imaginima

Energy stocks have been the only place to hide consistently for the bulls this year. The group has exploded higher during one of the worst starts to any year in stock market history. How we end is yet to be seen, but for now, energy reigns supreme.

Of course, there are many ways to gain exposure to energy’s bull market, from buying the commodities themselves, to those that drill, to those that refine, to those that transport, to those that distribute to customers. In this article, we’ll be taking a look at a giant in the transport space, Energy Transfer (NYSE:ET). The partnership reported third quarter earnings last night, and not only were earnings good, but management raised guidance for the third time this year. All is well, it seems, for Energy Transfer.

While I have some minor reservations about running out and buying right now, I do think we’re going to see Energy Transfer do well in the coming months. And let us not forget about that dividend, either.

A raging bull market?

There’s no question Energy Transfer has been outstanding this year. It has outperformed the S&P 500 by about 65% this year, and that doesn’t include the dividend. With dividends, it’s more like 70%. It’s an incredible performance, but as we know, these things tend not to last forever.

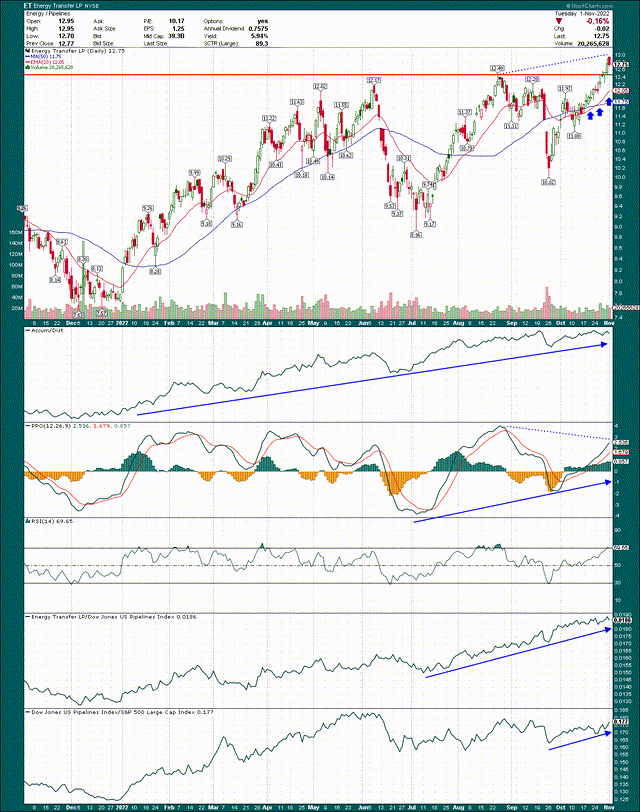

The daily chart has a lot to like here if you’re bullish. The stock broke out to a new high in mid-October, although volume was pretty weak. It traded down in anticipation of the earnings report, and is flat pre-market. There are two lines the bulls need to defend for this bull market in Energy Transfer to continue: the breakout point and the rising 20-day EMA.

The former is $12.49, and the latter will be something slightly higher than $12.05 today as it is rising. The most bullish scenario prefers a test of the breakout area that results in a further propulsion higher, but given the breakout rally was pretty weak – and very short – I think there’s a pretty good chance we fail that level and get a 20-day EMA test.

The good news is that if the 20-day EMA test occurs, that’s a low-risk entry point. You can simply set your stop below the 20-day EMA and get out if the stock fails it. For these reasons, I would not advocate buying today, but I do think the time to buy is very close.

My one concern is that the stock is putting in what is almost certain to be a negative divergence between the August and October tops. This occurs when price makes a new high, but momentum – as measured by the PPO or 14-day RSI – doesn’t. I drew dotted blue lines to illustrate what I mean, and it’s pretty clear in this case. Assuming ET pulls back a bit, that negative divergence is very likely to form, meaning the stock is showing signs of topping.

What this does not guarantee is a selloff, but negative divergences signal a rally is losing steam, so to speak. That’s keeping me from being very bullish here, but always remember that price action is king, and indicators are secondary.

Strong Q3 earnings

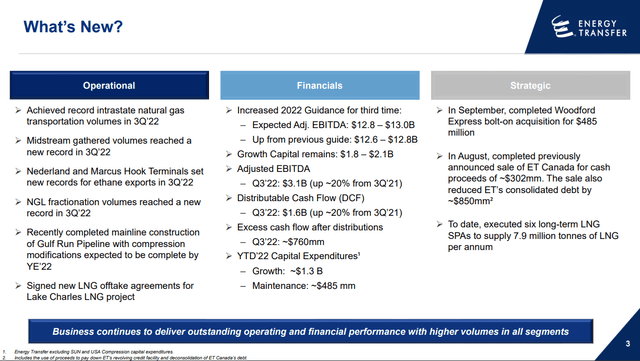

Third quarter earnings showed additional strength that built upon the prior two quarters this year, and the partnership saw fit to raise guidance once again. You’ll struggle to find many companies that have raised guidance three times this year, so ET is marking itself aside from most of the rest of the market.

