Vladimir Zakharov

Author’s note: This article was released to CEF/ETF Income Laboratory members on November 29th.

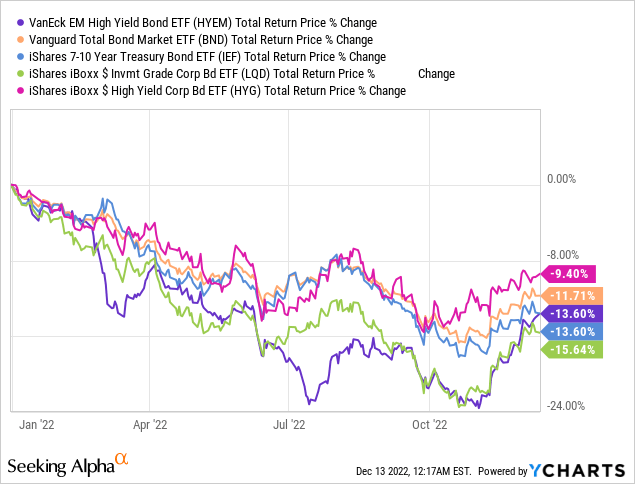

I last wrote about the VanEck Vectors Emerging Markets High Yield Bond ETF (NYSEARCA:HYEM) close to one year ago. In that article, I argued that the fund’s good dividend yield and prospective double-digit dividend growth made the fund a buy. Since then, the fund has slightly underperformed relative to its peers, as worsening economic conditions have caused credit spreads to widen, and high-yield bond prices to decrease. HYEM underperformed expectations, although only slightly so.

HYEM’s recent underperformance was a negative for its shareholders in the past, but is something of an opportunity for prospective investors. HYEM’s dividend yield has increased these past few months, to 6.6%, higher than average for a bond fund. HYEM’s prospective dividend growth remains strong, as interest rates rise. Investors could see some capital gains too, contingent on economic conditions improving, but these are far from certain.

In my opinion, HYEM’s strong 6.6% dividend yield and prospective dividend growth make the fund a buy.

HYEM – Basics

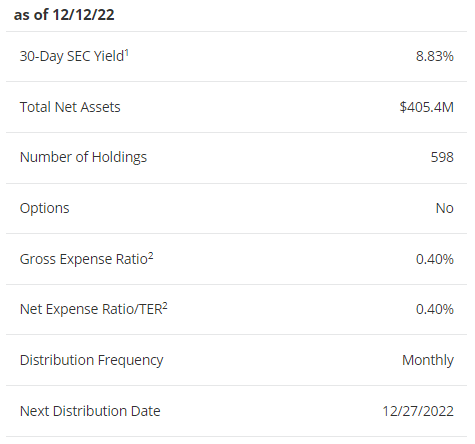

- Investment Manager: VanEck

- Underlying Index: ICE BofA Diversified High Yield US Emerging Markets Corporate Plus Index.

- Expense Ratio: 0.40%

- Dividend Yield: 6.57%

HYEM – Overview and Analysis

HYEM is a high-yield corporate bond index ETF, tracking the ICE BofA Diversified High Yield US Emerging Markets Corporate Plus Index.

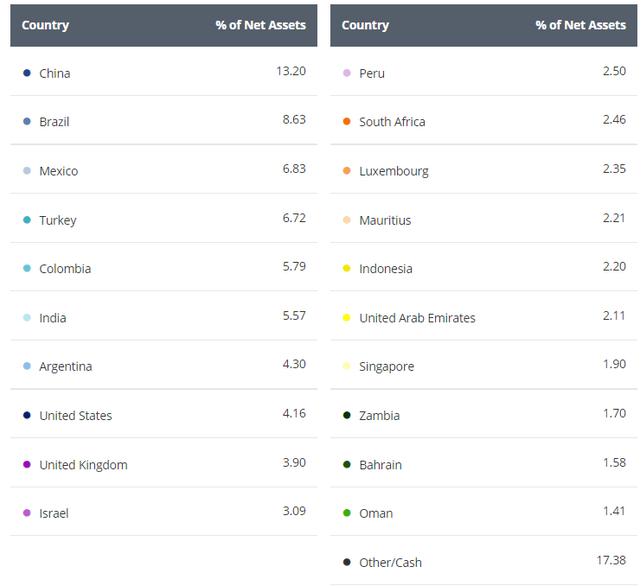

HYEM’s underlying index includes all dollar-denominated non-investment grade fixed-rate bonds issued by emerging market issuers, defined as those with significant exposure to emerging markets. Issuers headquartered in developed countries, but with significant exposure to emerging markets, are included in the index. Applicable securities must also meet a basic set of liquidity, trading, size, and maturity criteria. It is a market-capitalization-weighted index, with country and issuer caps to ensure diversification.

