halbergman/E+ via Getty Images

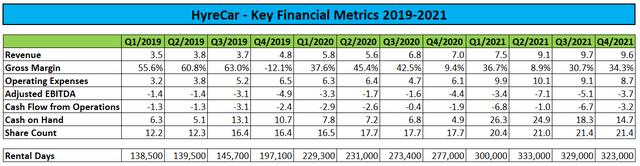

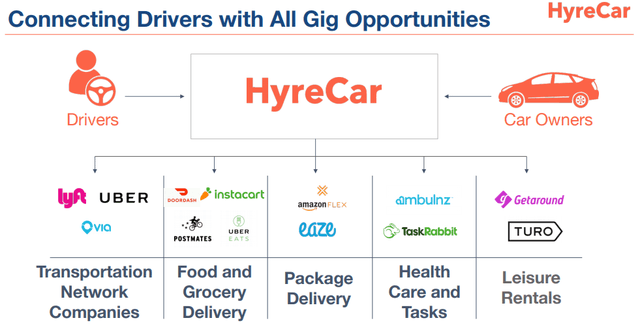

Two weeks ago, niche carsharing services provider HyreCar (NASDAQ:HYRE) reported uninspiring fourth quarter and full-year 2021 results as the company continues to struggle with an undersupply of cars on its platform. As a result, rental days were down for a second quarter in a row.

Particularly the much-touted strategic partnership with AmeriDrive Holdings (“AmeriDrive”) and Cogent Bank hasn’t played out as expected so far.

In recent quarters, the company was required to restrict an aggregate $3 million in cash as collateral for increases to AmeriDrive’s revolving credit facility with Cogent Bank thus reducing HyreCar’s unrestricted cash and cash equivalents to just $11.5 million.

That said, the company made additional progress towards its stated 40% gross margin target for the end of this year and reduced operating expenses further from Q2 highs.

Company Press Releases and SEC-Filings

On the conference call, management pointed to the requirement of doubling the number of cars available on its platform to up to 7,000 to achieve cash flow break-even with annual revenues between $65 and $70 million.

With tightness in the U.S. car market unlikely to ease anytime soon, scaling the company’s platform remains an uphill battle.

At the current rate of cash usage, the company will have to raise additional capital by the end of Q3 at the latest point.

Even worse, management pointed to “some seasonal uptick” in claims during the current quarter which is likely to result in some pressure on Q1 gross margins and cash flows.

Given these issues, I firmly expect the company to start utilizing its recently established $50 million “Equity Offering Sales Agreement” with D.A. Davidson and Northland Securities in the not too distant future.

On the call, management also stated its expectations to secure a warehouse credit facility in the very near future:

And so the way we have addressed that with our larger fleet operators is by trying to facilitate finding options with them, namely our warehousing line that we’re working on right now. I think that warehousing line is very close. As fast as we can, in the very, very near future, we’ll be giving you an update on that. (…)

To be clear on that, HyreCar is a third-party gainer on that financing. And so that main line is being written by — written to our large fleet operators. And they’re going to go out and buy cars.

If successful, the facility might help the company bridging current car market conditions and increase the near-term supply of cars to its platform.

Bottom Line

Given current car market conditions, it’s hard to get excited about HyreCar, particularly when considering the company’s near-term capital needs.

While a warehousing facility could help increasing the number of cars on the company’s platform, it would likely take a couple of months for supply to move up in a meaningful way.

Investors would be well-served to remain on the sidelines until near-term capital needs have been successfully addressed and growth is back on track.

Be the first to comment