I won’t read this slide to you but it’s worth a look if you’re interested in owning the stock. The partnership said all five of its core segments posted higher volumes year-over-year, which is the bread and butter of its results.

Intrastate natural gas transportation volumes were up 28% to a new record. Interstate natural gas volumes were up 43%. Midstream gathered volumes soared 47% to a new record. Natural gas liquids were up 5%, while natural gas fractionation volumes rose 6% to a new record. Crude oil transportation and terminal volumes rose 10% and 14%, respectively. There is good news everywhere from a volume perspective.

Management noted – while raising guidance – that mild weather has started to crimp demand in the winter heating season, so it remains to be seen how long that will last, and how it will end up impacting ET’s results. For now, ET is firing on all cylinders.

Great earnings = a higher share price?

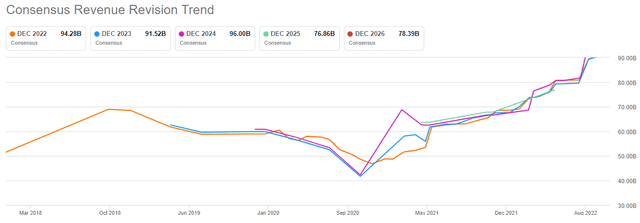

Let’s now take a look forward and to do that, we’ll start with revenue estimates, as seen below.

We can see revenue estimates have flown higher in the past two years, some of which was due to unwinding of COVID weakness, some of which is organic growth, and some of which is due to acquisitions. Regardless, the partnership’s revenue prospects continue to improve at a rapid pace, and given the volume activity we saw in Q3, it appears the upward moves aren’t done yet.

The caution here is that there is essentially no year-over-year growth coming, according to these estimates. ET keeps saying it is investing in growth projects and that it has a huge backlog, which is true. But estimates simply do not reflect anything like that right now.

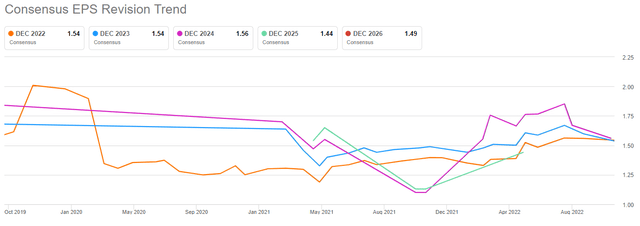

Let’s turn our attention to EPS, and before the comments start flowing about how EPS isn’t the right measure for ET, it is a measure we can use to assess growth. We’ll get to cash flow in a bit.

We see a very flat trajectory for EPS, and like revenue, there is no growth forecast. If that’s the case, it has implications not only for the share price, as we would expect the share price not to move much if earnings are flat, but the dividend as well. We’ll come onto that but let’s first turn our attention to free cash flow.

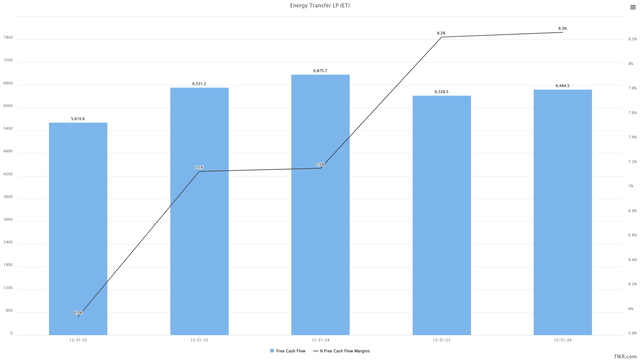

Below are annual estimates of FCF going out to 2026 from the analyst community, as well as FCF margin for reference.

We see here again the same story; ET’s FCF looks to be flat for many years to come. With the distribution having been cut 2020/2021, flat FCF will obviously make it more challenging to get back to pre-COVID levels at $1.22 annually per share. And given many investors value ET for its FCF, this is something I think investors should keep a keen eye on.

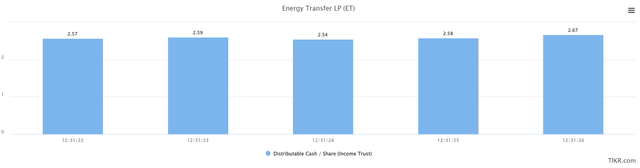

Let’s look at this another way with distributable cash per share. This is a great measure against the dividend as it takes into account what the partnership can spare to send to shareholders, not necessarily GAAP earnings or some other accounting measure.

