Getty Images/Getty Images News

Introduction

I’ve often asked myself if I should sell Huntington Ingalls (NYSE:HII) to put money into a faster-growing dividend stock. I discussed this in my last Huntington Ingalls article on May 6 as well. However, that idea has left my head a long time ago. While dividend growth is disappointing for now, Huntington Ingalls remains seriously undervalued for many reasons. The company is the Navy’s backbone as it is the sole producer of aircraft carriers and is in a duopoly with General Dynamics (GD) when it comes to nuclear submarines and next-gen warships. Adding to that, the company struggled to raise free cash flow, which is ending in the years ahead. The company is working its way to a double-digit free cash flow yield, which will almost certainly mean accelerating shareholder distributions. Moreover, politics are now a tailwind as the Navy’s importance in a rapidly changing geopolitical landscape is emphasized.

Long story short, I’m once again making the case for a dividend investment in Huntington Ingalls, this time including new macro-economic developments and the just-released company earnings.

So, bear with me!

What’s Huntington Ingalls?

But first, a brief overview of what Huntington actually does, given that most investors are focused on the “big guys” in the industry like Lockheed Martin (LMT).

With a market cap of $8.8 billion, Huntington Ingalls is one of the smallest players in the industry, yet still a giant in its own area: shipbuilding.

HII is the largest military shipbuilder in the United States and a provider of professional services to the government and its many organizations.

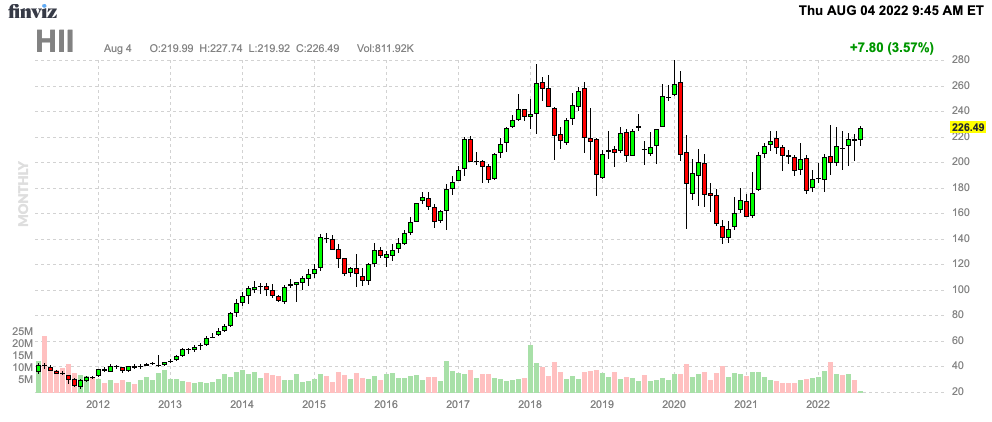

FINVIZ

After spinning off from Northrop Grumman (NOC) in 2011, the company is now operating three divisions: Newport News Shipbuilding in Newport News, Virginia where it builds nuclear aircraft carriers, and submarines, as well as related maintenance services.

Ingalls Shipbuilding covers its operations in Mississippi, where the company builds surface combatants, amphibious warships, and Coast Guard cutters.

In its Technical Solutions segment, the company focuses on next-gen technologies to gain a bigger piece of the pie called “multi-domain defense” and everything that comes with the push for a more connected defense force.

For example, last year, the company bought Alion to bring this segment to the next level.

The War, Inflation & The Need For Spending

I have a lot of defense exposure in my dividend growth portfolio. 22% of my portfolio consists of aerospace & defense exposure. The decision to buy this much defense exposure was not based on the expectations of war. It is only based on the need for the US and its partners to maintain a capable defense force, which means a steady flow of orders for the companies that I own – including Huntington Ingalls.

The war in Ukraine emphasizes readiness as the world has changed quite a bit in the past 2-3 years. Russia/China and its partners are increasingly focusing on their strategic targets in East Europe and Asia (i.e., Taiwan), while high food prices are triggering social unrest in African and Middle-Eastern countries.

Not only does the war in Ukraine emphasize how bad things can technically get, but it also shows that defense innovation is more important than ever. The Russian forces are much stronger than the Ukrainians, yet the invasion is slow and very costly – on both sides. Russian tanks are shredded by advanced missiles while its ships aren’t turning out to be as effective as the Russians may have hoped.

