The current underground resource at Granite Creek is ~650,000 ounces at 10.5+ grams per tonne of gold and could grow to more than 2.0 million ounces.

Granite Creek – South Pacific Zone (Company Presentation)

The benefits of this are:

• a de-risked mine plan due to better ground conditions

• a massive increase in the mine life, meaning the ~7-year mine life I had previously been assuming is now looking like 15+ years.

Importantly, Granite Creek lies just south of Nevada Gold Mines’ Turquoise Ridge Mine, which is host to over 10 million ounces of gold, making me cautiously optimistic that there’s still considerable resource growth on deck even after the recent discovery of the South Pacific Zone. However, while the success at Granite Creek is very exciting, the real game-changer appears to be Ruby Hill.

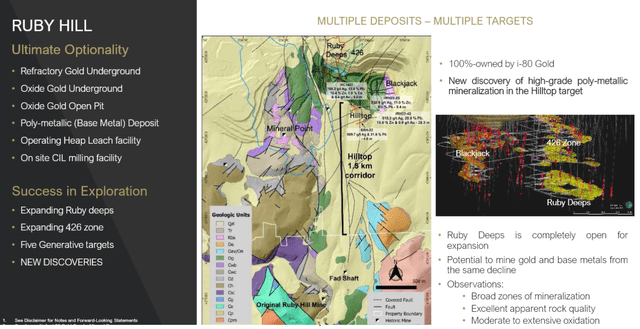

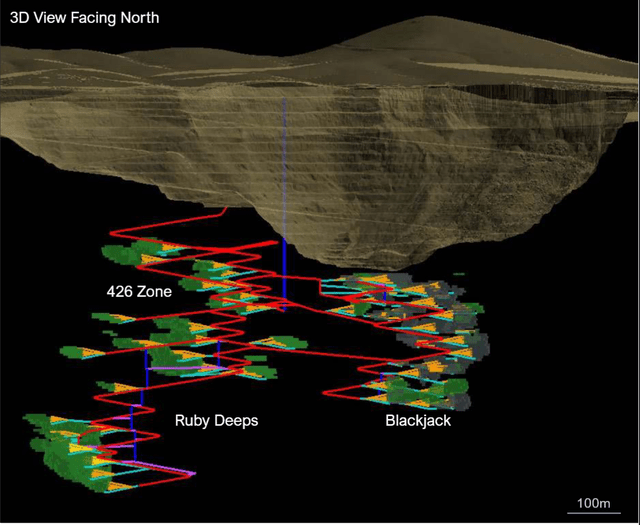

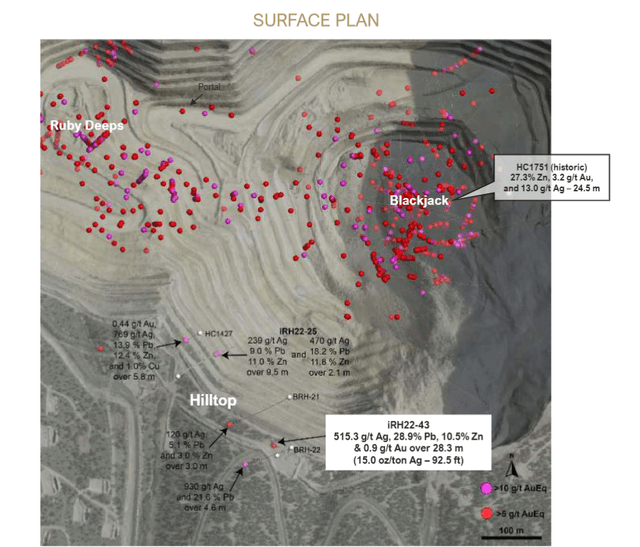

2. Ruby Hill is home to a massive low-grade open-pit resource (Mineral Point – 5.0 million ounces at 0.50 grams per tonne gold, plus an additional 170 million ounces of silver), an underground resource (1.8 million ounces at ~6.0 grams per tonne gold), and previous drilling had identified the potential for a polymetallic deposit to exist on the property (Blackjack). Since its acquisition, the company has hit high-grade oxide at the 426 Zone, extremely high-grade sulfides at Ruby Deeps, and recently hit blow-out polymetallic mineralization at a new target, Hilltop. This Hilltop target is separate from Blackjack (the known polymetallic deposit when Ruby Hill was acquired), suggesting significant potential to expand this resource. For those unfamiliar, the Eureka District has a long 100+ year history of high-grade polymetallic CRD (carbonate replacement deposit) mining.

