Justin Sullivan

A history of outperformance

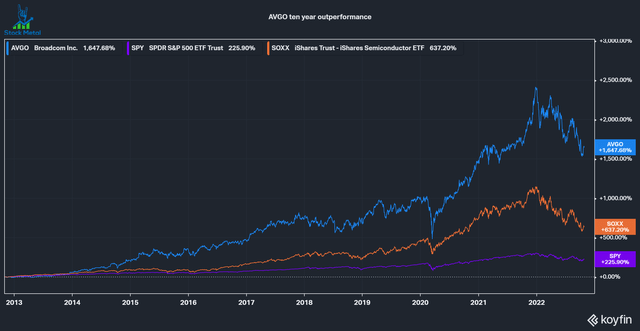

Broadcom Inc (NASDAQ:AVGO) is a broadly (sorry for the lousy pun) diversified manufacturer of analog semiconductors and infrastructure software solutions. The company has been a massive success for investors over the last decade, outperforming the S&P 500 and the iShares Semiconductor ETF (SOXX) by over 1000 percent points despite its current 30% drawdown. The company achieved this through a series of strategic acquisitions and by taking on lots of debt. Can this growth be sustained into the future?

Throughout this article, I’ll refer to Broadcom Inc as Broadcom and its ticker AVGO.

AVGO ten-year outperformance (Koyfin)

Industry and product portfolio

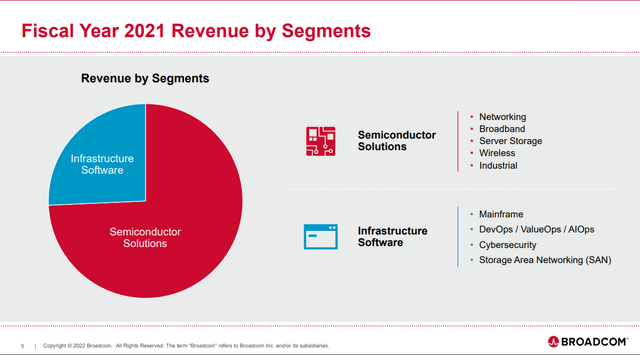

Broadcom has a diversified portfolio of semiconductor solutions and infrastructure software, as shown in the picture below. According to Fortune Business Insights, the semiconductor market is expected to grow by 9.2% CAGR through 2029. Surprisingly Broadcom’s CEO Hock Tan expects the industry to have a long-term growth rate lower than that:

I’ve always said the long-term sustainable demand in the semiconductor space is a mid-single-digit compounded growth rate, 5%, thereabout maybe 6%, 5%, 6%.

– Hock Tan, AVGO Q3 Earnings Call

This is a long-term outlook, though, and has no implications for the next few years.

According to Grand View Research, the infrastructure software market is expected to grow at a similar growth rate of 8.4%. In the slide below, you can see their FY 21 sales mix. In May, Broadcom announced the acquisition of VMware (NYSE:VMW) for about $61 billion in stock and cash. Additionally, Broadcom took on $8 billion of debt from VMware and $32 billion in debt from a consortium of banks. This deal will put both revenue segments at roughly 50% of revenues and add Virtualization, DevOps, a Multi-Cloud platform and Security solutions, amongst others, to its portfolio.

Even though the overall portfolio has a diversified mix of products, Broadcom does have serious customer concentration, with the top 5 end customers accounting for 35% of revenues in 2021, up from 30% in 2020 and just Apple (AAPL) alone accounting for 20% (2021) up from 15% (2020). Especially the exposure to Apple should be considered because there are always reports about Apple looking to develop its own chips. If this risk will eventually manifest itself is not clear, it shouldn’t be understated considering the size of concentration in this customer.

AVGO Revenue by segments (AVGO Company Overview)

VMware acquisition

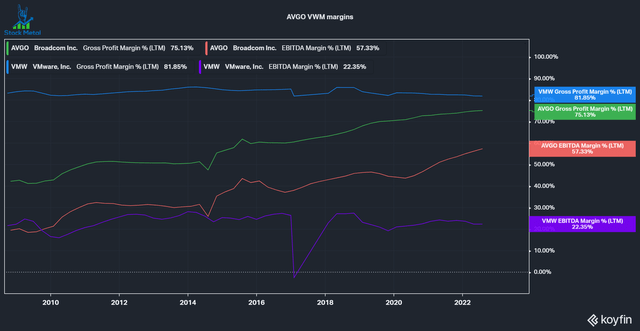

The $69 billion purchase offer for VMware is the largest deal the company made to date, after its $100 billion offer for Qualcomm (QCOM) was blocked by President Trump in 2018. The acquisition aims to create the world’s largest infrastructure software company by leveraging both companies’ portfolios of mission-critical solutions, large enterprise customer base and combined R&D efforts. Broadcom also sees an opportunity to improve VMware’s margins, which have stagnated for the last decade. At the same time, Broadcom achieved a 3300 bps gross margin improvement to 75% and a 3700 bps EBITDA margin improvement to 57%.