What this means is that it’s time for innovation. One of the many reasons why I bought Huntington is because the Navy is the backbone of the US defense forces. It allows the US to be ready in every single part of the world and it supports the Air Force’s operations via its aircraft carriers.

With that in mind, there are two pieces of news that I want to share with you.

First, the Navy needs 3-5% in annual budget increases for the next two decades.

As reported by Defense One,

The U.S. Navy’s planned fleet of 2045 will require annual real budget increases of 3 to 5 percent, according to the Navy’s top officer, who called that a “realistic” schedule for amassing the 500 hyperconnected manned and unmanned vessels that national security will require.

Because:

“I think it’s going to take a couple of decades to get us to yield that hybrid fleet that we think that we ultimately need in order to fight the way we think we want to fight, which is in a distributed manner,” Adm. Mike Gilday, chief of naval operations, told reporters on Tuesday.

Please note that we’re talking about real increases, which means on top of inflation.

With that said, it’s highly unlikely that HII will benefit from that kind of spending. Not because of the company’s capabilities but because this kind of spending isn’t likely to happen. At least not to this extent. Real spending above 3% in the Navy has happened only two times in the past. In the 1980s and after 9/11.

Yet, I’m still bringing it up because the need for modernization is high. Headlines like these will continue to surface and I believe it will be highly profitable for HII as modernization of the fleet means new boats, expensive overhauls, and a bigger utilization of the company’s tech capabilities.

The other piece of news is also budget-related.

Last month, POLITICO reported that the House approved an $839 billion National Defense Authorization Act in a 329-101 vote.

This deal is $37 billion higher than the administration was initially looking for.

On top of the budget, the bill also rebukes several of Biden’s national security plans. Members maintained a nuclear cruise missile the administration planned to scrap, hampered F-16 sales to Turkey and limited the number of aircraft and ships the Pentagon can retire.

Moreover, and with regard to Huntington Ingalls:

The bill authorizes 13 new warships, adding five ships the Navy didn’t request – an extra Arleigh Burke-class destroyer, another Constellation-class frigate, another fleet oiler and two expeditionary medical ships.

It also requires the Navy to keep five of the nine littoral combat ships it sought to retire. Lawmakers turned back a push by Smith to allow the service to scrap all nine hulls.