Ruby Hill Project (Company Presentation)

So, why is this so important?

Once the company’s Lone Tree Facility is full in 2025, with a +2,500 tonne per day capacity or ~1.0 million tonnes per annum, it isn’t easy for i-80 Gold to grow past 300,000 ounces without building a stand-alone project at Granite Creek Open Pit (~$100 million in capex), or without bringing Mineral Point back into production, which is relatively low-grade and would likely have $1,300/oz+ costs, diluting the company’s margins. There is a long-term option, which is increasing the capacity at Lone Tree, but I would assume this to be a 2029 or later opportunity if a decision were made to increase capacity. However, recent developments have added considerable upside potential to this production profile with relatively low capex on the table:

For starters, the upper part of the 426 Zone has high-grade oxide material, and i-80 has an existing CIL plant at Ruby Hill that needs minor work to restart. This could add early oxide production to complete its sulfide production expected from Ruby Deeps, with the potential for a 2-3 year mine life by processing the oxide mineralization from the 426 Zone while sulfides from Ruby Deeps are trucked to Lone Tree. It’s a very nice add-on opportunity with extremely low capex, which could contribute up to 80,000 ounces per annum over three years, depending on grades.

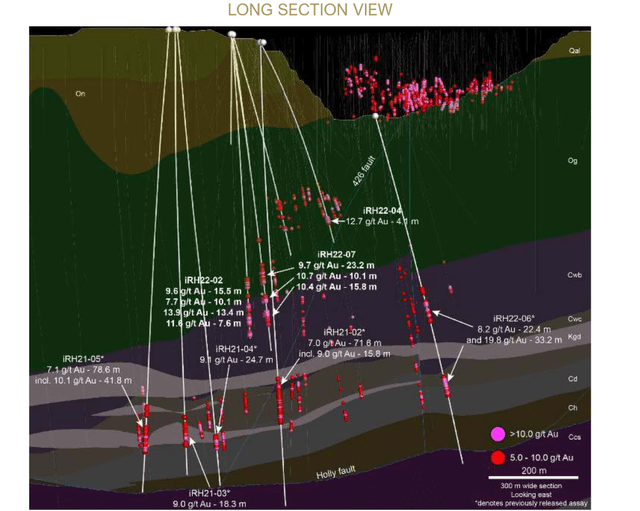

Ruby Hill Sulphides: based on previous owners’ work, it looked like Ruby Deeps might contribute 5.5 – 6.0 gram per tonne material. This would have made it a decent little contributor at 1,000 tonnes per day, but it would have taken a backseat to Granite Creek and McCoy Cove from a production standpoint. However, the drilling at Ruby Deeps continues to regularly assay above 8.0 grams per tonne of gold, with some phenomenal intercepts (33.2 meters at 19.8 grams per tonne gold, 13.4 meters at 13.9 grams per tonne of gold, 12.2 meters at 15.6 grams per tonne of gold, 15.8 meters at 10.4 grams per tonne of gold), suggesting a likely lift to grades of the deposit, and the potential for Ruby Deeps to contribute up to 80,000 ounces per annum at a 1,000 tonne per day mining rate. To avoid confusion, this is completely separate from the 426 Zone. However, there is an upside case.

Ruby Deeps & 426 Zone (Company Presentation)

Suppose i-80 can expand its autoclave down the road. In that case, Ruby Deeps looks bulk mineable given the widths, suggesting the possibility for 2,500 to 3,000 tonne per day mining rates, making this a unique asset that’s not only high-grade but the potential for it to support much higher mining rates than what’s currently being contemplated. So, not only have grades improved considerably vs. resources outlined at the time of the Ruby Hill purchase, but the mine life has potentially doubled from the time of the acquisition. Plus, there’s a 2,500+ tonne per day scenario on the table (~200,000 ounces per annum at 7.5 grams per tonne gold) if i-80 can successfully permit and expand its autoclave at Lone Tree.