I won’t repeat the lines but it’s the same story; no growth.

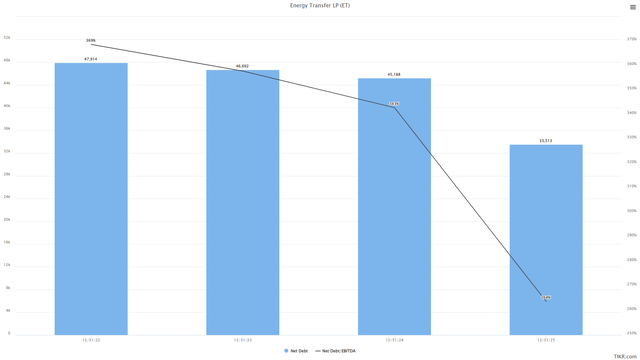

The good news is that the current level of distributable cash flow is quite elevated against the dividend. The bad news is that ET is trying to deleverage, given it has carried massive debt in recent years. Given its highly predictable earnings, high levels of debt are fine. But the partnership has made a point to reduce leverage meaningfully in recent years, including the sale of ET Canada this past August.

Analysts currently expect ET’s net debt to be sharply lower by 2025, with net debt to EBITDA shrinking massively as well. This is good for the partnership’s future, but it does mean dividends are likely to be on the back burner for some time. For investors that means likely smaller dividend increases for the foreseeable future.

Let’s value this thing

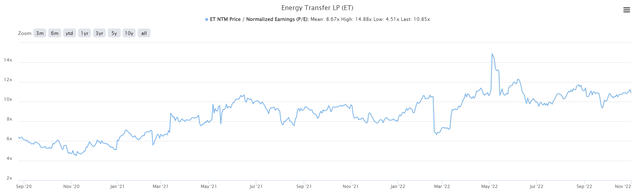

As I mentioned above, there are many ways to value ET, given it’s a utility-like stock that pays a great dividend. Let’s start with price-to-earnings for our first reference point.

The partnership’s P/E ratio has risen steadily in the past two years, from its low at 4.5X in late-2020, to the current value of 10.9X. On this basis, one would find it difficult to convince me ET is cheap. Expensive? No, not necessarily. Cheap? Certainly not.

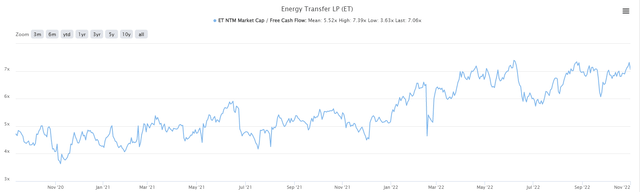

Let’s look now at price-to-FCF, which is below for the same period.

We see a similar story here where the stock has received a much higher multiple on its FCF, rising from the COVID low of 3.6X to the current value in excess of 7X. Seven times FCF is actually a reasonably high valuation for ET, so I’d err more towards it being expensive rather than neutral on this measure.

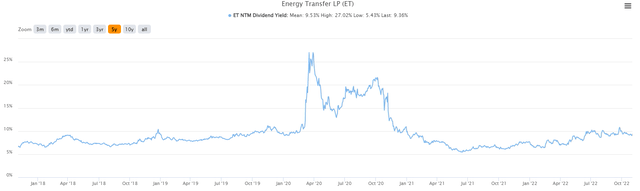

Finally, we can value the stock based upon its dividend yield, given it’s a partnership, and therefore, is owned by many for its income prospects, rather than purely for price appreciation.

This is a five-year look at forward yield, and we can see that the stock is pretty reasonably valued on this measure. It is my view the disjointed market of 2020 – due to COVID disruptions – isn’t comparable. But if we focus on the 2018 to 2020 period, we can see the stock traded with a slightly lower yield for much of that period than it is today. Given that, ET looks pretty attractive on this measure. If you consider ET is likely to raise its payout at least modestly for the foreseeable future, that’s not a bad place to be.

Final thoughts

The bottom line here is that ET’s third quarter results were great. And beyond that, guidance was boosted for the third time this year. However, the stock isn’t reacting to that this morning, at least not so far, and that gives me pause. When I look at the price chart, I see a stock that looks great, but is potentially losing upside momentum.

For that reason, following the “all-clear” investors received with the Q3 report from a fundamental perspective, I think the most prudent course of action is to wait. I like ET, and I’m slapping a buy rating on it, but I’ll caveat that by saying it’s a buy at the rising 20-day EMA, not necessarily today.

ET has a great dividend yield both in historical terms and in absolute terms, and its valuation on earnings and cash flow is okay, not great. But so long as volumes continue to move higher, I think the bias for ET is up as well.

Be the first to comment