Huntington Ingalls Dividend Qualities

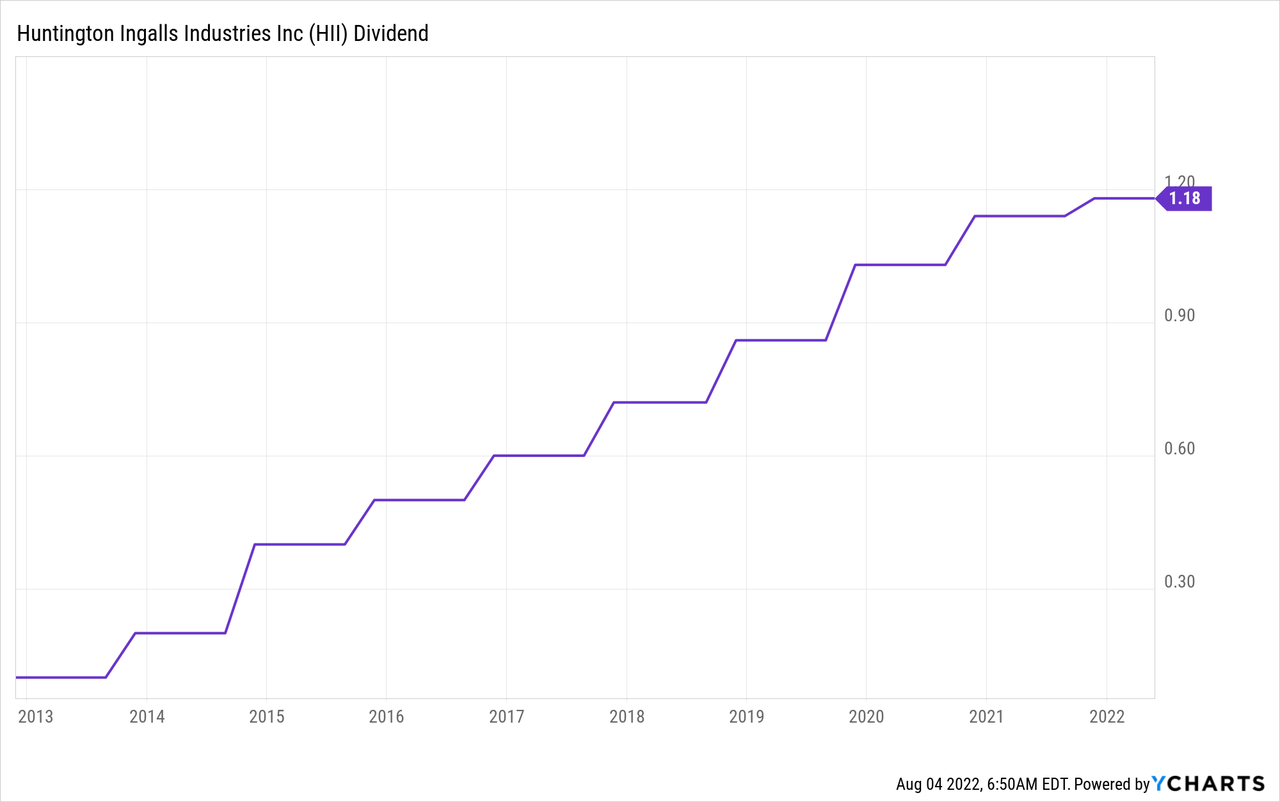

Huntington Ingalls pays its shareholders a $1.18 dividend per share per quarter. That’s $4.72 per share per year.