I have not modeled this upside case in this developing growth story, given that it’s too far out to be confident in just yet, even if Ruby Deeps continues to over-deliver with each new exploration update. The most recent development is the newly discovered 007 Zone, a significant step-out from recent drilling, with 11.1 meters of 10.5 grams per tonne gold intersected in the initial testing of this zone.

The planned sequence is that Granite Creek Underground material would be processed at Nevada Gold Mine’s Twin Creeks facility before moving to production at Lone Tree by 2025. Shortly after, McCoy Cove should begin production with processing at the Lone Tree Plant while maintaining the additional room at NGM’s roaster facilities for processing 750 tonnes per day. Finally, Ruby Hill Sulfides would follow, with production at Lone Tree once it’s refurbished. This production profile alone would support over 220,000 ounces of gold production in FY2025, excluding production from other deposits like Buffalo Mountain (a small low-grade heap leach opportunity near Lone Tree).

Ruby Hill – 426, Ruby Deeps, Blackjack (Company Presentation)

That said, given the oxide opportunity at the 426 Zone, which could be brought into production by 2024, the 250,000-ounce guidance in 2025 looks more achievable. Following this initial ramp-up, the decision would be whether to build a stand-alone operation at Granite Creek Open Pit, capable of producing ~180,000 ounces per annum at full capacity. The next major decision would be whether it is worth bringing the low-grade massive Minera Point open pit online at Ruby Hill, home to 5.0+ million ounces of gold and ~175 million ounces of silver. While this would have a manageable capex bill given the existing infrastructure, it would likely be margin dilutive but would still generate significant cash flow. However, the polymetallic results out of Hilltop could become a priority over low grades at Mineral Point and might end up being i-80 Gold’s highest-margin opportunity.

As shown above, Ruby Deeps, the 426 Zone, and Blackjack lie near the existing and partially mined-out Archimedes Pit, providing easy access and very low capex growth. This is complemented by an on-site CIL milling facility. However, with two polymetallic opportunities (Blackjack and Hilltop) and a massive untested corridor to the south, i-80 could have the opportunity to delineate a 5.0+ million-tonne polymetallic resource. The important takeaway is that the rock value could dwarf anything i-80 has in its portfolio currently, with its initial drill results from Hilltop having rock values north of $1,100/tonne.

The highlight intercept drilled at Hilltop was 28 meters at 515 grams per tonne of silver, 29.0% zinc, 10.5% lead, and 0.90 grams per tonne of gold. Hilltop is zinc-lead rich with high silver credits. Blackjack is zinc rich with some gold/lead/silver credits. Even if we blend the lower grades from Blackjack and the higher grades at Hilltop but cut down Hilltop’s grades materially, it looks like we could see a deposit with 10.0% zinc, 4.20% lead, and 240 grams per tonne of silver. A quick look at drilling to date suggests these are conservative assumptions, but this would yield a rock value of ~$500/tonne.

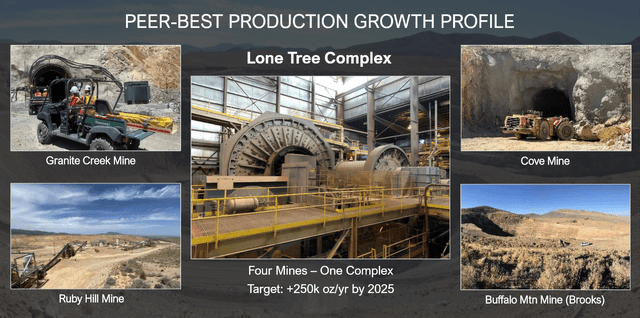

Hilltop Mineralization (Company Presentation) Hilltop Drilling Results (Company News Release)

If this is a much bigger CRD system at Ruby Hill, Hilltop and Blackjack alone could justify i-80’s current market cap. However, I have assumed just 3.0 – 5.0 million tonnes to be conservative. Initial drill results released from Hilltop are shown below:

Based on the potential to retrofit the current Ruby Hill CIL Plant to process base metals once oxide production is complete at 426 and increasing throughput to 2,000 tonnes per day (it has a crushing capacity of closer to 3,000 tonnes per day), this could generate annual revenue of ~$360 million from the base metals opportunity alone. That is the equivalent of ~205,000 ounces of gold at a $1,750/oz gold price, totally separate from Lone Tree, which caps out at 2,500 tonnes per day, or around 250,000 to 300,000 ounces per annum, depending on grades.

