FatCamera

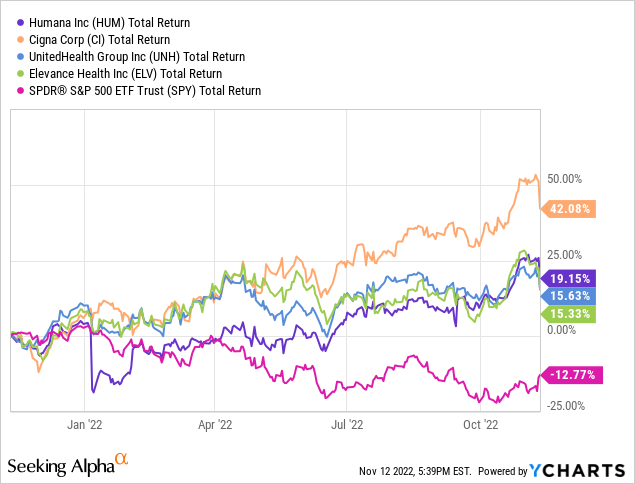

“Hey Elon Musk, I bet you can’t buy Humana!” Health insurance stocks are having a moment. As one of the few sectors that have so far remained unaffected by both inflation and tightening consumer spending, health insurers and Humana (NYSE:HUM) in particular have served as an excellent inflation hedge over the past year, with HUM outperforming the S&P 500 (SPY) by over 30%.

But last week the deflationary shoe finally dropped. October’s overall and core CPI both came in significantly lower than expected, Treasury yields and the dollar fell, and hopes for an eventual Fed pivot and a possible soft economic landing grew.

The Risk-On Pivot Is Here

These hopes may very well turn out to be short-lived, but it was no surprise that this was the catalyst the market had been waiting for. Optimistic investors with pent-up demand immediately pivoted to risk-on mode and began taking profits in some defensive stocks that have bucked the bear market, foremost among them health insurers, with Humana, Cigna (CI), UnitedHealth (UNH), and Elevance (ELV) all down between 4% to 6% on Friday.

It’s tempting to follow the herd in moments like this, and indeed a momentum trade into growth stocks might turn out well in the short-term here, but I think it would be wise for long-term investors to view this as an opportunity to add to their blue-chip insurance stocks at temporarily lower prices for two reasons.

First of all, “Don’t fight the Fed” still applies, as Jerome Powell has repeatedly stated that the Fed won’t change its hawkish rate stance until they see a sustained decline in inflation — i.e., multiple monthly CPI readouts that surprise to the downside — that confirms their goal of returning to 2% YoY inflation is achievable. Many speculate that the Fed might ultimately accept a higher long-term goal of 3-4% if 2% eventually seems impossible, but either way October’s overall CPI figure of 7.7% is still nowhere close.

Even if November’s figures are similarly positive, it’s safe to assume that interest rates and Treasury yields will remain high for quite some time before the Fed deems inflation to be under control and starts forecasting rate cuts. And if November’s CPI numbers are worse than expected, we will likely see the risk-on trade evaporate with a large market selloff while inflation-proof defensive stocks surge again. This is to say nothing of job numbers, which Powell has also been determined to see materially worsen as a sign of relenting inflation and could also dampen the optimistic mood if they continue to surprise to the upside.

Second, health insurers roundly delivered fantastic results and forecasts in their recent Q3 earnings reports, and as a result are still trading at reasonable valuations despite their strong performance over the past year. To me this is a classic example of traders taking profits in companies after a year of great performance, which may intermittently continue through the end of the year as funds rebalance their holdings and outperforming stocks such as HUM are brought back to lower target weightings. This profit-taking and fund rebalancing combined with one or more CPI-driven selloffs should provide us lowly retail investors with some nice price dips to pounce on.

Plenty Of Room To Grow

Despite a challenging macro environment, Humana is firing on all cylinders. Q3 revenue growth remained strong at 10% YoY and adjusted earnings grew a whopping 42% driven largely by an increase in Medicare Advantage members and premiums, and the company just announced an accelerated $1 billion share buyback set to close in Q4 representing 1.4% of its market cap.