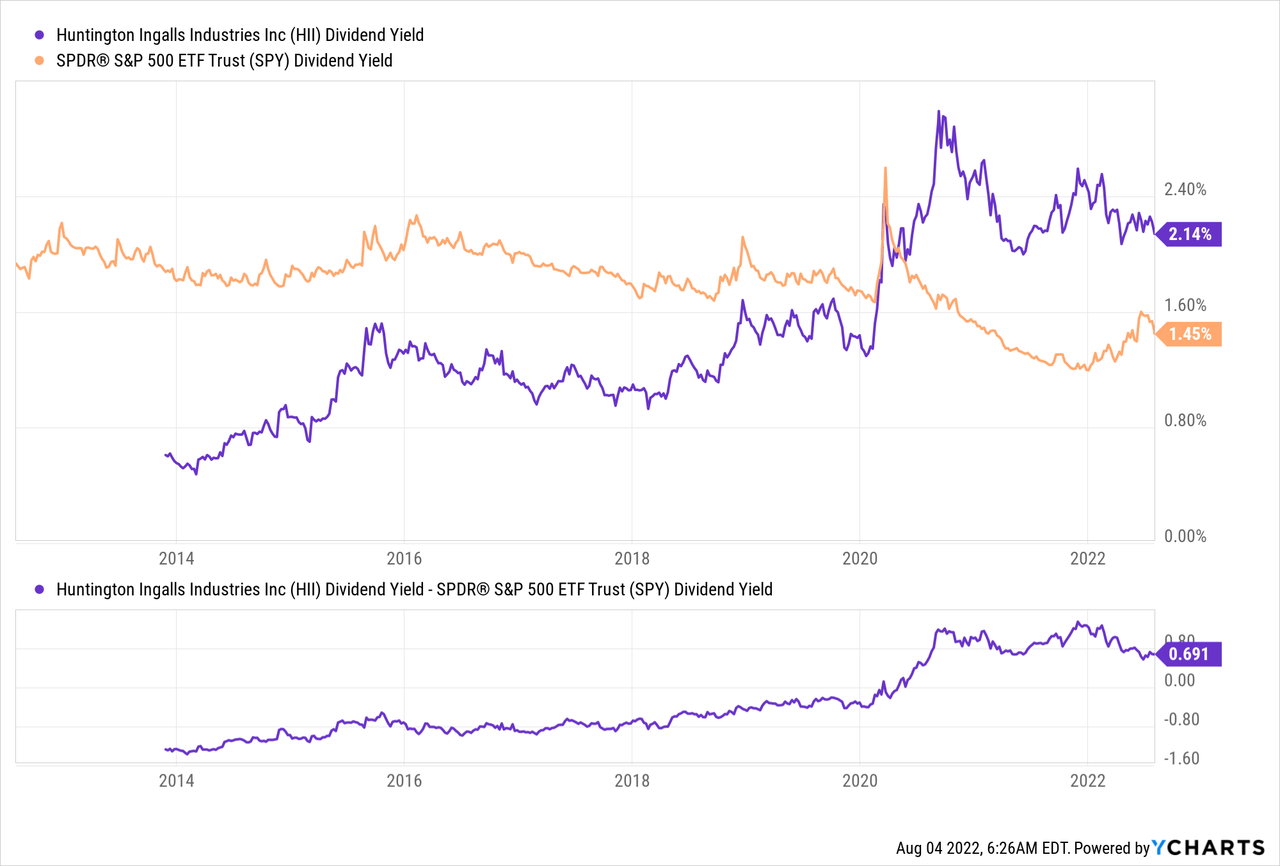

This translates to a 2.2% dividend yield using the current stock price.

The stock is now yielding roughly 70 basis points more than the S&P 500, which is decent.

Prior to the pandemic, HII used to yield less than the S&P 500. The reason the stock is now yielding more is stock price underperformance.

