artisteer

Thesis

The Western Asset High Yield Defined Opportunity Fund (NYSE:HYI) is a term fixed income CEF. The fund’s main feature is its maturity date of September 30, 2025. Most CEFs are perpetual, meaning that a true buy-and-hold investor can “wait out” any temporary negative performance. Not for HYI. Irrespective of fund performance, the collateral is going to be liquidated during that period and the funds returned to investors. That creates a quandary – is this a positive or negative aspect for investors? On one hand it could be a positive if the fund is bought at a discount, since the discount is going to move to a flat level to NAV upon liquidation, but at the same time a market stress during that period could spell a lower NAV, which would be crystalized.

HYI is not leveraged, and contains a portfolio of corporate bonds, with a small allocation to EM sovereigns. Although the vehicle contains some Russian bonds, they are extremely small in the overall portfolio (around 0.2%). The fund has suffered as rates have risen, and given where the Fed Funds forward curve is, we do not expect the fund to recoup all interest rate loses until liquidation. A retail investor needs to understand there is a difference between the maturity date of the underlying collateral, and the maturity date of the fund. To that end if a corporate bond is now trading at 80% an investor should not expect a pull-to-par upon the maturity date of the fund, because that is not the maturity date of the underlying bond. The maturity date disparity and the credit riskiness in the portfolio accounts for the high yield here.

So what is the advantage for a retail investor to take a position in a non-maturity matched CEF? The only one we can think of is the realization of a substantial discount to NAV. If the CEF is trading at a discount then a term liquidation would move that to a flat level versus the NAV. Otherwise a retail investor is taking an additional market risk, namely the timing risk – if Q2/Q3 of 2025 are marked by a risk-off environment, the fund will ultimately sell collateral at distressed levels, and there is no “waiting it out”.

HYI is a decent fund, but one where the manager actively trades the collateral and one where there is no maturity matching. The increased market risk taken by a retail investor should be compensated by a larger discount to NAV. A true buy-and-hold investor who likes to “wait out” poor market conditions would do well to steer away from HYI because the current structure introduces the risk of loss crystallization during risk-off environments. The best way to trade HYI in our minds is to pick it up at large discounts to NAV. The market will pull that discount to par as the fund approaches maturity in 2025.

Holdings

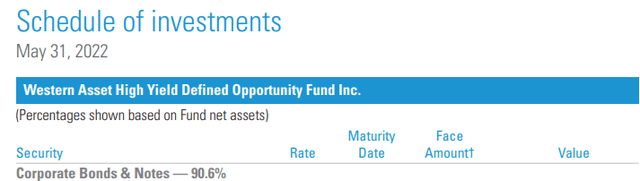

The portfolio is overweight corporate bonds:

Corporate Holdings (Annual Report)

Sovereign bonds and convertibles are the other components of the portfolio.

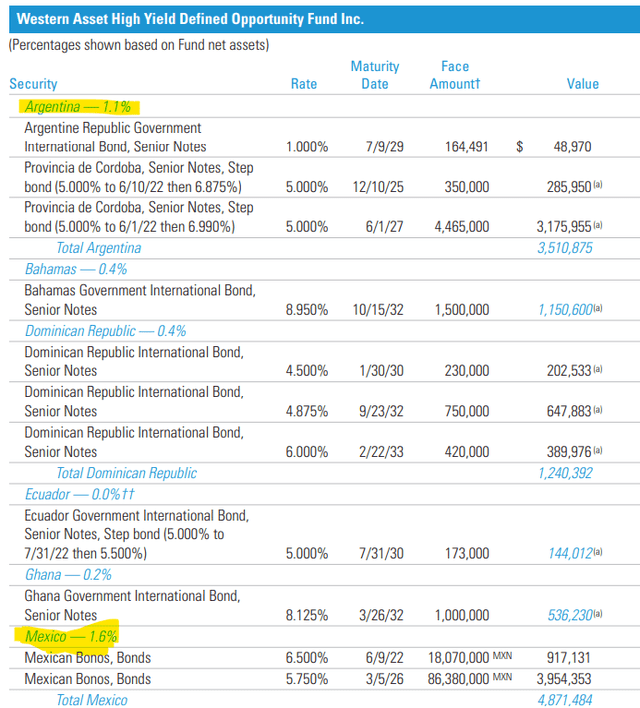

On the sovereign bond side Mexico and Argentina are the largest exposures:

The fund has a very small allocation to Russia of 0.2%, which is negligible.

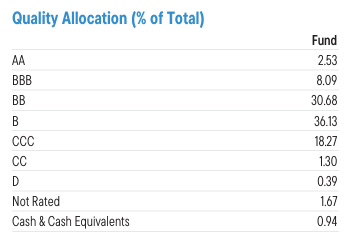

The fund has a middle of the road credit quality allocation, although it does sport a larger than usual “CCC” bucket:

Ratings (Fund)

The “BB” and “B” buckets are roughly the same at around 30% of the portfolio, while there are investment grade credits in the portfolio as well, which balance out the larger than usual “CCC” bucket which clocks in at 18%. Average high yield funds have “CCC” buckets which are below 10%. This CEF obtains more yield via taking additional credit risk here in some distressed credits.

