Blue Planet Studio/iStock via Getty Images

Investment Thesis

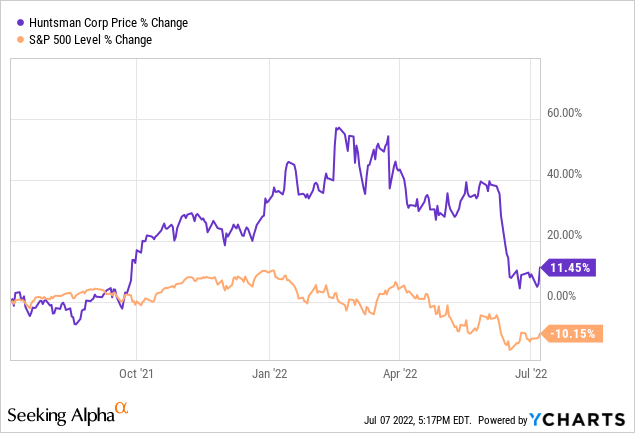

Huntsman Corporation (NYSE:HUN) has outperformed the market in the previous year and YTD but has lost about 18% of its market cap since the start of June against the market’s 5% loss. However, the company’s ongoing strategic initiatives have earned it exemplary financial performance with continuous sequential topline growth and margin expansion since Q2 2020.

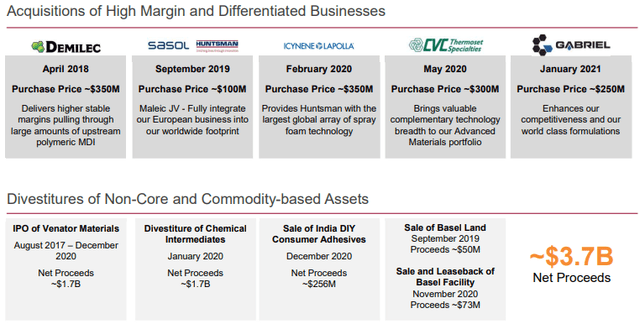

Its accretive acquisitions, cost control measures, cash management, and other strategic initiatives have already started positively impacting the company’s financial performance and position with over $100 million in synergistic run-rate benefits, expected to more than double by the end of next year.

The company’s balance sheet is also in excellent condition with improving debt and liquidity positions, higher-than-average management effectiveness ratios, and aggressive share buybacks.

The Company

Huntsman is a global manufacturer and distributor of over 2000 differentiated chemical products used in a plethora of industries, including synthetic fiber, adhesives, aerospace, automotive, construction, medical, power generation, electronics, insulation, textile chemicals, dyes, etc., and licenses 35 process technologies used in energy, agrochemicals, home and personal care, additives, and performance chemicals. It operates through four segments:

- Polyurethanes: This segment produces Methylene Diphenyl Diisocyanate (MDI), polyols, TPU, and other polyurethane-related products accounting for 58% of net revenue in the MRQ with almost 30% YoY growth;

- Performance Products: It produces specialty amines, ethylene amines, maleic anhydride, and technology licenses, accounting for 20% of revenue with 57.4% YoY growth;

- Advanced Materials: It produces specialty resin compounds; cross-linking, matting, curing, and toughening agents; epoxy, acrylic, and polyurethane-based formulations; specialty nitrile latex, alkyd resins, and carbon nano materials, accounting for 14% of net revenue with 20.5% YoY growth;

- Textile Effects: This segment produces textile chemicals and dyes, accounting for 8% of net revenue with 2% YoY growth.

Geographically, 37% of the company’s revenue is generated in North America with 51% YoY growth in the MRQ, 26.4% from Europe with 31% YoY growth, 28% from Asia with 9% YoY growth, and 8.6% from the rest of the world with 32% YoY growth.

