SERSOL/iStock via Getty Images

Investment thesis

Despite the shares correcting 30% since our downgrade to a neutral rating in February 2022, we maintain our neutral stance on HSBC (NYSE:HSBC). We believe the state of the UK credit market places too much risk over the bank, in terms of bond duration risk, falling lending activity, and increasing delinquencies.

Quick primer

HSBC is a global retail and commercial bank with the UK and Hong Kong as its home markets. Its core franchise is in trade finance, which supports its corporate and investment banking operations. Its key geographic markets are the UK, Asia, the Middle East, and North America.

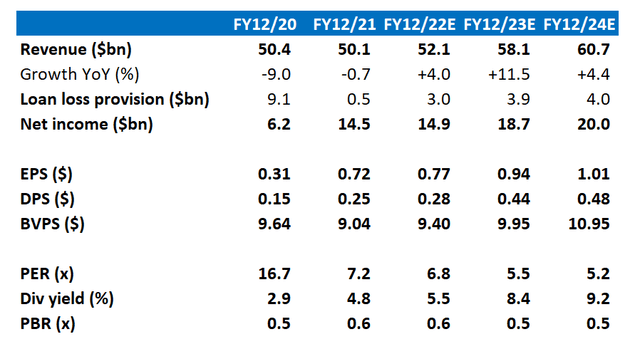

Key financials including consensus forecasts

Key financials including consensus forecasts (Company, Refinitiv)

Our objectives

The shares have corrected 30% after our downgrade to a neutral rating in February 2022. We want to assess whether it is now a buying opportunity for the shares, or if macro conditions make the risk-reward profile unattractive. We will take a look at interim FY2022 results, and the current situation given the turbulent time the UK banks have had after the ‘mini-budget’ speech given by Chancellor Kwasi Kwarteng.

Not exactly in rude health

Interim FY2022 results highlighted patches of soft activity in our views, as opposed to an outright post-pandemic recovery growth profile. Adjusted revenue (half-year) saw marginal growth at 3.8% YoY, with profit before tax declining 7.8% YoY with a return to ECLs (expected credit losses) from Mainland China’s commercial real estate versus a positive net release a year previously from COVID-related provisions.

There were some bright spots, with a positive outlook for net interest income as the loan book grew 6% YoY for Q2 FY12/2022 Commercial Lending, and the net interest margin benefitted from rising yield curves. However, overall lending for the bank in Q2 rose only 3% YoY and was flat QoQ.

Risk management appeared to be concentrated on Mainland China lending where nearly 20% of the lending book is exposed to commercial real estate, and reducing the number of government bonds held in its ‘Hold-To-Collect-and-Sell’ investment portfolio insightfully citing duration risk (changes in the interest rate).

Management appeared positive on the outlook for the business, talking about a ‘benign’ credit environment and reinstating quarterly dividends from FY2023 together with an approximate dividend payout ratio of 50%. There was some caution over macro conditions into H2 FY12/2022 which we felt to be a bigger risk, and this is what we will assess next.

A ‘little’ turbulence

Europe made up less than 10% of reported profits before tax for HSBC in H1 FY12/2022, with Asia making up nearly 70%. Europe (the UK specifically) is about to contribute a much smaller amount. The mini-budget announced by Chancellor Kwarteng in the UK on 23rd September 2022 setting forward major fiscal loosening resulted in two key events: 1) a major weakening of the pound sterling (now recovered as some U-turns were made over tax cuts) and 2) a surge in yields for the UK government bonds (still ongoing). It is the surge in borrowing costs that concerns us, as the Bank of England is set to raise base rates higher to curb inflation.

Increasing interest rates will negatively impact HSBC’s borrowing costs, lower demand for credit, increase loan delinquencies, and duration risk (valuation losses) for its UK gilt portfolio. These events will have a knock-on effect on other geographies such as Europe and the US, making the outlook for either lending or fee-income activities such as underwriting or asset management much less positive.

A key example of the challenges facing UK-based lenders at the moment is home mortgages. At the beginning of FY12/2022, UK lenders were offering somewhere in the region of 2.5% for a 5-year fixed-rate mortgage. Currently, HSBC is offering first-time buyers a 5-year standard fixed-rate mortgage of 5.59%, on a loan-to-value of 60%. The implications here are that many potential borrowers are priced out of the market, resulting in a deterioration in lending. Borrowers who need to re-mortgage with their initial fixed rates expiring, or those on variable rate mortgages seeking refuge will see a major increase in credit costs and hence poses a higher risk of delinquency.

Duration risk for UK gilts was exemplified by the Bank of England stepping into Britain’s bond market to stem a market rout, buying around 65 billion pounds (USD69 billion) of long-dated bonds.

With this challenging backdrop, we conclude that current consensus forecasts (see Key financials table above) look too optimistic. Growing revenues look to be out of the question with rising inactivity in the loan market, and loan provisions will increase at a much higher rate YoY. Consequently, despite the correction in the share price, we are not convinced that the outlook is positive enough to invest in the bank.

Valuation

With consensus forecasts appearing too bullish, the shares are trading on a dividend yield of 8.4%. We believe the reality is more akin to FY12/2022 with a yield of around 5% at best. With exposure to Mainland China and the UK, we do not see this yield as being attractive enough.

Risks

Upside risk comes from HSBC being firmly committed to raising shareholder returns via dividends or buybacks, in spite of softer than expected business conditions in FY12/2022 and beyond.

HSBC could also instigate further cost reduction measures in order to free up earnings available for distribution. Although the business portfolio has been reviewed, further asset sales of non-core businesses could free up capital for shareholders.

Downside risk comes from adverse macroeconomic conditions that result in low or no growth. This will place pressure on management to utilize capital to generate new avenues of growth that could cut back returns for shareholders.

Credit delinquencies may become higher than standard pre-pandemic levels as a result of high inflation. As salaries remain static there will be more pressure on debt defaults and deteriorating credit quality, particularly in the UK.

Conclusion

Without fiscal mismanagement by the UK government, it could be argued that HSBC could have generated a relatively low but stable growth profile in the medium term. This scenario is no longer viable as borrowing costs have skyrocketed, placing the entire UK credit market in question as activity comes to a standstill. With all UK lenders including HSBC working out a way out of this mess, we reiterate our neutral rating.

Be the first to comment