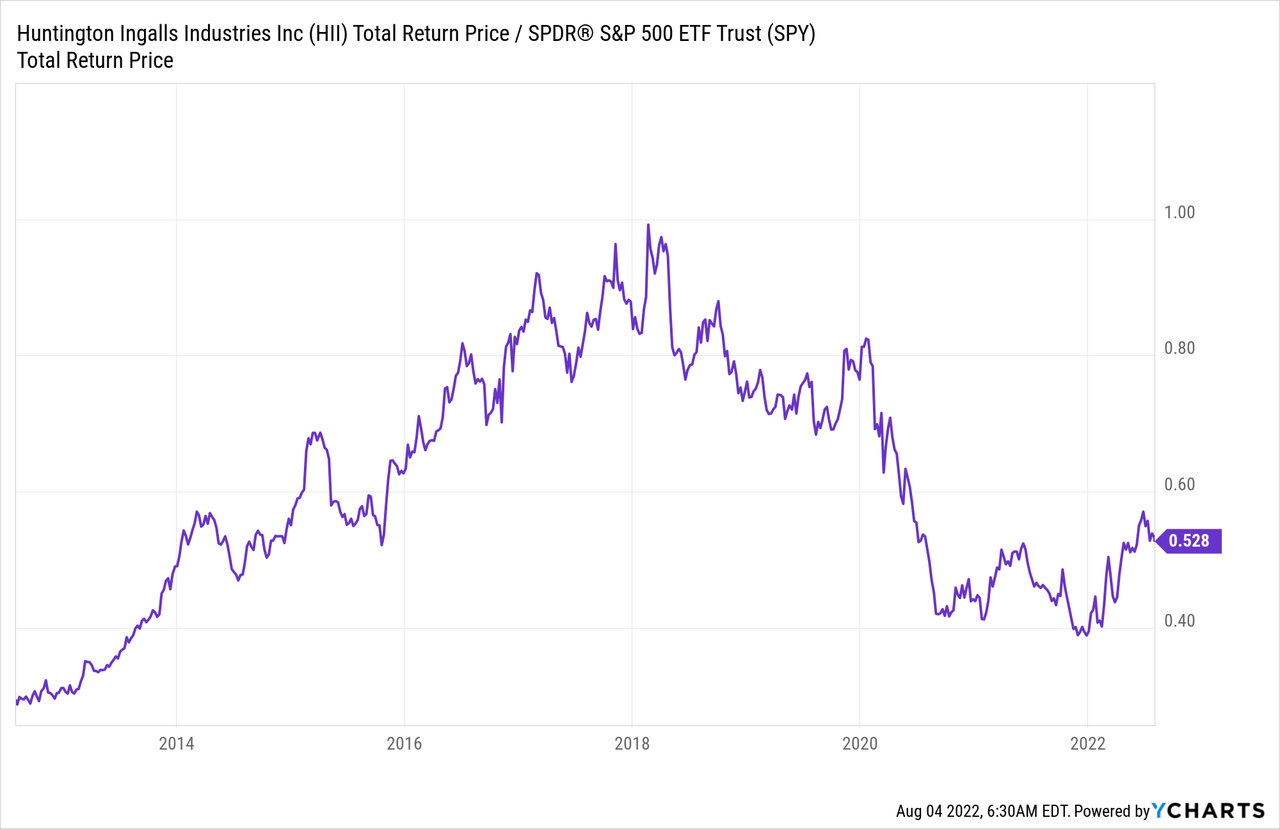

Looking at the ratio between the HII total return and the S&P 500 total return, we see that HII quit outperforming the market in 2018. Back then, global growth peaked. In 2020, this trend worsened due to the pandemic, which caused investors to shift money out of stocks that suffered from commercial aerospace and labor-intensive companies dealing with shortages. Huntington Ingalls does not have commercial exposure, yet it suffered from money leaving the industry and supply chain problems. The good news is that all of this makes the valuation better.

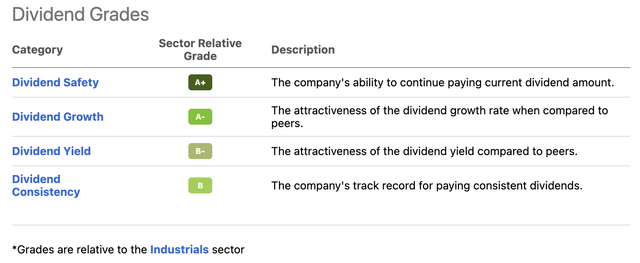

With that said, this is what the dividend scorecard provided by Seeking Alpha looks like:

The company scores high on dividend growth, consistency, and safety – relative to the industrial sector.

In 2012, the company initiated its dividend at a mere $0.10 per share. This quickly grew to $3.02 (on an annual basis) in 2018 after a number of aggressive hikes. Hence, the dividend growth history isn’t a great way to start, given the company’s short history as a stand-alone corporation.

These are the most “recent” hikes:

- November 2021: 3.5%

- November 2020: 10.7%

- November 2019: 19.8%

The 3.5% hike in 2021 was a huge disappointment and caused some investors to sell, which I know because readers told me.

Moreover, buybacks more or less stopped after the pandemic.

In 2018, HII bought back shares worth $767 million. This was reduced to $285 million in 2019. In 2020, it was a mere $100 million. In 2021, it was $108 million.

Yet, during the 2017-2021 period, HII bought back 12% of its shares outstanding. Most of it happened in 2018 and 2019, which shows what HII is capable of once it commits to shareholder distributions – both indirect and direct.

Now, here’s why I expect dividends and buybacks to accelerate – along with the stock price on a long-term basis.

Deep Value In Huntington Ingalls

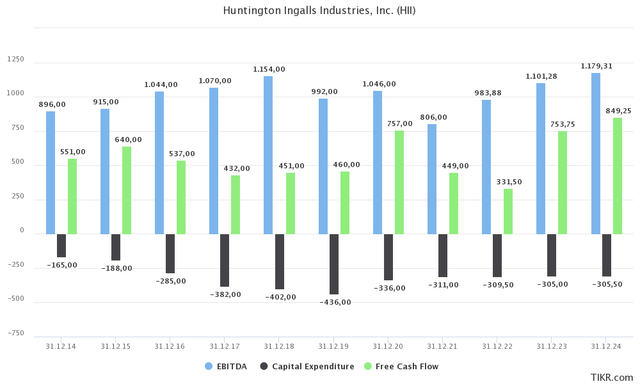

Huntington Ingalls’ financials are volatile because the company works on major projects (ships). This causes revenue and related financials to be volatile with certain outliers.