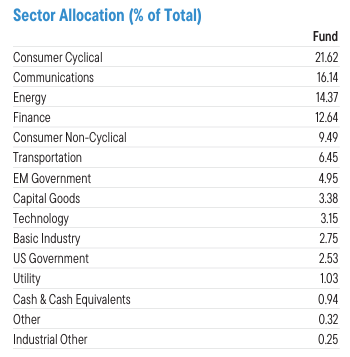

From an industry standpoint the CEF is overweight Consumer Cyclicals:

Sector Allocation (Fund)

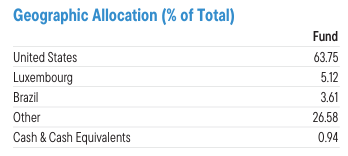

We do not usually like to see sectoral allocations above 15%, but this CEF has a larger than usual top allocation. Most of the fund’s risk is driven by U.S credits:

Geographic Allocation (Fund)

We saw how the vehicle has an EM sovereign allocation, but even the high yield corporate portfolio contains some non-U.S. names.

Performance

The fund is down over -18% year to date:

YTD Total Return (Seeking Alpha)

HYI is not leveraged, yet it has a very similar performance to the Credit Suisse Asset Management Income Fund (CIK) which we reviewed here. CIK is leveraged, with a 34% leverage ratio, and has a similar “CCC” bucket. The differentiator is the leverage loan allocation, with CIK containing around 25% floating rate leveraged loans. The other comparison in the graph, JNK, only has an 11% allocation to “CCC” credits.

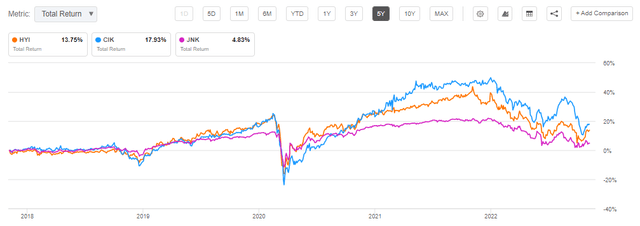

On a 5-year basis the total return profile is similar, with CIK having a close correlation to HYI from a total return perspective:

5Y Total Return (Seeking Alpha)

We did see CIK outperform during the zero rates environment encountered in 2020/2021.

Premium/Discount to NAV

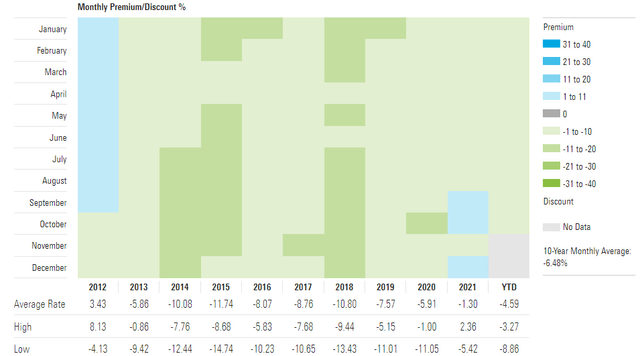

HYI has usually traded with discounts to net asset value:

Premium / Discount (Morningstar)

We have seen the fund’s discount narrow during the past few years, with the fund having actually a premium for a short period in 2021.

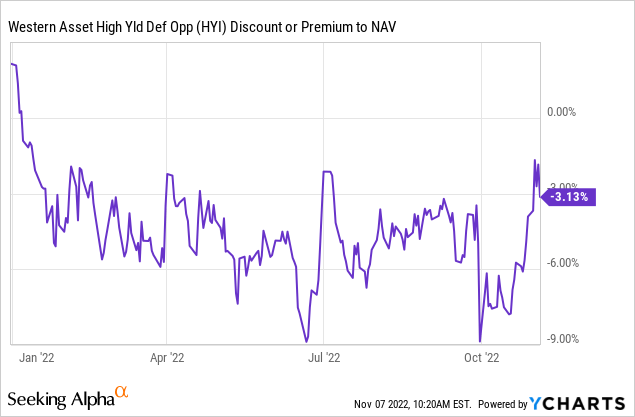

This year the CEF has exhibited a beta to the overall market:

The fund’s discount widened both in June and late September as the market sold off. Expect a continuation of this pattern.

Conclusion

HYI is a fixed income CEF. What makes this fund stand out is its term structure, with the vehicle set to liquidate on or about September 30, 2025. The fund does not maturity match its collateral, meaning the underlying bonds can have and do have very different maturities than September 2025. This basis introduces an additional market risk component in this structure because a true buy and hold investor cannot “wait it out” if there is a risk event in the credit markets in Q2/Q3 2025. HYI is unleveraged, but is currently yielding in excess of 9% due to its large “CCC” bucket of almost 20%. The fund is not for everyone, with the loss incurred by the violent rise in rates this year unlikely to be gained back, given where Fed Funds futures trade for 2025. The best way to trade HYI is to wait for large discounts to NAV to purchase the CEF. Discounts to NAV are going to be gained back when the fund liquidates, hence they represent a guaranteed cushion for any additional market risk taken through the term structure.

Be the first to comment