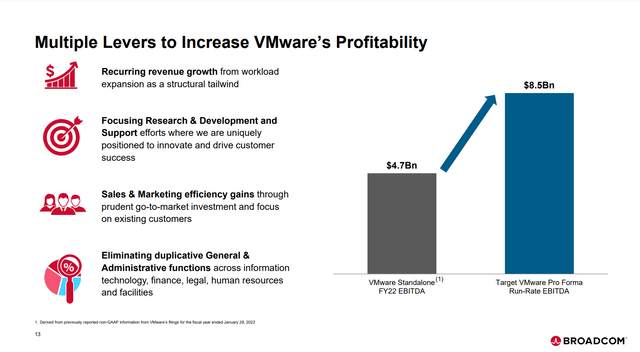

The purchase price of $69 billion for VMware implies a current EV/EBITDA of 23 ($2.94 billion LTM), 15 ($4.7 billion adjusted) or 8 forward ($8.5 billion target EBITDA). If they manage to achieve their target EBITDA, then this was a cheap acquisition, but I don’t think the path is clear and there is definitely some risk with this acquisition from a price perspective.

I believe that there is a good chance this acquisition will go through, offering a good merger arbitrage right now ($110 price versus $142.5 buyout offer). For a deeper look, I recommend you look at this article from Geoff Considine about the probability of the transaction closing.

Is the M&A strategy working?

The acquisition of VMware is the third large software acquisition in the software space:

| Company | Purchased in | Purchase price |

| CA Technologies | 2018 | $18.9 billion |

| Symantec | 2019 | $10.7 billion |

| VMware | 2022 | $69 billion(including $8b debt) |

According to an article from business insider, Customers and Employees of VMware alike are skeptical about the acquisition.

Work at VMware quickly lost meaning for employees under the threat of Broadcom’s impending acquisition. On top of layoff worries, workers fear they’ll lose remote-work benefits and the company’s focus on inclusion.

Meanwhile, VMware customers are starting to feel the ripple effects. Customers told Insider they feared innovation would be stifled under the chip giant and that top talent would leave the firms.

Another article from Computerwoche (this one is in German, but DeepL should be able to translate it well) talks about AVGOs venture capital-like acquisition strategy:

After the acquisitions of CA and Symantec, Broadcom quickly raised prices, reduced support activities and stopped investments into R&D

Broadcom claimed that it learned from its mistakes and will not make the same mistakes with VMware, but we have to be skeptical, especially in light of Broadcom’s plan to increase VMware’s profitability, as you can see below. The company is expecting to increase EBITDA from $4.7 billion to $8.5 billion in the following years by growing recurring revenues (sounds like cutting products), focusing R&D and support (has to be monitored if they are really focused or if this is just a fancy word for cutting the costs off), S&M efficiencies and eliminating G&A duplicated functions. VMware currently has $13b in revenues with $4b S&M, $3b R&D and $1b G&A expenses. There is definitely some fat to trim, but investors have to try and monitor that they don’t repeat the same mistakes again.

Plan to increase VMware’s profitability (AVGO IR)

Valuation

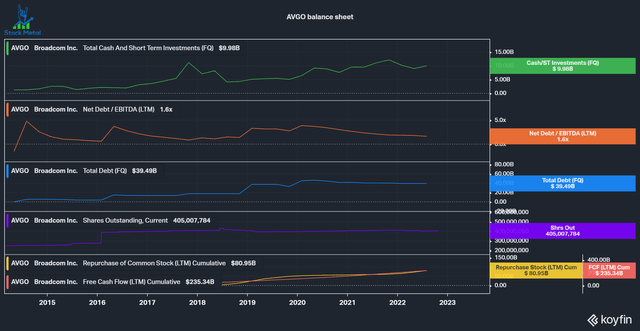

First, I’d like to look at AVGO’s balance sheet. The company is constantly levering up for acquisitions (typically to 3-5x net debt/EBITDA) and occasionally diluting and then paying off the debt again. This led to the total debt building up to $40 billion and the share count almost doubling in the last eight years, even though the company spent a combined $80 billion on buybacks from its cumulative $235 billion in Free Cash Flows. The debt is manageable at a current $1.5 billion in annual interest payments and an effective interest rate of 4.11%, according to gurufocus.

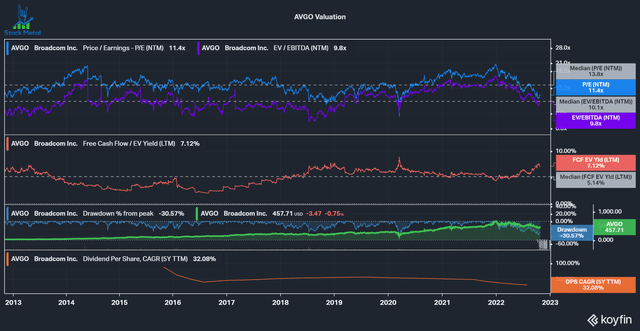

Broadcom is trading slightly below its ten-year average valuation multiples on a PE and EV/EBITDA basis, especially on an EV/FCF yield; the shares look attractively valued. Broadcom is a dividend growth favorite after they raised their Dividend at an incredible pace over the last decade, increasing the Dividend per share by an astounding 2588%. I believe these great dividend increases are not sustainable and that the company relied on its venture capital-esque approach of buying companies and aggressively cutting costs to achieve a lean cost structure to fund these increases. The past margin expansion by over 3000 bps cannot easily be replicated.

Conclusion

Broadcom is a risky semiconductor and software play, despite its low valuation. The aggressive approach to make large acquisitions and strip them of fat to increase margins is not well-liked in the corporate world, especially now that Broadcom has made a name for itself, as I mentioned in the “Is the M&A strategy working” segment. I believe that Broadcom can still provide decent returns to shareholders, but I’m not too fond of the reliance on aggressive acquisition. I prefer a more defensive semiconductor stock like Texas Instruments (TXN), which is one of my largest positions outlined in this previous article.

Be the first to comment