inhauscreative

Last week, the U.S. Senate and House of Representatives passed the Inflation Reduction Act of 2022, sending the bill to the White House for signature. The bill is notable as the largest climate bill in history and has major healthcare provisions as well. Readers may check out the full text of the bill here, or the summary here. So, without further ado, let’s analyze the bill and what it means for your portfolio.

What Is The Inflation Reduction Act?

The Inflation Reduction Act (IRA) is legislation that will raise corporate taxes, reduce the budget deficit, lower prescription drug prices, invest heavily in sustainable energy production, and invest moderately in U.S. oil production. The bill is a result of over a year of negotiations between moderate Democrats, the White House, and progressives. All in, estimates are for there to be about $750 billion in revenue raised and about $450 billion in spending. I believe the bill is good long-term policy, and if it weren’t an election year, I wouldn’t be surprised if it were bipartisan. The bill is a dramatic improvement over the nearly $3 trillion Build Back Better Act, which I profiled last year for being toxic to the economy and full of pork. Senators Joe Manchin and Krysten Sinema likely played a large part in neutering the crazier parts of the bill.

And of course, while the bill is good policy, calling it the Inflation Reduction Act is a bit of a misnomer, because inflation reduction doesn’t appear to be the main purpose of the bill, at least not in the sense that it will have an immediate impact.

Key Provisions of the Inflation Reduction Act:

Revenue:

- Corporate Alternative Minimum Tax of 15% – $222 billion over 10 years.

- Prescription Drug Pricing Reform – $265 billion over 10 years.

- Increased IRS audits – $124 billion over 10 years.

- 1% stock buyback tax – $74 billion over 10 years.

- Corporate loss limitations – $52 billion over 10 years.

Spending:

- Sustainable energy & emissions reduction – $369 billion.

- ACA subsidies – $64 billion*.

- Drought resiliency – $4 billion.

Budget Deficit Reduction

*To be fair the ACA subsidies are using a classic budget reconciliation trick where the spending is loaded in front years while the revenue is loaded in back years. They’re extending these for three years, at a cost of ~$21 billion a year. This is a band-aid and they’re going to have to do more healthcare reform down the road, likely in 2024 or 2025.

** To my earlier point, you can probably cut this number in half given the ACA subsidy accounting trick, but the deficit reduction is still in progress.

Inflation Reduction Act Analysis

- The corporate AMT is a pretty decent tax increase. Just for reference, the US collected about $372 billion in corporate taxes in 2021 (a huge year, by the way), and this is for about $22 billion per year. However, these are both really small compared to GDP which is about $25 trillion, but it’s the equivalent of raising the corporate tax rate a couple of points. Just for reference, when you see a $250 billion annual tax increase proposed, that means that it’s about 1% of GDP. Context is important. Since the taxes are all corporate in nature, the immediate effect here is that you can probably take off a ballpark of about $5-$7 of S&P 500 (SPY) earnings for 2023. This always had to happen at some point due to the huge budget deficits the government has been running every year, and it will probably happen more in the future as Congress slowly works on the budget deficit. Not a huge deal, but it goes to show the S&P 500’s ability to put up big earnings growth numbers is going to be constrained by the fiscal reality of the U.S going forward.

- Prescription drug reform needed to happen as well, and this is only going to increase going forward. I don’t really know how to handicap this in terms of earnings but I’d guess you can take off another ~$2-$5 of S&P 500 earnings going forward for this.

- The stock buyback tax is probably the most interesting provision. You’d think that it would be bad for stocks, but I actually like this provision because it will nudge companies to pay out bigger dividends and spend less on buying back their stocks (especially if their stock is overvalued). It’s low enough to raise revenue and high enough that I think it will start to curtail some of the crazy stuff you see at companies, like where companies will buy back billions in stock, only to be forced to sell it back at the bottom to stay afloat. Independent analysis shows that the 1% excise tax on buybacks might increase dividends by 1.5% to 2% or so. It’s equivalent to a tax rate increase of about 0.8% on heavy buyback users like Apple (AAPL), Google (GOOG), the company formerly known as Facebook (META), and Oracle (ORCL).