This could provide a significant increase to consolidated production in 2027 if the polymetallic opportunity comes to fruition, and it’s very margin accretive, given that there should be a profit of at least $300/tonne at what looks to be conservative grades. At 2,500 tonnes per day, if this has enough scale, the production profile could come in north of 250,000 GEOs. To summarize, a path to becoming a 550,000-ounce+ producer status for i-80 Gold is looking more achievable long term.

A company of that size in the best mining jurisdictional global could easily command a market cap of $2.50 billion. For reference, Wesdome Mines (OTCQX:WDOFF) commanded a market cap of nearly $1.50 billion as a ~150,000-ounce producer in Ontario/Quebec, and i-80 Gold’s results have surpassed Wesdome from an exploration upside standpoint with this new CRD discovery, and given that it already has three high-grade mines on the gold side (McCoy Cove, Ruby Deeps, Granite Creek).

So, while there are many moving parts, and it’s hard to model this far into the future with total confidence, I see the possibility of 600,000+ ounces in the upside case by 2030. Normally, I would be skeptical of a growth story this unique. Still, the team has been over-delivering on promises by miles to date, so I think it is worth modeling what the upside case could be here. In the upside case, this is a company with a net asset value potentially north of $2.40 billion by 2028 once the continued exploration success starts moving ounces into the resource/reserve category. Hence, longer term, I see the potential for a share price of US$7.50+ if the CRD opportunity at Ruby Hill pans out and i-80 can execute successfully on its growth.

Hub & Spoke Model (i-80 Gold Presentation)

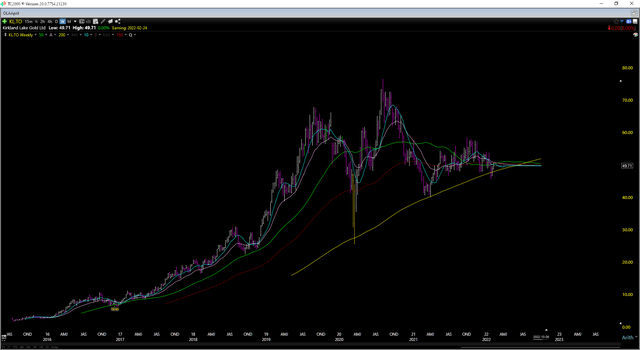

Putting this all together, this story has considerable upside, and even in the base case, I see more than 140% upside. However, the polymetallic opportunity is by far the most exciting, given that it opens up i-80 to a whole class of new potential suitors if it gets big enough. In my view, this opportunity could be similar to Kirkland Lake Gold in Q4 2016 – Q2 2017, when the stock was misunderstood, the sector was getting killed, and the sentiment was not great in the sector after the peak in miners in Q3 2016. In this instance, Kirkland Lake spent about a year at very undervalued levels before the market really woke up to the opportunity.

Kirkland Lake Gold Chart – 2016-2021 (TC2000.com)

Given that i-80 has the potential to go from a small-scale producer this year to a 450,000 – 600,000-ounce producer by the end of this decade with existing infrastructure in place, I think we could see significant outperformance from the stock, which in KL’s case was a 150%+ rally as the story became more understood even in a flat market for the GDXJ, and likely much more if sentiment does come back to the sector. The upcoming catalysts will be the completion of the study at Lone Tree, new resources at South Pacific (Granite Creek) and Ruby Deeps, and continued drilling success across its properties coupled with steady production growth.

Valuation & Insider Buying

i-80 Gold currently has ~240 million shares, but I have purposely modeled ~310 million shares to be ultra-conservative, with warrants (~25 million shares), options (8 million shares), and a convertible loan of $60 million (~20 million shares). Based on all these shares being exercised and the potential for marginal share dilution over the next two years, i-80 Gold has a fully-diluted forward market cap of ~$589 million at US$1.90 (~310 million shares). This figure pales compared to an estimated net asset value of $1.45 billion solely for its gold projects (Ruby Hill, McCoy Cove, Granite Creek, Lone Tree/Buffalo Mountain).