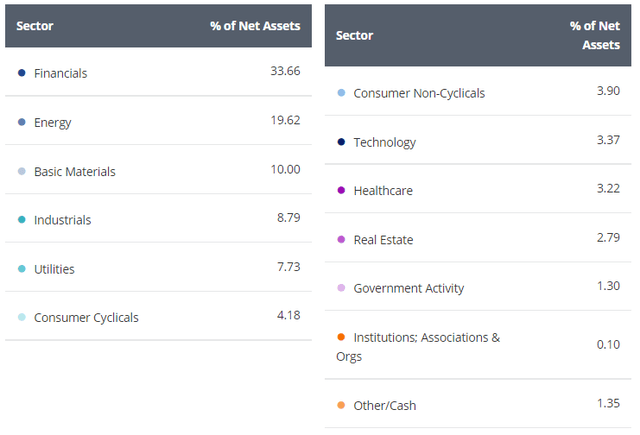

HYEM’s underlying index is quite broad, which results in a well-diversified fund. HYEM has over 600 holdings from dozens of emerging markets, and with exposure to most relevant industry segments. Concentration is reasonable on all counts. HYEM only invests in high-yield bonds, so there is no sub-asset class diversification.

HYEM’s diversified holdings reduce portfolio risk, volatility, and potential losses from the default of any individual issuers.

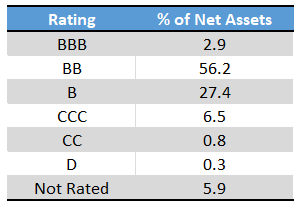

HYEM focuses on non-investment grade bonds, with these accounting for over 90% of the value of the fund. Unrated bonds, and recently uprated BBB bonds are the reminder. BB is the median rating, as is common for non-investment grade funds.

HYEM – Chart by Author

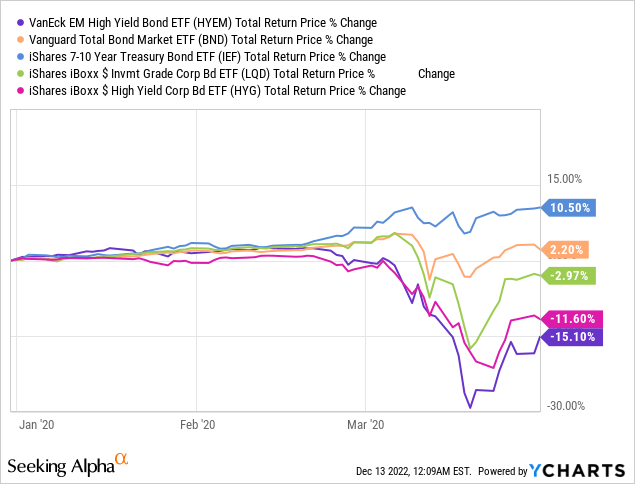

Low credit ratings are indicative of risky securities with high default rates, issued by companies with weak financials and balance sheets. Securities rated BB and B, which encompass most of the fund, are almost always at no risk of short-term default, but risks materially increase when economic conditions worsen. Focusing on emerging market bonds boosts risks and potential losses further. Expect higher default rates and significant losses during downturns and recessions, as was the case during 1Q2020, the onset of the coronavirus pandemic. HYEM significantly underperformed relative to most bond indexes during said time period, but only moderately underperformed relative to high-yield corporate bond indexes.

Diversification is particularly important for riskier bond funds, so as to prevent catastrophic losses from the (eventual) default of any specific issuer. HYEM’s underlying holdings are risky enough that at least some will almost certainly default in the coming years, so limiting the fallout is incredibly important.

On a more positive note, HYEM’s underlying holdings have relatively low interest rate risk, with a duration of 3.5 years. Low duration reduces capital losses when interest rates increase, an important benefit, and one which is particularly important when interest rates are rising, as they currently are. Due to this, HYEM should outperform when interest rates increase. The fund has not outperformed during the current hike cycle, as worsening economic conditions led to wider credit spreads. In simple terms, the fund’s high credit risk outweighed its low interest rate, so far at least.

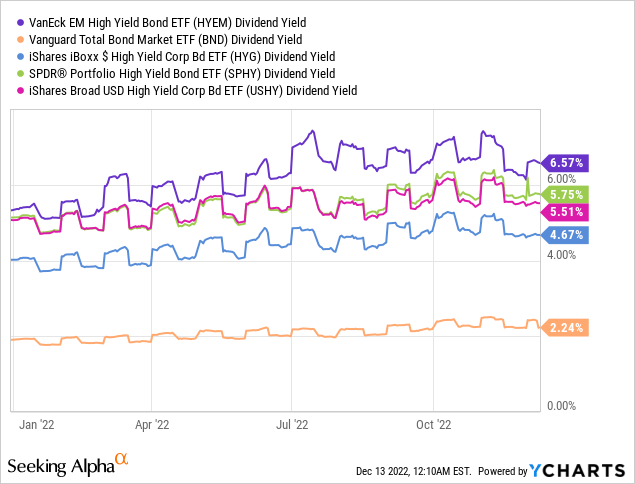

HYEM’s bonds are relatively risky, but also relatively high-yielding, with the fund currently sporting a 6.6% dividend. It is a good yield on an absolute basis, significantly higher than the bond index average, and slightly higher than the high-yield corporate bond average. Strong yield all around.