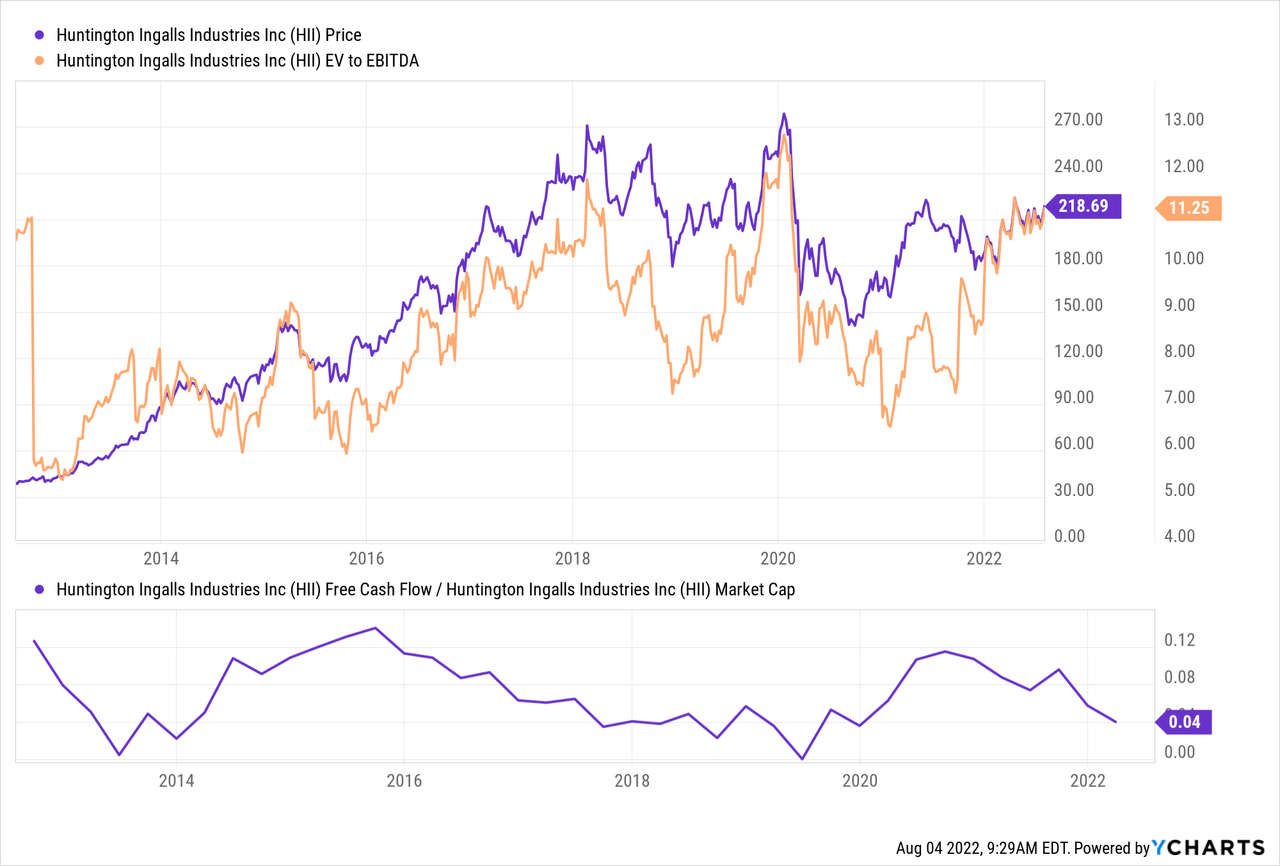

As the dividend growth rate in 2021 may suggest, 2021 wasn’t a great year. EBITDA fell to a multi-year low with free cash flow once again failing to continue the uptrend that started in 2020.

Now, that’s changing. The company just reported 2Q22 earnings, which included $2.7 billion in quarterly revenue, 22.7% higher compared to the prior-year quarter, and $4.44 in GAAP EPS, which is $1.10 higher than expected.

The company, which is now sitting on $47 billion in funded backlog launched the National Security Cutter Calhoun, it Christened amphibious transport dock Richard M. McCool Jr., and it was awarded a new contract for LPD 32, which is also an amphibious transport dock.

HII also launched the Virginia-class submarine New Jersey and a wide range of other projects.

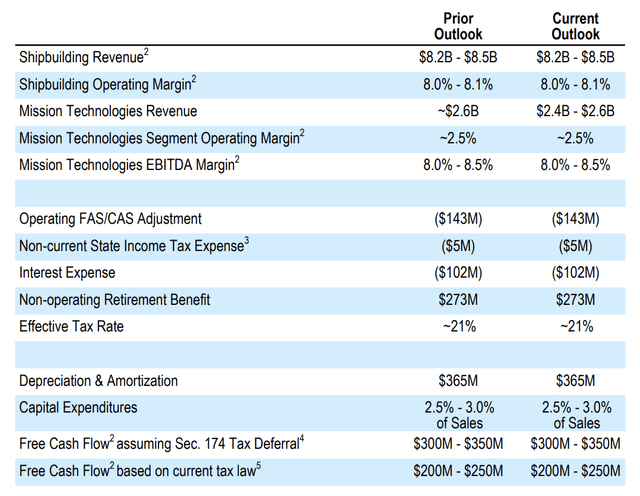

What I care most about is that the company affirmed its guidance. Full-year revenues are set to be between $8.2 and $8.5 billion. The operating margin is expected to be at least 8.0%. This was important in light of ongoing supply chain/labor issues. Moreover, CapEx is expected to be 3.0% of total revenue max with free cash flow coming in between $300 and $350 million. That’s what analysts expected as well.