Improving Growth and Profitability

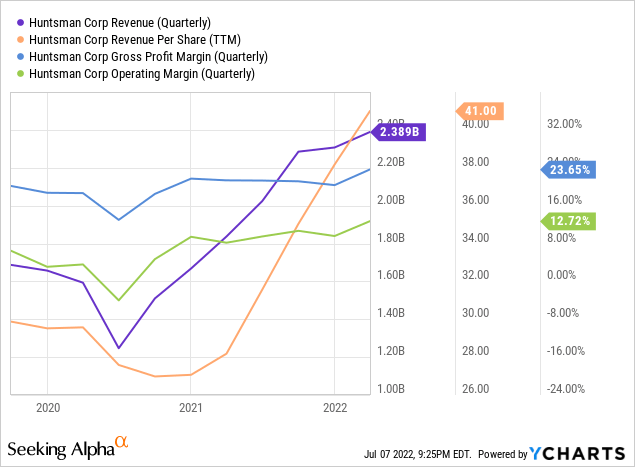

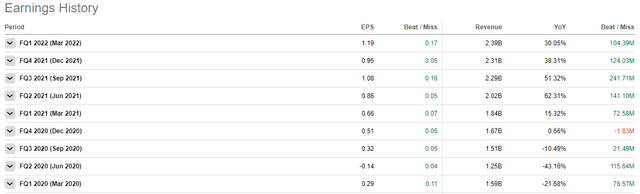

Huntsman’s financial performance has consistently improved post-pandemic, with unhinged sequential improvements since Q2 2020. HUN’s topline growth has been successfully carried down the line as well, with improving margins and a phenomenal 3-year EPS growth CAGR of 60.55%. Most of the growth and profitability have been fueled by a recovering economy and positive industry trends, partially offset by lower demand in China due to the pandemic-related lockdowns and higher input costs.

Its two largest segments, Polyurethanes and Performance products, showed a 4% and 3% sales volume growth driven by automotive, coatings & adhesives, fuels & lubes, and composites demand growth. Declining sales volumes in the Advanced Materials and the Textile Effects segments partially offset this due to the deselection of the low-margin commodity business and the deselection of value products, focusing on downstream products.

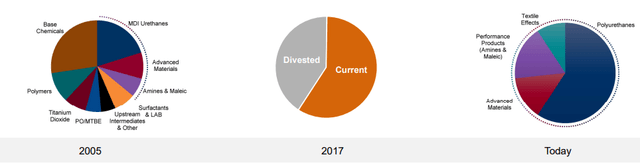

However, despite the decline in sales volumes, the deselection comes as part of HUN’s transformational strategy, including accretive acquisitions like Gabriel Performance Products in 2021 and divesting legacy commodity businesses like Titanium Dioxide, Ethylene Oxide, Propylene Oxide, etc. These activities aim to increase the company’s product specialization and improve profit margins through cost reduction initiatives, resulting in long-term growth & profitability improvements.

Huntsman International Q2 2022 Investor Presentation Huntsman International Q2 2022 Investor Presentation

The results of the strategy are already apparent in the financial statements, with over $100 million of positive impact in 2021. Given its success, I expect the company to continue this trend of accretive acquisitions and divestments to marginalize risks further and attain topline growth and profitability optimization synergies, achieving the targeted run-rate benefits of over $200 million by the next year.

By 2024, the company is targeting an Adjusted EBITDA margin of 18%-20%, up from the 17% in the MRQ, through fixed cost reduction, supply chain optimization, the Geismar MDI Splitter project, which is expected to report figures in the current quarter will enable HUN to upgrade its existing commodity-grade MDI to a higher-margin product, and other growth projects.

Its recent management successes like contracting nearly 90% of settlement for its Polyurethanes European pricing contracts from a quarterly basis to a monthly one for optimizing cash flows, implementing surcharges on its MDI products to offset rising energy costs, maintaining and expanding its margins by overcoming supply chain issues throughout the post-pandemic period, and an affinity to not miss its consensus EPS targets, boost my confidence in the company’s ability to achieve the aforementioned targets successfully.

Huntsman’s sales volume growth coupled with strong pricing and controlled costs, resulting in wider spreads, significant geographical footprint expansion, and accretive transactions, are signs of solid long-term sustainable growth.