HYEM’s yield is quite strong, and should see strong dividend growth moving forward, due to higher U.S. and emerging market interest rates. HYEM currently sports an SEC, a standardized measure of short-term generation of income, of 8.80%. ETFs generally distribute any and all income generated to shareholders, so fund dividends should increase to around 8.80% in the coming years.

HYEM

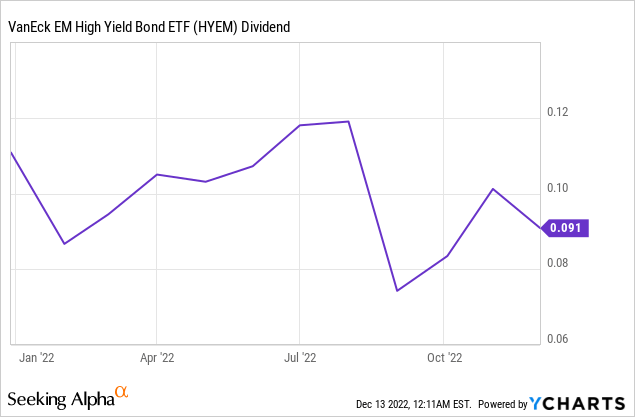

On a more negative note, HYEM’s dividends are incredibly volatile. The volatility itself is a negative for most investors, especially retirees who might depend on dividends to fund their retirement. Dividend volatility also makes it difficult to estimate dividend growth figures for the fund. Seeking Alpha says dividends are flat for the past twelve months and that does seem to be the case eyeballing the graph, but monthly dividends have grown YTD, as have monthly dividends from early 2021 to now.

In any case, it does not seem like HYEM’s dividends have growth these past few months. Evidence would be much more conclusive if this were the case.

Notwithstanding the above, I’m confident that the fund’s dividends should see growth moving forward. Interest rates have risen, and the fund is generating more in income than it distributes to shareholders. Under such conditions, dividends are almost certain to grow.

HYEM – Peer Comparison

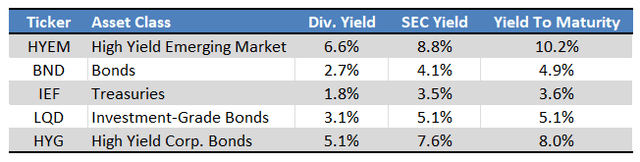

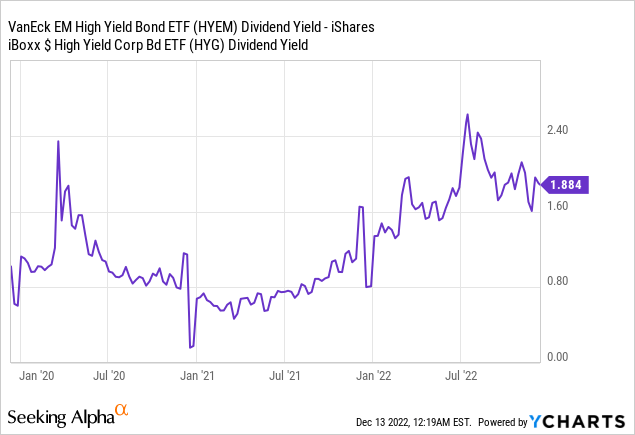

HYEM offers investors a strong, growing 6.6% dividend yield. This is a reasonably good value proposition, but also a relatively common one: approximately all high-yield corporate bond ETFs offer similar, albeit not identical, dividend yields and growth. HYEM’s key value proposition vis a vis these other funds is the fact that its current and expected dividend yields are quite a bit higher than average.

HYEM’s 6.6% dividend yield is higher than average, which means the fund is offering higher dividends to investors right now.

HYEM’s 8.8% SEC yield is also higher than average, which means the fund’s underlying holdings generate more in income / pay more in interest than those of its peers.

HYEM’s 10.2% yield to maturity is also higher than average, which means the fund’s long-term expected returns / dividends are higher than those of its peers.

Confused about the differences between these three yield metrics? Read my in-depth article on the subject here.

Fund Filings – Chart By Author

In my opinion, HYEM’s strong, above-average 6.6% dividend yield should lead to above-average returns moving forward. Although I do think this is the case, I thought the same last year, and have been wrong (so far). HYEM has slightly underperformed relative to broad-based bond index funds and high yield corporate bond index funds YTD, although the difference is quite small, all things considered.

Importantly, even though the fund’s performance has not been all that great, its fundamentals remain strong. There have been no dividend cuts, nor have emerging markets seen significantly increased default rates as of late (economic conditions are not great, but they are not terrible either). HYEM’s dividend is generally a bit higher than that of most high-yield bond ETFs, but the gap is quite a bit wider than average.

Even though HYEM has slightly underperformed expectations these past few months, fund fundamentals remain strong, so I remain bullish.

Conclusion

HYEM’s strong 6.6% dividend yield and prospective dividend growth make the fund a buy.

Be the first to comment