What matters more is the longer-term outlook.

See, this year, we’re looking at roughly $330 million in free cash flow, which translates to a free cash flow yield of 3.8%. That’s not a lot and nothing to get excited about.

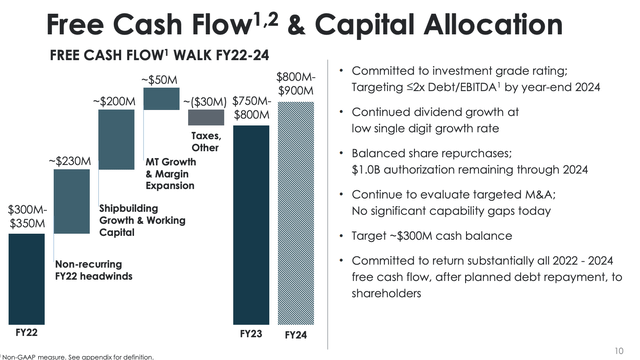

Yet, in 2023, the company is looking to boost this to at least $750 million based on non-recurring headwinds in 2022, less working capital in shipbuilding (dependent on project timing), and higher margins.

Now, we’re talking about an implied free cash flow yield of at least 8.5%.

In 2024, FCF is likely to exceed $800 million, implying a >9% FCF yield.

What’s important is that HII indeed confirmed that it looks to do $3.2 billion in cumulative FCF in the FY20-FY24 period.

The company is looking to return ALL of it to shareholders after reducing debt. The company targets a less-than-2x net debt ratio by 2024.

2024 EBITDA is expected to be $1.2 billion. Two times that is $2.4 billion in target net debt. 2022 net debt is expected to be $2.6 billion, which means at least $200 million will need to go towards debt reduction. Analysts expect that net debt will end up close to $2.0 billion in 2024.

Regardless, the company is in a position to do more than $800 million in annual free cash flow as it can benefit from investments in working capital in the years prior to 2023, a big backlog of orders, and high expected new orders.

That’s a best-case scenario and a valuation that is way too low. As we get closer to 2024, I don’t see how “the market” will let HII trade at an implied long-term FCF yield close to 10%. Hence, I think this company has at least 50% longer-term upside potential.

The median free cash flow yield is 7% for HII. I’m obviously using 2023/2024 numbers, but my bull thesis is also a long-term thesis.

With regard to the expected enterprise value, we’re dealing with an $8.8 billion market cap, $2.0 billion in expected 2024 net debt, and $760 million in pension-related liabilities. This puts the expected enterprise value at $11.56 billion.

That’s 9.6x expected 2024 EBITDA of $1.2 billion. Excluding pensions, the EV/EBITDA multiple is 9.0x. That’s too cheap and it does support my bull thesis that there’s a lot of upside in the next 2-3 years.

Over the next 2-3 years, I expect at least 30%-40% in capital returns. 50% over the next four years.

Headwinds include recession risks pressuring overall market sentiment, ongoing supply chain issues that put pressure on profitability, and/or political decisions that hint at very slow future Navy funding.

Takeaway

Huntington Ingalls has become one of my favorite dividend growth investments. While its returns have been slow since 2020, the company is in a terrific position to generate high future returns for its shareholders. Navy funding is expected to accelerate, the backlog is high, and working capital developments are expected to boost free cash flow to the high $800 million range.

Management is expected to distribute almost all of its excess free cash flow after reducing debt, which means that shareholder returns are set to accelerate given a rapidly declining net debt ratio.

While Huntington Ingalls isn’t a well-known dividend stock, I think it’s one of the most promising investments in the defense industry, which means it’s a much more exciting dividend investment than its current yield or 2021 dividend growth rate may suggest.

(Dis)agree? Let me know in the comments!

Be the first to comment