Strong Financial Position

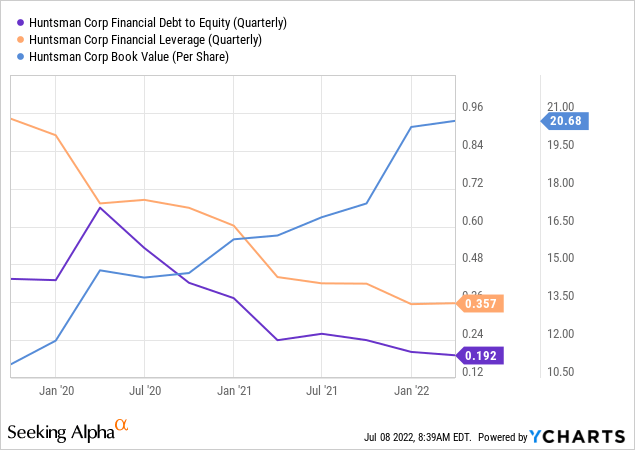

The company’s financial position has been showing consistent improvements along with its financial performance, augmenting its debt and liquidity metrics. Huntsman has been aggressively buying back its shares under its $2 billion share buyback program, including about 5.5 million shares purchased in the MRQ for an aggregate price of around $210 million.

This has significantly improved the per-share metrics, resulting in an almost 43% rise in its book value per share since Q2 2020 from $14.48 to $20.68, notably higher than its stock price movement during the same time.

Similarly, the company has paid off almost a quarter of its total debt during the same period and brought it down from over $2.5 billion to almost $1.95 billion, improving the leverage to around 0.4x and total debt-to-equity ratio to about 43%.

The management has also achieved higher-than-industry-average resource utilization ratios with an ROE of almost 30%, ROTA of 12.6%, and ROC of 9.8%, compared to the industry medians of almost 13%, 5.2%, and 7.4%, respectively.

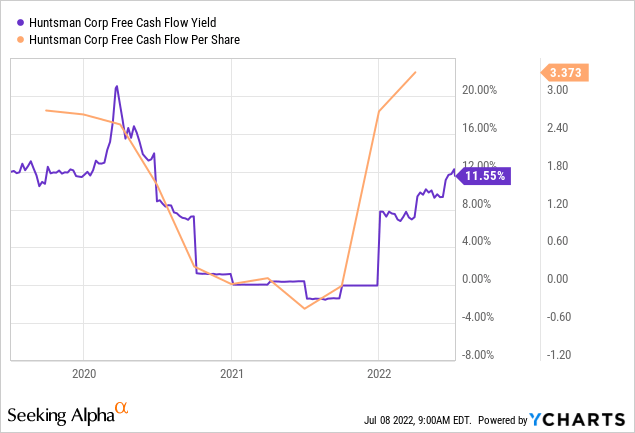

The company expects to incur about $300 million CAPEX in 2022, which it easily covers as it holds over $800 million in cash as of the MRQ. Its liquidity position is well covered and poised to further improve, with a current ratio of 1.88x and a quick ratio of 1x. This is facilitated by a rising FCF yield and a forward FCF per share growth ranging between 4.5x to 5x, further improving its liquidity position.

Valuation

Despite the exemplary financial performance, the stock appears undervalued to me as the market has failed to price in all the upside encompassed within the stock. On average, the stock is trading at a 36% discount to the industry medians and a 38% discount from its 5-year average, which gives me a share price intrinsic value of about $45 per share, an upside of around 55%.

Additionally, a strong FCF yield of over 11% ensures the safety of Huntsman’s 2.91% yielding annual dividend of $0.85 per share. The dividend has almost a 10% 5-year growth rate, with the most recent improvement of 13.33% in February 2022. Further, the share buyback program also adds to investor returns, with $210 million returned through it in Q1 2022. A strong FCF generation can reasonably be assumed to lead to further solid shareholder returns throughout the following fiscal periods.

Conclusion

Huntsman’s robust financial performance and balance sheet improvements resulting from product portfolio transformation initiatives, accretive transactions, cost reduction endeavors, and profit margin expansion are expected to lead to strong and sustainable improvements throughout the decade, turning HUN into a solid conglomerate.

Its strong fundamentals, including a strong liquidity position of around $2.3 billion, offer investors an opportunity to invest in an investment-grade security strong enough to endure the upcoming macroeconomic turmoil.

Be the first to comment