If i-80 were not permitted, had no hope of funding its projects, and had no plant, a P/NAV multiple of 0.50 – 0.70x would make sense, or even lower, given that without the potential to process refractory ore or a toll-milling agreement, it would be hard to assign much value to these assets. However, i-80 Gold has these boxes checked and also has two processing agreements from Nevada Gold Mines as part of its deal while selling South Arturo, meaning it can process double-refractory ore from McCoy Cove over the next decade and can generate revenue from Granite Creek/McCoy Cove while refurbishing Lone Tree.

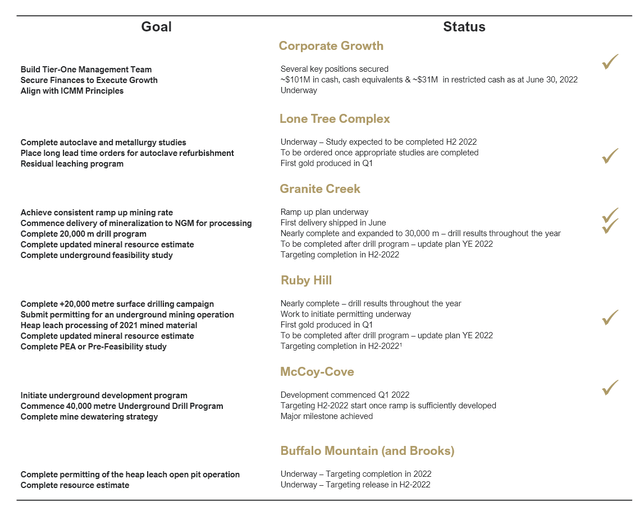

i-80 Gold Scorecard (Company Presentation)

This is a huge benefit and highlights CEO Ewan Downie’s deal-making capabilities. In my view, this justifies a multiple of 1.0x P/NAV when combined with the fact that i-80 Gold has the best growth profile sector-wide, with the potential to grow production from ~70,000 ounces in FY2023 to ~220,000 ounces in FY2025, up to 350,000+ ounces in FY2026, and 400,000+ ounces in FY2028. These are base case assumptions, with the upside case potentially being 550,000+ ounces in FY2028. The result is an industry-leading 40% plus compound annual production growth rate. It’s worth noting that Kirkland Lake Gold, with a similar industry-leading growth story in a Tier-1 jurisdiction, traded at more than 2.0x P/NAV during a bear market for the Gold Juniors Index from 2017-2019. Hence, I believe the 1.0x P/NAV multiple is more than reasonable. At 1.0x P/NAV, I see a fair value of US$4.68, representing more than 140% upside from current levels.