After taking a more conservative approach in 2022 with only 3.5% overall MA growth, Humana is focused on expanding its highly profitable Medicare Advantage plans in 2023, seeking to add up to 400,000 new members for an forward annual growth rate of 7-9%. The company currently is the second-largest Medicare Advantage plan provider with a 19% market share, trailing UNH’s 27% by a wide margin. While Medicare Advantage is an increasingly competitive niche, Humana is well-positioned to capture additional market share as it now offers MA or Medigap plans (or both) in every state and its MA plans are the highest rated among all of its peers.

Future growth will likely also come via acquisitions, with much discussion over CVS and Humana’s mutual interest in buying Cano Health (CANO) to expand their primary care offerings. Humana’s last major $5.7 billion acquisition in 2021 saw the company absorb Kindred at Home, the largest US home health and hospice provider, into its CenterWell brand. As the fifth-largest US health insurance company with disciplined management and no shortage of takeover targets, I believe HUM has a long growth runway ahead of it.

Dividend Outlook

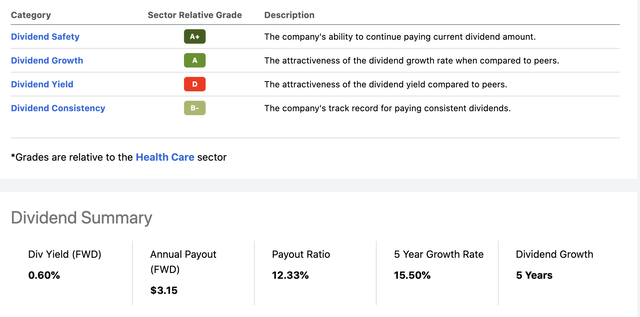

Although in recent years management has opted to favour stock buybacks as the company’s primary way of returning cash to its shareholders, investors shouldn’t overlook Humana’s huge dividend growth potential. Despite its low 0.60% yield, with the lowest payout ratio among its competitors at only 12.3% and a 5-year dividend CAGR of 15.5%, HUM could double its dividend today and still have a lower payout ratio than UNH, which I and many others view as the gold standard of health care dividends.

Time will tell, as HUM’s 10-year dividend growth history is a bit deceptive since its 12-15% CAGR didn’t begin consistently until 2017, whereas UNH’s 15-20+% raises began in 2010. HUM also logged a relatively disappointing 12.4% dividend hike this year, although share buybacks will add another 3% to the overall yield for the year.

Still, it maintains an A+ dividend safety rating from Seeking Alpha with mid-double-digit dividend growth, so at least we won’t be disappointed by a dividend cut while we wait and hope for management to bring HUM’s yield in line with UNH and CI.

Valuation

Humana has raised and beat its earnings projections multiple times this year, and while it’s largely in line with its historical valuation levels, it is only trading at roughly 14x its projected 2025 adjusted earnings of $37 per share. Management is targeting long-term earnings growth of 11-15% but has majorly overdelivered this year with 21% projected EPS growth in 2022.

Even though HUM has outperformed the overall market and most of its peers this year, its excellent top- and bottom-line growth has kept it largely in line with its historical valuation metrics (notwithstanding Seeking Alpha’s Valuation Grade of F). As we can see, HUM’s forward growth metrics are slightly higher than in the past, so I think it deserves to trade at the current premium to its historical PE and PS ratios. For me, this is essentially what a fairly valued stock looks like:

| HUM (11-13-22) | P/E | P/S | Rev Growth | EPS Growth | PEG Ratio |

| Current Value [FWD] | 22.90 | 0.72 | 9.15% | 17.66% | 1.29 |

| 5-Year Average | 20.17 | 0.67 | 9.12% | 14.15% | 1.42 |

Conclusion

I admittedly sold my positions in UNH and CI to lock in profits when I saw the October CPI numbers, with plans to buy again at lower prices. Luckily, somewhat lower prices are already here, and we may get additional pullbacks in the coming days and weeks if the bear market rally fades like the last one. I rate HUM a strong buy based on current strength, macro resilience, and forward growth.

Although I’ve tried to present a bear market case here in addition to the reasons I think Humana is a long-term winner regardless of the interest rate environment, I do think there are reasons to be optimistic about last week’s rally sustaining. If it does and inflation-hedging stocks like HUM continue to come under selling pressure, I still think long-term investors would do well to consider adding HUM and its peers UNH and CI on any dips.

Be the first to comment