- IRS audits. This is kind of scary, but I know that the Trump administration dramatically scaled back on IRS audits, so this may be more of a return to normal.

How Will The Inflation Reduction Act Affect The Stock Market?

So far, the biggest winners after the bill was announced, far and away were solar stocks. Invesco has a Solar ETF (TAN) that immediately spiked after the announcement. Big holdings of TAN include Enphase Energy (ENPH), SolarEdge (SEDG), and First Solar (FSLR). The push for utility-scale solar benefits NextEra Energy (NEE). Electric vehicle stocks were more subdued, with the idea being that the most likely beneficiaries of the bill are established domestic manufacturers like General Motors (GM) and Ford (F). Albemarle (ALB) is a big second-order play on this as a lithium producer.

As an aside, I skimmed the bill and found the sustainable energy provisions to be really good. There’s money for energy efficiency improvement (heat pumps, solar water heaters, insulation, better windows, doors, etc). These are made by a broad group of companies, but a lot of them are Japanese companies, like Mitsubishi (OTCPK:MSBHF). There’s incentives for biodiesel in the bill, which is often able to turn agricultural and commercial waste into fuel. Some stocks that specialize in this are Renewable Energy Group, which was bought by Chevron (CVX), Alto Ingredients (ALTO), and Aemetis (AMTX). Some of this tech is going to work and some of it isn’t, but that should give you some quick places to look. And of course, the bill allows more oil production in the Gulf of Mexico (i.e. not getting oil from Saudi Arabia or Russia). Again, Chevron and Occidental (OXY) look to benefit here. The bill simplifies the process for pipelines as well, and Energy Transfer (ET) has been thought to be a winner.

The winners are fairly concentrated, but the broad nature of the revenue raises means that there aren’t as many huge losers. Mega cap tech names will see tax increases and I think they’re overvalued anyway, but a 1% stock buyback tax and making them pay 15% of their profits in tax isn’t going to be what stops the party. Stocks will see a slight decrease in earnings compared to what they would be otherwise, but nothing major.

The closest companies to “losers” here are Big Pharma names that have benefitted from unnatural levels of government support. Think about it! Medicare Part D covered seniors’ drug costs, but medicare was not allowed to negotiate the price. Insane!

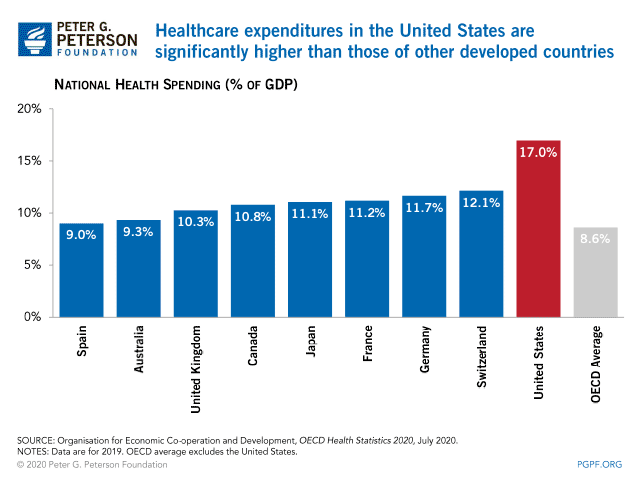

The structural problem is that we spend more on healthcare than our peers.