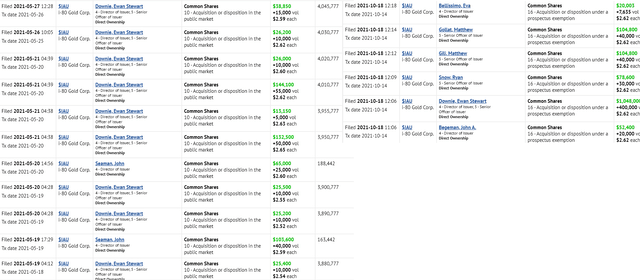

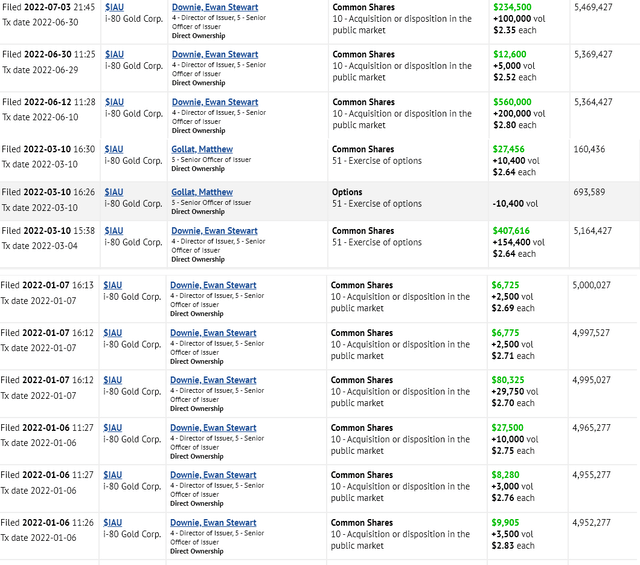

I’d be remiss not to note that the insider buying we’re seeing at i-80 Gold is like nothing I have seen in years in the sector and is a huge divergence from what is typically minimal insider buying, with $100,000 in insider purchases per year for small-cap companies being considered high. In i-80 Gold’s case, insider buying is persistent with significant purchases, with CEO Ewan Downie buying over 570,000 shares last year, valued at nearly $1.0 million. In 2022, insider buying has continued, with over 400,000 shares purchased at prices ranging from C$2.00 to C$2.83, translating to prices of US$1.50 to $2.11. Notably, we’ve also seen buying from the Chief Financial Officer, Ryan Snow (30,000 shares), and the Chief Operating Officer, Matt Gili, with 40,000 shares purchased.

i-80 Gold – 2021 Insider Buying (SEDI Insider Filings) i-80 Gold – Insider Buying 2022 (SEDI Insider Filings)

This vote of confidence in the stock is reassuring and is likely attributed to i-80 Gold having a strong technical team with considerable Nevada experience and exploration results at multiple assets that continue to enrich already high-grade ore bodies. While the exploration success could not be more encouraging and continues to exceed management’s expectations, the technical team is an even more critical piece to the story, which significantly de-risks the company’s growth plans.

For starters, the company’s COO and President is Matt Gili, a Professional Mining Engineer who was Executive General Manager of the Cortez District and Chief Technical Officer for Barrick, bringing key Nevada experience, and COO for Oyu Tolgoi. The company has also retained Andy Cole as Senior Metallurgical & Processing Advisor, who has more than 34 years of experience in mine development, processing, and production and spent 20 years at Barrick’s Goldstrike asset in Nevada. The addition of Andy Cole is a very important piece to the team as it looks to restart Lone Tree, with Andy Cold being autoclave/roaster superintendent, before being promoted to General Manager of Goldstrike.

Finally, the team has retained Tony Carroll as Project Director at Lone Tree and David Westhoff as Project Manager at Granite Creek. In the latter case, David Westhoff brings key experience to the newly producing mine with engineering and underground experience at several Nevada mines, including Turquoise Ridge, a massive mine next door to Granite Creek (FY2021 production: 543,000 ounces). As for Tony Carroll, he could not be a better fit with 30 years of experience in project development, mineral processing, and production, and he was previously Capital Project Manager for Barrick at Goldstrike.

This managerial experience at key Nevada assets cannot be overstated, and combined with permitted assets, existing infrastructure, and CEO Ewan Downie’s base metal experience at Wolfden (he was part of the team with Iain F. Downie and Ian Neill that received the Prospector of the Year Award in 2004 for the discovery of the West Zone at High Lake), I see a very bright future for the company with limited execution risk. This is an extremely important distinction, given that financing risk and execution risk have been two major issues for juniors in the market. Fortunately, this team has the experience and is much more inflation-resistant, having to refurbish an already built facility vs. starting from scratch with a $500+ million capex like some other developers.

Summary

To summarize, I don’t recall the last time I saw an opportunity this interesting outside of Kirkland Lake Gold in 2017. While it might seem too good to be true and a complex story, it’s a relatively simple Hub & Spoke model that’s been employed on the neighboring trend, with multiple mines feeding a centralized plant (McCoy Cove, Granite Creek, Ruby Deeps set to provide feed for Lone Tree, with incremental production from the 426 Zone at the existing CIL Mill at Ruby Hill). The bonus to the thesis, of course, is the CRD potential, with the possibility to process this on-site by retrofitting the Ruby Hill CIL Mill, which looks to be completely ignored by the market despite world-class grades in first-pass drill results at Hilltop.

Hilltop Mineralization (Company Presentation)

Given that I see i-80 as a top-5 exploration story and the top emerging producer from a growth standpoint, it is my favorite idea in the sector. So, if we see further weakness in the stock, I would strongly consider adding to my position. However, given how special this story is, even if the stock does continue to trend higher, this is a name where I’d be comfortable averaging up on my position. This is because even if it rallies 25% from here, it would still be trading at a fraction of its long-term potential if the team can execute. Hence, I believe the sector-wide weakness has given investors a gift, keeping a lid on a stock that could easily be trading over US$3.00 already based on its exploration success to date.

Be the first to comment