z1b

Investment Thesis: While revenue and earnings growth for Hyundai Motor are encouraging, I take the view that a reduction in long-term debt would be needed for significant upside in the stock.

In a previous article back in September, I made the argument that Hyundai Motor (OTCPK:HYMTF) may have potential upside ahead, but investors are likely to remain cautious.

My reason for making this argument was that while sales growth of the Hyundai IONIQ 5 EV model was encouraging – overall sales growth last August was still below levels seen in August 2019.

Additionally, with long-term debt levels having increased significantly for Hyundai over the past five years – a rebound in sales growth may not necessarily be sufficient to inspire investor confidence.

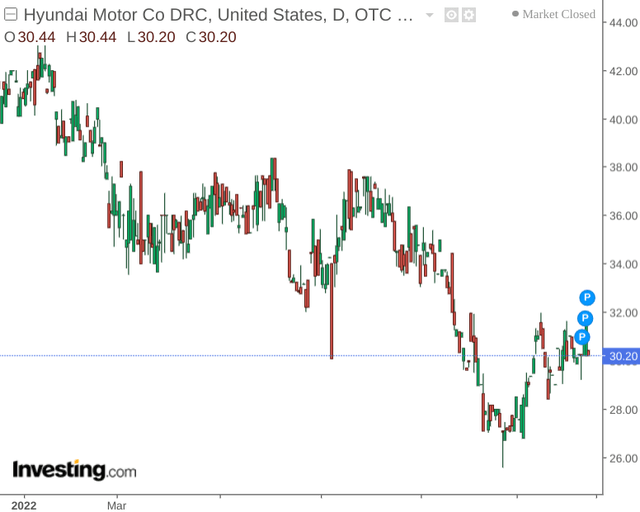

While the stock saw some downside in the interim – Hyundai Motor is trading at a similar level to that of last September:

The purpose of this article is to determine whether Hyundai Motor could have the capacity to see a longer-term rebound in upside from here.

Performance

When looking at the company’s balance sheet, we can see that long-term debt to total assets has increased slightly from December 2021 to September 2022, while this ratio remains at a significantly higher level to that of September 2019.

| Sep 2019 | Dec 2021 | Sep 2022 | |

| Long-term debt | 9,514,831 | 10,667,731 | 13,800,237 |

| Total assets | 191,669,882 | 88,565,366 | 100,638,897 |

| Long-term debt to total assets ratio | 4.96% | 12.05% | 13.71% |

Source: Figures sourced from Hyundai Motor Company Consolidated Financial Statements For The Periods September 2019 and September 2022. Figures provided in millions of Korean won, except the long-term debt to total assets ratio. Long-term debt to total assets ratio calculated by author.

When looking at sales of recreational vehicles for both domestic and international markets, we can see that total domestic RV sales for Hyundai Motor grew by 30% from August to November – but that of the IONIQ 5 did not see growth and as a result accounted for a lesser percentage of overall sales.

Domestic RV Sales

| August 2022 | November 2022 | |

| IONIQ 5 (NE) | 1,998 | 1,920 |

| Domestic RV Sales | 18,921 | 24,707 |

| % of sales | 10.56% | 7.77% |

Source: Figures (unit sales) sourced from Hyundai Motor 2022 Sales By Model. % of sales calculated by author.

However, we saw significant sales growth for the IONIQ 5 internationally, up by 35% since August with international RV sales as a whole up by 25% over the same period.

International RV Sales

| August 2022 | November 2022 | |

| IONIQ 5 (NE) | 5,842 | 7,940 |

| International RV Sales | 50,843 | 63,865 |

| % of sales | 11.49% | 12.43% |

Source: Figures (unit sales) sourced from Hyundai Motor 2022 Sales By Model. % of sales calculated by author.

From this standpoint, sales growth across the RV market has picked up significantly since August in spite of inflationary and macroeconomic concerns. It is also notable that while sales growth for the IONIQ 5 saw growth internationally – the company has not been dependent on this model to lift overall sales growth, which is encouraging.

Looking Forward

Given that the company has recently seen strong growth in the plug-in electric car segment, Hyundai Motor Company could conceivably see this lifting overall sales growth going forward.

In terms of potential risks for Hyundai Motor, we have seen that long-term debt has continued to grow as the company continues to invest in electric vehicle production. While sales growth across this segment has been encouraging, higher debt levels could be of concern to investors if it is perceived that this could hinder investment in vehicle production in the future.

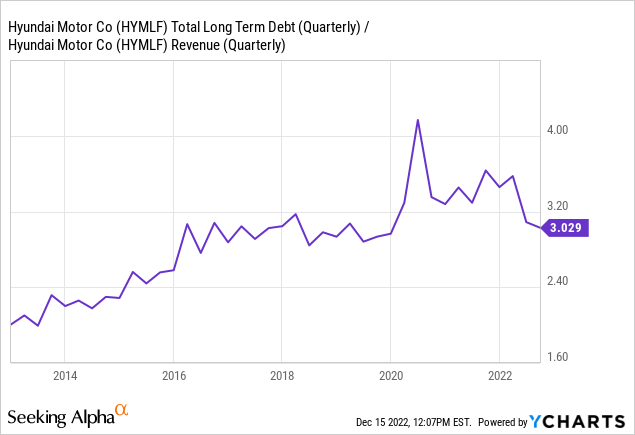

We can see that on a ten-year basis, long-term debt to revenue has seen a steady rise.

ycharts.com

Going forward, I take the view that a reversal in this ratio would be needed to justify long-term upside – i.e. Hyundai Motor needs to demonstrate that it can justify higher long-term debt loads with higher revenue – if not reducing long-term debt outright.

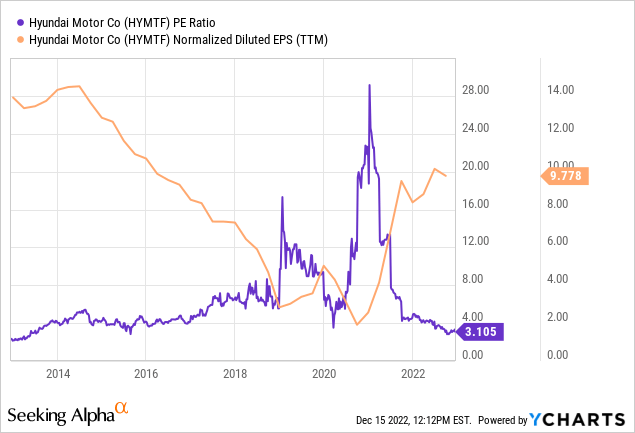

With that being said, we can see that the company’s P/E ratio is at a 10-year low, while earnings per share are recovering strongly from lows seen in 2020.

ycharts.com

In this regard, the stock could be trading at a more attractive value than previously from an earnings standpoint.

Conclusion

To conclude, my overall view on Hyundai Motor is that while revenue and earnings growth are encouraging, a reduction in long-term debt could be a catalyst for significant upside in the stock.

Be the first to comment