Insane Spending (Peter G Peterson Foundation)

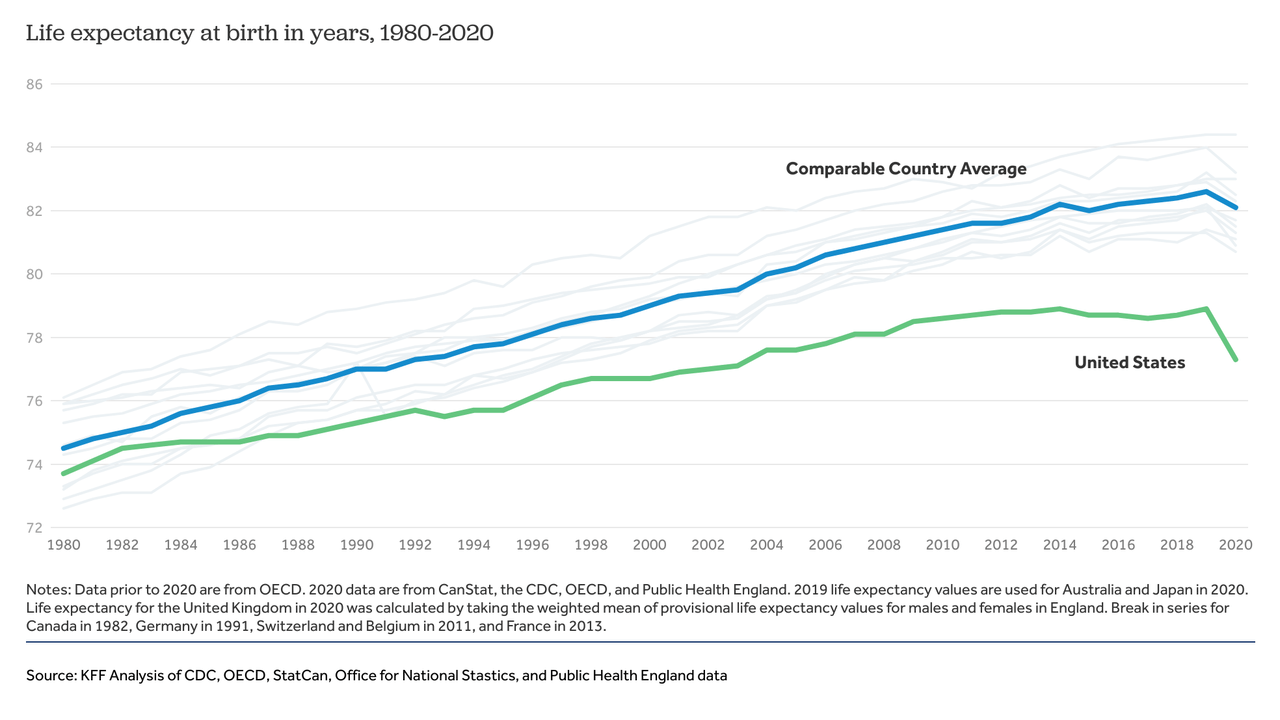

And we get worse outcomes.

US Life Expectancy Vs. Peers (CDC)

The writing is on the wall here that there is going to be more healthcare reform, likely after the 2024 election. Our closest peers are other developed English-speaking countries-Canada, Australia, and the UK. They all spend far less on healthcare, and they live longer and healthier lives. For this reason, the highly profitable US healthcare system isn’t sustainable.

The biggest American pharma companies by revenue, for reference, are Pfizer (PFE), AbbVie (ABBV) Johnson & Johnson/Janssen (JNJ), Merck (MRK), and Bristol Myers (BMY). UnitedHealth (UNH) is the biggest health insurer and has the largest weight in the Dow. Some of these stocks are cheap enough to warrant further analysis, but stocks like UnitedHealth and AbbVie are actually pretty expensive on a PE basis. I’d avoid them at this point.

Bottom Line

The Inflation Reduction Act has broad implications for the future of the US and the world. This article mainly focuses on the sources and uses of the money and what stocks may be the biggest winners and losers. The bill puts a down payment on fixing some of the structural issues that the US faces over time, but there will likely need to be more reforms and tax increases over the next few years. What do you think of the bill? Share your thoughts in the comments! In particular, we want to hear about stocks that you think may be among the biggest winners and losers from the new legislation.

Be the first to comment